ATM on Servers

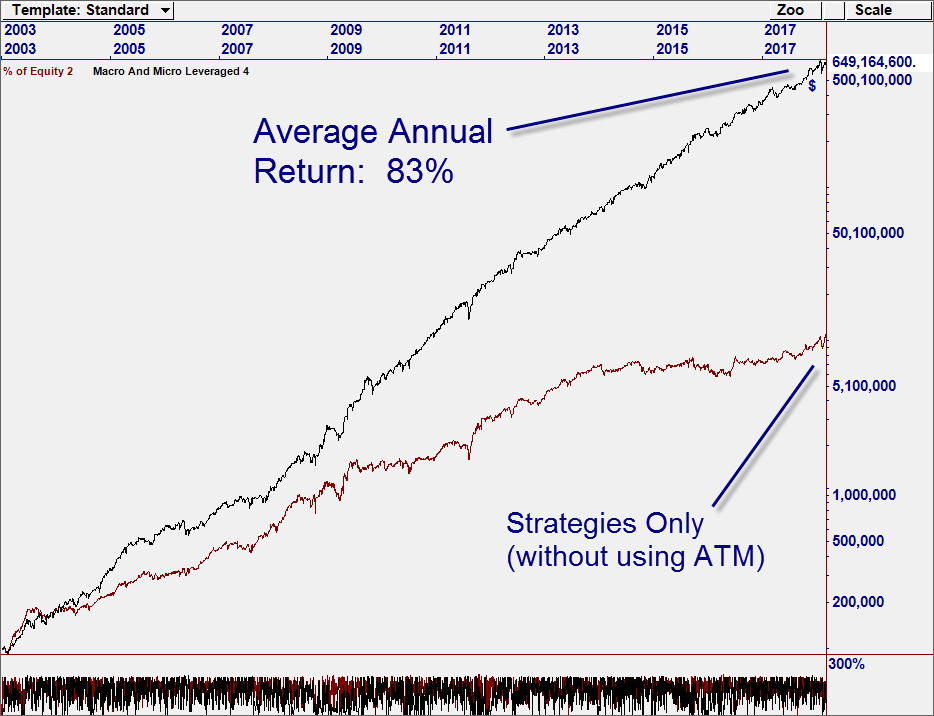

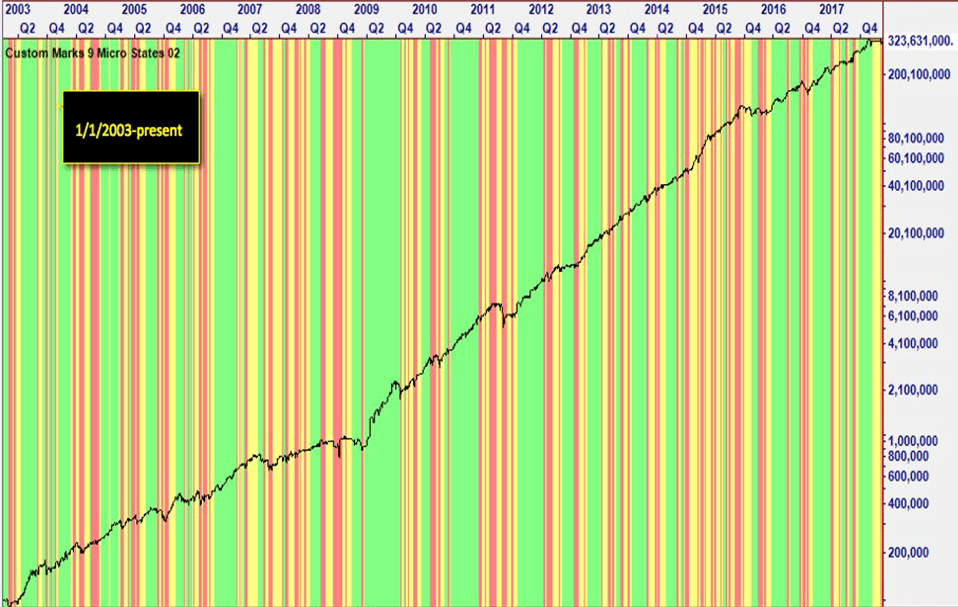

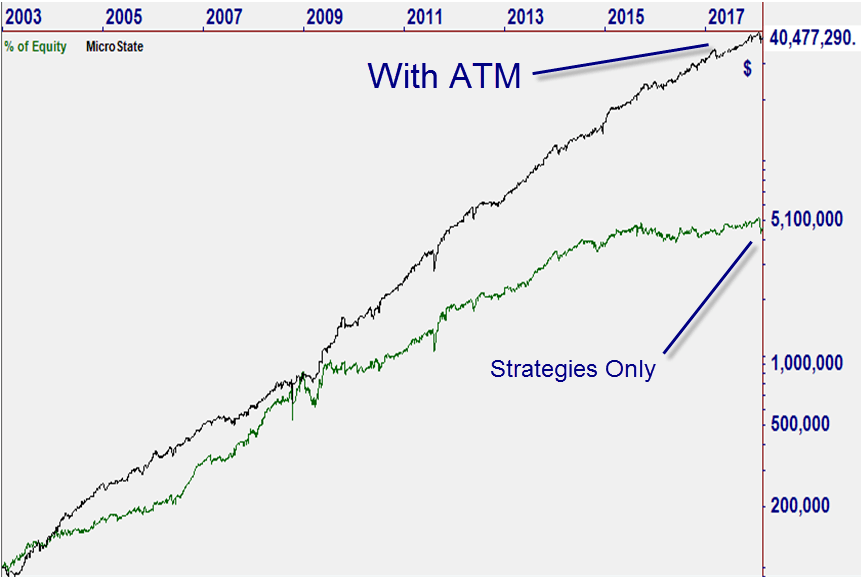

ATM is Now Running on Our Servers!Breaking News! ATM Methods can now run on our OmniVest Servers. A new ATM Method Upload feature has been developed that enables ATM Owners to upload their Methods directly to OmniVest under the Strategy Upload facility! Now, you can develop profitable ATM Methods using any Strategies (including those we […]

Continue reading