X-Suite

$995

Compatible Platform: OmniTrader / VisualTrader

Recommended Data: OmniData Real Time or End Of Day

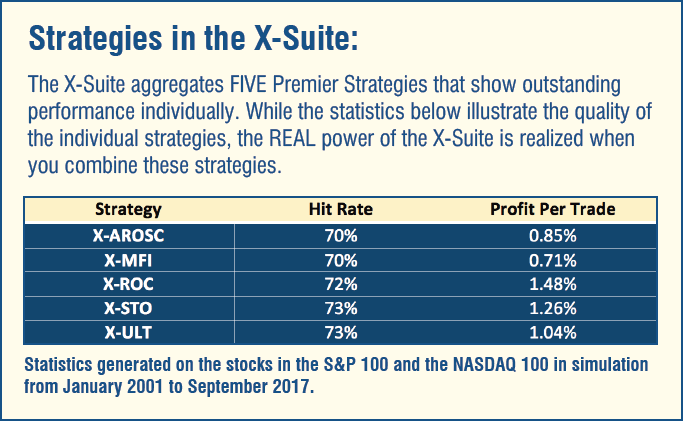

The key to steady performance is the aggregation of really great Market Strategies that have complementary trades, so they maintain trade allocation in an account to maximize gains and minimize risk. The X-Suite is the result of this work.

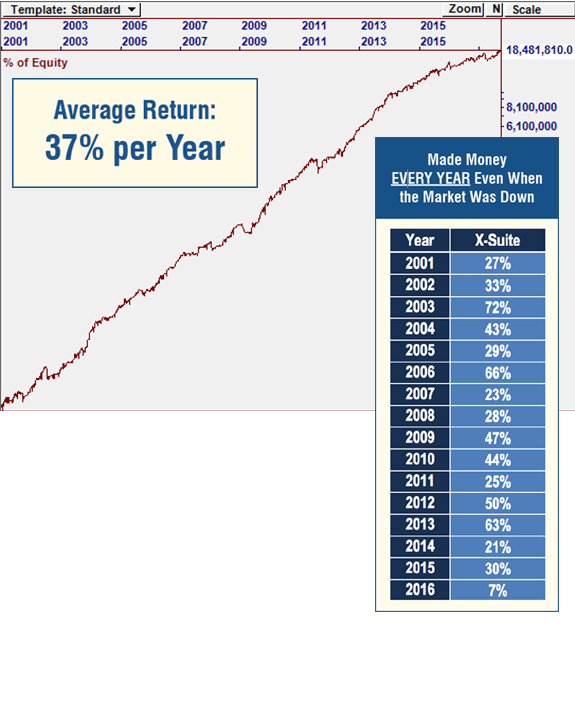

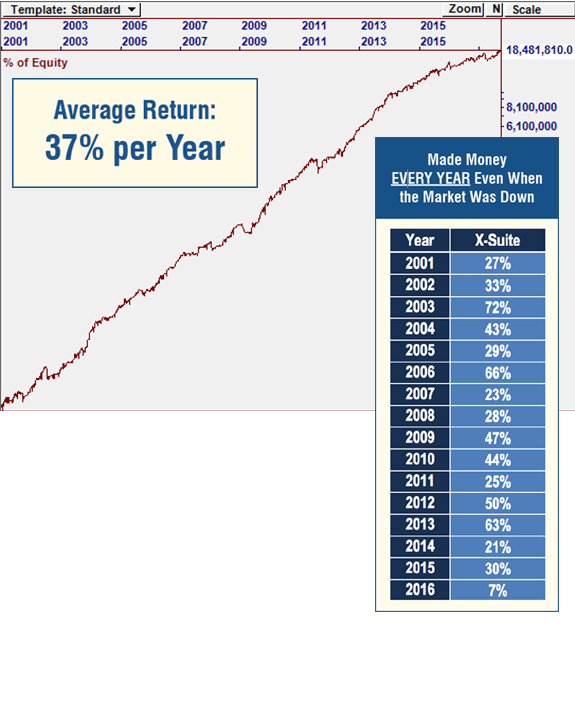

Our Best Performer Ever!

A New Standard in Strategy Performance

When our developers set out to create the Strategy Suite, our goal was to beat the performance of other Strategies, with consistent gains and low draw downs.

The key to steady performance is the aggregation of really great Strategies that have complementary trades, so they maintain trade allocation in an account to maximize gains and minimize risk.

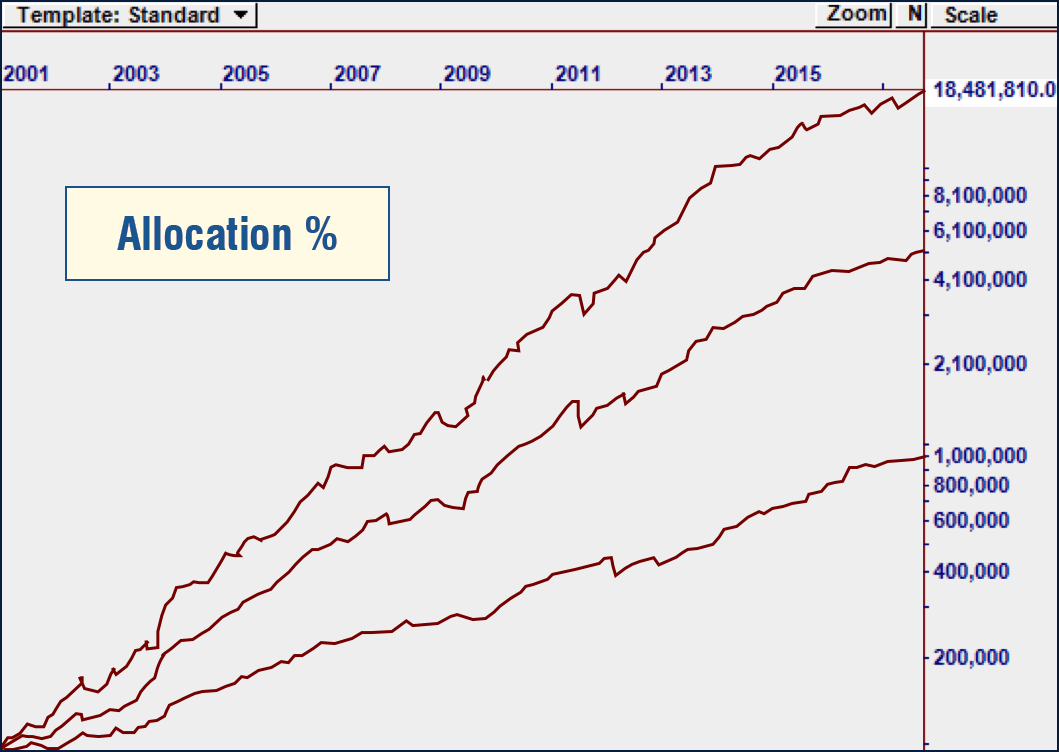

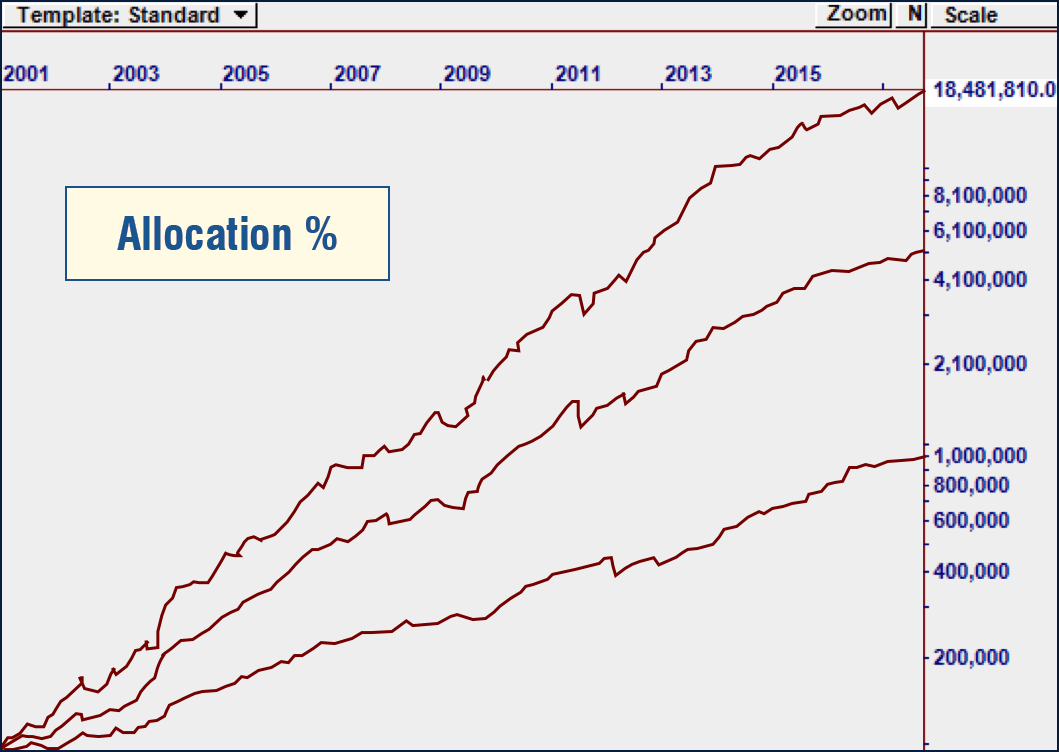

Looking closely at the simulated equity curve, we see several periods in which the X-Suite made considerably higher gains than the market, especially when the market had significant losses in 2001 and 2008.

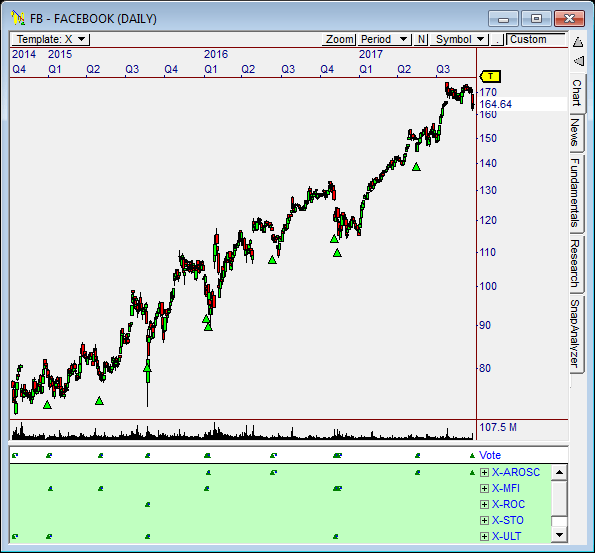

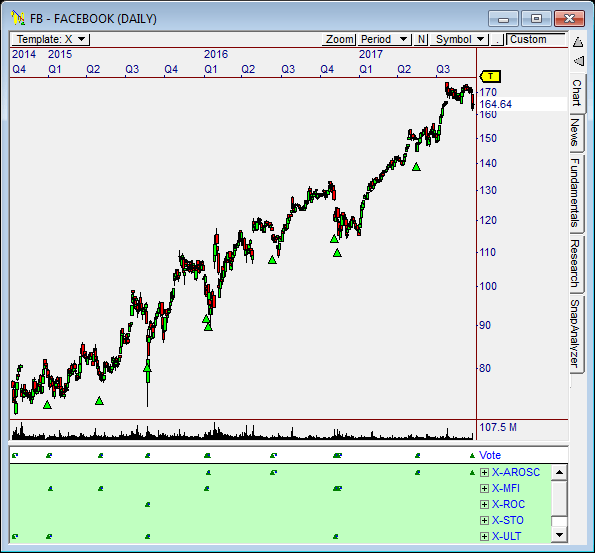

While some of the Signals from the X-Suite occur at the same

time, most of them do not. This means more trades and more allocation in an account.

The aggregation of these Premier Strategies provides outstanding performance across any of the major stock lists. On the right, you’ll see how this special package performs at various allocation settings, giving you the ability to tune it to your personal trading goals.

The Secret to the X-Suite's Performance

How is the X-Suite able to generate this kind of performance?

Two words:

Strategy Aggregation.

It’s easy to create a Strategy that fires a lot of Signals. However, in order to get the most accurate signals, Strategies must employ sophisticated filters that screen out all but the most probable candidates. This results in fewer trades.

It’s easy to create a Strategy that fires a lot of Signals. However, in order to get the most accurate signals, Strategies must employ sophisticated filters that screen out all but the most probable candidates. This results in fewer trades.

Select Your Allocation

for Higher Returns OR Less Risk

Delivering Consistent Gains

The key to risk reduction is reduced allocation per trade, resulting in more trades and higher diversification.

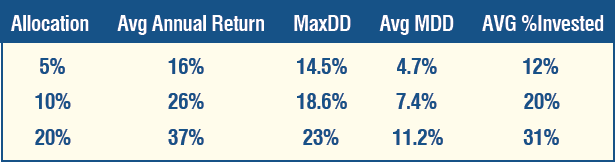

The equity curve simulations above were run on 3 different allocation values, 5%, 10% and 20% of equity per trade. Given the dramatic differences in returns, why would we want to use a lower allocation?

Looking at the table, we see that at 5% allocation per trade, we get a 16% return with a 4.7% average max draw down. Keep in mind, that is 16% on our account, not what we have invested. This return is made with just 12% of our account at risk, on average.

Equity curve simulations at 5%, 10%, and 20% allocation per trade.

High Gains. Reduced Risk.

If we can get 16% a year with just 12% of our money at risk on average, our account is much better protected. If the market were to correct 20%, our account should show a significantly lower loss than the market.

On the other hand, if we are less concerned about market risk, using 20% allocation gets us into high return potentials of 37% per year – with an average of only 31% of our account invested. That’s incredible!

You may be wondering, “With all the advantages offered by the X-Suite: Super Returns, Solid Risk Reduction and steady account growth year after year, what else can be done to improve it?” here...

Well, we’re glad you asked, because it’s time to unveil the

Special Bonus we are including in the X-Suite Package...