Harness the Power

of Relative Strength!

“The Most Profitable Method I Have Ever Traded.”

– Ed Downs, CEO Nirvana Systems

Have you ever seen a Stock “Blast Off” and make enormous gains in just days or weeks?

We call them Rocket Trades. The Good News is they’re easy to find if you use the right approach.

Many of our customers are making 30% a month with the RocketTrade Method.

Now, it’s your turn!

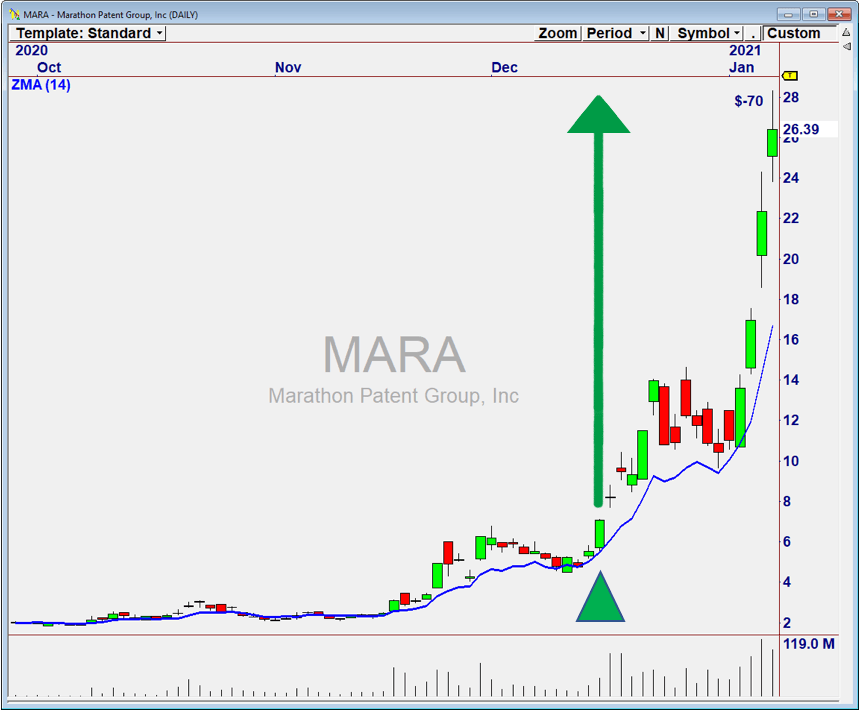

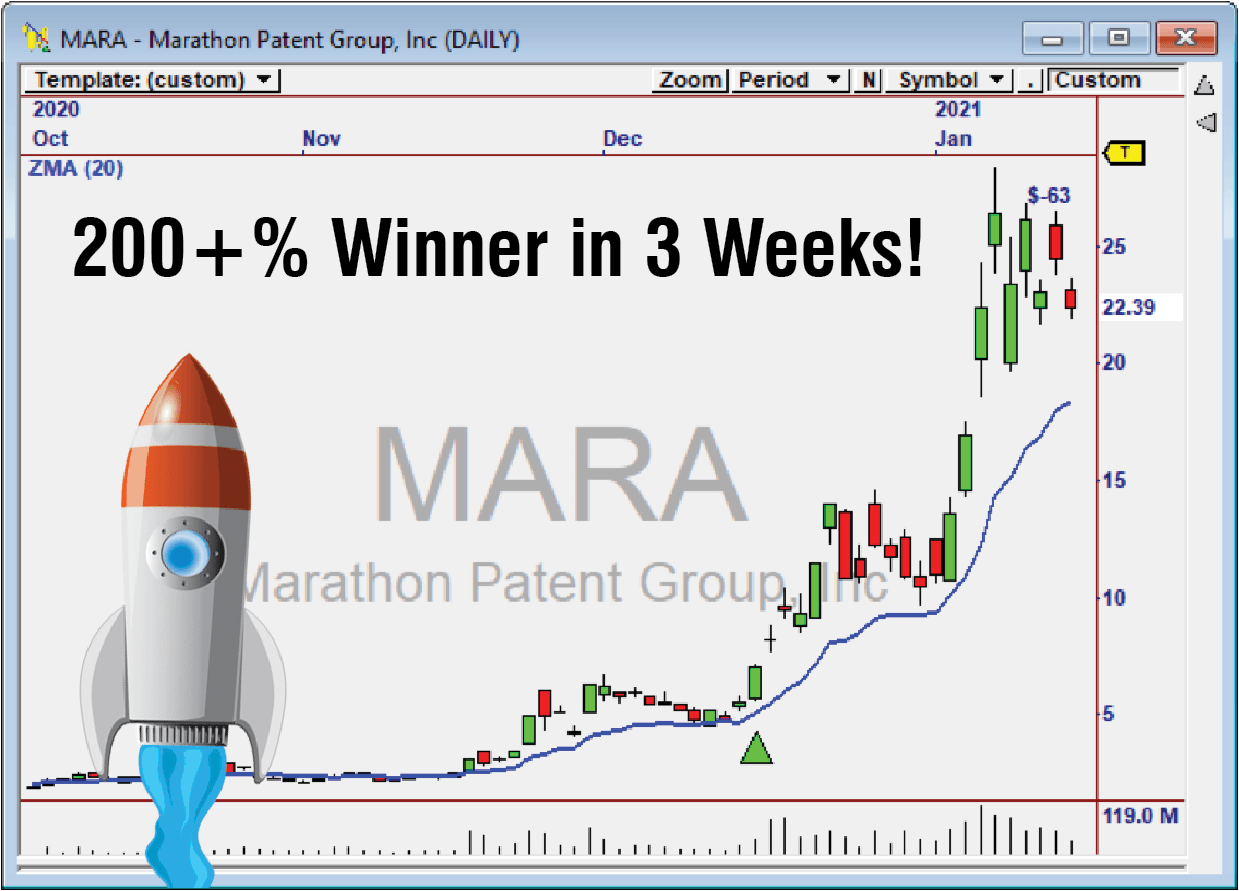

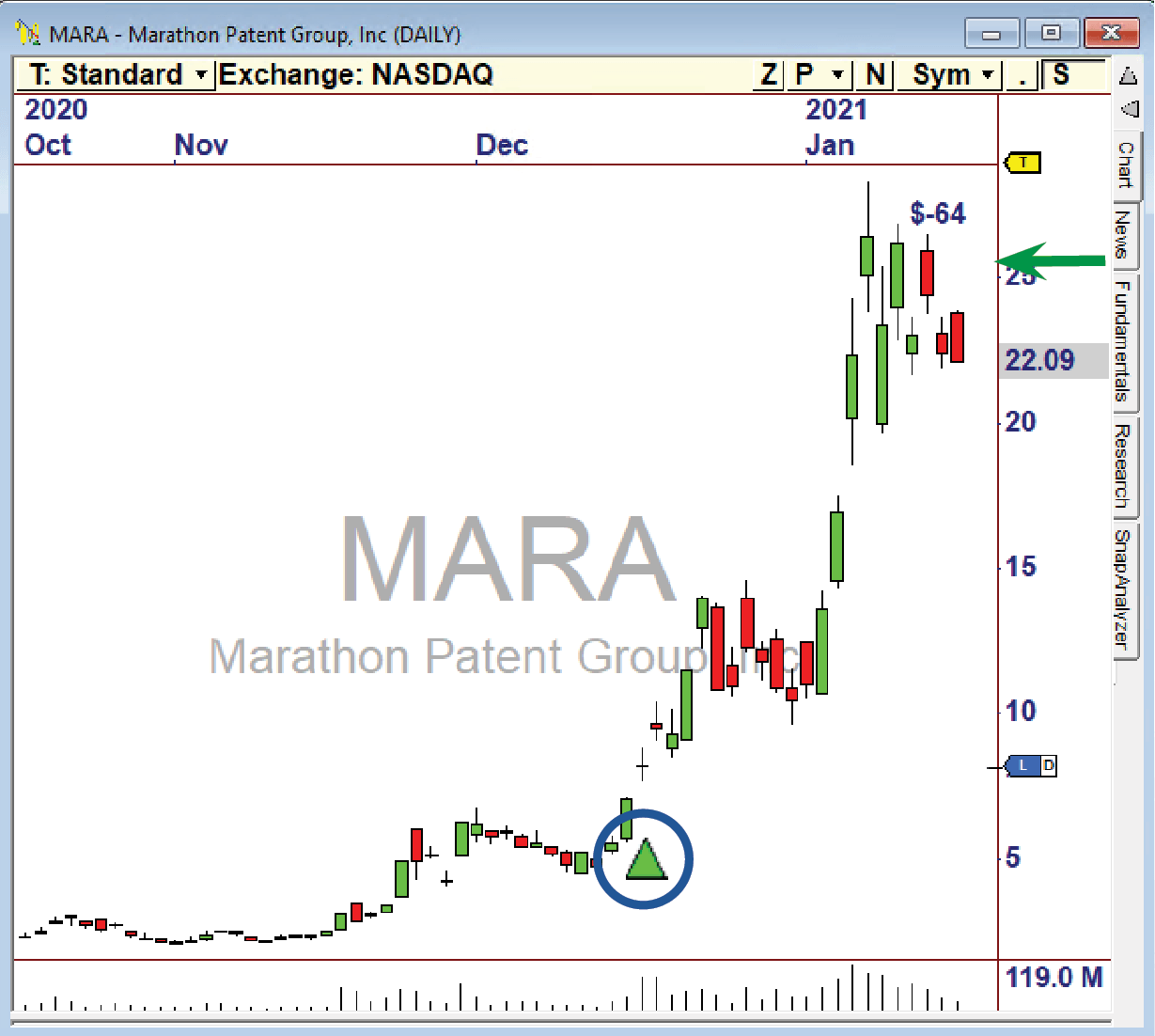

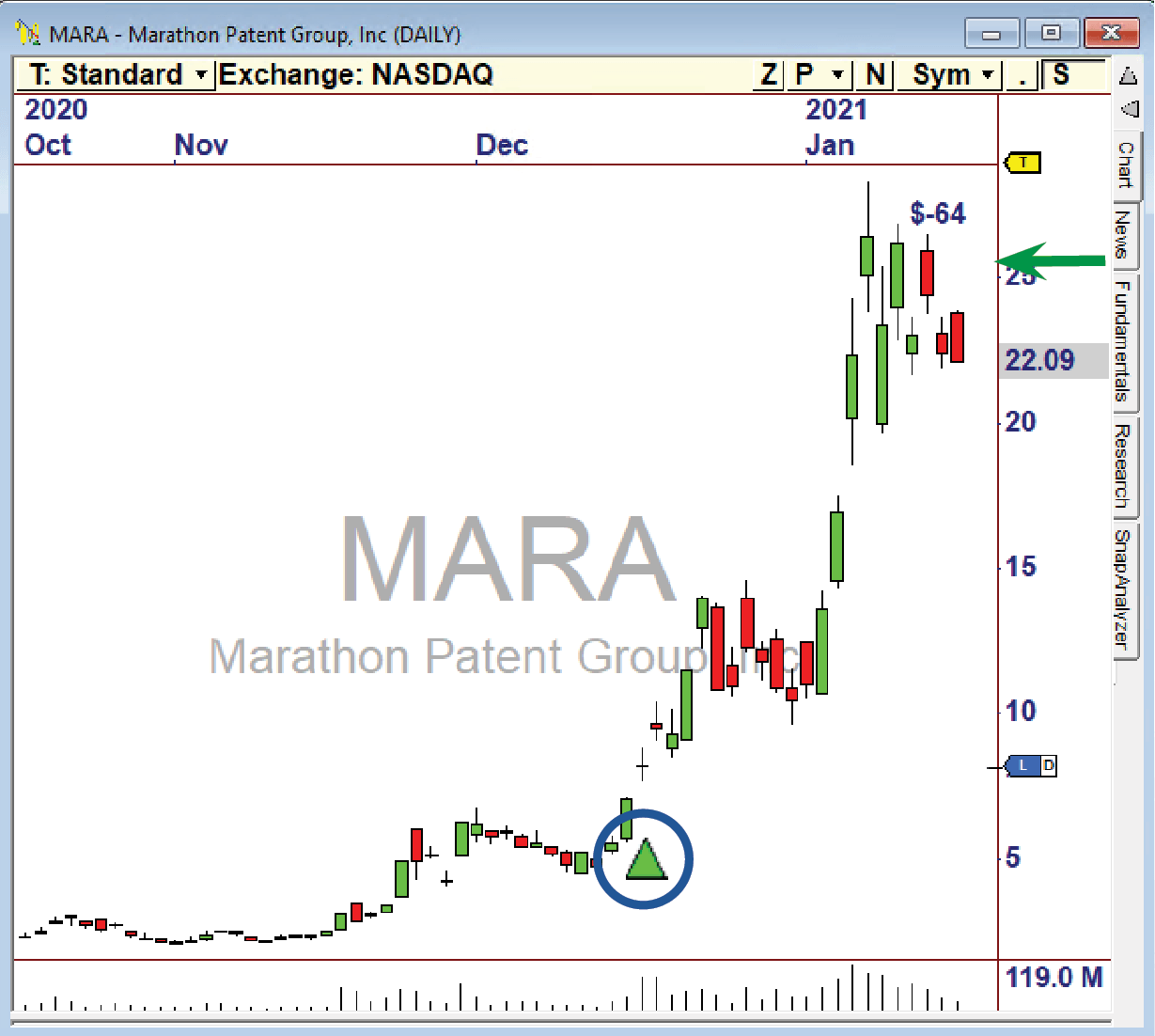

After the Signal, Marathon Patent Group (MARA)

launched off the pad to make a 300% Gain!

Harnessing the Power of Relative Strength

The RocketTrade Method is based on Nirvana’s Rocket 2 Plug-In and is composed of 4 parts:

1. Indicators 2. Scans 3. Strategies 4. RocketTrade Training

While it is not necessary for traders to fully understand each part, it’s important to show how they combine to make the RocketTrade Method so unique and valuable. Here is a summary of the four components, which are described in more detail in the following few sections.

1. Indicators

The classic ways of calculating Relative Strength only show instantaneous values and do not show when a stock is under Accumulation. These NEW Relative Strength Indicators are used in both the OmniScans and the Strategy. They also visually show the degree to which Accumulated Relative Strength has built up in a chart.

2. OmniScans

Using the Relative Strength Indicators, the provided OmniScans can identify those stocks that have the highest Relative Strength, and are in a Blast Off, Launch or Stage pattern. If you review the trades that have been identified, the power of these scans is obvious.

The Strategies job is to find optimal entry points once a stock has been identified as being under accumulation by market participants. The Signals from the three Strategies provided save time when reviewing candidates and provide the best possible entry points.

While the components of Relative Strength are powerful, there are specific chart clues that enhance results while trading. In Ed’s 3-Part Training Series, “The RocketTrade Method”, he demonstrates the precise steps he took to grow an account more than 50% in a short period of time while managing risk, in just 10-15 Minutes a day. See here for an overview of this valuable content.

Powerful Automation

The RocketTrade Method is based on proprietary indicators and Scans. These unique assets provide the basis for the Method. OmniTrader is so automated, all a trader has to do is review the candidates and trades each day.

The real power is in how easy this is. In my three RocketTrade Training Sessions, I will show you how to find and manage great trades in just 15 Minutes a day. I look forward to sharing the Power of Relative Strength so YOU can put this remarkable Method to work for you.

Sincerely,

Ed Downs

1. The Indicators

The Essence of the RocketTrade Method

I researched two key concepts that led me to create the Relative Strength indicators used in the Method.

The first indicator measures the difference between the current Relative Strength and prior values of Relative Strength, and is thus called the “Difference” indicator.

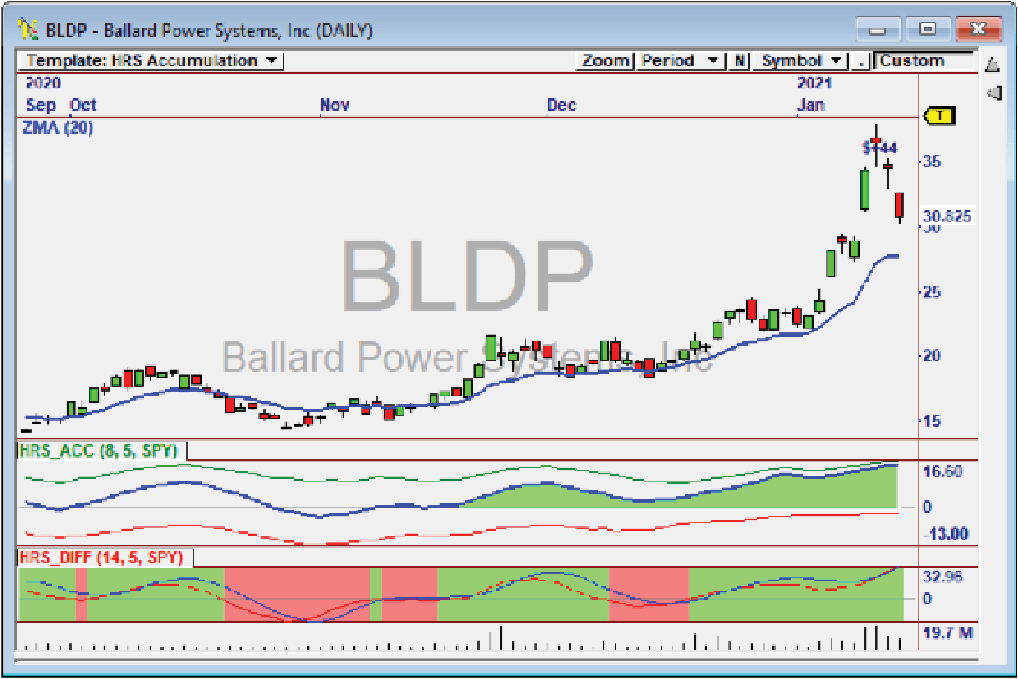

The Color Chart to the right shows the positive (green) and negative (red) Relative Strength difference measurements. The transition between red and green indicates an increase or decrease of this measurement. The accumulation of these values is used in theAccumulation indicator (discussed next).

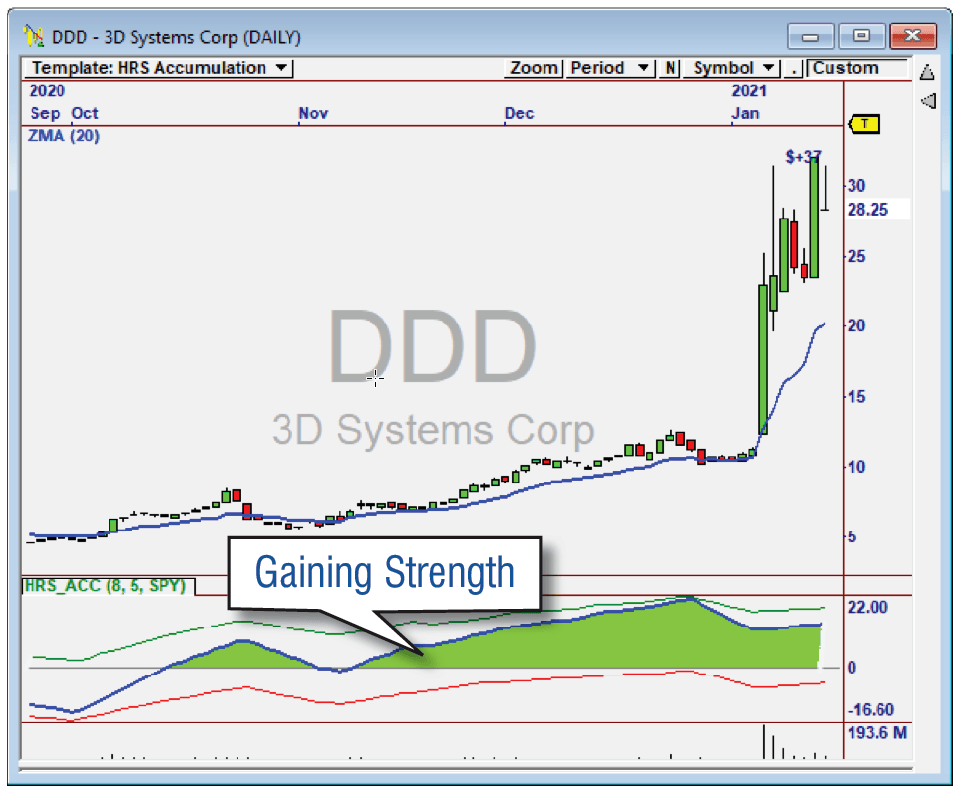

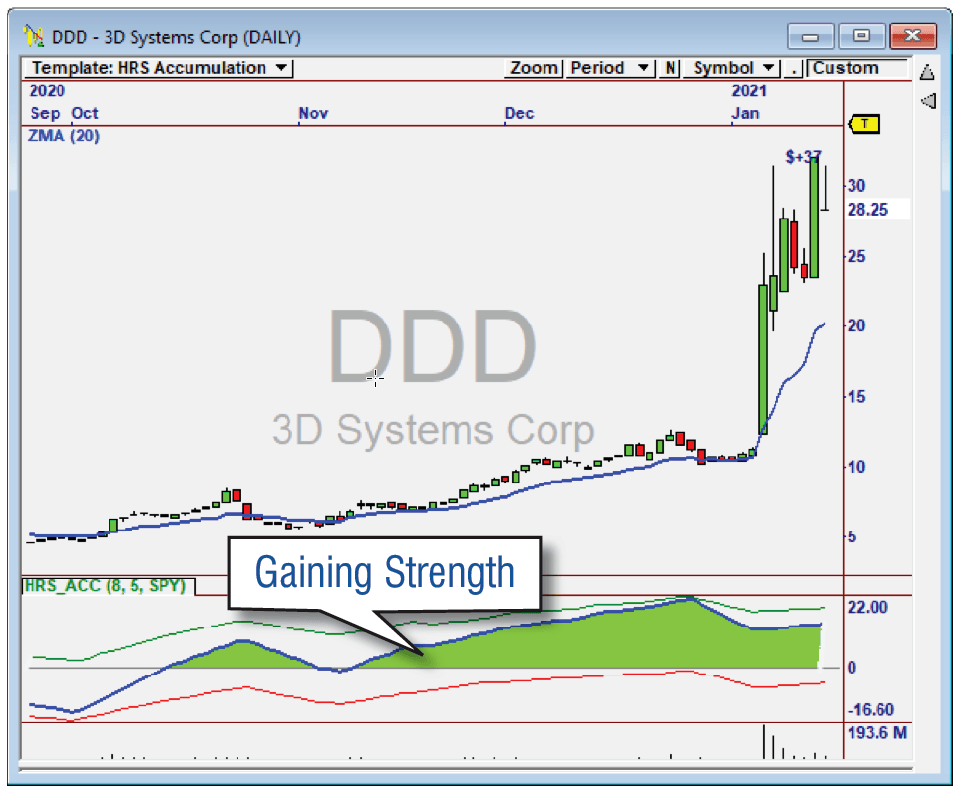

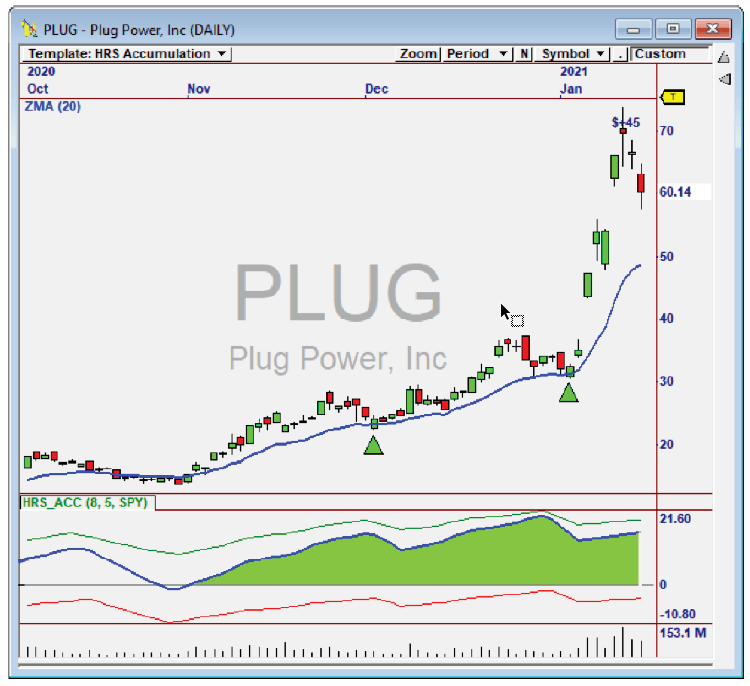

Another indicator I developed measures the accumulation of Relative Strength and is called the “Accumulation” Indicator. It basically indicates when Relative Strength is accumulating or not, by virtue of the Blue Line being above or below zero.

When the Blue Line is above zero for a period of time, we know the stock is in an accumulation mode, and the reverse for a distribution mode, making it easy to Scan for candidates each day.

Learn about the unique OmniScans that use this indicator here.

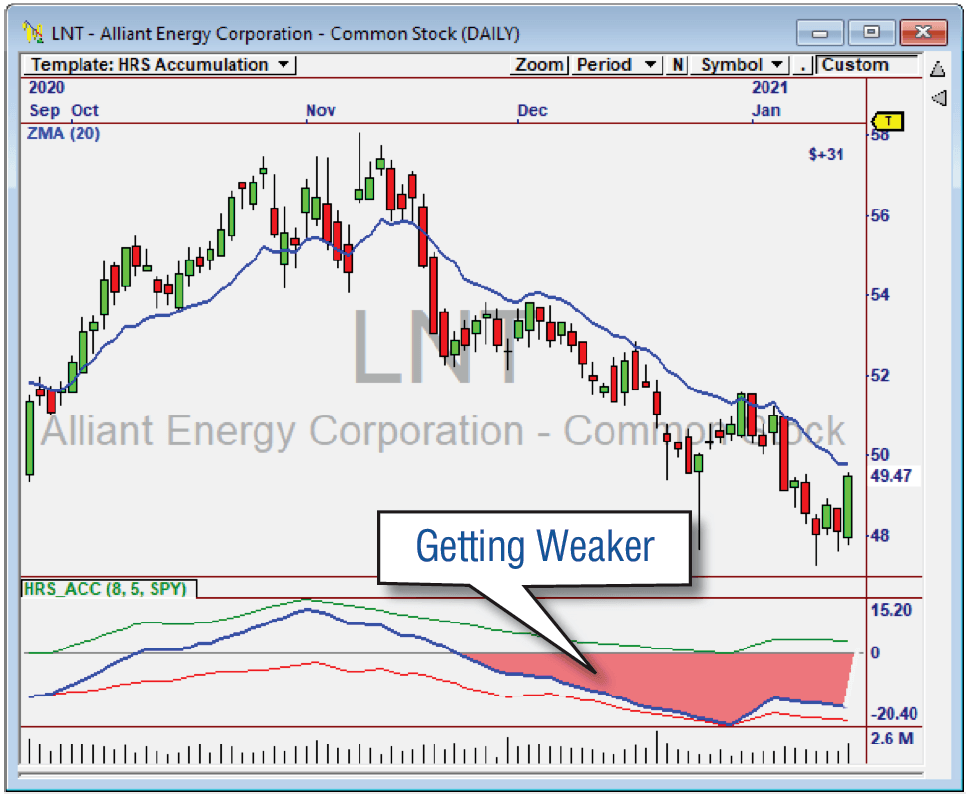

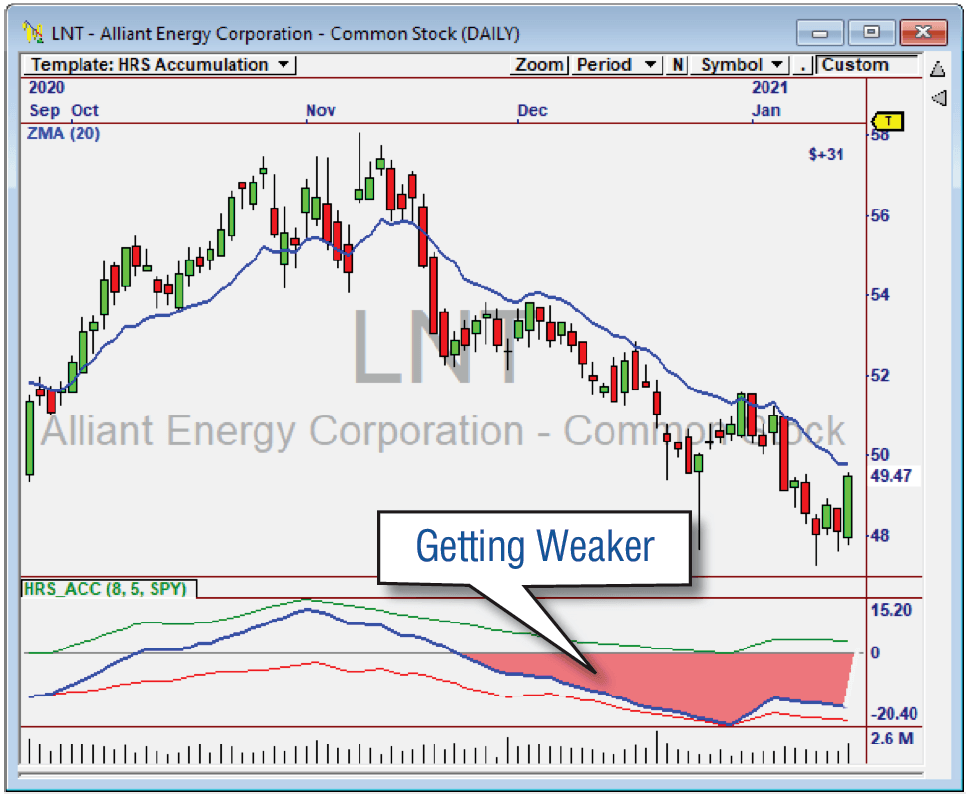

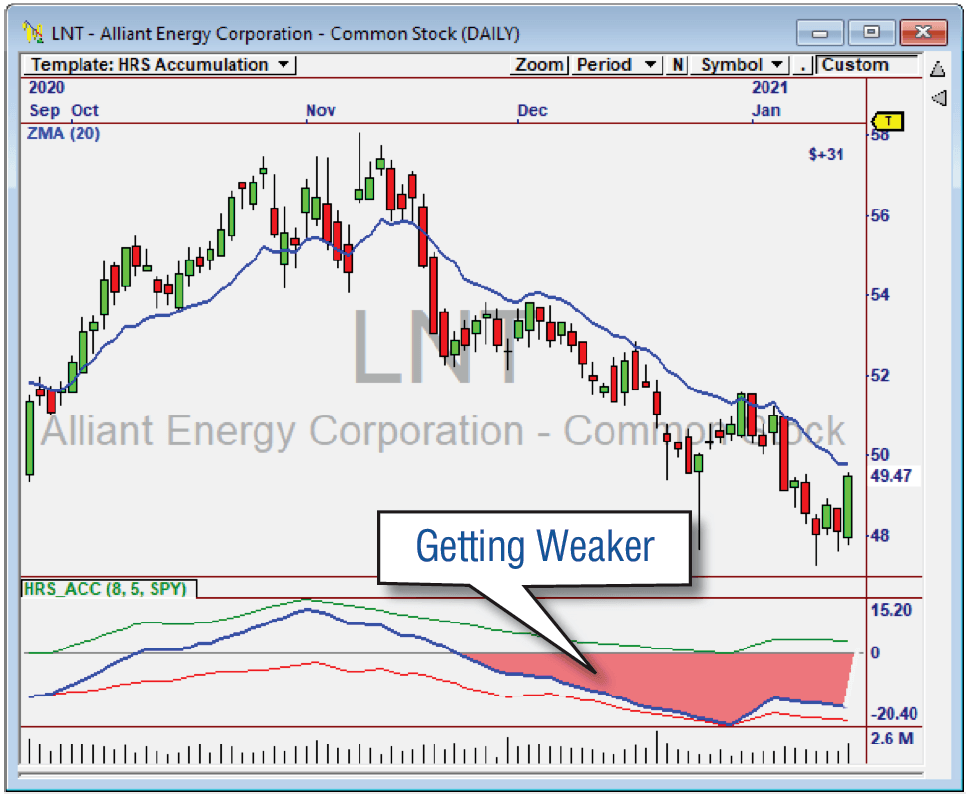

Measuring Distribution

The Accumulation Indicator goes negative for LNT in lateNovember, showing weakness that continued from there.

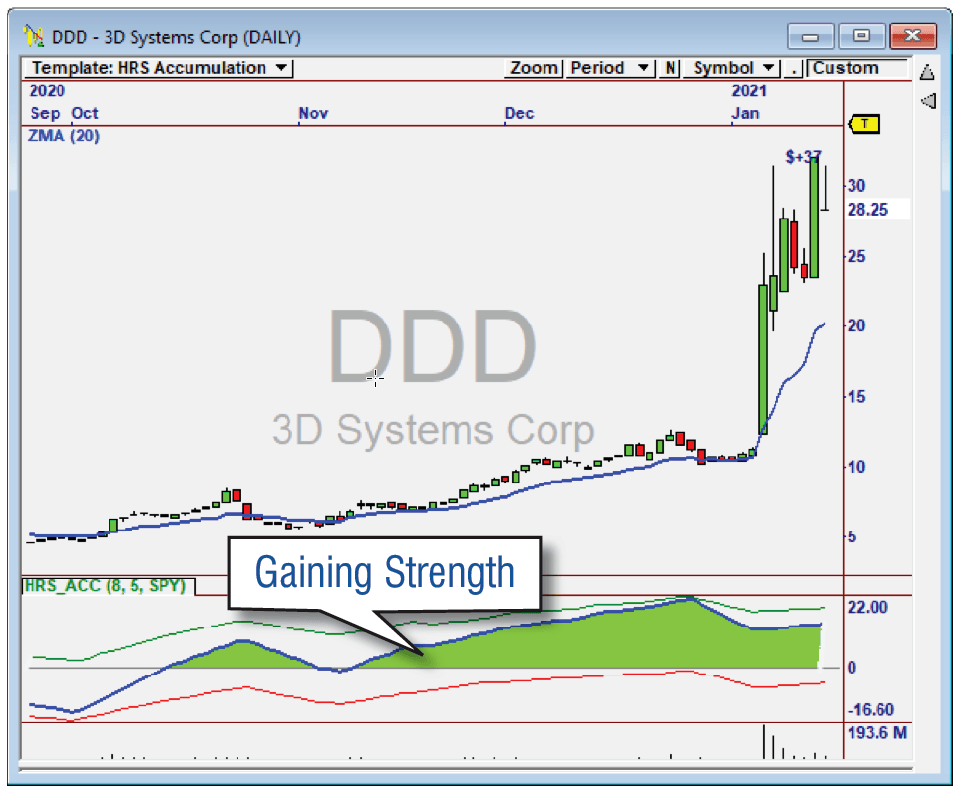

Measuring Accumulation

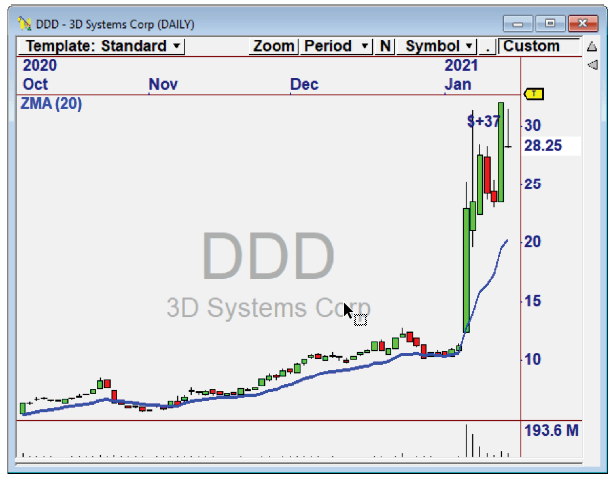

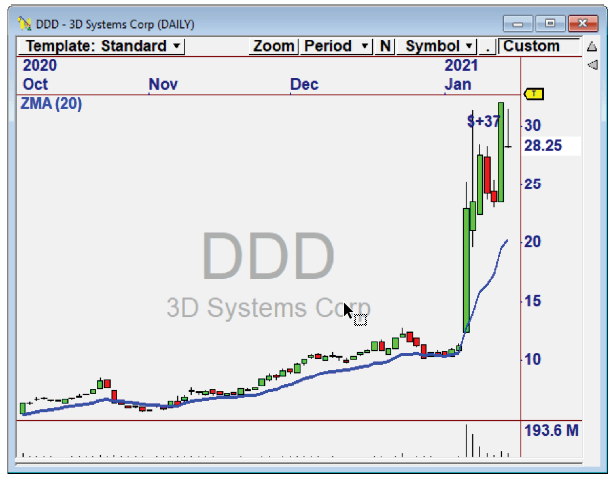

In DDD, we see the Accumulation indicator trending up above zero since early November – an indication the stock would continue up.

2. The Scans

Find the Best Candidates – Automatically

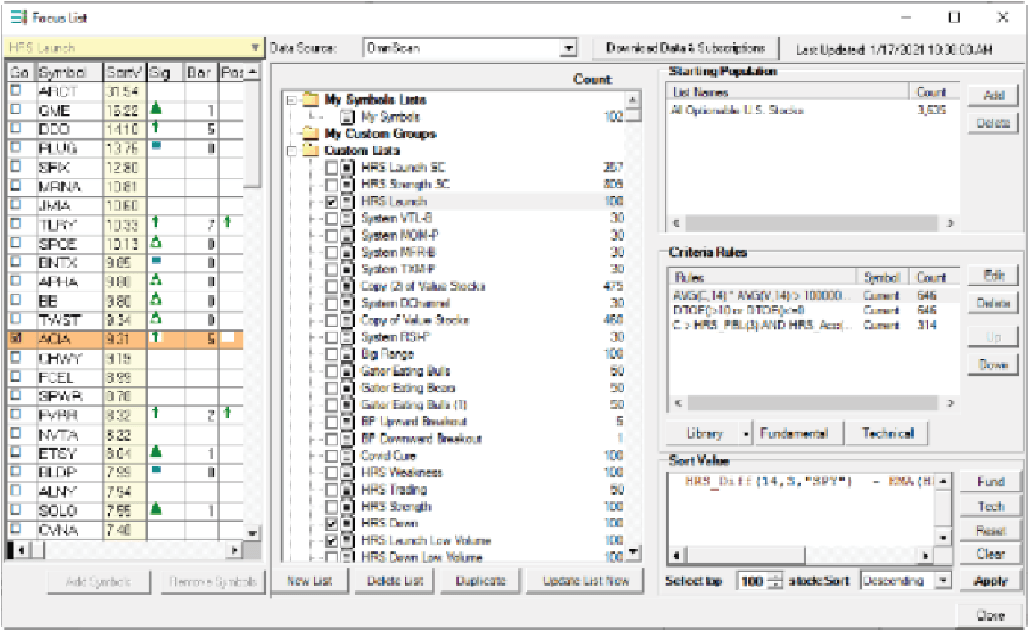

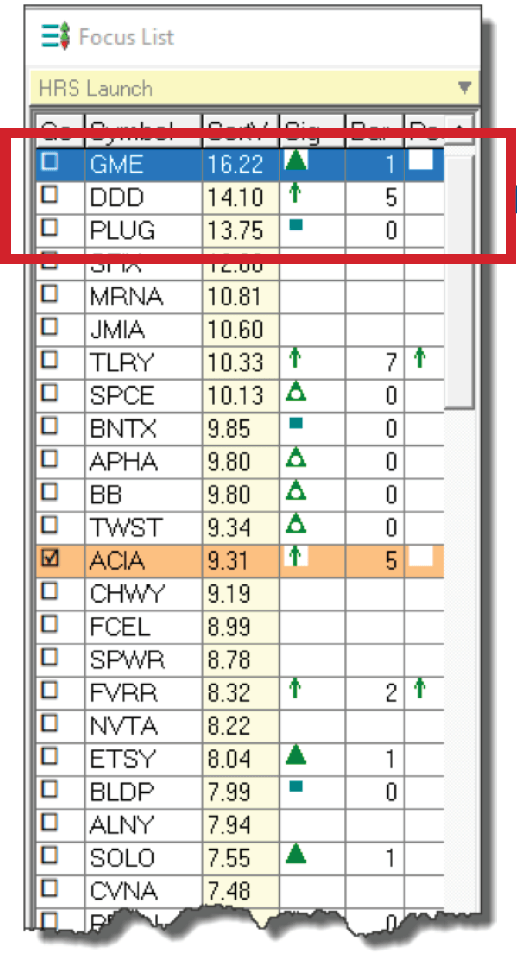

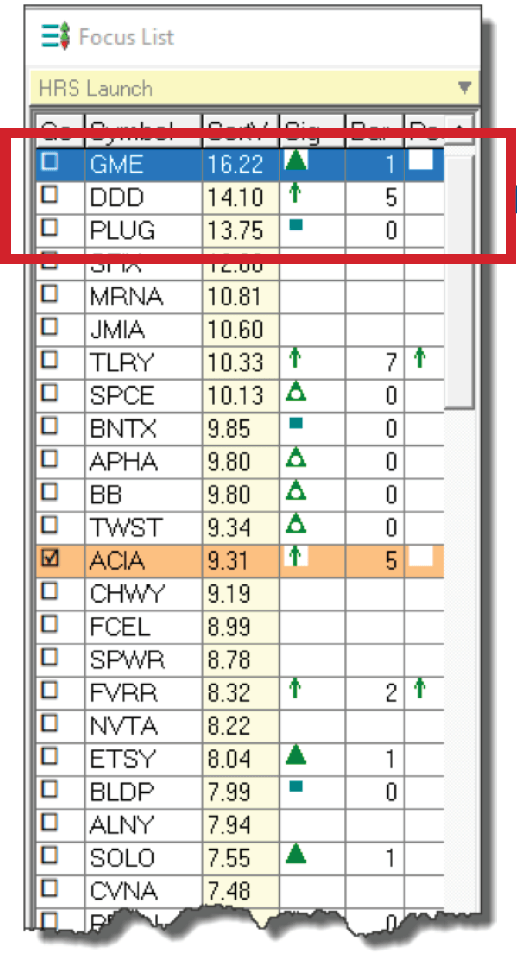

Rocket Scans deliver the most explosive candidates you have ever seen, ready for the Strategy to generate great Signals on them.

Let the Scans bring the candidates to you, and get your trading done in just 10-15 Minutes each day.

3. The Strategies (Signals)

Excellent Entry Signals

While we certainly can look through all the candidates generated by the OmniScans (and some users do this), a huge time savings is generated by running the Strategies provided with the RocketTrade Method.

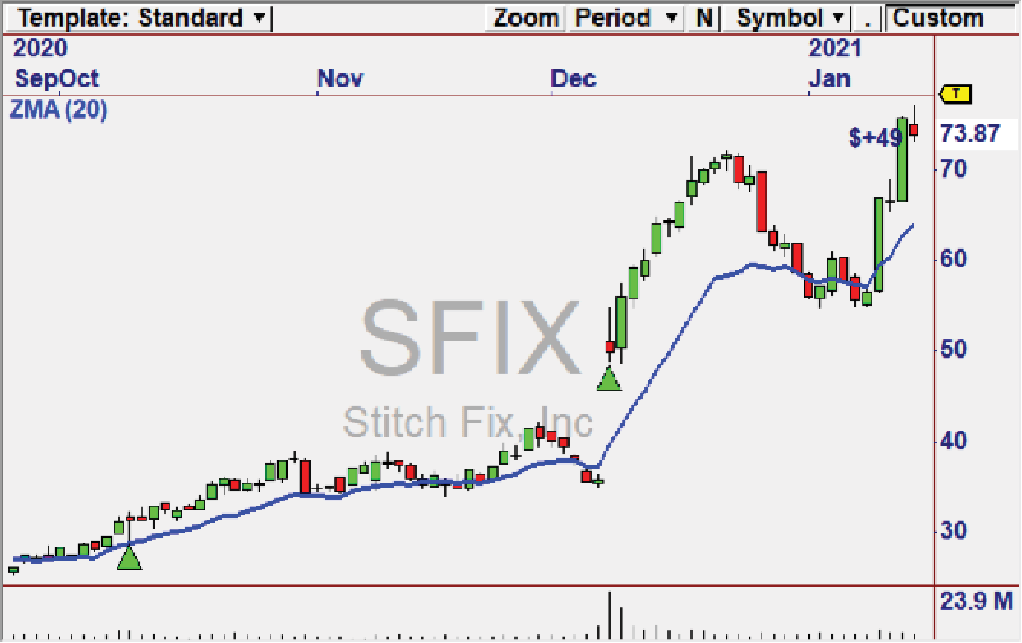

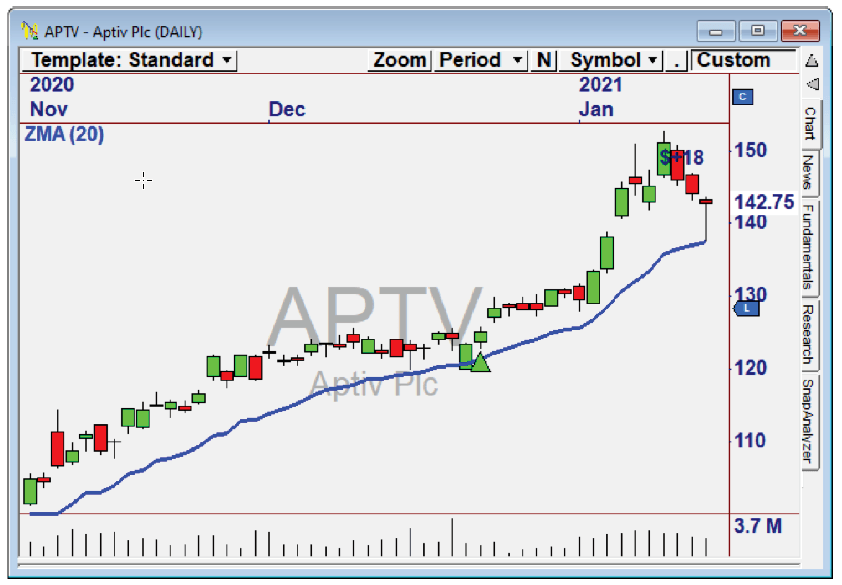

The Strategies looks for candidates with the highest Relative Strength that are turning up off a Moving Average. This often results in candidates that “run” which is where the bulk of the profits come from.

In the training sessions, Ed shows examples of how to select the best candidates from the Entry Signals presented in the Focus List. Part of the process is identifying chart clues that indicate they are likely to go higher.

Ed uses the Signals and Scans to do this in about 10-15 minutes a day across all candidates in the entire market. So far, the results speak for themselves!

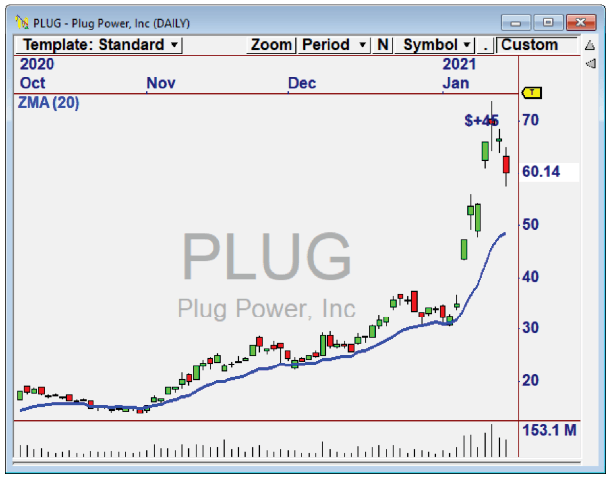

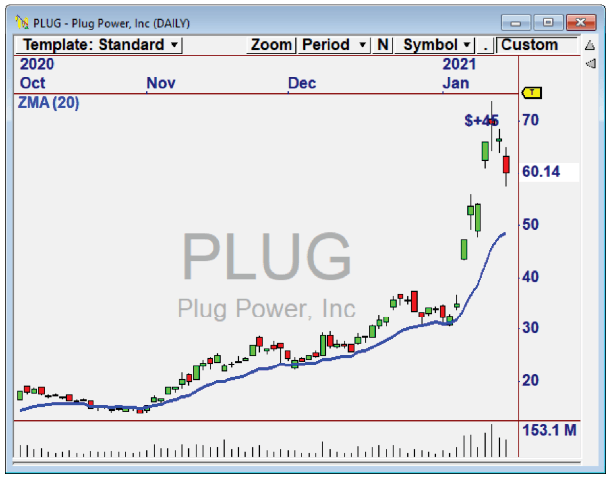

The chart for PLUG shows the Power of a Strategy coupled with Relative Strength combination. You can see solid green for 2 months where Accumulated Relative Strength is above zero, coupled with pull-backs to the ZMA for the Signal. Time and time again, this combination results in EXPLOSIVE moves.

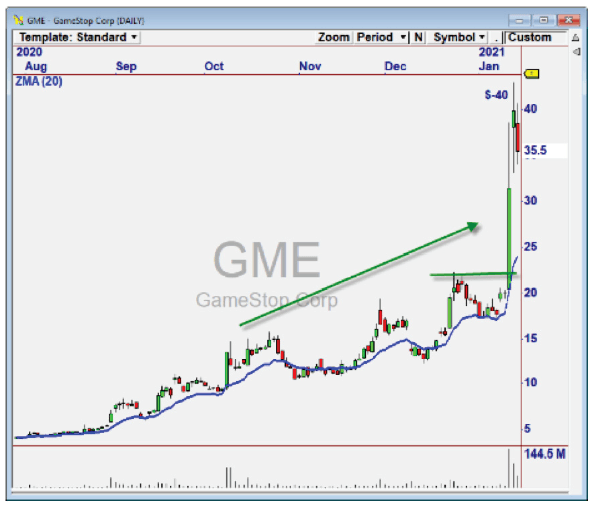

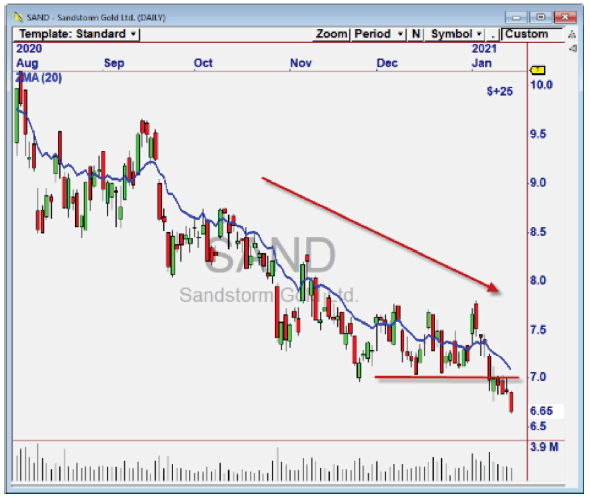

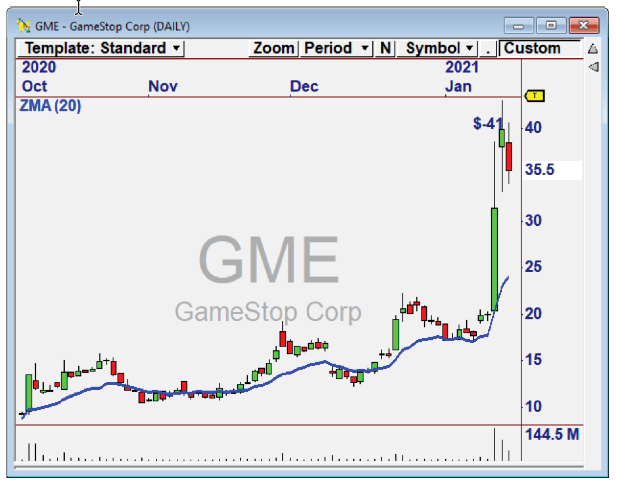

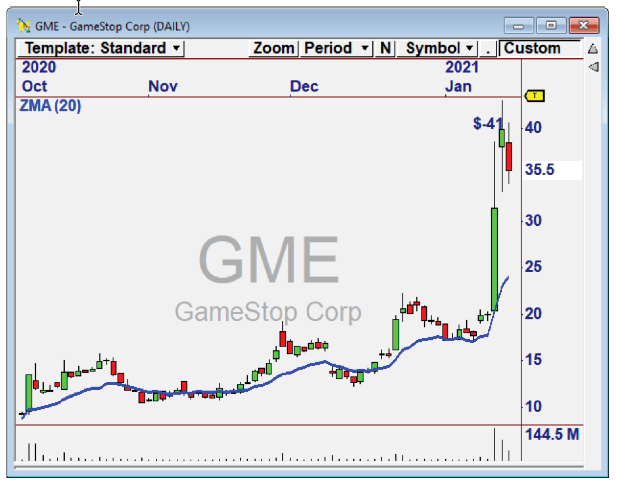

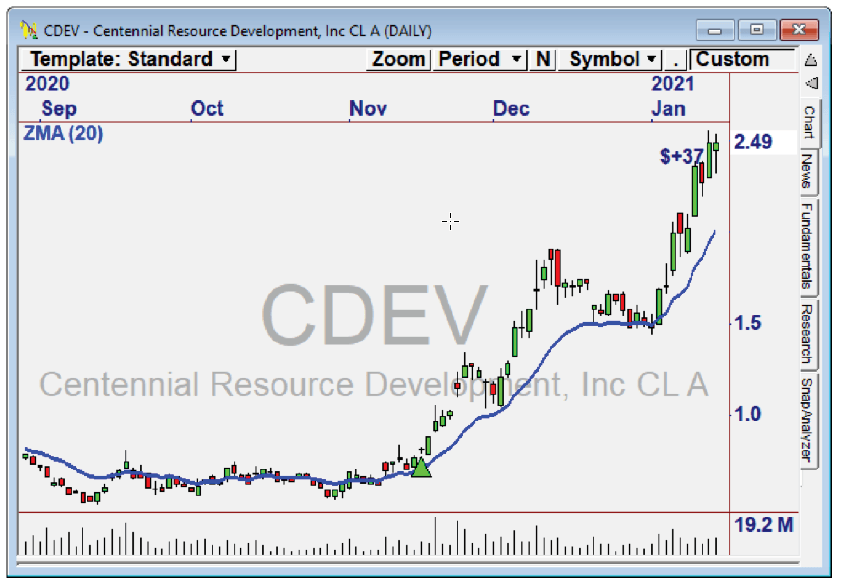

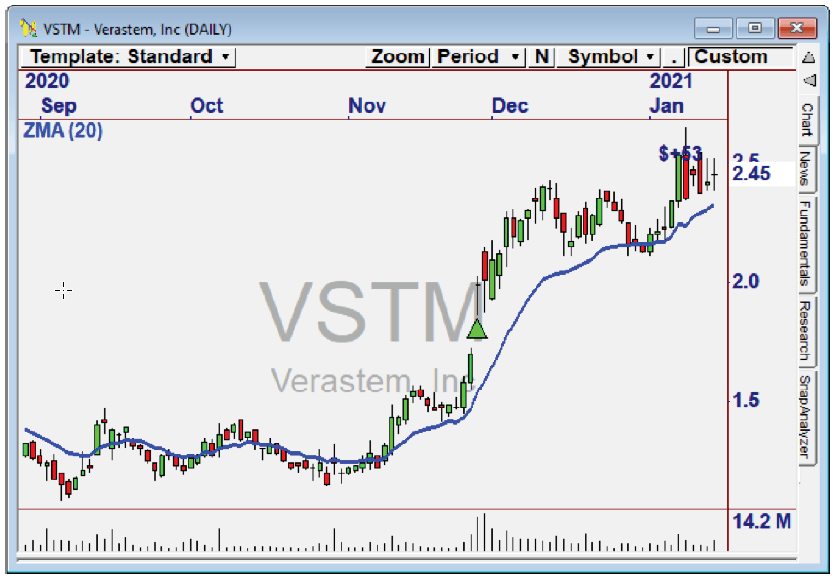

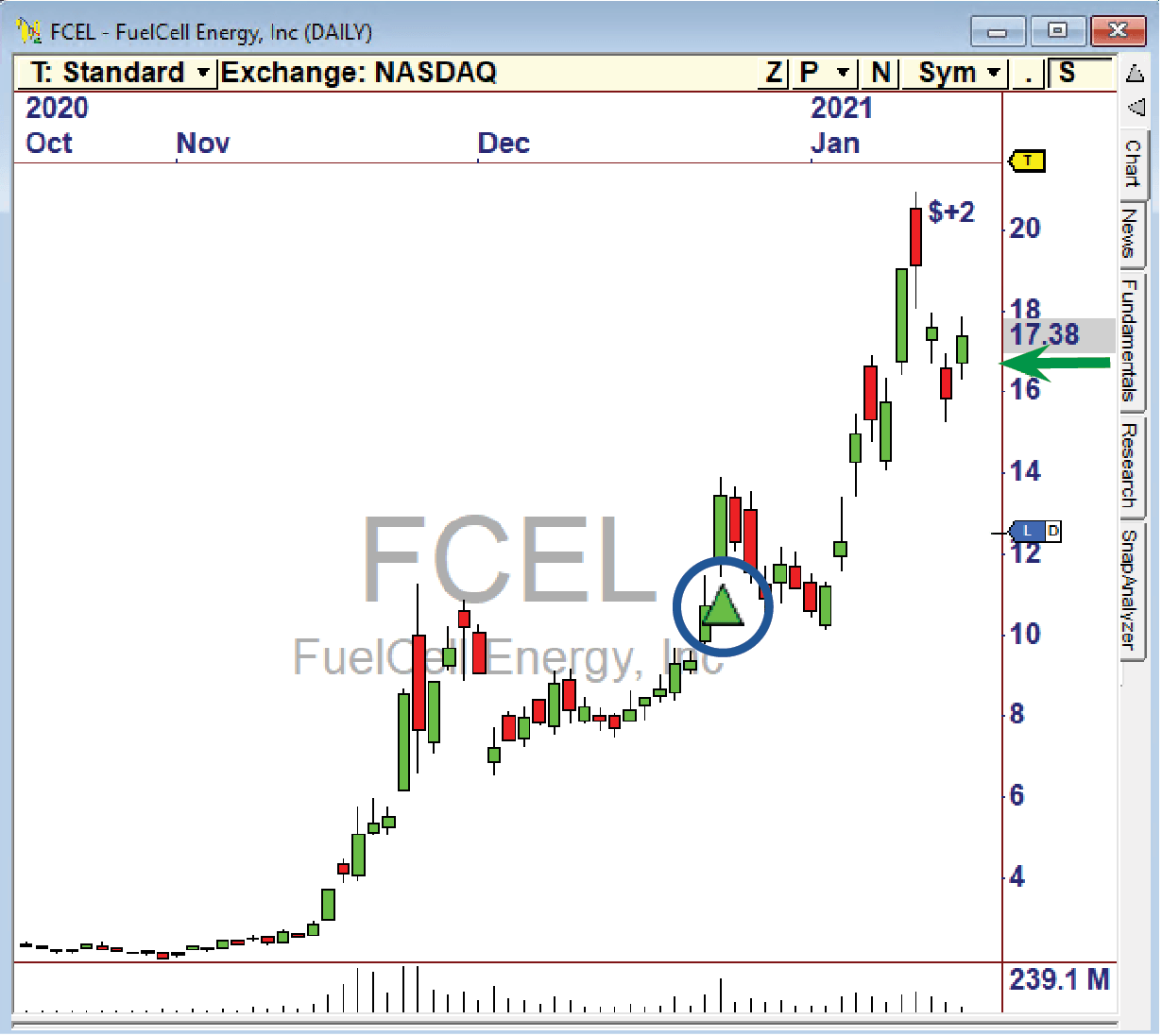

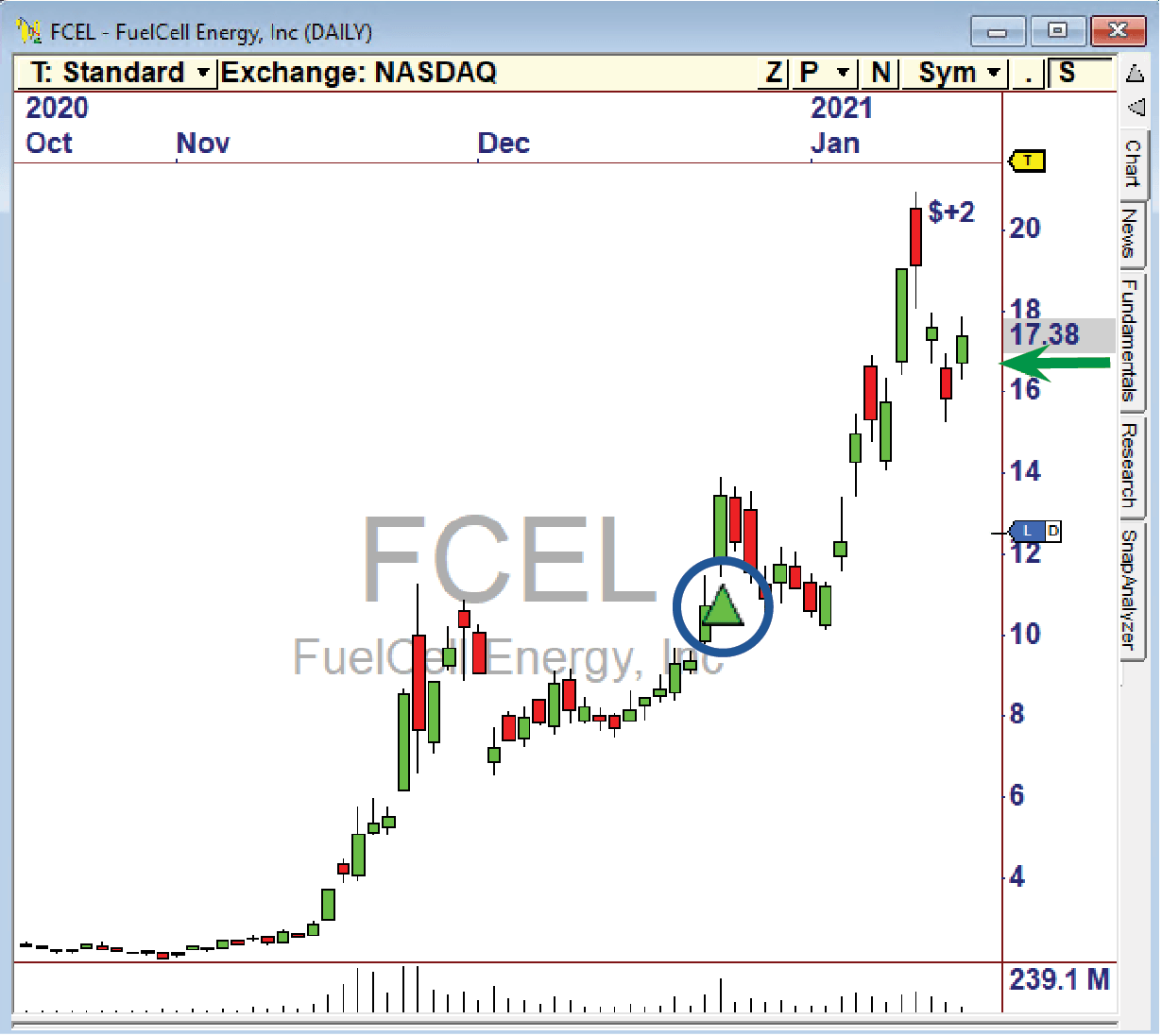

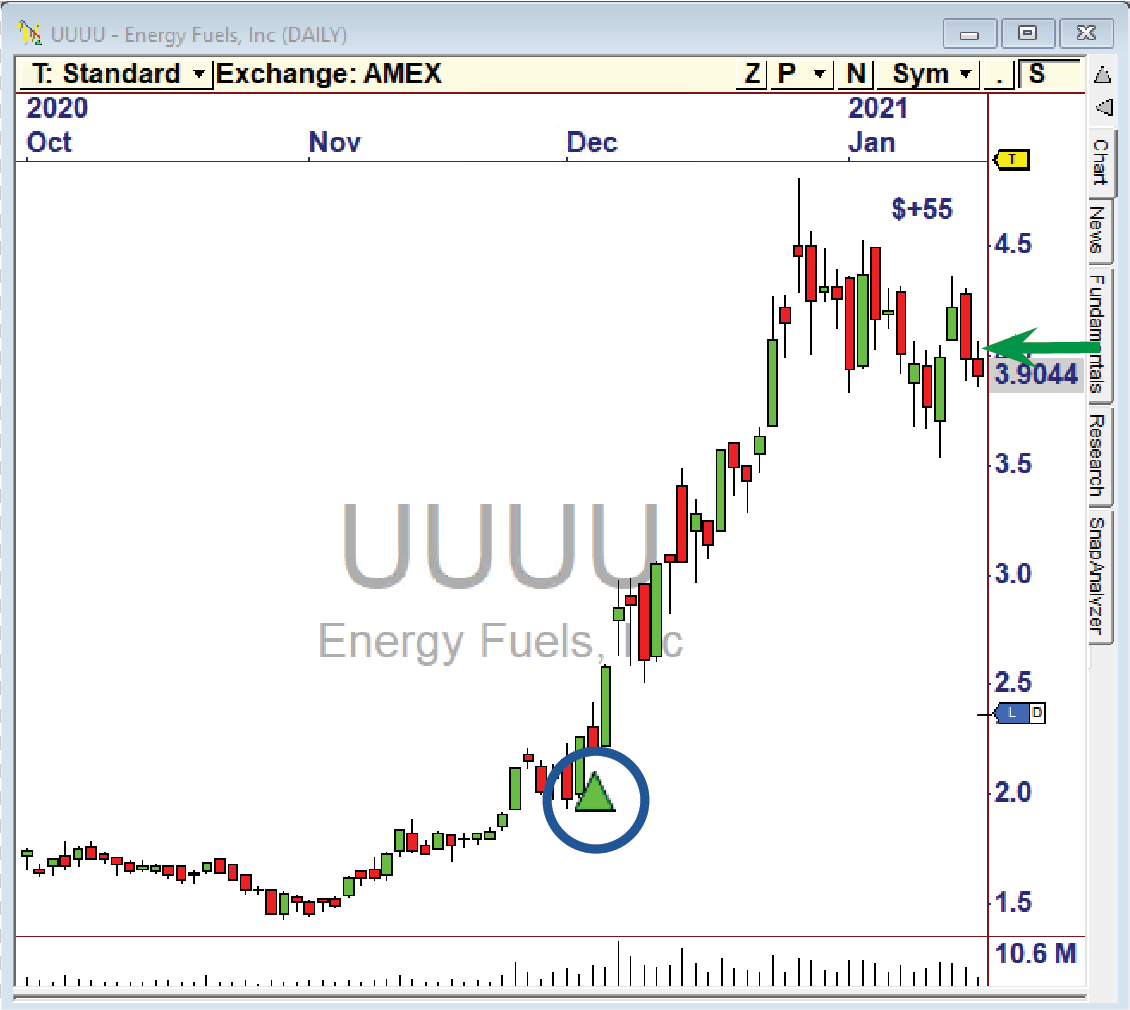

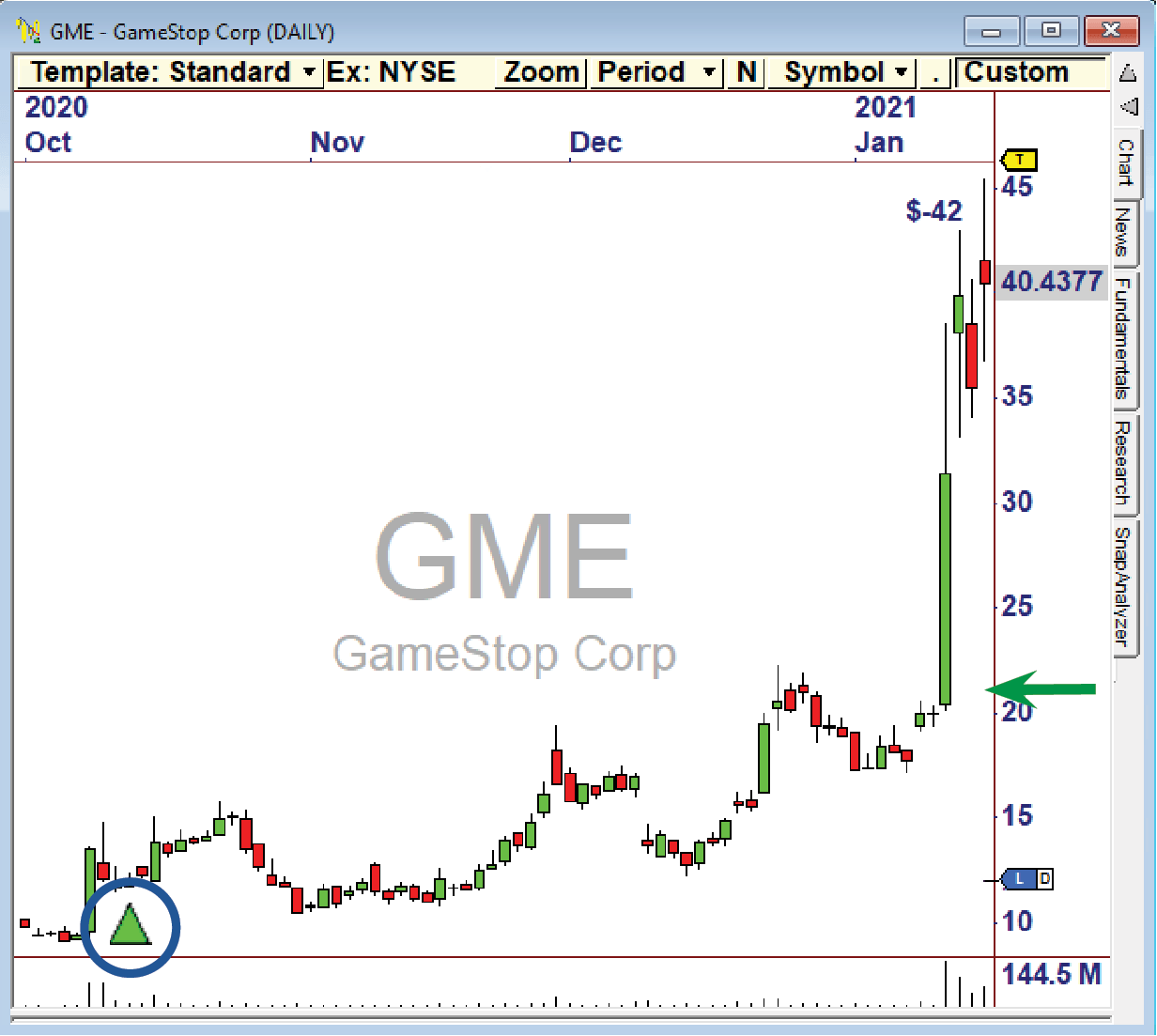

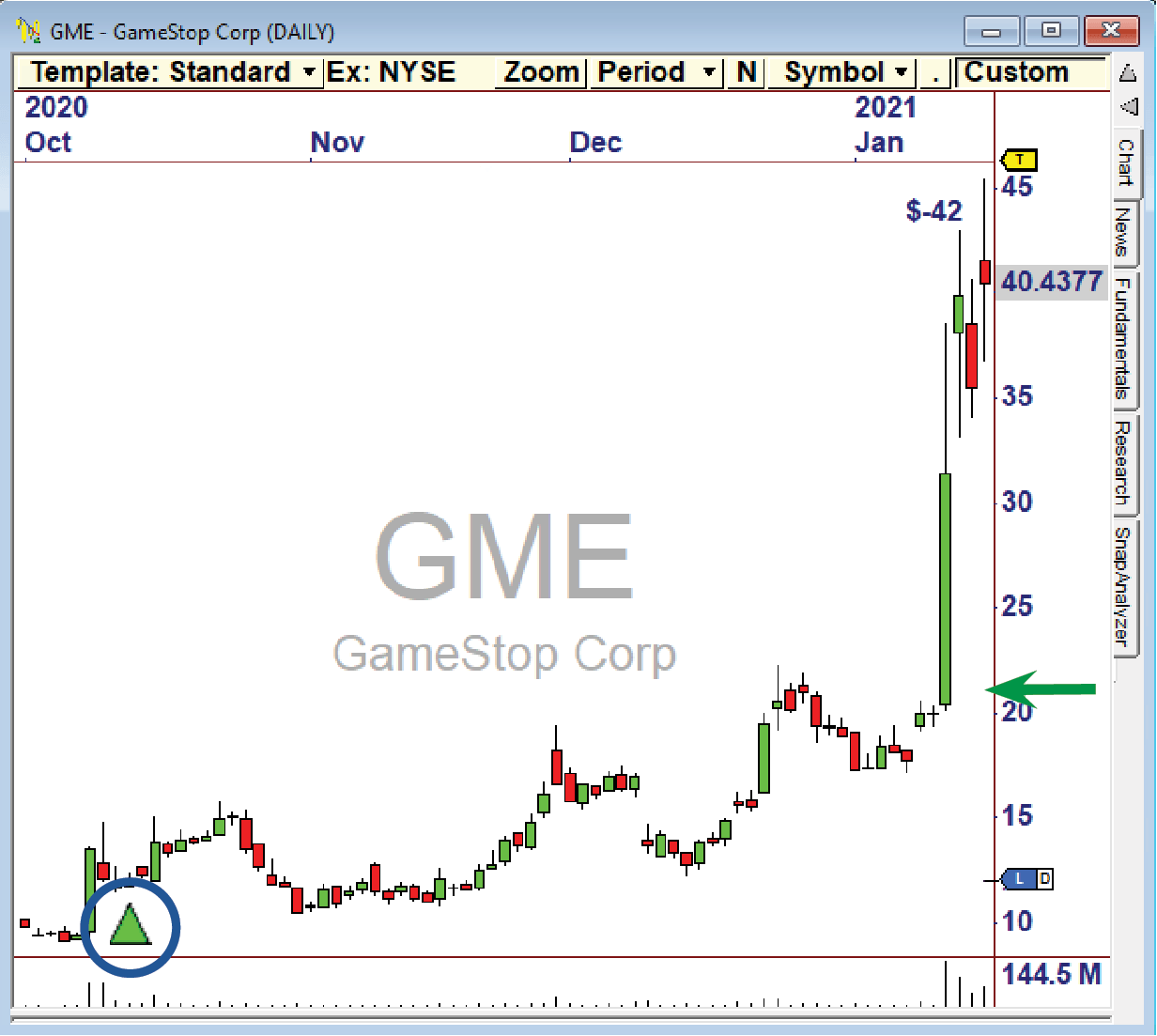

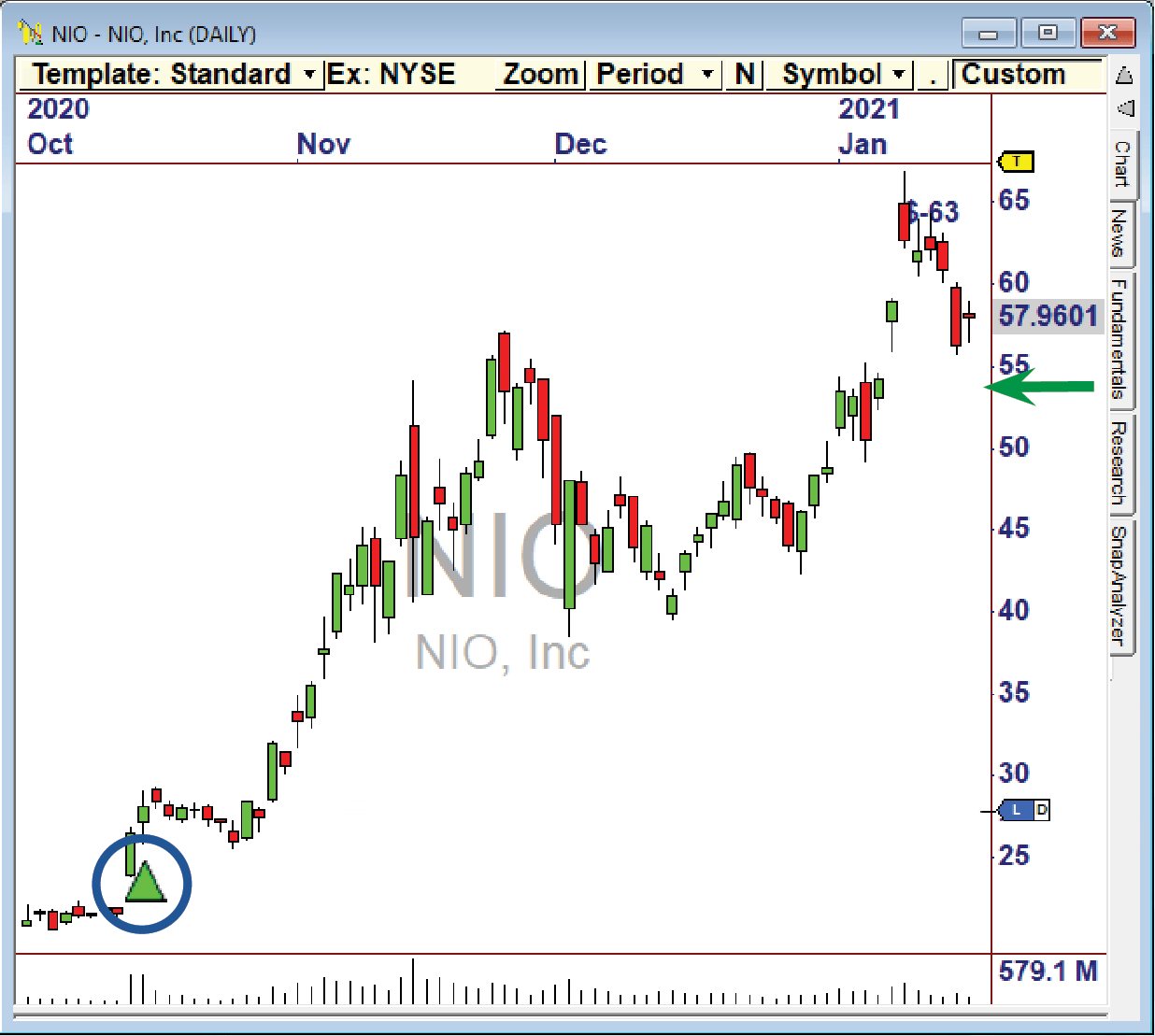

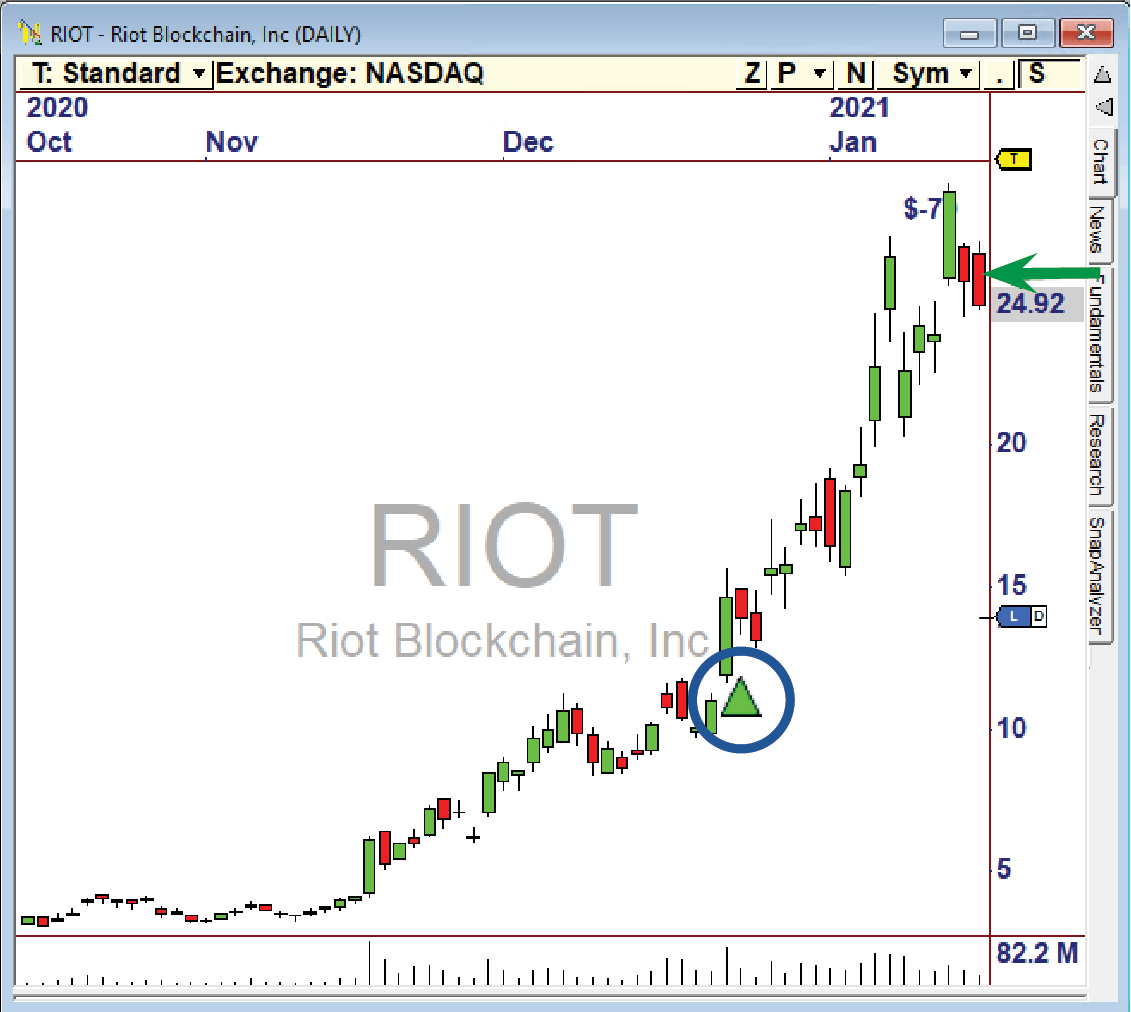

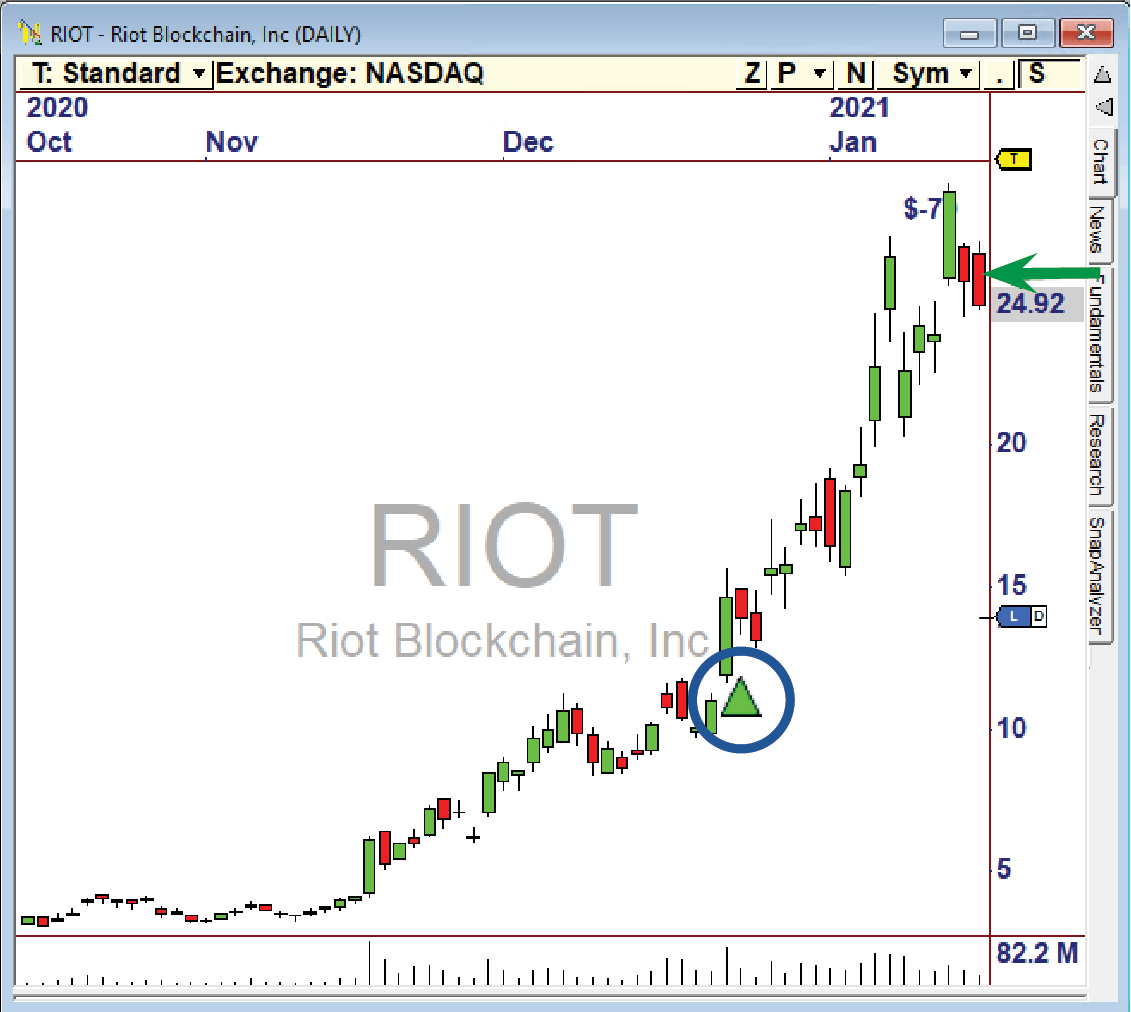

Recent Signal Examples

4. RocketTrade Method Education

THREE Training Sessions

"Let me show YOU how to Harness the Power in YOUR account!"

In these seminars for the RocketTrade Method, I disclose PRECISELY how I used Relative Strength to make consistent gains in the market.

While I can't guarantee gains, I CAN guarantee you will get really excited about what you see - providing the motivation to stay with the program and keep going.

-

Part 2: Watering the Garden

-

Part 3: Reducing Risk

Part I: Finding the Rocket Trades

One of the secrets to my success is the accumulation of potential and mitigation of risk through incremental diversification and trade management.

By periodically adding positions that have the “Right Stuff”, while dropping out of those that are unlikely to appreciate further, I’ve been able to steadily grow my account.

Relative Strength makes it easy to find stocks that are being accumulated by market participants.

“This is a Rocket to Trading Success!”

Discover how Keith B., an Opera Singer from Colorado, gained 22% in just 10 days!

Dwight Yackley

"I'm having great success with Rocket Trade.

My account is up 20% in three weeks!"

Bob Moodle

"I’d say the software paid for itself today (Jan 29, ’21). Made $33k on BYND Calls using RocketTrade and OptionTrader!"

Keith McIntyre

"Actual price performance at the hard right edge is as close to a “Holy Grail” as I have found. This is a Rocket to Trading Success!"

Paul Simons

"The Rocket Trade Method is simple to understand, illustrative and effective. I have really improved my trading results since I started using it."

Don Frazeur

The support provided by other vendors I have dealt with does not compare with the support Nirvana provides. You definitely score 110% for customer support."

Trade Examples

It’s easy to see the explosive nature of these trades.

“Let Me Show YOU How to RocketTrade!”

My job as CEO of Nirvana is to make great software - not to be a trader! But once I saw how much these Relative Strength trades could make, I decided to start trading them. I didn’t set out to generate a 50% return, but was thrilled when I did! It was an easy decision to share what I had learned with our loyal OmniTrader users. The RocketTrade Package includes great software and the best approach to trading I have ever seen. I know you will profit from it!

The RocketTrade Method Includes…

Nirvana’s Rocket Trader 2 Plug-In

Our Rocket Trader 2 Plug-In includes all the assets described here.

• Proprietary Relative Strength Indicators.

• Powerful OmniScans that find stocks with the highest Relative Strength.

• Signal-Generating Strategies and a Profile.

Price...................................................................................................$695

RocketTrade Method Training Three Part Course

Educational series, with Recordings available on your Product Dashboard after the event, to refresh your knowledge any time.

• Part I – “Finding the Launch Trades” - Introduction & training on how to find the powerful “Launch Candidates” and add them to your Portfolio.

• Part II – “Growing Your Garden” - Step-by-Step Instructions on how to manage your trades from day to day to maximize profits.

• Part III – “Reducing Risk” - We cover several great ways to reduce risk, including trade balancing and hedging with other instruments.

Price...................................................................................................$995

Get the Full Package

Only $695

“Let Me Show YOU How to RocketTrade!”

My job as CEO of Nirvana is to make great software - not to be a trader! But once I saw how much these Relative Strength trades could make, I decided to start trading them. I didn’t set out to generate a 50% return, but was thrilled when I did! It was an easy decision to share what I had learned with our loyal OmniTrader users. The RocketTrade Package includes great software and the best approach to trading I have ever seen. I know you will profit from it!

The RocketTrade Method Includes…

Nirvana’s Relative Strength Plug-In

Our “Harness the Power of Relative Strength” Plug-In includes all the assets described here.

• Proprietary Relative Strength Indicators.

• Powerful OmniScans that find stocks with the highest Relative Strength.

• Signal-Generating Strategies and a Profile.

Price...................................................................................................$995

LIVE and Recorded RocketTrade Method Training

Educational series, with Recordings available on your Product Dashboard after the event, to refresh your knowledge any time.

• Part I – “Finding the Launch Trades” - Introduction & training on how to find the powerful “Launch Candidates” and add them to your Portfolio.

• Part II – “Growing Your Garden” - Step-by-Step Instructions on how to manage your trades from day to day to maximize profits.

• Part III – “Reducing Risk” - We cover several great ways to reduce risk, including trade balancing and hedging with other instruments.

• INCLUDES Nirvana’s Relative Strength Plug-In.

Price...................................................................................................$1,495

$2,500

Our software is backed by our unconditional Money Back Guarantee. If for any reason you are not fully satisfied, you may return the software, within 30days of purchase, for a 100% refund, less shipping and handling. In bundle offers, the OmniTrader upgrade is valued at $199 if purchased by the deadline,$249 after the deadline. Texas residents add 8.25% sales tax. Educational material is non-refundable.

Important Information: Futures, options and securities trading has risk of loss and may not be suitable for all persons. No Strategy can guarantee profits or freedom from loss. Past results are not necessarily indicative of future results. These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. There are numerous market factors, including liquidity, which cannot be fully accounted for in the preparation of hypothetical performance results all of which can adversely affect actual trading results. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.