The Mobile version of this Site is sill under construction. Please visit the Desktop version on your computer.

Thank you.

Now Supporting Real Time Methods

Announcing RTQ

"Real Time on the Q's"

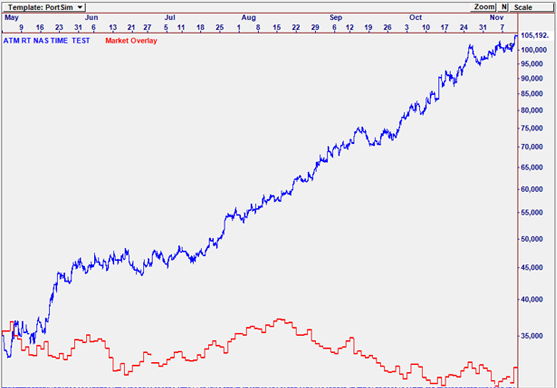

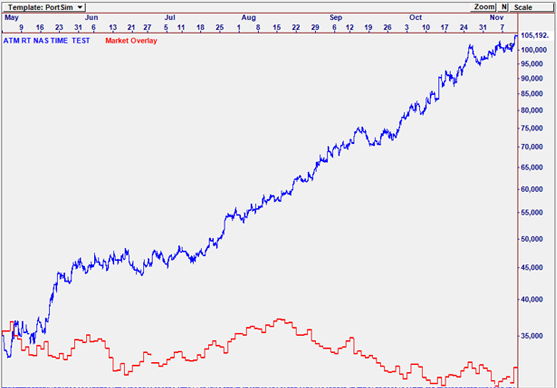

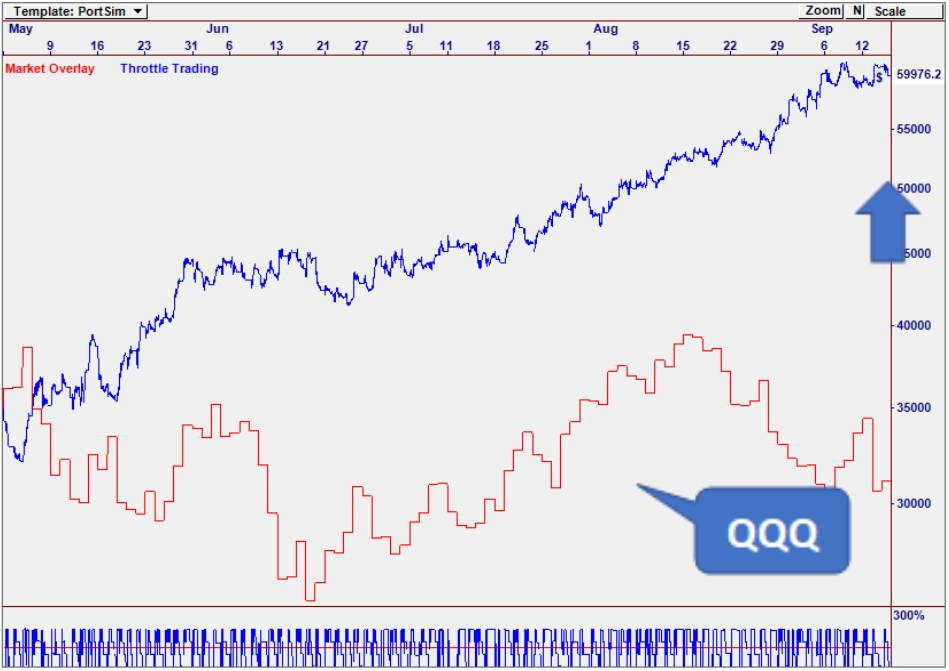

RTQ (2:1) compared to QQQ May-Oct 2022

RTQ (2:1) compared to QQQ May - Oct 2022

Trades in Direction of the Market.

Has Made a 200% Return

in Just 6 Months.

Max Draw Down Just 9.5%!

RTQ – “Real Time on the Q’s”

Our First Real Time ATM Method

Why RTQ is So Powerful

Uses Market States - Waits for the NASDAQ (QQQ) to make a strong move and then trades the stocks that are showing the strongest momentum in the same direction.

Selective Trades - Only trades those stocks that are the most highly correlated to the QQQ.

Uses the NEW ATM5 with RT Support - Harnesses the power of the NEW ATM Real Time Functionality to apply Market State Control during the session.

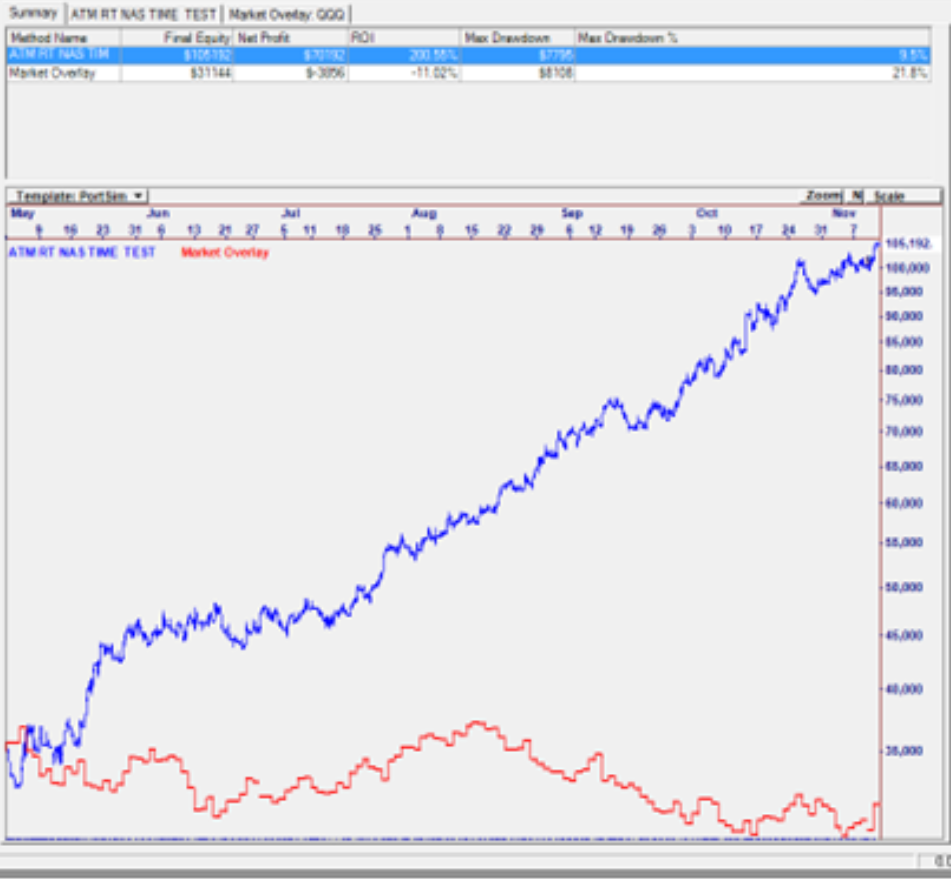

A Live Market Test

Our first version of RTQ showed great performance – especially when compared to that of the QQQ (ETF representing the Nasdaq 100 index). All results shown are purely mechanical testing/trading.

On September 15, we began trading it LIVE in actual market conditions.

The Strategy made substantial gains in September and October.

While we were pleased with this performance, we wanted to see if we could enhance it even further…

MORE Improvements!

We set ATM to adjust allocation based on the time of the trading session. For example, approach the open of the session differently from an allocation perspective from the mid-morning session. With this research, we were able to improve performance further…

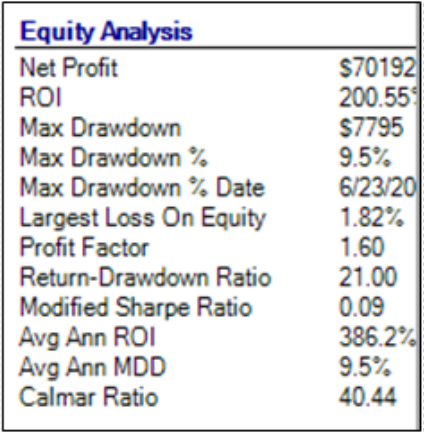

For the 6 months from May-October 2022, RTQ generated a 200% return in

a down market. Max Draw Down was just 9.5% in this period.

From May to October 2022,

RTQ generated a 200% return

in a down market.

Your Personal Real Time ATM Method

Besides trading it, the potential applications of RTQ are enormous. ATM RTQ owners can easily create their own Methods with different symbols, or different reference symbols and lists. For example, you could use the SPY ETF and the most correlated stocks to SPY, or any group-based ETF and its constituents.

RTQ can perform like this because it harnesses the power of ATM5. If you’re not familiar with ATM, the following section will explain why it is the highest level of trading automation available to traders today.

New to ATM?

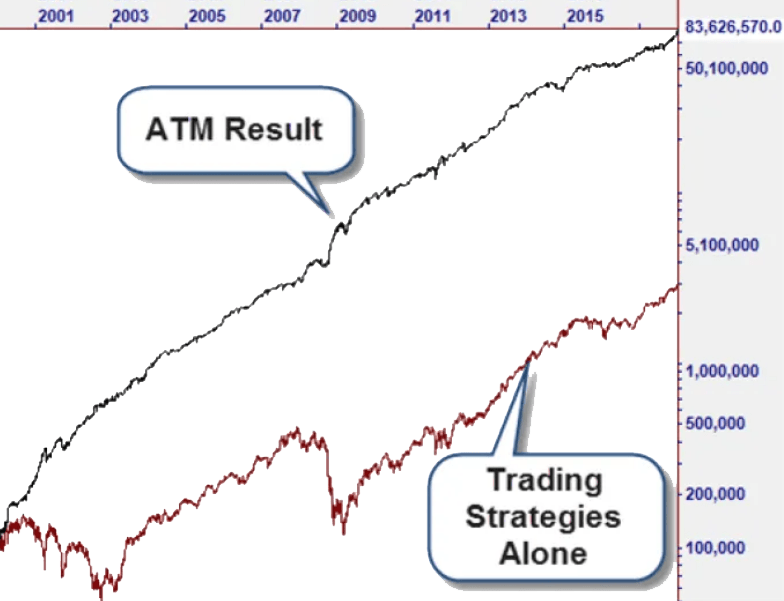

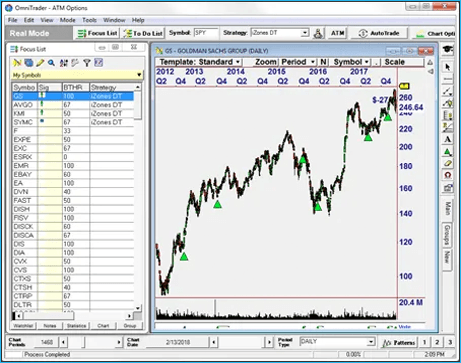

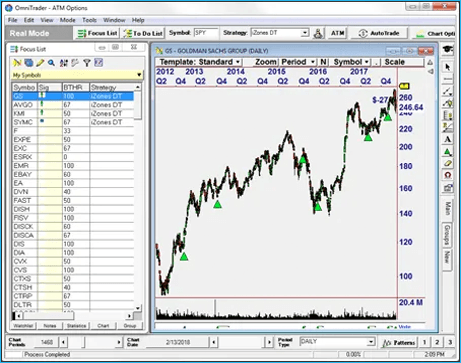

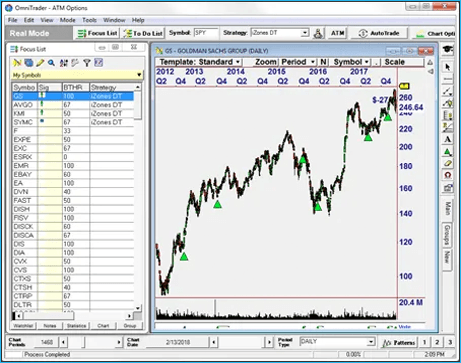

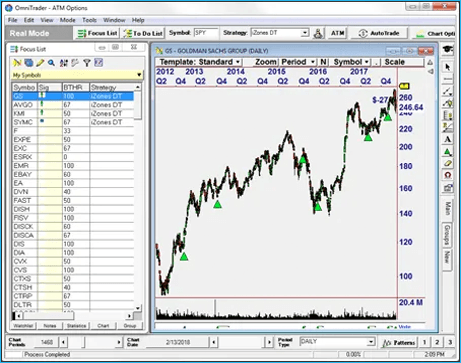

Adaptive Trade Management (ATM) is a dynamically automated approach to trading. ATM allows us to adapt to changing markets by determining the type of market, and then adjusting our trading approach in order to maximize results.

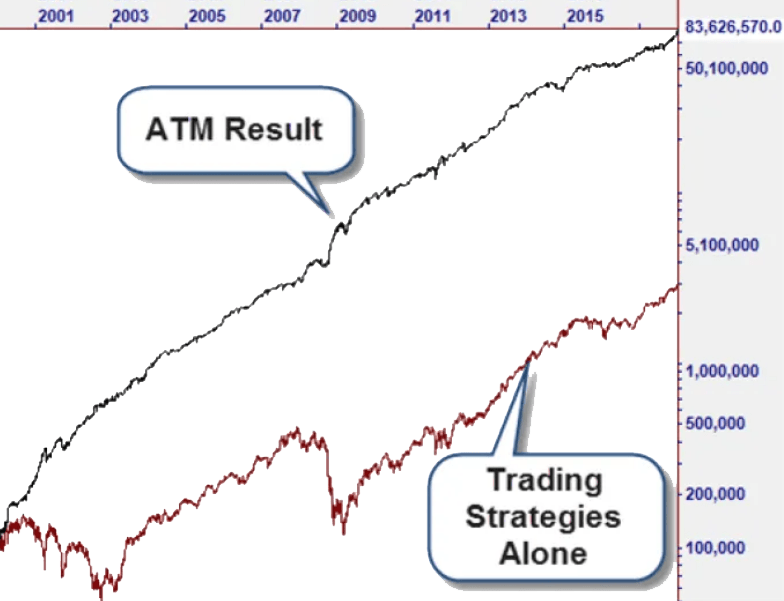

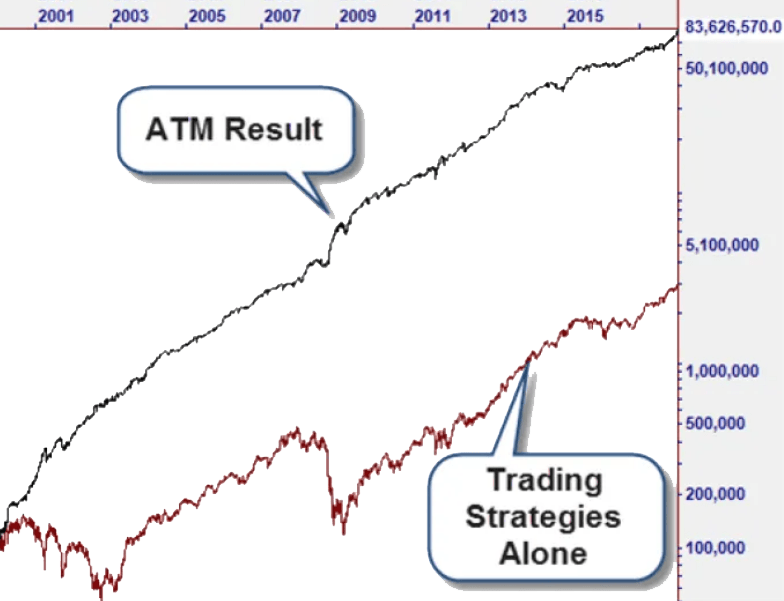

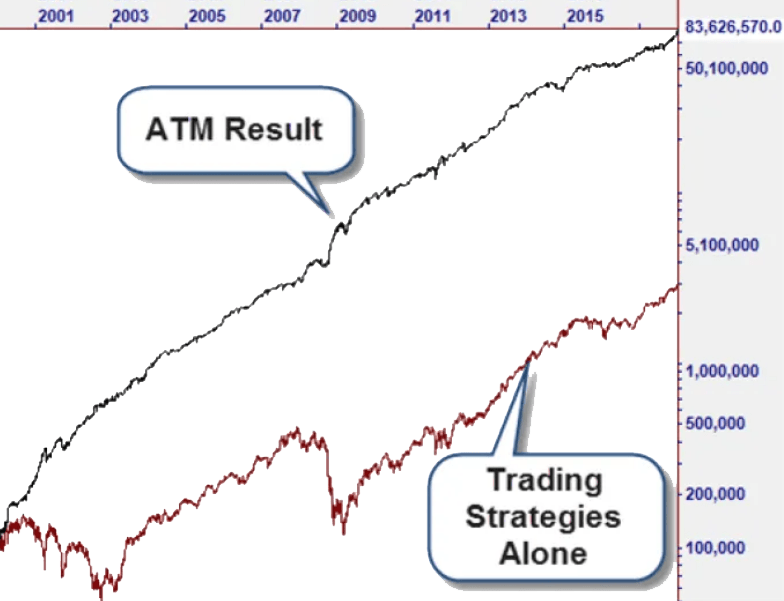

The equity curves to the right shows the dramatic improvement that this technology can have on results. Consistent gains, low drawdowns, outstanding performance in all markets - ATM delivers!

New to ATM?

Adaptive Trade Management (ATM) is a dynamically automated approach to trading. ATM allows us to adapt to changing markets by determining the type of market, and then adjusting our trading approach in order to maximize results.

The equity curves to the right shows the dramatic improvement that this technology can have on results. Consistent gains, low drawdowns, outstanding performance in all markets - ATM delivers!

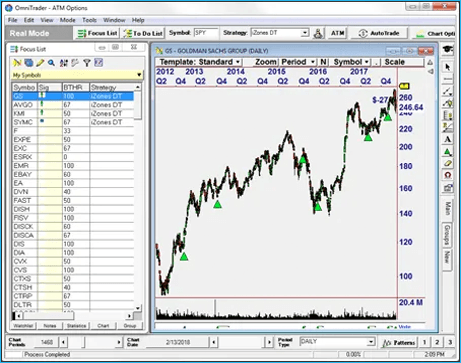

It's So easy to use!

With the ATM5 package, you do NOT have to know...

· Which Symbols to trade

· Which Strategies to use

· Which Market States to use

The ATM5 package comes with several great Methods, or you can create your own. Remember, the ATM5 package will decide which assets to trade, so it’s not that important to “get it right”. You just need a good selection of Market States and Strategies for it to work from.

The included Methods can be used right out-of-the-box.

All you have to do is click “Run Analysis” in the Portfolio Simulator!

It's So easy to use!

With the ATM5 package, you do NOT have to know...

· Which Symbols to trade

· Which Strategies to use

· Which Market States to use

The ATM5 package comes with several great Methods, or you can create your own. Remember, the ATM5 package will decide which assets to trade, so it’s not that important to “get it right”. You just need a good selection of Market States and Strategies for it to work from.

The included Methods can be used right out-of-the-box.

All you have to do is click “Run Analysis” in the Portfolio Simulator!

Step By Step - How ATM Achieves These Results:

Market States

ATM will first determine the state of the market. By looking at different factors in the broad market, ATM will determine the Market State which determines which Trading Strategies to use, which trade filters to employ, which available trades to take, and how much to allocate to each trade.

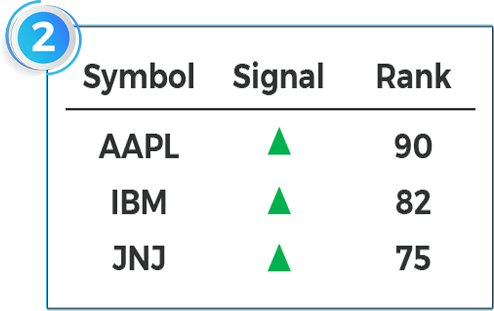

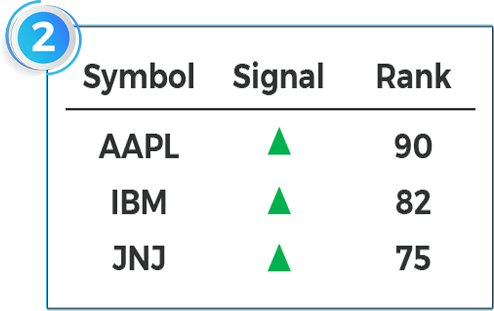

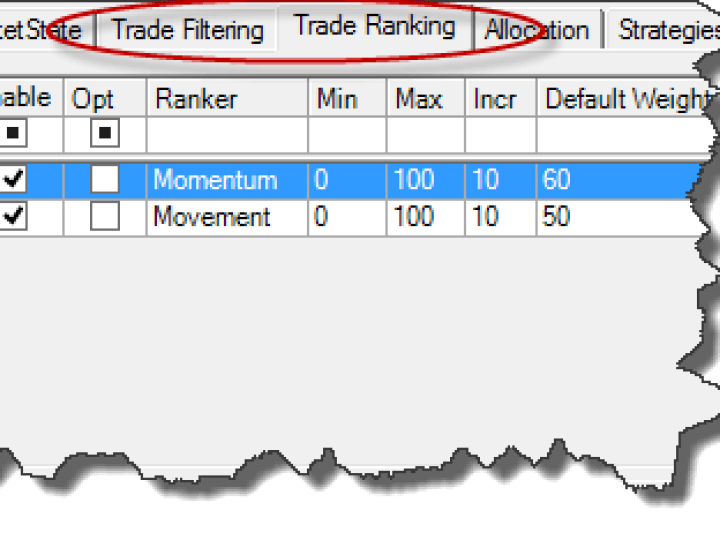

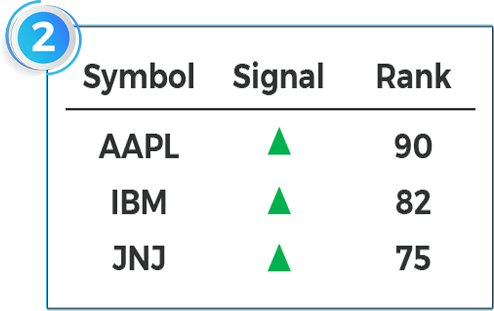

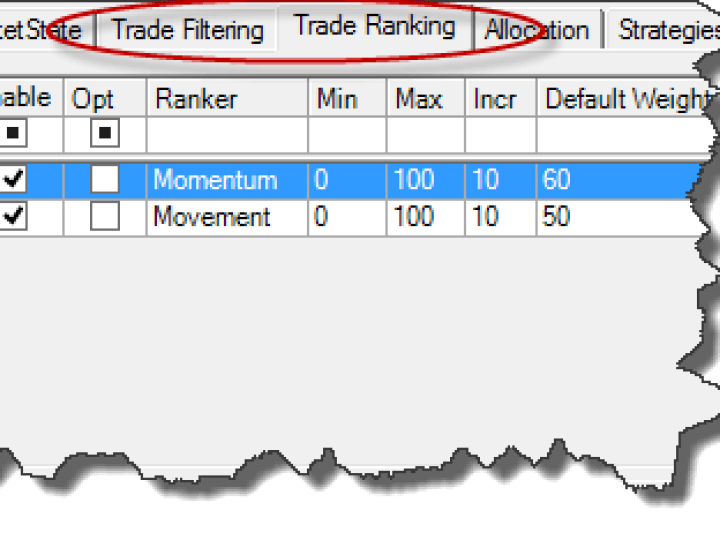

Trade Ranking

Once ATM has determined which Trading Strategies to use in the current Market State, ATM will then look at the trades generated by the strategies. It will rank them in order to determine which trades are best poised to profit in the current market.

Symbol Filters

ATM is designed to determine which trades have the best chance for success in the current market. Each Market State has Trade Filters which are used to make sure that all trades taken are conducive to the current market personality.

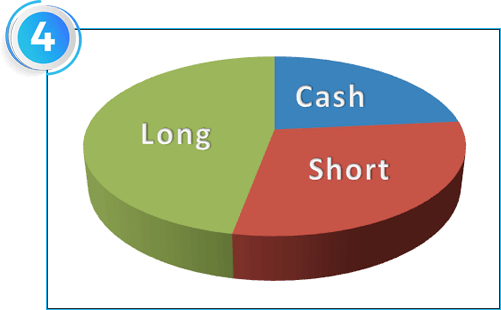

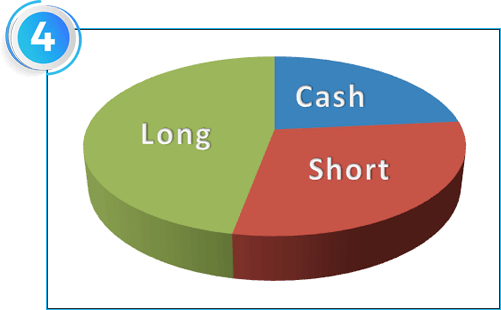

Smart Allocation

Depending on the Market State, we may want to increase or decrease our amount invested, number of trades, and trade size. ATM allows each of these factors and more in every Market State, giving you unprecedented control over your market exposure.

Believe it or not, ATM doesn’t stop there.

It also has the ability to have different long/short balance and trade size for each Market State.

Automatic Ranking for the Best Trades

Using the best Strategies for each Market State is good, but we want the absolute BEST trades.

ATM can filter out the trades that we don’t want, and then it will rank the remaining potential trades in order to insure that we are only taking the trades with the highest profit potential.

Market Specific Allocation is Key

Whether you want all longs in a Bullish Market, a mix of longs and shorts in a Sideways Market, or reduced trade size in a Volatile Market, ATM automatically adjusts to make sure you have the perfect balance.

Step By Step -

How ATM Achieves These Results:

Market States

ATM will first determine the state of the market. By looking at different factors in the broad market, ATM will determine the Market State which determines which Trading Strategies to use, which trade filters to employ, which available trades to take, and how much to allocate to each trade.

Trade Ranking

Once ATM has determined which Trading Strategies to use in the current Market State, ATM will then look at the trades generated by the strategies. It will rank them in order to determine which trades are best poised to profit in the current market.

Symbol Filters

ATM is designed to determine which trades have the best chance for success in the current market. Each Market State has Trade Filters which are used to make sure that all trades taken are conducive to the current market personality.

Smart Allocation

Depending on the Market State, we may want to increase or decrease our amount invested, number of trades, and trade size. ATM allows each of these factors and more in every Market State, giving you unprecedented control over your market exposure.

Believe it or not, ATM doesn’t stop there.

It also has the ability to have different long/short balance and trade size for each Market State.

Automatic Ranking for the Best Trades

Using the best Strategies for each Market State is good, but we want the absolute BEST trades.

ATM can filter out the trades that we don’t want, and then it will rank the remaining potential trades in order to insure that we are only taking the trades with the highest profit potential.

Market Specific

Allocation is Key

Whether you want all longs in a Bullish Market, a mix of longs and shorts in a Sideways Market, or reduced trade size in a Volatile Market, ATM automatically adjusts to make sure you have the perfect balance.

Discover the Difference ATM Can Make:

In Just 3 minutes, see how Market States, Trade Ranking, and Smart Allocation can achieve this goal!

ATM Benefits Your Trading 2 Ways:

Manual Trading:

Use it to show you the best trades to make each day...

Fully Automated Trading:

Let it manage your account with 100% automated trading!

It Also Works with Any Strategy!

Nirvana has created and released many great Strategies, including Reversion to Mean,

Trend Following, Swing Trading and More! Whatever you are using, ATM can improve results.

Don't have any Strategies?

Call us and we'll help! 512-345-2566

ATM Benefits Your Trading 2 Ways:

Manual Trading:

Use it to show you the best trades to make each day...

Fully Automated Trading:

Let it manage your account with 100% automated trading!

It Also Works with

Any Strategy!

Nirvana has created and released many great Strategies, including Reversion to Mean, Trend Following, Swing Trading and More! Whatever you are using, ATM can improve results. Don't have any Strategies?

Call us and we'll help!

512-345-2566

Harness the Power of ATM5 and RTQ Today!

“ATM, developed for OmniTraders International, is our crown jewel achievement. There is no other product on the market like it! No other software offers automated trading based on Market State analysis, Ranking, and Dynamic Allocation.

And more importantly, while ATM is an Open System, we’ve done all the work to create the provided Methods! All you do is turn it on and activate AutoTrade. Discover the ATM difference today.”

Ed Downs

Or Call 800-880-0338

Harness the Power of ATM Today!

“ATM, developed for OmniTraders International, is our crown jewel achievement. There is no other product on the market like it! No other software offers automated trading based on Market State analysis, Ranking, and Dynamic Allocation.

And more importantly, while ATM is an Open System, we’ve done all the work to create the provided Methods! All you do is turn it on and activate AutoTrade. Discover the ATM difference today.”

Ed Downs

For ATM5 Owners:

✓ RTQ Method...............$1,495

Special Offer:

Just $995

For ATM 1- 4 Owners:

ATM5 Upgrade

Package Includes:

✓

RTQ Method: $1,495

✓

ATM5 Upgrade: $995

$2,500 Value

Special Offer:

Just $1,495

Or Call

800-880-0338

Our software is backed by our unconditional Money Back Guarantee. If for any reason you are not fully satisfied, you may return the software, within 30days of purchase, for a 100% refund, less shipping and handling. In bundle offers, the OmniTrader upgrade is valued at $199 if purchased by the deadline,$249 after the deadline. Texas residents add 8.25% sales tax. Educational material is non-refundable.

Important Information: Futures, options and securities trading has risk of loss and may not be suitable for all persons. No Strategy can guarantee profits or freedom from loss. Past results are not necessarily indicative of future results. These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. There are numerous market factors, including liquidity, which cannot be fully accounted for in the preparation of hypothetical performance results all of which can adversely affect actual trading results. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.