I am thrilled to announce the approach of ATM2 - our latest version of the Adaptive Trade Management System that builds upon the foundation that was released in February.

ATM is all about Higher Returns with Less Risk!

ATM is all about trading the right symbols, using the right Strategies, at the right time, based on what the market is doing. The first version of ATM allowed us to do this on the symbols in a profile. New features in ATM2 are FURTHER extending its lead in Automated Trading Technology. But it's not just for automatic trading - I'll explain in a minute.

Harnessing the Power of Group Rotation

The primary improvement in ATM2 has to do with trading groups of Symbols with their own Market States, based on select Market Symbols. The feature is called Symbol Lists and Concurrent Market States.

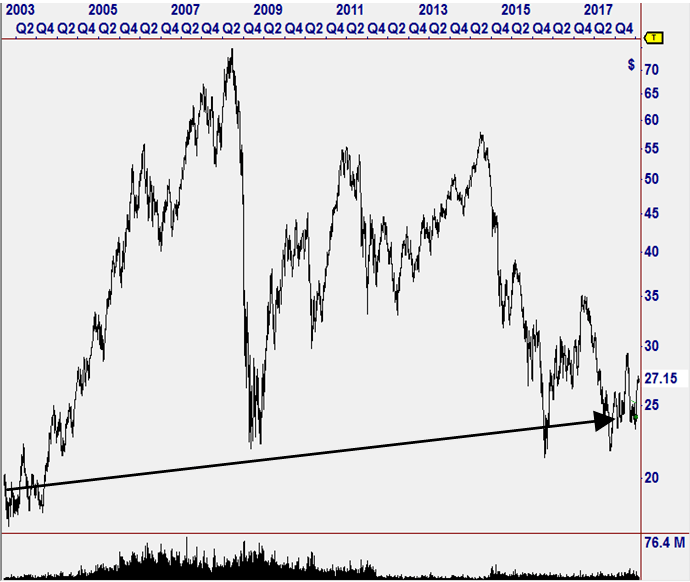

Consider just one group - the Oils. Here is a chart of OIH, which is an Exchange Traded Fund that represents oil producers:

OIH went up and down for 15 years, going almost nowhere

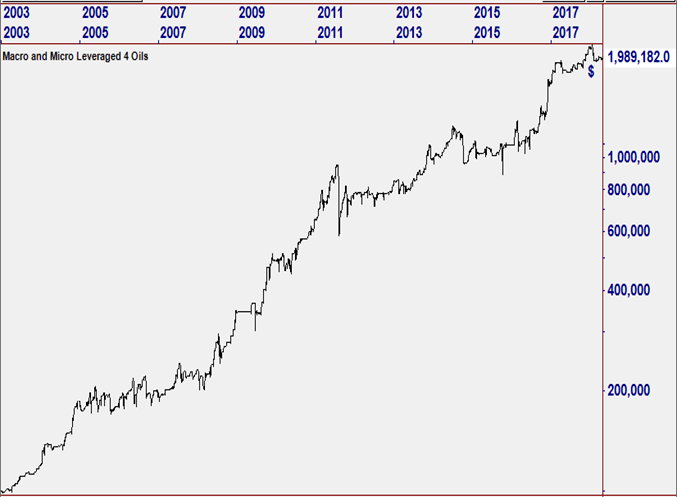

The Oil Producers, as a whole, made very little progress over 15 years, as shown in the chart above. HOWEVER, letting ATM trade the individual stocks in this group created a much different outcome!

* Historical Trading Simulation

ATM, Trading the Oil Stocks, made 26% per year!

Want Higher Returns? Just add more groups!

Because these new Market States will be allowed to run concurrently, a trading account can become much more fully allocated (more invested) by trading more groups, which means returns will be higher.

Then, there's Index Put Protection...

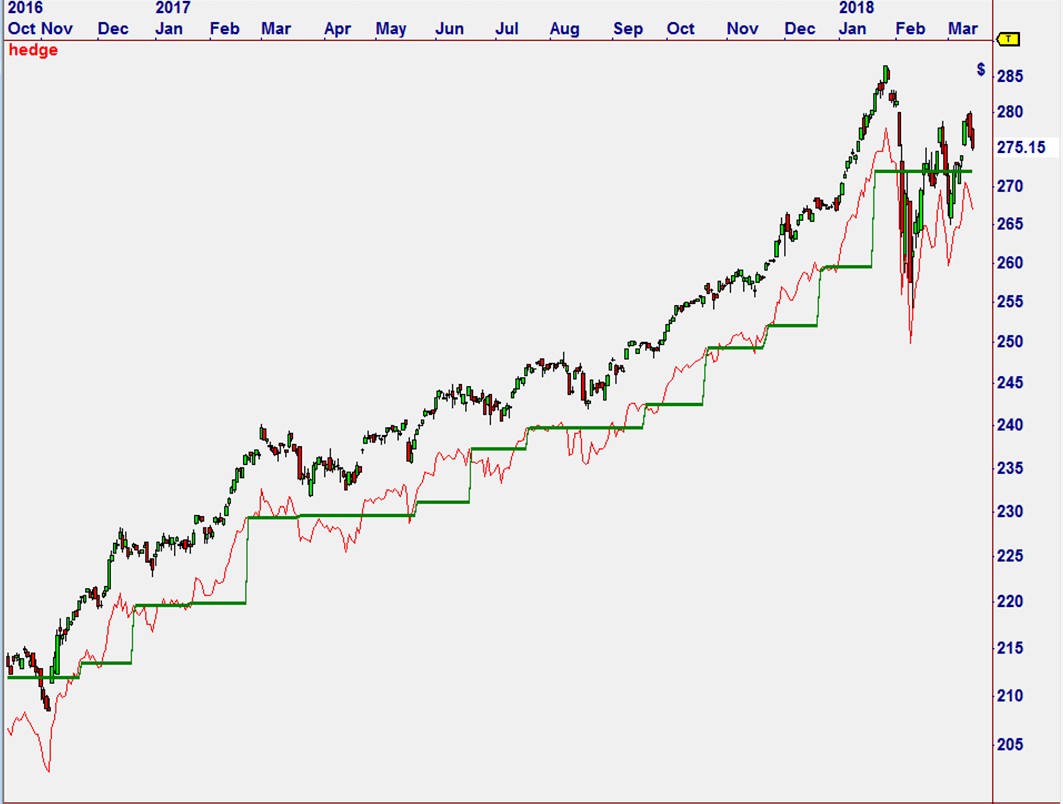

To reduce risk, we are adding a very important, advanced feature called Index Put Protection. The idea is to provide "insurance" for an account, such that if (and when) the market enters a correction, usually with a very high negative one-day move, appreciation of puts on an index symbol can counter the paper losses in the account. This is demonstrated in the chart below...

By purchasing Put Options on an Index, and account can be protected from sudden losses. The green line in this picture represents the "stair step" put protection concept. When the market falls through, the Puts become valuable and counter the loss.

The user can set ATM to automatically decide whether to take profits on the puts and stay invested, or get out altogether.

By the Way... ATM is NOT Just for Automatic Trading!

Because ATM shows all trades in the Focus List (whether AutoTrade is being used or not), a user can simply be advised of trades identified by ATM, and then place them with discretion.

Complete Webinar Explaining ATM

I recently published a Webinar Recording for prospective ATM users that covers the basis for ATM, as well as the new features that are coming in ATM2.

Click Here to view the Sales Webinar for ATM2 (html version, with chapters for easy navigation)

also available: mobile version & powerpoint

Questions on ATM? Contact us at 800-880-0338.

Important Information: Futures, options and securities trading has risk of loss and may not be suitable for all persons. No Strategy can guarantee profits or freedom from loss. Past results are not necessarily indicative of future results. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading.