ATM RTQ Info Sheet

The ATM RTQ Method is a real time strategy that is meant to be traded in the 5-minute timeframe.

The ATM RTQ Method is a real time strategy that is meant to be traded in the 5-minute timeframe. TheMethod analyzes the ETF for NASDAQ 100 (QQQ). It looks for the QQQ to make a strong move in eitherdirection. Once this move is detected, it will trade the strongest (for longs) or weakest (for shorts) stocksin the Focus List. The number of trades taken depends on the time of the trading session.

The trades are managed by the RTQ Trade Plan. This Trade Plan will use various stops in order tomanage risk and capture profits. However, this Trade Plan is unique in the fact that it includes an extrastep if the trade hits its Fixed Profit Stop. This is done to deter the Method from entering another tradeon that same symbol right away. By using this extra step our testing has shown that it helps us avoidoverbought (for longs) or oversold (for shorts) situations and enhance the Method’s performance.

ATM Method Specifications

Reference Symbol:

QQQ

Starts Trading:

Session Open

Market States:

Market Open = First 15 Minutes of Trading Session

After Open = 15 Minutes After Open to 30 Minutes After Open

Morning Session = Half an Hour After Market Open to

2 ½ Hours After Market Open

Afternoon Session = 2 ½ Hour After Market Open to

½ Hour Before Session Close

Last Time Trading:

Half an Hour Before Session Close

Latest Exit Time:

10 Minutes Before Session Close

Symbols Traded:

AAPL, ADBE, AMD, AMZN, CSCO, CTSH, FTNT, GOOGL INTU, ISRG, MSFT, NVDA,

PYPL, QCOM, QQQ, SBUX, SWKS, WDAY

This method is constructed to be traded mechanically, but there are various discretionary steps you may wish to engage. Be sure to watch the RTQ Traders Seminar in your customer dashboard to learn more about this method and different ways it can be traded. If you have any questions, please contact our customer service department at Support@nirvsys.com and we will be happy to assist you. The installation also includes a version of ATM RTQ called ATM RTQ Open. This version will only take trades the first half hour of the trading session. Everything else in the method is the same as the original ATM RTQ Method.

Discover the Difference ATM Can Make:

In Just 3 minutes, see how Market States, Trade Ranking, and Smart Allocation can achieve this goal!

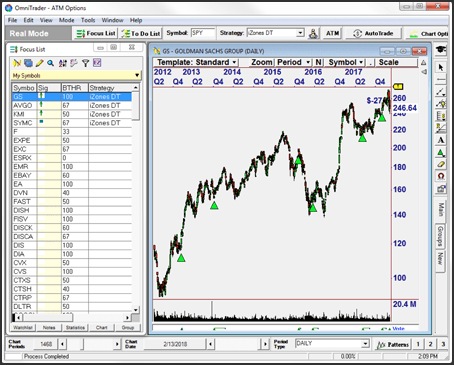

The Adaptive Trade Management System (ATM) has one simple goal - maximizing return while minimizing risk.

This groundbreaking technology controls every aspect of how a trading system, or collection of systems, approaches the market. In fact, it is a virtual Market Mastermind.

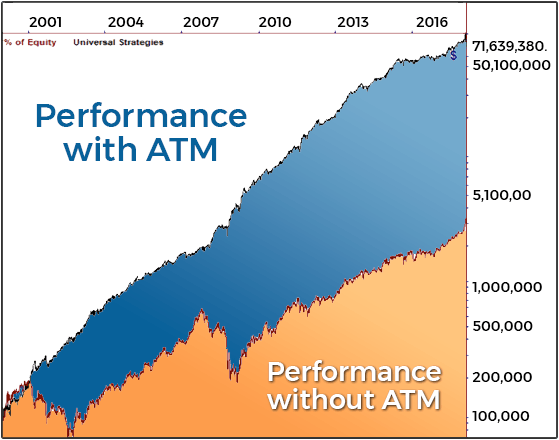

To the right is a Trade Simulation from 2000 through 2017. Using ATM, ending equity hits $71.6 million versus $3 million without ATM. And, Avg Annual Max Draw downs are just 9% compared to 40%.

How does ATM Achieve these results?

Market States

ATM is constantly aligning itself with the current market by detecting Market States. Each different state will use different Strategies, Filters, Rankers and Allocation that are conductive to the current market

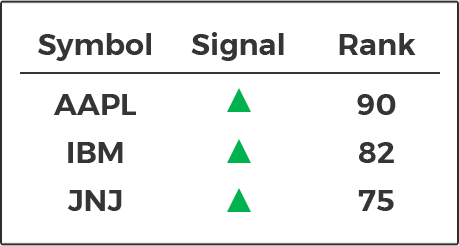

Trade Ranking

ATM Ranks trading candidates based on the current market and measurements on each , in order to select the best candidates each day.

Symbol Filters

Filters keep trades from being made when the trade is too risky. For example, avoiding stocks in a trending market that are too volatile.

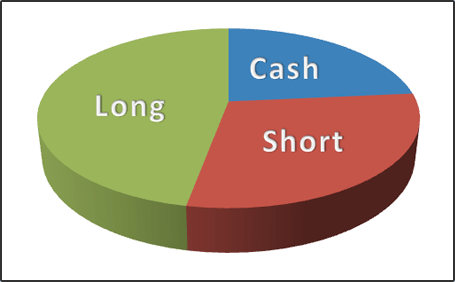

Smart Allocation

Smart Allocation based on market behavior can reduce risk even more.

In uncertain markets, ATM can take fewer or smaller positions or hedge between Long and Shorts.

Works with Any Strategy!

Nirvana has created and released many great Strategies, including Reversion to Mean, Trend Following, Swing Trading and More!

Whatever you are using, ATM can improve results. Don't have any Strategies?

Call us and we'll help.

ATM Benefits Your Trading 2 Ways:

ATM runs in Nirvana's OmniTrader, the simplest and most automatic trading software in the world. **

Manual Trading:

Use it to show you the best trades to make each day...

Fully Automated Trading:

Let it manage your account with 100% automated trading!

One License. Two Powerful Uses.

ATM was created by Omni Traders International, the company who brought us OmniVest, an automated web platform that runs Nirvana Strategies.

Soon, ATM will be available in OmniVest so users can apply this powerful technology to Portfolios of Strategies.

The good news?

It's available in OmniTrader NOW.

Users Discover the Power of ATM.

"This is exactly what

I've been waiting for!"

"This is it! This is exactly what I've been waiting for! I've been with Nirvana for years and now it all comes together. I am as excited as you are about ATM. I would characterize the new Adaptive Trade Management System as the Complete Solution." - John L

"It's a dream come true"

“ATM is simply amazing! When the Market changes, we can modify the Strategies used, Allocations, Long / Short ratios and then only enter the highest ranked trades. This is a dream come true.” - Mark H.

"ATM is going to forever change the way I trade!"

“What if your new suit could instantly adapt to the weather conditions? That’s the magic of Nirvana’s new ATM plugin for OmniTrader. Not only can I now adjust every aspect of my trading systems to my exact style, I can now have that system change with the market conditions. I can balance between longs and shorts or switch from between systems or even change trade filters and sorting. Tremendous possibilities! This is the capability I've always wanted and I know it is going to forever change the way I trade.” – Steve M.

Generous Discounts Available for "Early Adopters"

Omni Traders International is providing generous EARLY ADOPTER discounts for customers who want to acquire a license to this powerful technology while it is being developed for OmniVest. Important: After the OmniVest version is released, the OmniTrader version will continue to be supported.

Important Information:

Futures, options and securities trading has risk of loss and may not be suitable for all persons. No Strategy can guarantee profits or freedom from loss. Past results are not necessarily indicative of future results. These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. There are numerous market factors, including liquidity, which cannot be fully accounted for in the preparation of hypothetical performance results all of which can adversely affect actual trading results. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.