Why Trade Options?

Options provide the best of all worlds. With options you can:

• Increase Profits

• Generate Income

• Limit your Overall Risk

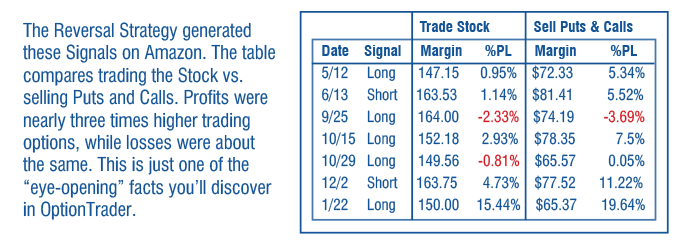

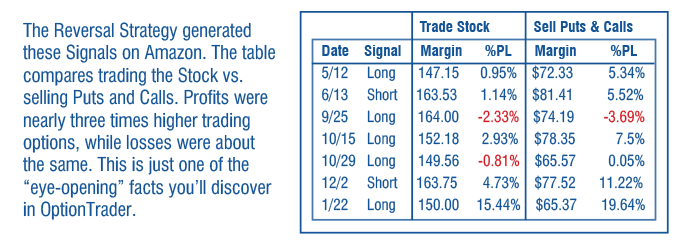

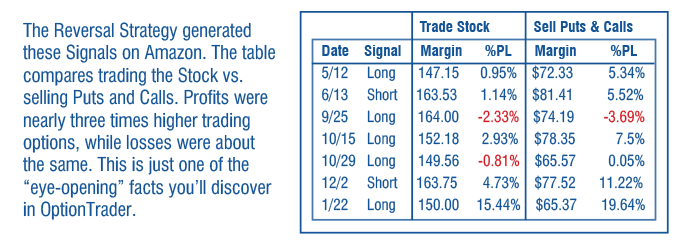

Options can dramatically increase trading profits. In the example to the right, we compare the same trades on the stock versus selling options. Profits were nearly three times higher trading options, while losses were about the same.

We can also use options to generate income in our accounts, by selling time premium to the market using Covered Calls, Butterflies and other methods. All you have to do is decide which approach to take for a given chart…

Harnessing the Power of Options with OptionTrader 3

We designed OptionTrader to simplify the option trading process. Given a goal, the software will tell you which option method to apply.

How do you know when to generate income vs. placing a directional trade? How do you establish your chart levels? These questions and more are answered in Ed’s Course.

OptionTrader is the best options trading platform in the world. Combined with the new Options Course, you will be able to engage the options market with confidence. We guarantee it!

We built OptionTrader with three goals in mind:

Make options trading easy.

Automatically identify the most profitable options method for any trade.

Automatically test options methods on historical data in OmniTrader.

Success with Options

Nirvana Customers share their experiences and insights.

”

New OptionTrader "sees the light"

Greg Henry

I just started trading options several months ago in order to make best use of my resources, and have suspended trading equities for now. I have not had a Return on Investment on my winning trades of less than 40% and I have only had ONE losing trade since starting!

”

An Option Trader's Comments

Cameron Alistair

Investing in stocks looks attractive but the capital requirements are huge. Options, on the other hand, provide a low cost entry to the market and can provide diversity with hundreds of stocks, indexes and futures that offer options opportunities.

I believe the confusion for the aspiring option trader is the many combinations of calls, puts, long and short positions that can be derived. The inclusion of weekly options and LEAPs just compounds the decision in what to trade, when to trade, and what combination of strike price and time element.

Nirvana’s software integration with gxtrader will enable me to quickly set my buy/sell position, and instantly have my target price and stop/loss level confirmed. Plus, I do not want to be at my computer during the entire market trading day.

Nirvana is key to my future with their existing platforms and expanded features in OptionTrader.

”

Unique Oppurtunities with Options

Dan Lesley

My favorite strategy is controlling a significant amount of stock with very little money—if any at all. A few years ago IBM was around $90 per share, it would have been expensive to buy 1,000 shares, so I purchased 10 calls at the strike price nearest the price of IBM four months out, then I sold 10 puts at the same strike price four months out.

This actually put money into my pocket because the puts paid for the calls plus some. This also created a “synthetic long” position with Delta at about 100% (which means, for each point of movement in IBM, my position would move the same amount.) This was done on a Friday, On Saturday I left for Austin, Texas for the annual Nirvana Club Meeting.

When I returned Monday evening the price of the stock increased $6. Therefore, when I liquidated my positions Tuesday I had a profit of $6,000.

NClub Discounts Apply at Checkout

1-800-880-0338

Free 90-day Introductory subscription to End-of-Day Options Data. $15 per month after 90 days.

OptionTrader is backed by our 30-Day Money Back Guarantee.

Important Information: Futures, options and securities trading has risk of loss and may not be suitable for all persons. No Strategy can guarantee profits or freedom from loss. Past results are not necessarily indicative of future results. These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. There are numerous market factors, including liquidity, which cannot be fully accounted for in the preparation of hypothetical performance results all of which can adversely affect actual trading results. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NClub Discounts Apply at Checkout

1-800-880-0338

Free 90-day Introductory subscription to End-of-Day Options Data. $15 per month after 90 days.

OptionTrader is backed by our 30-Day Money Back Guarantee.

Important Information: Futures, options and securities trading has risk of loss and may not be suitable for all persons. No Strategy can guarantee profits or freedom from loss. Past results are not necessarily indicative of future results. These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. There are numerous market factors, including liquidity, which cannot be fully accounted for in the preparation of hypothetical performance results all of which can adversely affect actual trading results. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.