Advanced Mode lets you learn Advanced Option Trading Methods better than any other software on the planet!

Advanced Mode

There are many different Option Methods traders use, and each having specific advantages depending on the situation and objective:

- Naked Options

- Debit Spreads

- Credit Spreads

- Diagonal Spreads

- Calendar Spreads

- Synthetics

- Butterflies

- Condors

- Straddles

- Strangles

- And more!

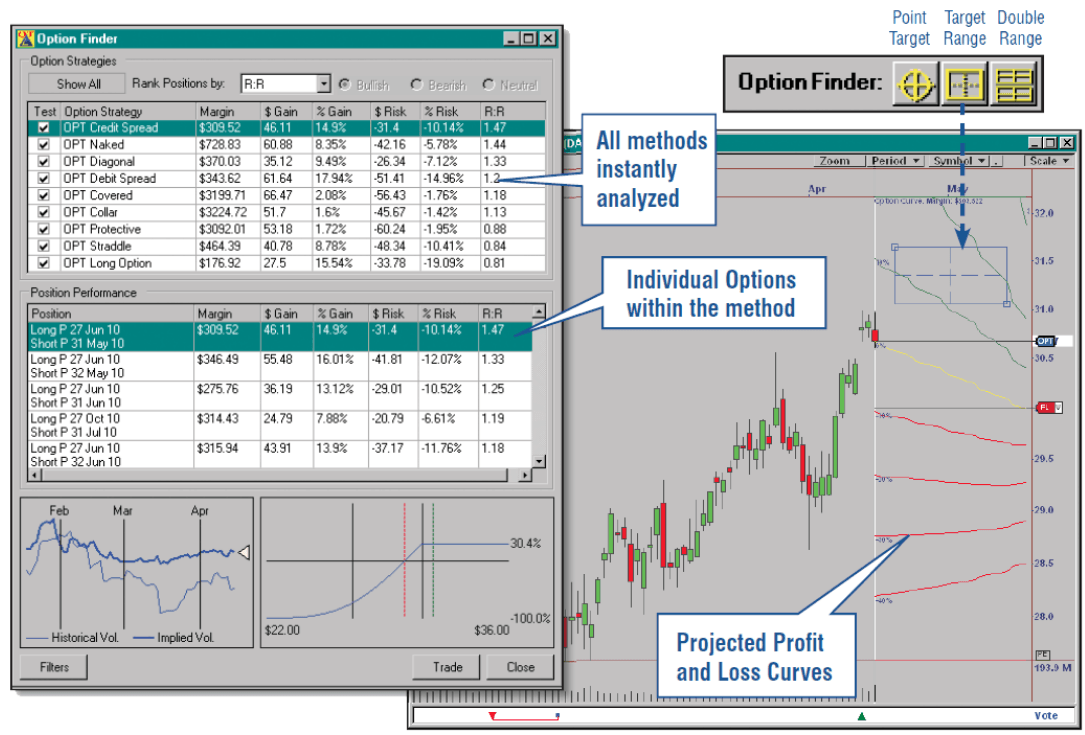

Just Drop a Target and Let Option Finder lead the way! You’ll know exactly which option method will make the most money with the least risk, and you’ll SEE the P&L Curves right in the chart, meaning you never have to interpret Expiration Curves again! Become an instant options genius – with OptionTrader!

Perhaps you’ve wanted to learn why and when you would consider using any of these methods, Option Finder makes it easy! Option Finder allows you to instantly know which options to trade - in any situation. And using it is easy. Just drop the appropriate target on the chart, and the software will instantly evaluate and rank specific option trades under each Method, showing you which ones have the highest Reward, Risk, and Reward:Risk Ratio based on a Stop Level.

More Advanced Features

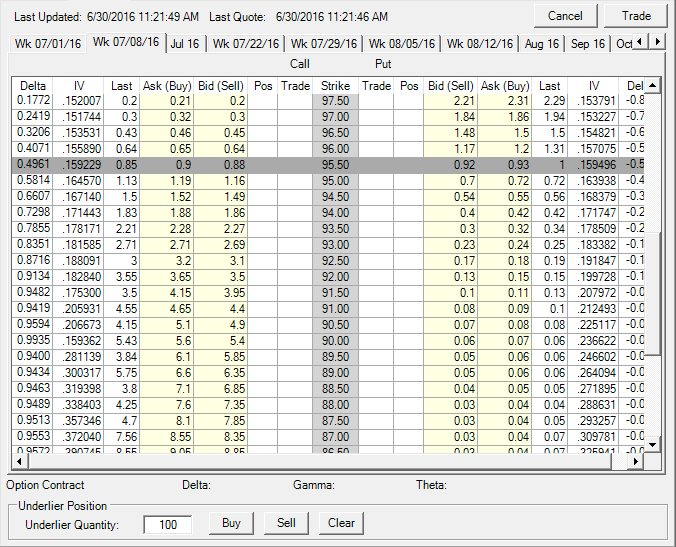

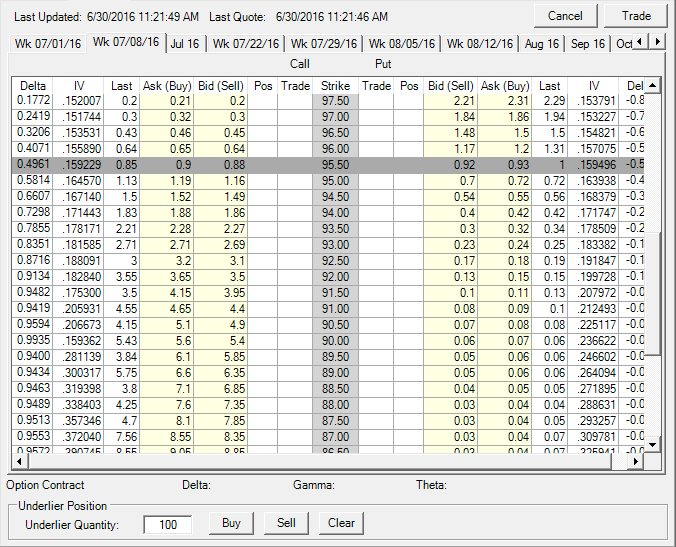

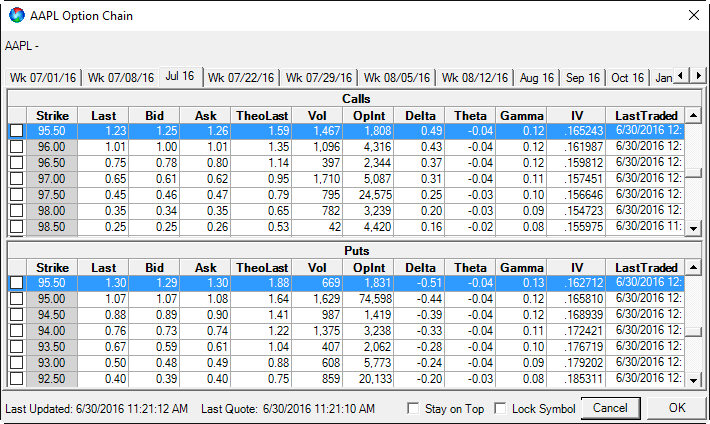

The Option Grid

From the Option Grid, you can trade options directly from the chain. This allows you to quickly build and adjust options positions on the fly.

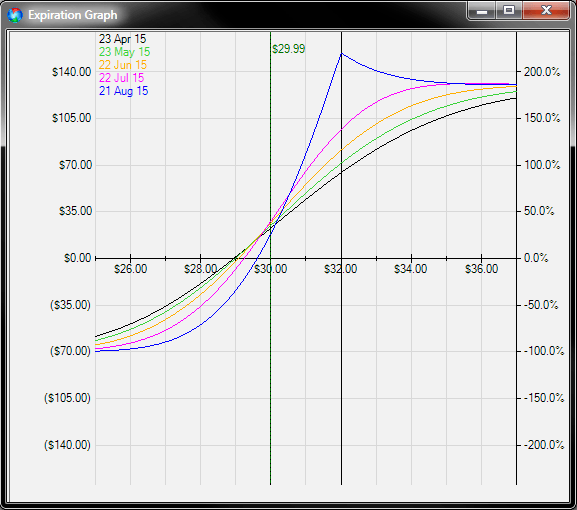

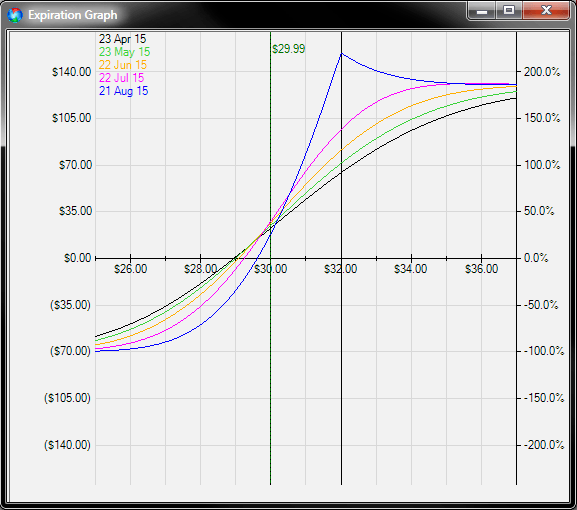

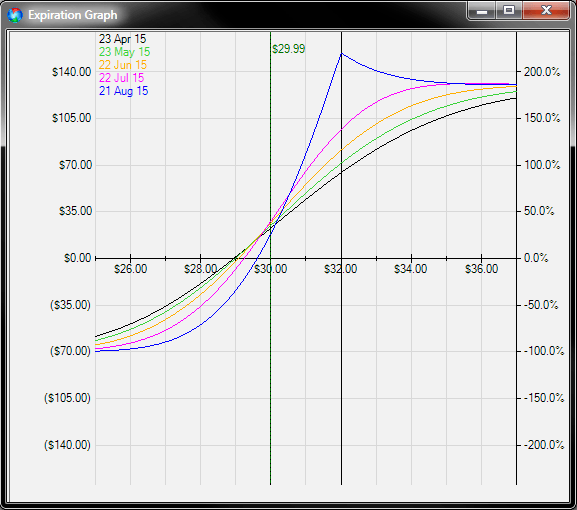

Classic Expiration Curves

We show classic curves, showing option strategy values at multiple points in time in the future. This same information is available in the chart for all bars of data.

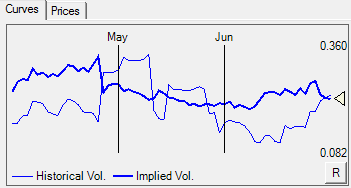

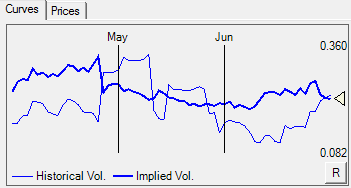

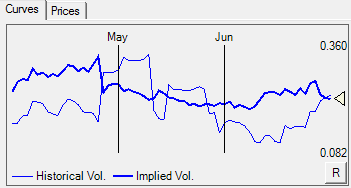

Volatility Slider

The primary factor that affects pricing is VOLATILITY. Our unique Volatility Plot shows historical and implied volatility, with a SLIDER. If Volatility is temporarily increased, just pull the slider down so Option Finder can find Strategies with that assumption. Easy.

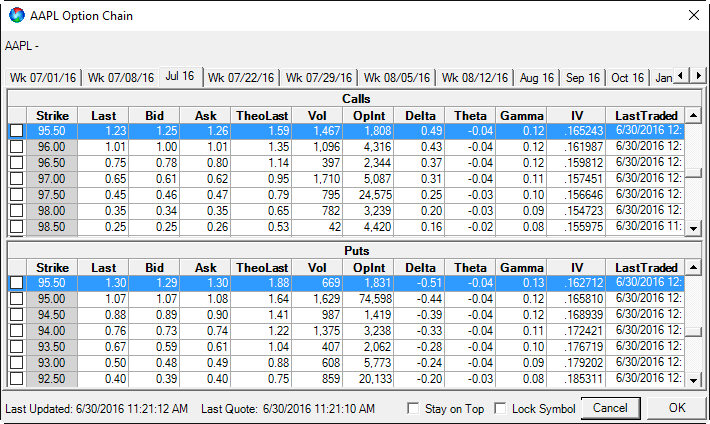

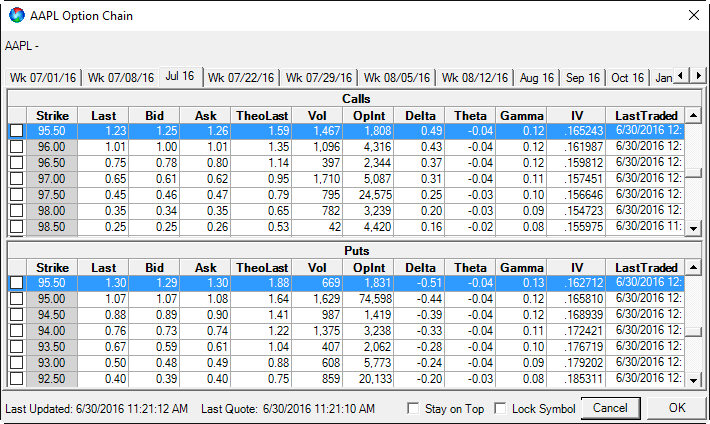

Improved Option Chain

We have improved the Option Chain interface and added weekly options in to the mix. This makes it easier to quickly analyze all available options.

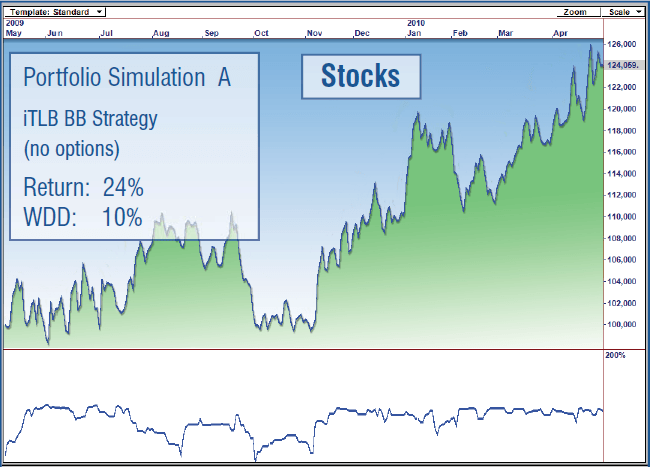

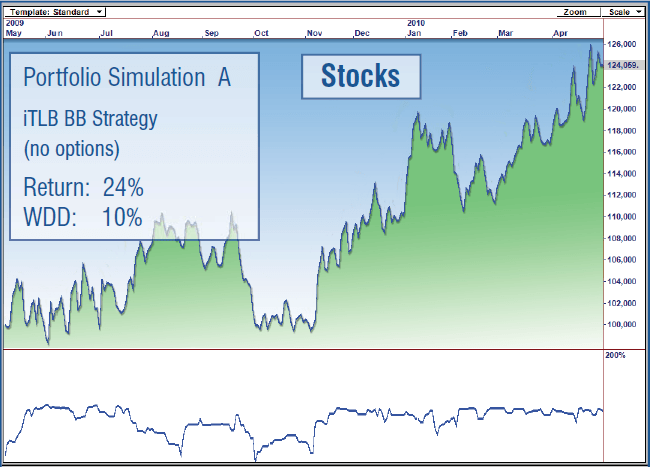

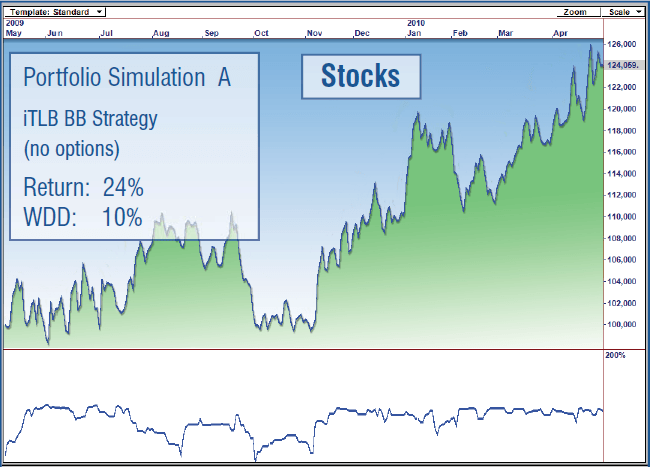

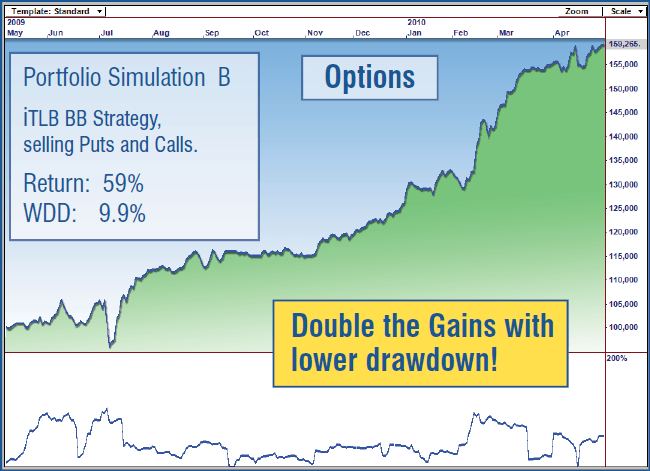

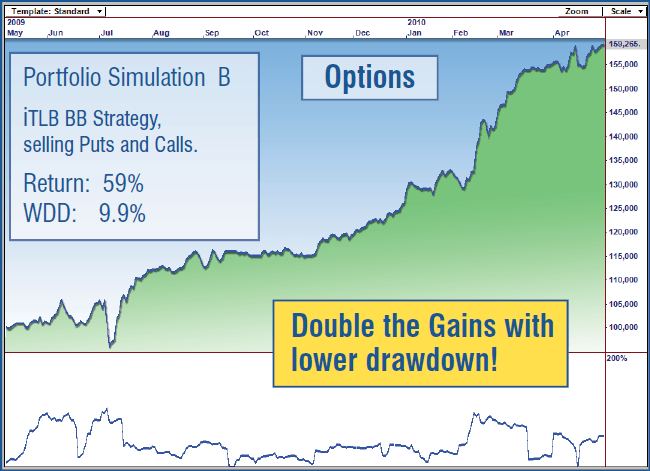

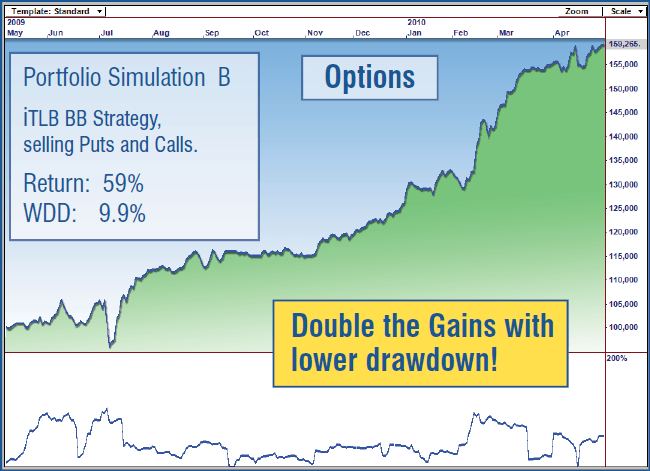

Portfolio Simulator

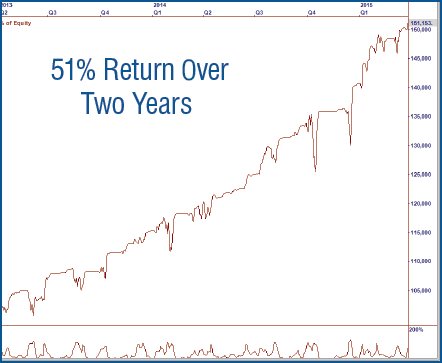

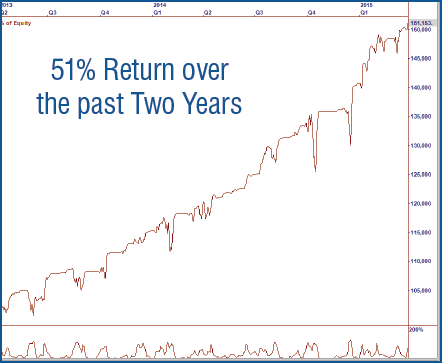

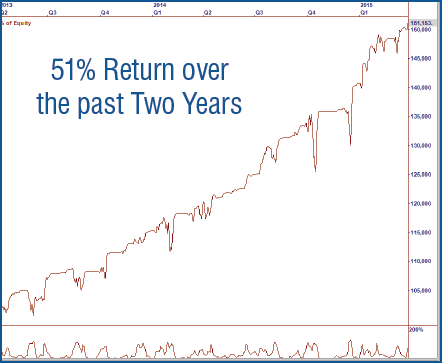

Portfolio Simulator is the only product in the world that can simulate options trading on a list of symbols. The results of these simulations can be amazing, as shown in the examples to the right.

Portfolio simulations on options trading are very important for many reasons. Options are dynamic assets - their values fluctuate continuously over time. And combined to create spreads, variations in price can be dramatic. As a result, gains and losses can vary a great deal from trade to trade.

Using our accurate historical options pricing models, the Options Portfolio Simulator will give the trader a very good idea of how his or her Strategy would have performed in live trading on a portfolio of optionable stocks.

Option Strategies

Option Strategies Maximize Returns for Swing and Extended Trades

OptionTrader includes FOUR mechanical options trading strategies. The strategies identify points where directional options trading yields a significant advantage.

Swing Trade with Options

The first two Strategies incorporate options writing approaches to capitalize on the quick moves associated with Swing Trading.

- Swing Trading (Credit Spread)

- Swing Trading (Naked Puts)

When you put these two advantages together, you end up with an extremely powerful directional options writing strategy that produces major results.

Equity Curve showing the performance of the Swing Trading (Naked Puts) Strategy trading options on the symbols in the S&P100 over the past two years. The Strategy returns 51% over this time period with a maximum drawdown of only 7.3%.

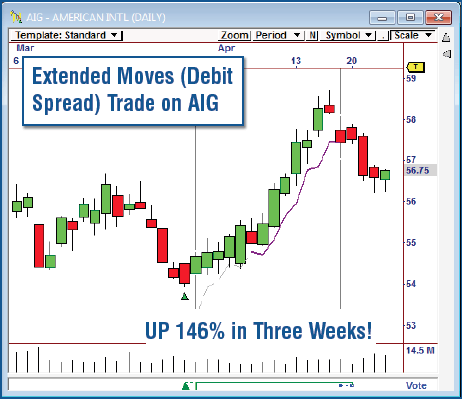

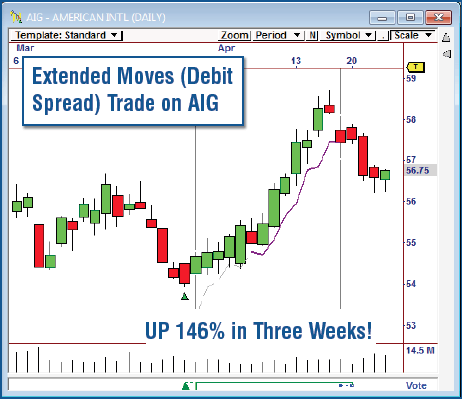

The second two options strategies find slightly longer term trading opportunities, and buy options to increase leverage while limiting risk.

- Extended Moves (Long Option)

- Extended Moves (Debit Spread)

The Extended Moves (Debit Spread) Strategy captures a big gain on AIG. The stock itself moved up 6.6%, but the debit spread picked up 146% in just three weeks.

These Strategies purchase options when they are relatively cheap, and the stock is likely to make an extended move. This allows these strategies to produce huge percentage gains, like you see in the chart of AIG (left).

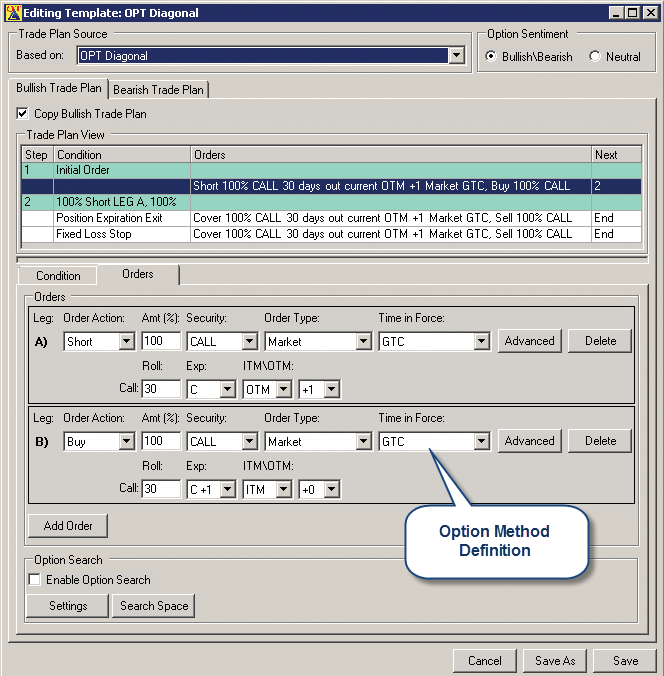

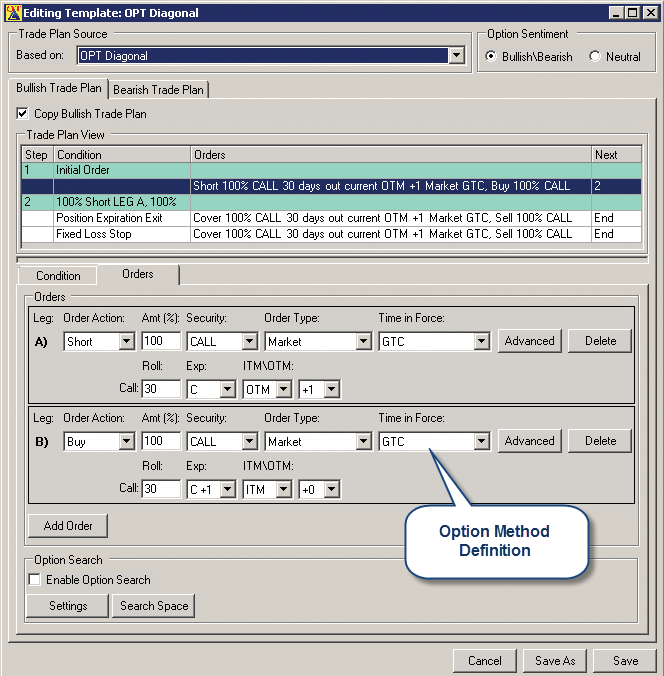

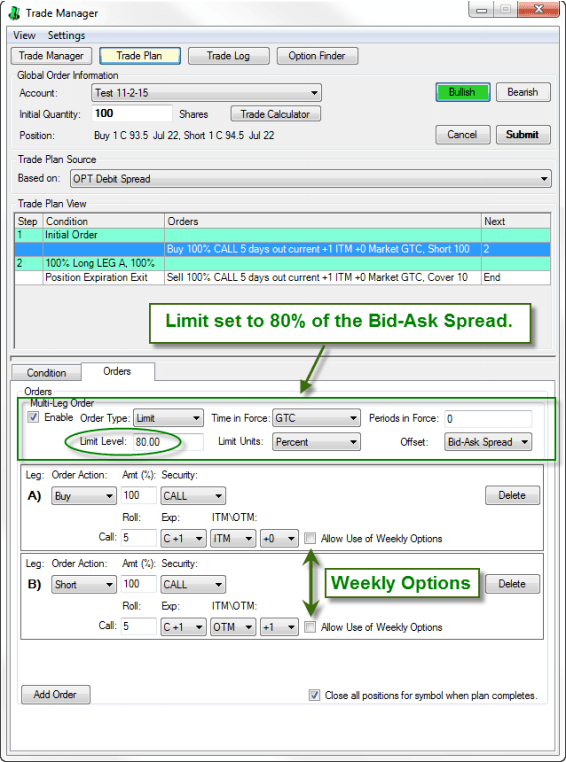

Option Trade Plans

OptionTrader comes with a Trade Plan for each Strategy. The Trade Plans can be used as-is (Expiration Exits) or can be modified with things like Trailing Profit Stops, and so on.

We provide 15 pre-defined Option Trade Plans, including Debit Spreads, Credit Spreads, Calendars, Condors, Butterflies and 10 more. Simply add an existing Option Trade Plan to any OmniTrader Strategy and Back Test it on your data.

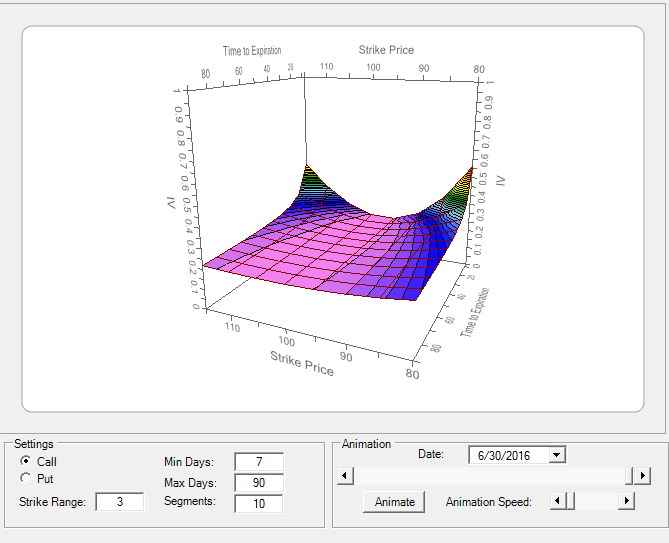

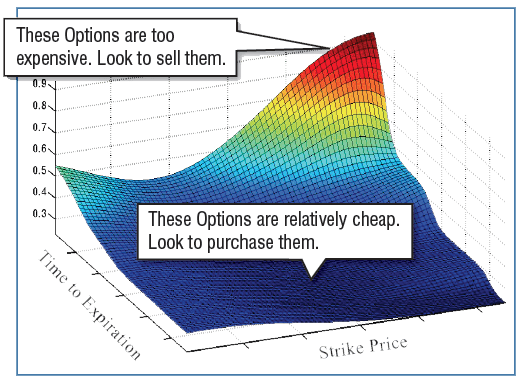

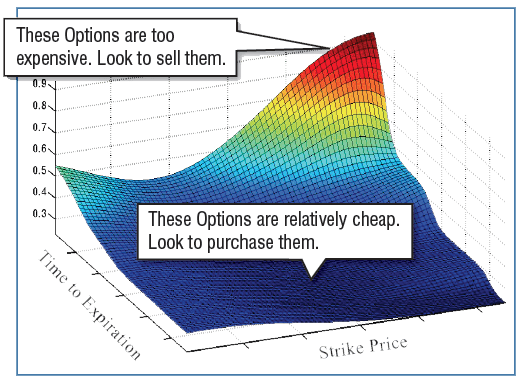

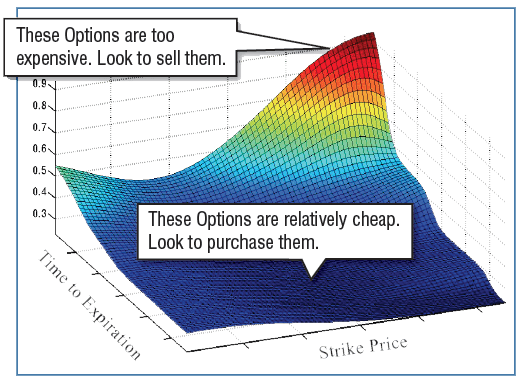

Visual Volatility Tool

Our Visual Volatility Tool lets you see which options in the chain are relatively cheap and which ones are too expensive. You can use this information to ensure you are always buying the ones that are cheap and selling options that are overpriced.

The Visualizer also has an animated playback feature that allows you to see how the volatility surface changes from day to day, and helps you avoid the costly surprises that can come from an abrupt change in volatility.

This feature brings the rocket science of options analysis into a simple, easy to understand plot, and takes the guesswork out of monitoring options volatility.

Visual Volatility Graphs

Option Pricing is based on several factors, including Volatility, Strike Price, and Time to Expiration. The most important of these is Implied Volatility. The 3D Volatility Plot in OptionTrader instantly shows which options are over and under-priced, making it easier to decide which options to trade.

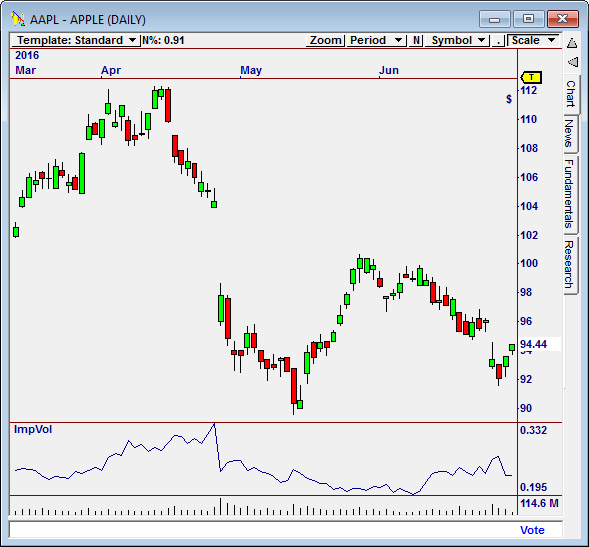

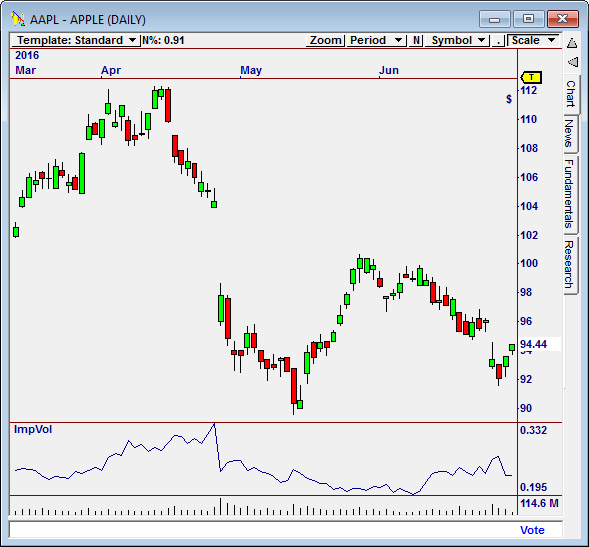

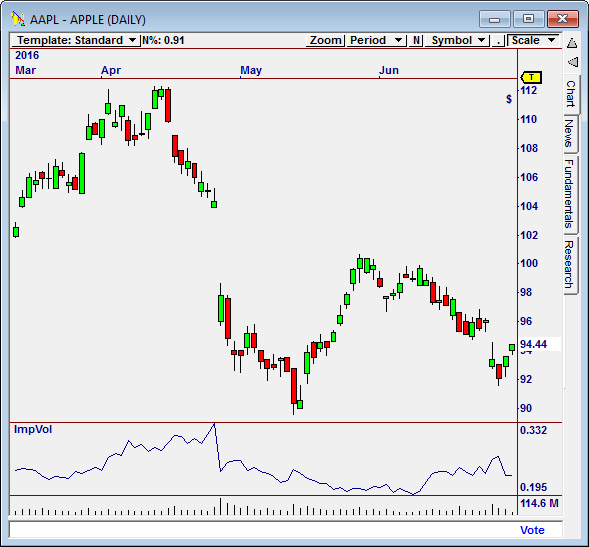

Option Indicators

OptionTrader comes with a variety of Option Indicators, including Volatility. Plot these indicators below a chart to assist in the decision process.

- Implied Volatility

- Historical Volatility

- Open Interest

- Put-Call Ratio

- Put and Call Volumes

- Theoretical Option Value

- Actual Option Value

Automatically Set Limits on Spreads

A Complete Solution for Trading Options

The many automated option trading features supported by OptionTrader are not found in any other software - anywhere. From OptionFinder to Strategies to Portfolio Simulation, you can start simple and ultimately trade fully-automated option Strategies. It's all 100% supported in OptionTrader.

Add ANY Options Method

to ANY OmniTrader Strategy!

Nearly all options “gurus” tout the same benefits of trading options, such as “Enjoy limited risk with unlimited gain potential,” Generate income by selling Covered Calls,” and so on. But, none of them can answer the key question, “How much better would a trader do if they traded options?”

It is always the same generic answers. The reason for this —they don’t have a way to measure results.

This is one of the most significant aspects of OptionTrader. An options modeling engine based on key daily statistics going back to 2004 was built. This modeling enables OptionTrader to accurately model options prices on historical data on individual stocks.

Just set the Trade Plan in any OmniTrader Strategy to one of the included Options Trade Plans. There are Trade Plans for every popular method including: Long Options, Covered Calls, Debit Spreads, Credit Spreads and more!

Using these Trade Plans, OptionTrader will accurately model the selected method on the OmniTrader Signals that are generated, producing all the statistics that OmniTrader supports, such as Back Test Hit Rate, Profit per Trade,

and so on.

There is no other product available that can automatically test options methods on historical stock market data. And, it’s FAST— Options Strategies can be tested at about the same speed as non-Options Strategies.

NClub Discounts Apply at Checkout

1-800-880-0338

Free 90-day Introductory subscription to End-of-Day Options Data. $15 per month after 90 days.

OptionTrader is backed by our 30-Day Money Back Guarantee.

Important Information: Futures, options and securities trading has risk of loss and may not be suitable for all persons. No Strategy can guarantee profits or freedom from loss. Past results are not necessarily indicative of future results. These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. There are numerous market factors, including liquidity, which cannot be fully accounted for in the preparation of hypothetical performance results all of which can adversely affect actual trading results. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

NClub Discounts Apply at Checkout

1-800-880-0338

Free 90-day Introductory subscription to End-of-Day Options Data. $15 per month after 90 days.

OptionTrader is backed by our 30-Day Money Back Guarantee.

Important Information: Futures, options and securities trading has risk of loss and may not be suitable for all persons. No Strategy can guarantee profits or freedom from loss. Past results are not necessarily indicative of future results. These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. There are numerous market factors, including liquidity, which cannot be fully accounted for in the preparation of hypothetical performance results all of which can adversely affect actual trading results. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.