MS-16

$495

Compatible Platform: OmniTrader / VisualTrader

Recommended Data: End Of Day / Real Time

The MS-16 Strategy employs a new indicator called Days to Earnings. This powerful indicator helps us avoid trading into a potentially dangerous earnings report. But the real magic is obtained by using the MS-16 Strategy with the MS-16 Dynamic Scan. This scan pinpoints the stocks that are outperforming the market but have made a significant pullback against the trend.

We first set out to create a good mechanical trading strategy. Using two different momentum based systems and filtering based on trend direction, we were able to get solid initial results.

The MS-16 Strategy also employs a new indicator in OmniTrader

called Days to Earnings. This powerful indicator helps us avoid trading into a potentially dangerous earnings report.

But the real magic is obtained by using The MS-16 Strategy with the

MS-16 Dynamic Scan. This scan pinpoints the stocks that are outperforming the market but have made a significant pullback against the trend.

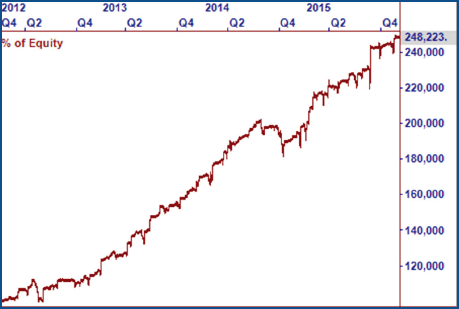

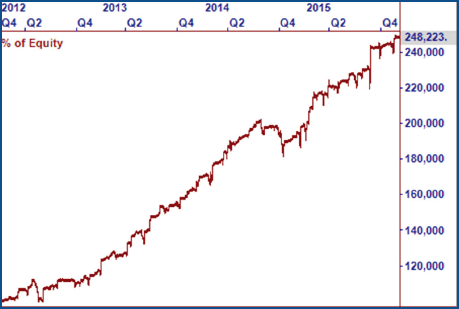

OmniTrader includes the ability to test how a strategy would

perform historically if it were traded with a stock scan. Armed with this ground-breaking technology, we were able to verify the substantial increase in performance by trading the MS-16 Strategy/Scan combo versus trading the strategy on a static list of symbols.

BIG Improvement w/ the Combo

By scanning the whole market for the best setups for our strategy,

we have a major advantage against trading a static symbol list.

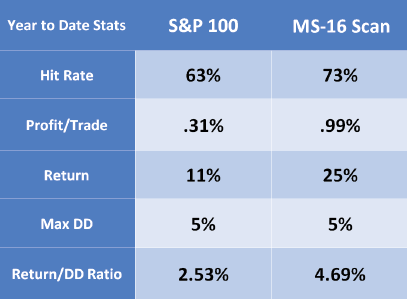

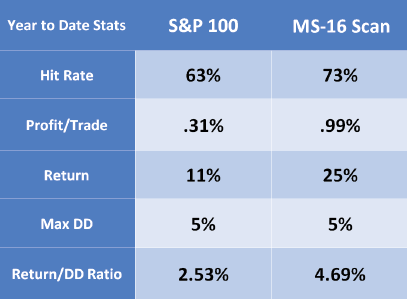

The table to the right shows the results of trading two different

lists with the MS-16 Strategy.

The first column shows the results of trading MS-16 on the stocks

currently in the S&P 100. The second column shows the results of

trading MS-16 on the stocks that would have passed the MS-16 Scan.

The strategy actually performed well on both lists. But notice how the MS-16 combo was able to substantially improve EVERY category while maintaining the low drawdown!

The year-to-date performance of the MS-16 strategy on the stocks in

the S&P 100 vs. the dynamically changing stocks in the MS-16 Scan.

Using the Dynamic MS-16 Scan, we show a double digit improvement

in Hit Rate, three times the profitability, and over double the return!

The Profit Magic of the MS-16 Combo

The year-to-date performance of the MS-16 strategy on the stocks in the S&P 100 vs. the dynamically changing stocks in the MS-16 Scan. Using the Dynamic MS-16 Scan, we show a double digit improvement in Hit Rate, three times the profitability, and over double the return!

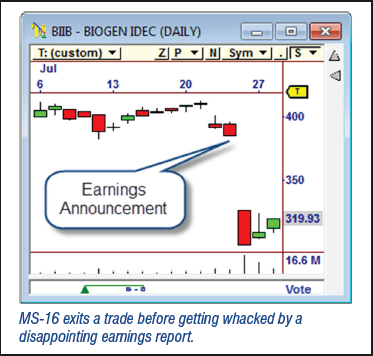

Never Trade into an Earnings Report Again!

The new Days to Earnings indicator is now included in OmniTrader, and it can be used to completely remove the risk of trading into an earnings report surprise.

Days to Earnings (DTE) can be used as a filter in a strategy so that you don’t take a trade when an earnings report is looming. And traders will really love the new DTE Stop. This powerful new addition to OmniTrader will exit a trade (n) number of days before

an earnings report is scheduled.