Introducing The...

OptionMasters Group

Creating the most profitable Strategies the world has ever seen....

All OptionMasters Group (OMG) Members get our new DebitMagic Strategy immediately. Members also get at least two of our new Strategies that we roll out with this Summer – advanced Strategies that could be worth many thousands of dollars.

If you believe in The Power of Options, joining OMG could be the Opportunity of a Lifetime.

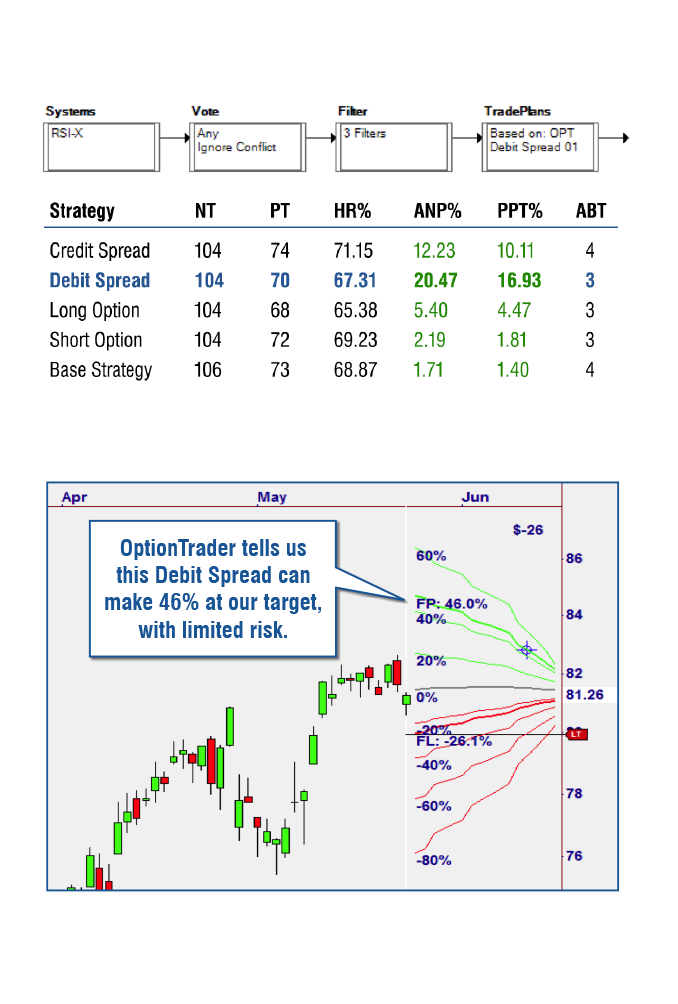

Our first project involved adding Option Trade Plans to a good “Base” Strategy. To the right is the result of one of those tests.

By applying Option Trade Plans from OptionTrader 5 to the Strategy and testing them, we see that OmniTrader Strategies can GREATLY benefit from the application of options.

The Base Strategy (without options) showed a Profit per Trade of 1.4%, which is very good. But ALL the Option versions did better than this, with the Debit Spread version making nearly 17%. That’s over 10 TIMES the Profit!

From this starting point, we worked on new Strategies that incorporated Debit Spread Trade Plans, resulting in The Debit Magic Strategy Suite (see page 8). But we aren’t finished with options yet!

The power of options to make high returns, reduce drawdown, and provide income is so great — we decided to launch the Option Masters Group to continue the research. The next project is Reversals on Renko Charts.

DebitMagic

A wake up call on the potential of options...

Breaking the Strategy Performance Barrier!

Debit Magic is the first Strategy Suite we are delivering to the OptionMasters Group.

Based on our early work in Debit Spreads we developed three special RTM Strategies designed for this option method.

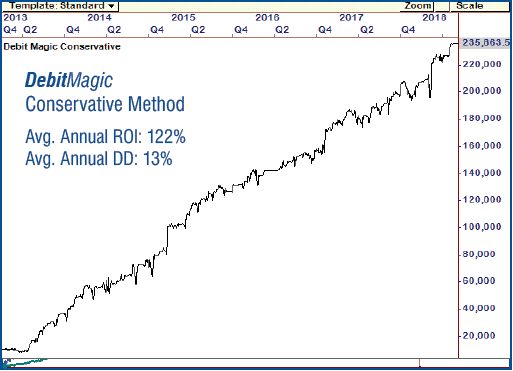

The example to the right uses a small trade allocation, but still averages 122% return over 5 years with average draw downs of

just 13% - a 10:1 Ratio.

Because Debit Spread trades can cost as little as $50, it’s possible to trade them in a small account. This historical simulation shows a $10,000 account growing to over $250,000 in 5 years.

Doubles an Account Every Year

This historical simulation shows DebitMagic making an average return of 122% a year with Max Draw Down of just 13% - a 10:1 Ratio.

Firing the Imagination...

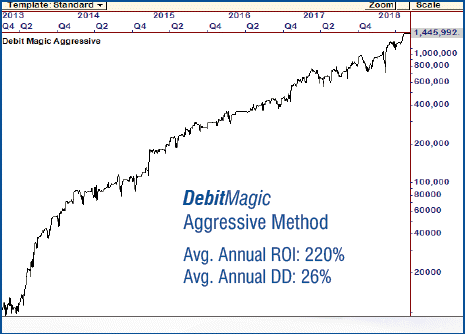

We had to ask, “What if we increased allocation in an account using Debit Magic?”

Honestly, the result was pretty phenomenal. We’ve NEVER seen this kind of performance before in a small account.

If it truly is possible for a Strategy to do this, it may make sense to open a small $10k “mad money” account and just let it go. Depending how aggressive you want to be, you could potentially see extraordinary gains.

Just the Beginning...

The Debit Magic Strategies are just the first to be released. Additional approaches are under development that have different goals, such as long term investing.

Even Higher Returns!

By increasing per-trade allocation, DebitMagic was able to generate an average of 220% per year in the sample profile (risk is higher of course). The historical simulation shows a 26% average DD. That’s also a 10:1 ratio.

Current OMG Strategy Projects

The OMG Mission:

To create at least 3 powerful option Strategies for release to OMG Members in 2018. The first is Debit Magic. Here are some of the other ideas we are working on. Members automatically get all results, including interim versions.

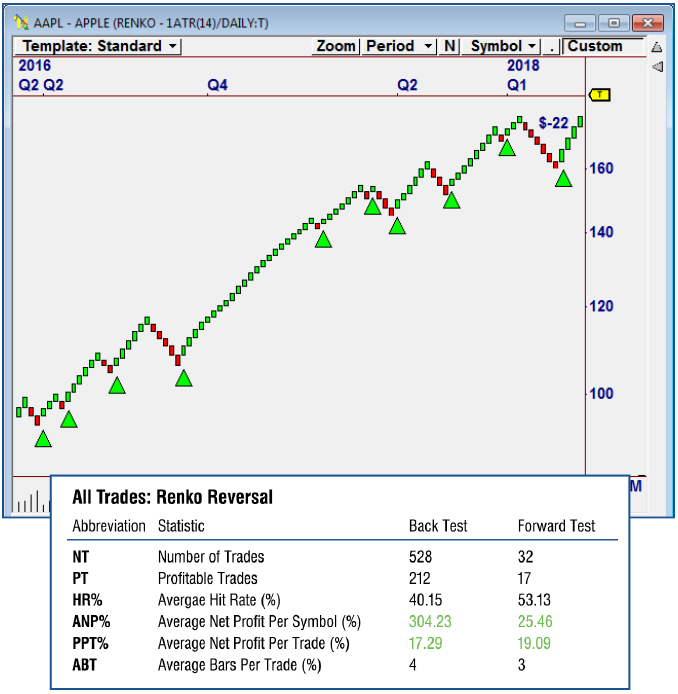

Buy Calls on Renko Reversals

Renko reversals have the unique characteristic that the charts can run a very long way.

We are working on a Strategy that trades Out of the Money Calls for “home runs.” About half will expire worthless but about half should make enormous profits.

The Renko Chart to the right shows how long

the runs can last. A recent Performance Report (shown to the right) showed nearly 20% average Profit per Trade.

The goal of this Strategy is to create enormous gains when the market runs, and then couple that behavior with a “Market State” measurement to capture those rare moves.

Sell Credit Spreads in Volatile Markets

The Strategy test shown on the prior page says that Credit Spreads have the highest accuracy. To create a Credit Spread, we Sell a Put and Buy a Lower Put, which creates a credit to our account. The goal is for the trade to “decay” so we can close it for a max profit.

Credit Spreads are perfect for charts that have just seen a strong spike in volatility. High volatility translates to higher proceeds on the sale of the first Put, which is where the profit comes from. This Strategy has enormous potential and is one of the OMG Strategies under development.

Synthetic Spreads

Advantages: Same profit as owning the stock, but with 5:1 leverage overnight.

We can simulate stock ownership by purchasing a Call and Selling a Put “At the Money.” However, the Put and Call tend to cancel each other or cost very little and we only need to put up 20% of the cost of the stock to cover the Put sale. Excellent for Longer term Strategies like iZones where runs can take months to develop.