Reaching The Next Level of Performance

Right now, we are releasing an amazing new Strategy called T21. Its name comes from our work to create Strategies that are working well in 2021 – a difficult market compared to 2020. While there has been some focus on other Strategy components, this work on Trade Plans is the most important Strategy work we have ever undertaken. T21 is just the starting point. Those who join us get T21 now and the other assets of Trade Management Solution (TMS) as we develop them.

Introducing T21

A Powerful New Mechanical Strategy

Powered by the Trade Management Solution

Reaching The Next Level of Performance

Right now, we are releasing an amazing new Strategy called T21. Its name comes from our work to create Strategies that are working well in 2021 – a difficult market compared to 2020. While there has been some focus on other Strategy components, this work on Trade Plans is the most important Strategy work we have ever undertaken. T21 is just the starting point. Those who join us get T21 now and the other assets of Trade Management Solution (TMS) as we develop them.

The T21 Breakthrough

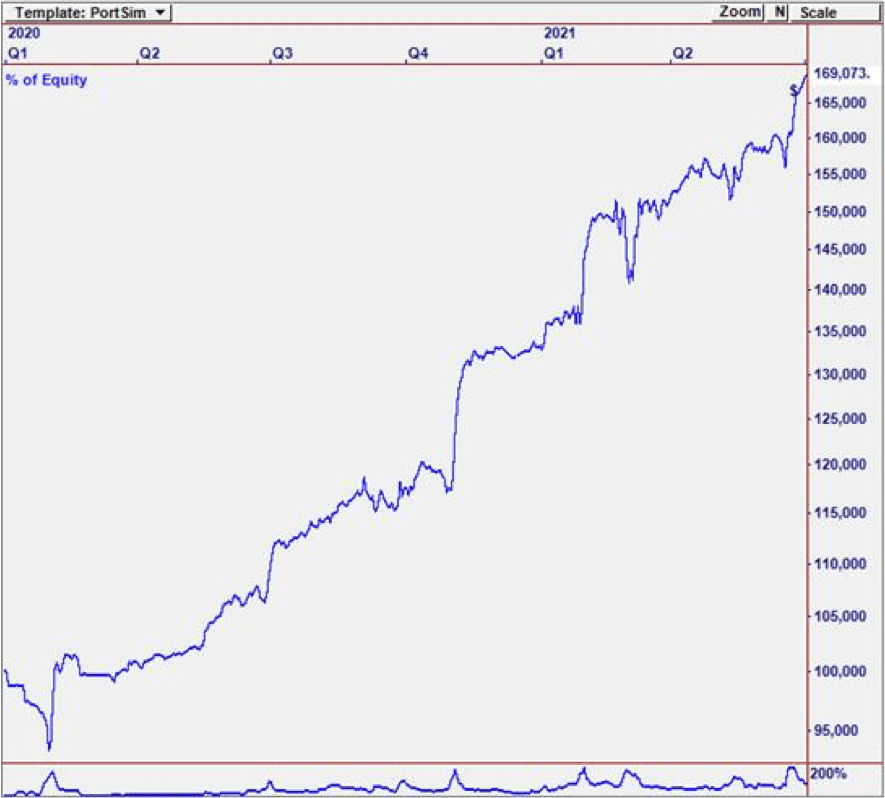

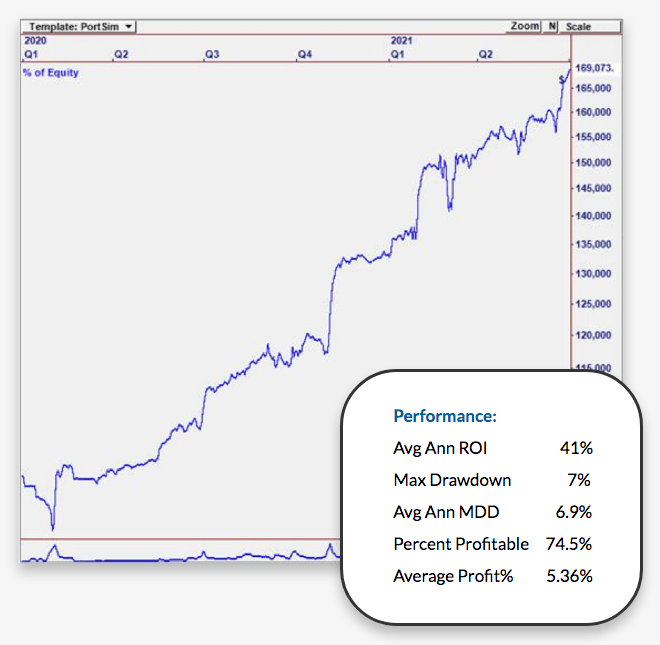

To the right is an equity curve from T21 trading stocks in the S&P 100 and NASDAQ 100. Note that the test covers BOTH 2020 and year to date for 2021. This consistent performance is achieved by using special tests in the Strategy to avoid risky markets, in addition to the Trade Management features.

While T21 shows winning performance in both 2020 and 2021, it’s really just the start of our Trade Management Solution.

Creating Universal Trade Plans

This project is unlike anything we have undertaken before. Our objective is to create Universal Trade Plans that can be used to improve existing Strategies, and then to apply them for that purpose. T21 is our first test Strategy. But others (and more than one version of T21) will be provided.

This Research has already begun. All participants will get T21 now and the results of this work as we perform and complete this analysis in July.

Performance:

Avg Ann ROI 41%

Max Drawdown 7%

Avg Ann MDD 6.9%

Percent Profitable 74.5%

Average Profit% 5.36%

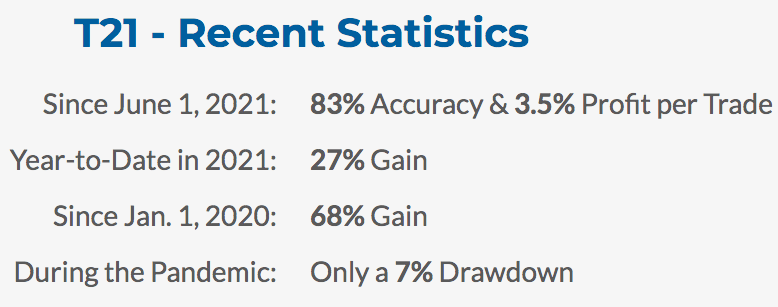

T21 - Recent Statistics

Since June 1, 2021:

Year-to-Date in 2021:

Since Jan. 1, 2020:

During the Pandemic:

83% Accuracy & 3.5% Profit per Trade

27% Gain

68% Gain

Only a 7% Drawdown

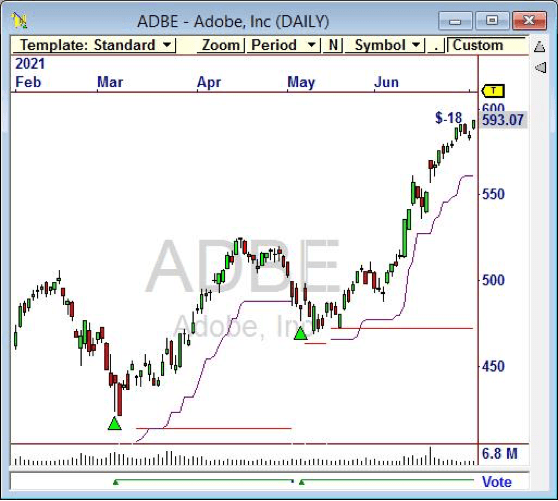

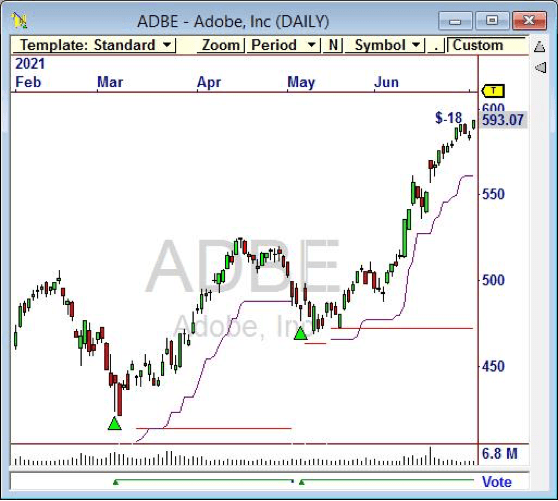

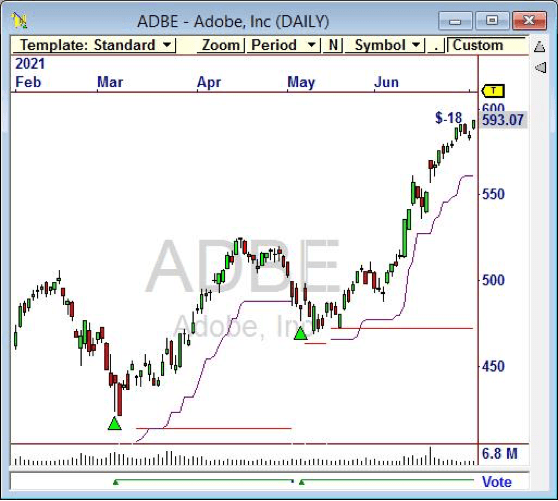

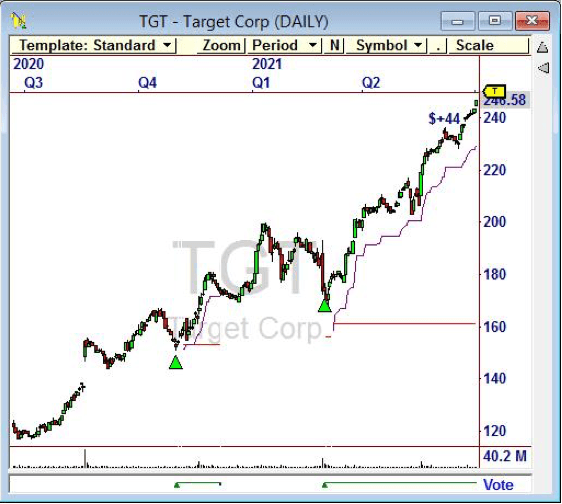

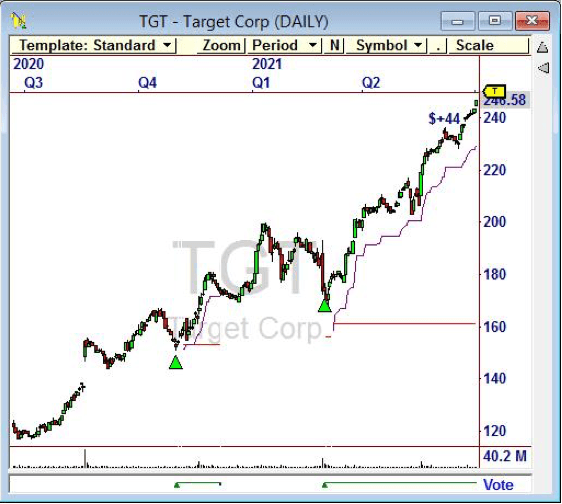

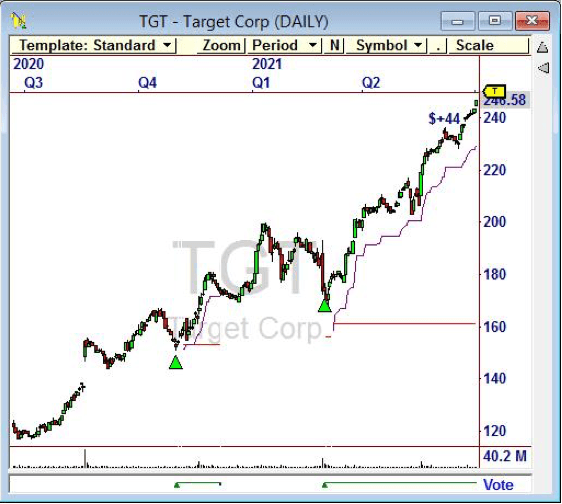

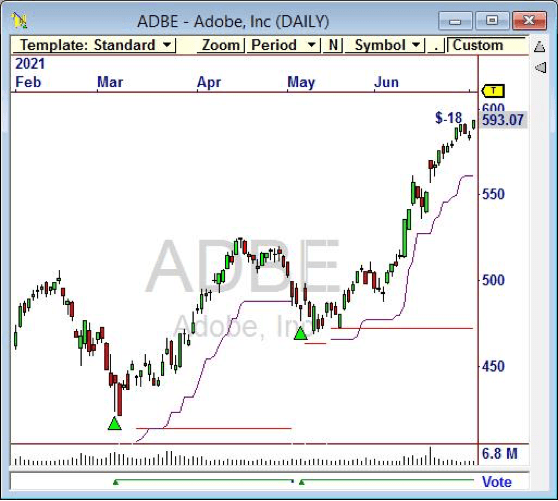

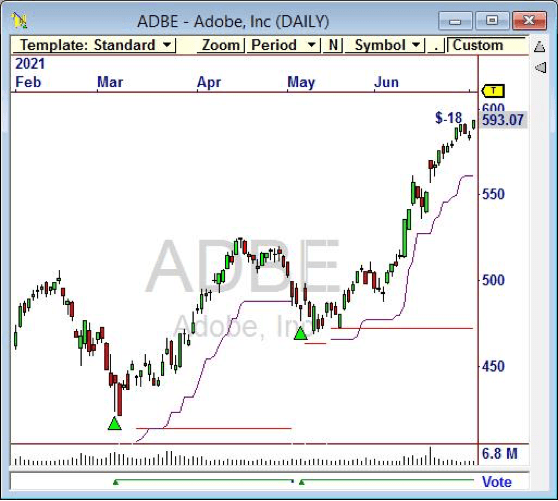

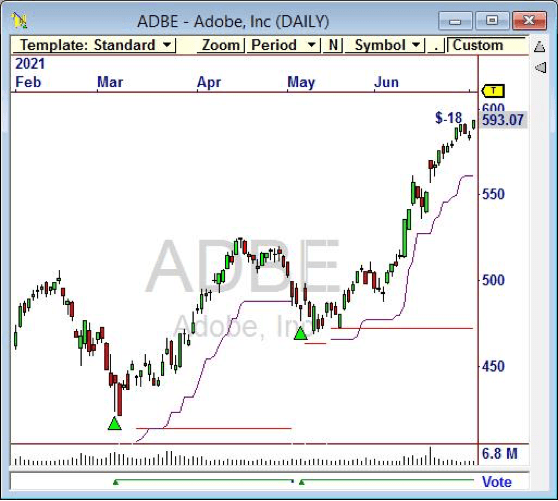

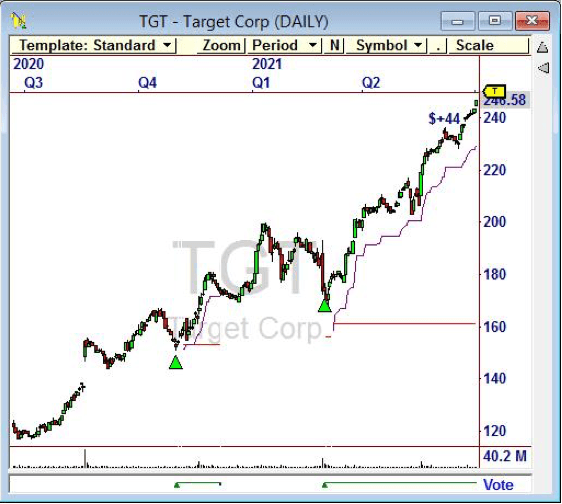

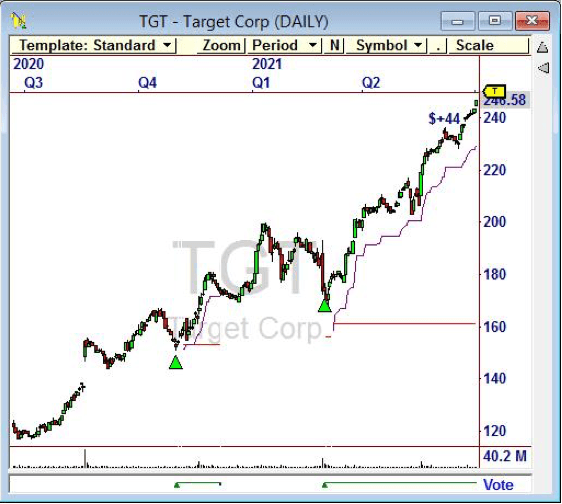

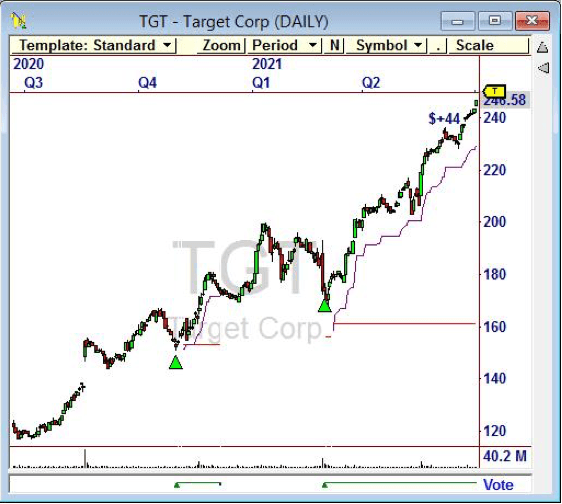

These charts show multiple trades from T21, which is an RTM Strategy. But it has greatly improved

Trade Management that lets the best trades continue to run for higher profits.

The T21 Breakthrough

Above is an equity curve from T21 trading stocks in the S&P 100 and NASDAQ 100. Note that the test covers BOTH 2020 and year to date for 2021. This consistent performance is achieved by using special tests in the Strategy to avoid risky markets, in addition to the Trade Management features.

While T21 shows winning performance in both 2020 and 2021, it’s really just the start of our Trade Management Solution.

Creating Universal Trade Plans

This project is unlike anything we have undertaken before. Our objective is to create Universal Trade Plans that can be used to improve existing Strategies, and then to apply them for that purpose. T21 is our first test Strategy. But others (and more than one version of T21) will be provided.

This Research has already begun. All participants will get T21 now and the results of this work as we perform and complete this analysis in July.

These charts show multiple trades from T21, which is an RTM Strategy. But it has greatly improved Trade Management that lets the best trades continue to run for higher profits.

What Participants

can Expect

We will run the hundreds of tests required to identify the best Entries, Exits, and Position Sizing to create even more adaptive versions.

We believe this research will generate some great new Mechanical Strategies based on Trade Plan concepts and Improved Trade Plans that can be used in other Strategies (see Benefits, below).

Yes. TMS is backed by our 100% money back guarantee.

Educational Webinars

The Best Entries for Different Markets

Thursday, 7/15

Our first work on Trade Plans is to explore Entry Orders in different markets. We plan to provide a webinar for participants on 7/15 to show results and provide new Strategies as they are generated in the Dashboard.

1.

Exploring Market and Market on Open Entry Orders

2.

Is There an Advantage to Using MOC Orders?

3.

Getting a Confirming Move with Stop Orders

4.

The Profit Advantage of Limit Orders

5.

Which Order Entry Type is Best in Each Market

(Bullish, Bearish, Volatile, Extremely Bullish or Bearish, etc.)?

Maximizing Profits with Exit Orders

Thursday, 7/22

The more challenging topic of Exit Orders will be explored next, with the Webinar covering the results provided the following Thursday.

1.

Locking in Exit Price with MOC Orders

2.

Trailing the Trade with Stop Orders

3.

Taking Profits with Limit Orders

4.

The Advantages of Different Exit Orders in Different Markets

Adjusting Position Size for Bigger Profits and Lower Risk

Thursday, 7/29

The final, most important segment will cover our work on how to manage position size. Some of the topics are listed below. We will wrap up our Trade Management endeavor, including new Strategies on July 29.

1.

Using Price Targets

2.

The Moving Average Target Advantage

3.

The Best Way to Trail a Trade

4.

Comparing Profit Targets with Trailing Stops

5.

When to Increase Position Size

6.

When to Decrease Position Size

What Participants

can Expect

We will run the hundreds of tests required to identify the best Entries, Exits, and Position Sizing to create even more adaptive versions.

We believe this research will generate some great new Mechanical Strategies based on Trade Plan concepts and Improved Trade Plans that can be used in other Strategies (see Benefits, below).

Educational Webinars

The Best Entries for Different Markets

Thursday, 7/15

Our first work on Trade Plans is to explore Entry Orders in different markets. We plan to provide a webinar for participants on 7/15 to show results and provide new Strategies as they are generated in the Dashboard.

1. Exploring Market and Market on Open Entry Orders

2. Is There an Advantage to Using MOC Orders?

3. Getting a Confirming Move with Stop Orders

4. The Profit Advantage of Limit Orders

5. Which Order Entry Type is Best in Each Market

(Bullish, Bearish, Volatile, Extremely Bullish or Bearish, etc.)?

Maximizing Profits with Exit Orders

Thursday, 7/22

The more challenging topic of Exit Orders will be explored next, with the Webinar covering the results provided the following Thursday.

1. Locking in Exit Price with MOC Orders

2. Trailing the Trade with Stop Orders

3. Taking Profits with Limit Orders

4. The Advantages of Different Exit Orders in Different Markets

Adjusting Position Size for Bigger Profits and Lower Risk

Thursday, 7/29

The final, most important segment will cover our work on how to manage position size. Some of the topics are listed below. We will wrap up our Trade Management endeavor, including new Strategies on July 29.

1. Using Price Targets

2. The Moving Average Target Advantage

3. The Best Way to Trail a Trade

4. Comparing Profit Targets with Trailing Stops

5. When to Increase Position Size

6. When to Decrease Position Size

Yes. TMS is backed

by our 100% money

back guarantee.

Educational Webinars Start

Thursday 7/15 Order Today

T21 Powered by

$995

Trade Management Solution

Get Trade Management Solution and reap all the following benefits this July:

• T21 Strategy.

• Additional Strategies with advanced Trade Management.

• All valuable Trade Plans discovered in the course of our research.

• Education about which approaches work in which markets.

• Trade Plans and Knowledge can be applied to other Strategies.

As new versions are released (with new Trade Plans) in July, we will post them on the dashboard, along with release notes, followed by an Educational Webinar on each part.

The cost to sign up now and receive all these assets is just $1,495.

But we are currently promoting an early purchase special at just $995.

Educational Webinars Start Thursday 7/15

Order Today

Trade Management Solution

Get Trade Management

Solution and reap all the following benefits this July:

• T21 Strategy.

• Additional Strategies with advanced Trade Management.

• All valuable Trade Plans discovered in the course of our research.

• Education about which approaches work in which markets.

• Trade Plans and Knowledge can be applied to other Strategies.

As new versions are released (with new Trade Plans) in July, we will post them on the dashboard, along with release notes, followed by an Educational Webinar on each part.

The cost to sign up now

and receive all these assets

is just $1,495.

But we are currently promoting an early purchase special at just $995.