The Best Way to Trade Group Rotation!

Discover the Power

of Relative Rotation!

Funds and institutions often accumulate stocks based on the industry group they are in. That’s why Group Rotation is one of the best ways to trade stocks that are confirmed to be moving in a given direction. Relative Rotation Trader makes finding and trading the best Group Rotations easier than ever before, because it combines the two forces of Momentum and Relative Strength for truly unstoppable trading power!

To the right is a Group Rotation on Transportation Companies identified

on April 19.

Each Stock was already under accumulation and is turning up

based on a renewed accumulation by market participants!

How it Works

Relative Rotation is about identifying the increased movement of stocks in the bullish or bearish direction (Momentum) as well as their Strength compared to a benchmark index symbol (Relative Strength).

Using these two powerful concepts, Relative Rotation Trader will help you quickly find the groups and individual stocks that are turning up (or down) in the current market.

As you can see in the chart to the right for VST, the plots of Momentum and Relative Strength combine to create a powerful indication of Strength.

When both indicators are above zero – and especially when they are rising – there is usually a lot of bullish sentiment in that market.

When both indicators are above zero – and especially when they are rising – there is usually a lot of bullish sentiment in that market.

Signals are provided at Reversal, Trending, and Breakout points in concert with the indicators to make it easy for OmniScan to find specific candidates to consider for action.

System Overview

The RRT Components Work Together to help you find and trade the best opportunities.

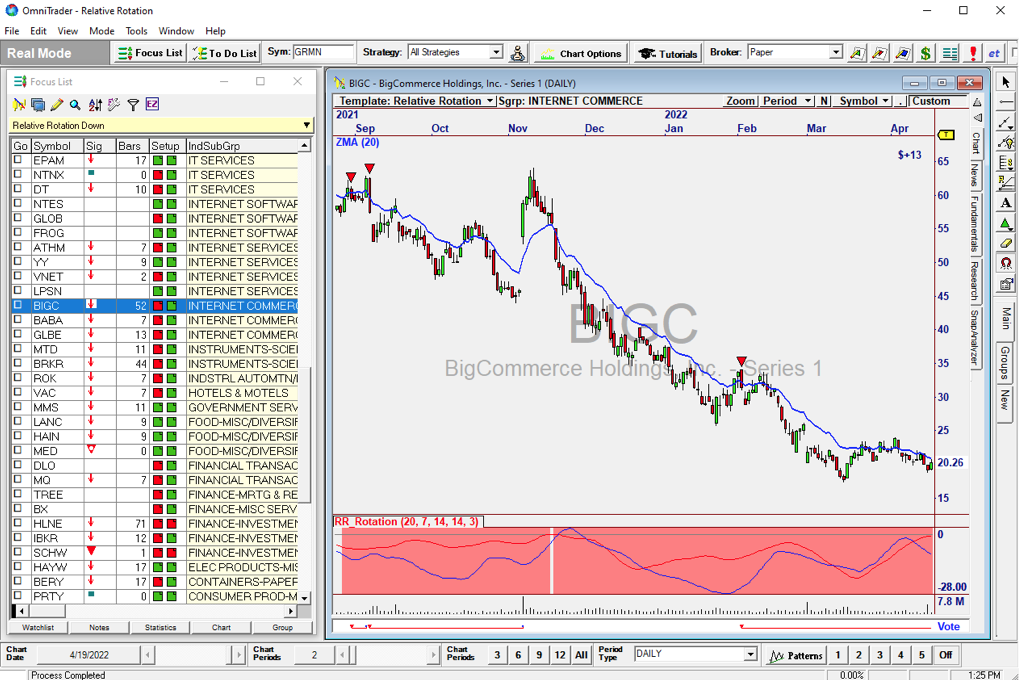

Here is a picture of OmniTrader with all the assets shown in one view. The List shown is the Relative Rotation Up list from OmniScan, which looks for these bullish indications as well as Signals, so every candidate in the list can be considered for trading.

The List is sorted on Industry SubGroup. Now, we can quickly see multiple symbols firing in each group, and can easily isolate those that have the most potential.

The List has Red/Green “Setups” showing CHANGE in Relative Strength and Momentum, so you can see, at a glance, not only which ones are strong but which ones are turning up (or down) and getting stronger (or weaker).

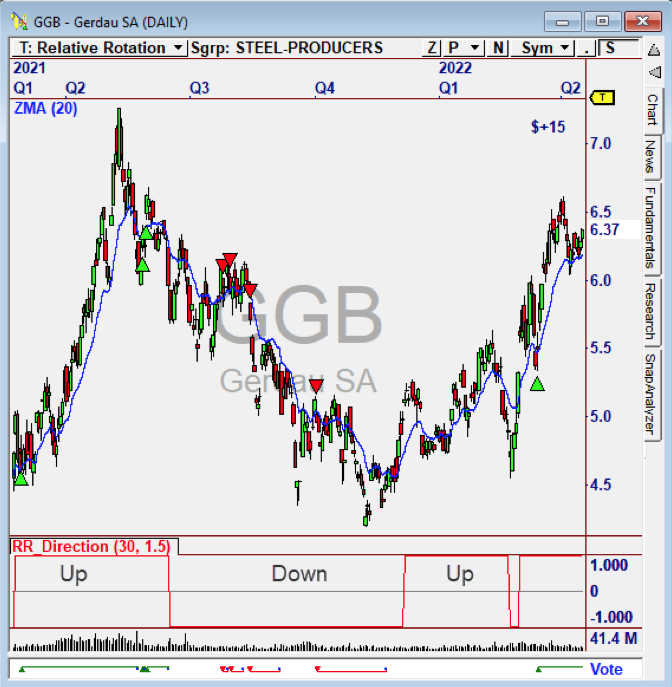

Included Indicator identifies New Trend Direction RR_Direction shifts from plus to minus and back when a trend change is detected. It’s really good, and is the basis for our RRT OmniScans.

Signals for All Market Modes

Relative Rotation Trader comes with 3 NEW Strategies that identify important technical criteria for a strong move in a new or continued direction.

Breakouts

Reversals

Trending

Also Works in Down Markets

A Relative Rotation Down OmniScan is included, so you can identify powerful bearish rotations –

offering some of the best money-making opportunities in the stock market.

The Internet Commerce Subgroup has been hammered. The Short Signals from

the Trending Strategy just nailed BigCommerce, which is still weak.

Included Assets

…Work Together like a Symphony to Bring You the Best Candidates

Indicators

Easy to understand indicators that are used to identify the strongest candidates.

• RR_Strength – Shows Relative Strength

• RR_Momentum – Shows Momentum

• RR_Direction – Shows New Trend Direction (NEW CONCEPT!)

Strategies & Systems

Every Signal Mode is represented, so they can be found with OmniScan. This new concept makes it easy to get specific Signals in the Focus List.

• RR_Trending – Trend-following Signals based on the 30p ZMA

• RR_Breakout – Identifies clear breakouts on strong moves.

• RR_Reversal – Identifies all Short Term Reversals as the earliest possible entry points.

OmniScans

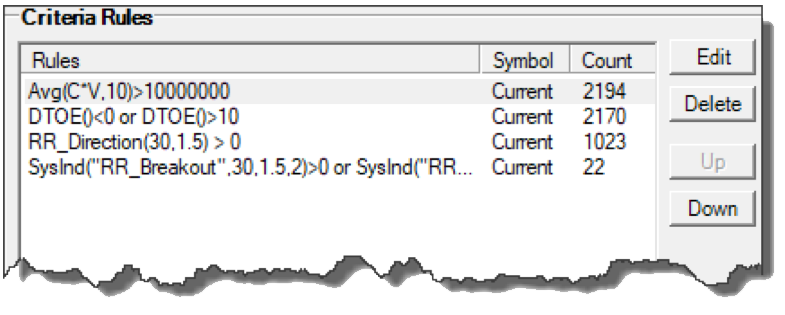

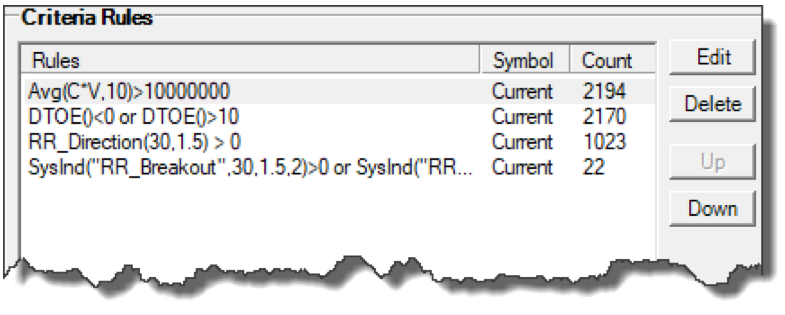

We provide just 2 Scans, because 2 is all you need! Less to review!

• Relative Rotation Up

• Relative Rotation Down

Carefully Constructed Scans

✓ Sufficient Liquidity

✓ Avoiding Earnings

✓ Rotation Up or Down

✓ System Signals Present

Powerful Yet Easy to Use

With Relative Rotation Trader, just run the ToDo List every day and let the Scans, Strategies and Indicators do the work!

I created RRT so I could quickly find the best Rotation Candidates the market has to offer to use for my trading, and now I’m sharing it with our valuable customers. It’s the primary tool I use every day, and I’m sure you will find it invaluable in your trading!

Included: My Instructional Video:

“Trading Group Rotations for Fun and Profit!”

Ed’s instructional video will walk you through the steps for starting, running, and monitoring your trades every day. The Method is so easy to adopt, with just a few tips, you will be empowered to profitably apply Group Rotation in your account.

Introductory Pricing:

Relative Rotation Trader .......................................... Reg. $695

Introductory Special ........................................... Just $495

Includes:

✓ 3 Powerful Indicators

✓ 3 Systems for All Trading Modes

✓ 2 OmniScans for Up and Down Markets

✓ Pre-Configured Profile & Focus Lis

Our software is backed by our unconditional Money Back Guarantee. If for any reason you are not fully satisfied, you may return the software, within 30 days of purchase, for a 100% refund, less shipping and handling. Texas residents add 8.25% sales tax. Educational material is non-refundable.

Important Information: Futures, options and securities trading has risk of loss and may not be suitable for all persons. No Strategy can guarantee profits or freedom from loss. Past results are not necessarily indicative of future results. These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. There are numerous market factors, including liquidity, which cannot be fully accounted for in the preparation of hypothetical performance results all of which can adversely affect actual trading results. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.