Special Offer for 2022

Special Offer for 2022

Nirvana’s Trade Secrets offer interactive instruction, powerful tools, and hands-on coaching.

You’ll have the opportunity to develop the skills you need to trade with confidence and build wealth – no matter what

the market is doing. This is your chance to gain a decisive tactical advantage for your trading, this year and beyond.

“Overall it is the BEST Nirvana education product/tool system I’ve received. A+ to Ed and the team. Well done, I am very happy with what I got for my time and money.”

- William L.

Adaptive Trading is the “Cornerstone Event” because it’s about assessing Market Direction and Risk. We focus on this topic as the pre-cursor to the Trade Secrets, because once you understand the market, you can make more money by focusing on highly specialized situations.

“Innovative New Approaches, and

Useful New Tools!"

- Jim D.

Nirvana’s Trade Secrets offer interactive instruction, powerful tools, and hands-on coaching. You’ll have the opportunity to develop the skills you need to trade with confidence and build wealth – no matter what

the market is doing. This is your chance to gain a decisive tactical advantage for your trading, this year and beyond.

Adaptive Trading is the “Cornerstone Event” because it’s about assessing Market Direction and Risk. We focus on this topic as the pre-cursor to the Trade Secrets, because once you understand the market, you can make more money by focusing on highly specialized situations.

Learn how to Make Money in Any Market but Reduce Risk in Uncertain Markets.

In this cornerstone event, we cover specific Market Phases, Clues, and Events that tell us the likely direction of the market, – AND when to reduce exposure. Special Confirmation Techniques are also explained that help you find and trade the very best candidates each day.

Adaptive Trading is all about understanding the Market and trading according to Directional Clues and Reduction of Risk. Lessons learned here are leveraged in the other Trade Secrets, where individual candidates are identified and traded according to specialized methods.

Learn how to Make Money

in Any Market but Reduce Risk

in Uncertain Markets.

In this cornerstone event, we cover specific Market Phases, Clues, and Events that tell us the likely direction of the market, – AND when to reduce exposure. Special Confirmation Techniques are also explained that help you find and trade the very best candidates each day.

Adaptive Trading is all about understanding the Market and trading according to Directional Clues and Reduction of Risk. Lessons learned here are leveraged in the other Trade Secrets, where individual candidates are identified and traded according to specialized methods.

Assessing

Market RISK

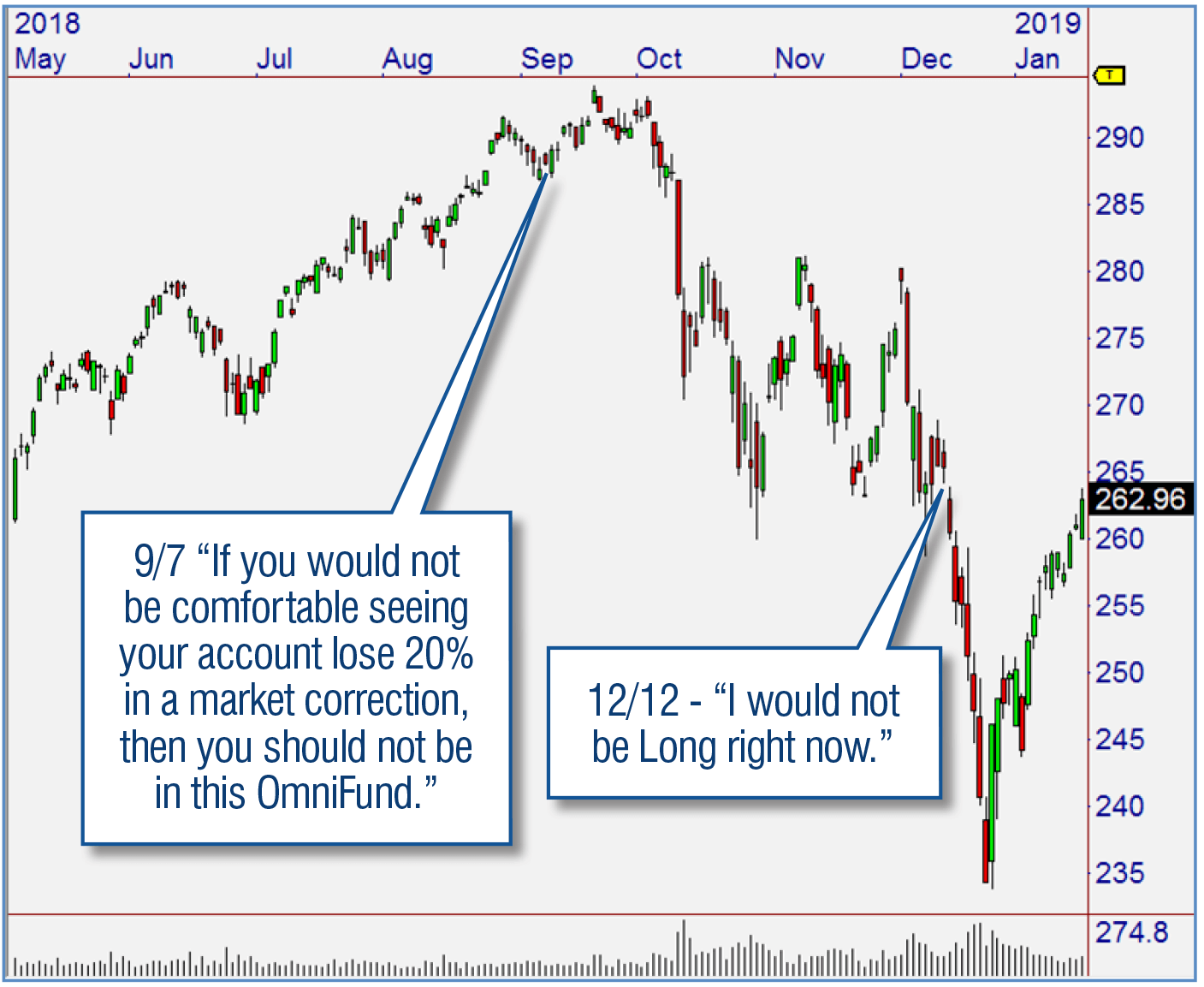

Market Clues can tell us when the Risk is too high to stay invested. Ed Downs applied these ideas in his September letter to OmniFunds subscribers, and in a December webinar. Ed’s precise market analysis techniques are revealed and used in Trade Secret 1.

It’s all About

Market Phase

Adaptive Trading is based on defining the Market Phase. Once we know what phase the market is in, we can apply the strategies and techniques that work in that particular Market Phase.

Market Direction

CLUES

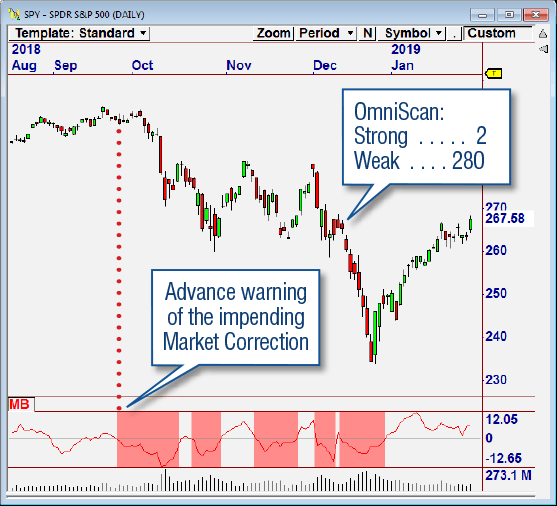

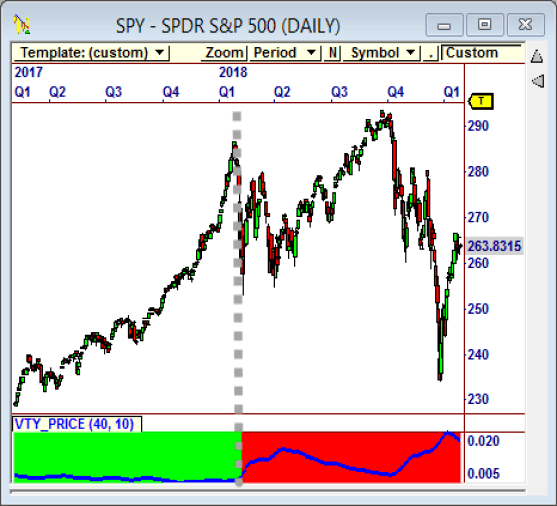

The new Composite Market Breadth indicator can signal potential market events ahead of time. You can see in the left chart that the indicator turned red a week ahead of the correction. When combined with OmniScan counts, we can get a clearer picture of market strength or weakness.

Market Direction

Events

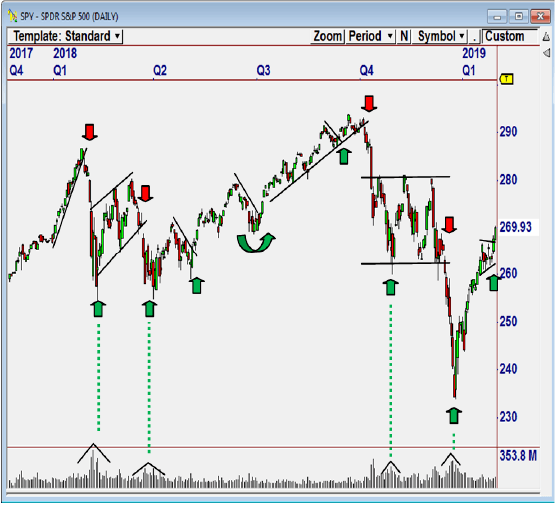

Consolidations, Support and Resistance Levels, Trend Lines and Volume Climax patterns often predict market direction and targets.

Trade Secret 1 includes specialized indicators that can detect these events on indexes and on individual stocks.

Assessing

Market RISK

Market Clues can tell us when the Risk is too high to stay invested. Ed Downs applied these ideas in his September letter to OmniFunds subscribers, and in a December webinar. Ed’s precise market analysis techniques are revealed and used in Trade Secret 1.

It’s all About

Market Phase

Adaptive Trading is based on defining the Market Phase. Once we know what phase the market is in, we can apply the strategies and techniques that work in that particular Market Phase.

Market Direction

CLUES

The new Composite Market Breadth indicator can signal potential market events ahead of time. You can see in the left chart that the indicator turned red a week ahead of the correction. When combined with OmniScan counts, we can get a clearer picture of market strength or weakness.

Market Direction

Events

Consolidations, Support and Resistance Levels, Trend Lines and Volume Climax patterns often predict market direction and targets.Trade Secret 1 includes specialized indicators that can detect these events on indexes and on individual stocks.

Updated and Targeted for Today's Market!

This first Trade Secret will help you engage any market for higher profits with less risk. We have collaborated to bring you great Trading Assets that support the approach, grounded in solid truths we have learned about the market over 30 years!

When you purchase Trade Secret 1: Adaptive Trading, your Dashboard will contain the following:

Instructional Video & Assets

In Part 1 of Trade Secrets 1, we focus on determining Market Phases and then matching them to strategies that perform in each phase. We start by looking at how the market is seen by others so we are aware of the most commonly used tools, we then explore how we determine Market Phases by concentrating on Market Direction, Strength, and Volatility. With this info, we can then look at the new strategies provided and they perform in our Market States.

Interactive Q&A Session

In this Session, Jeff illuminates the material with examples and interact with attendees to help them understand the concepts to the greatest extent possible.

Instructional Video & Assets

In Part 2, we study three different ways to determine likely market direction - Chart Patterns on an Index Chart, Market Breadth, and OmniScan Counts. Combine all three methods for the best possible read on market direction in the next time frame.

Interactive Q&A Session

In the interactive session, we discuss the components discussed in the educational video. ScanCounts() is the superb new feature that was added for Trade Secrets 1, Part 2, and has a lot of potential beyond the course. We discuss various other scans that could be productive in determining market direction.

Instructional Video & Assets

In Part 3, we revisit the Market Phases covered in Part 1, but we take an in-depth look at the indicators used to define these phases. Once we have a thorough understanding of these indicators, we apply that knowledge to create new Short Term and Long Term Market Phases.

Interactive Q&A Session

In the interactive session, we bring together all of the components discussed in Trade Secrets 1 and using the different concepts and combining them together to engage the market.

• NEW Strategies that have been designed

to fire in specific Market Phases.

• NEW Market Allocation Calculator tells you

how much Long/Short Exposure is appropriate

in any market.

• NEW Indicators that show the most likely Market

Phase or Direction for the current time period.

• NEW OmniScans that deliver actionable

candidate lists for each Market Phase.

Regular Price ..................................................... $1,495

Loyal Customer Price ............................................ $995

Special Offer for 2022 ...................................... $495

This first Trade Secret will help you engage any market for higher profits with less risk. We have collaborated to bring you great Trading Assets that support the approach, grounded in solid truths we have learned about the market over 30 years!

When you purchase Trade Secret 1: Adaptive Trading, you will receive Recorded Session along with:

• NEW Strategies that have been designed

to fire in specific Market Phases.

• NEW Market Allocation Calculator tells you how much Long/Short Exposure is appropriate in any market.

• The 3 Part Seminar Series with Ed Downs and Jeff Drake.

• Strategies that have been designed to fire in specific Market Phases.

• Market Allocation Calculator tells you how much Long/Short Exposure is appropriate in any market.

• NEW Indicators that show the most likely Market Phase or Direction for the current time period.

• NEW OmniScans that deliver actionable candidate lists for each Market Phase.

• NEW 3 Live Sessions targeted to Today's market, hosted by Ed Downs and Jeff Drake.

• Indicators that show the most likely Market Phase or Direction for the current time period.

• OmniScans that deliver actionable candidate lists for each Market Phase.

30-Day Money Back Guarantee: Our software is backed by our unconditional Money Back Guarantee.* If for any reason you are not fully satisfied, you may return the module, within 30 days of purchase, for a 100% refund, less shipping and handling. Texas residents add 8.25% sales tax.

*Trade Secrets are educational products, not software.

Important Information: Futures, options and securities trading has risk of loss and may not be suitable for all persons. No Strategy can guarantee profits or freedom from loss. Past results are not necessarily indicative of future results. All statistics and results shown in this mailer are simulated. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading.