Powered by the Nirvana's Trade Secrets Club

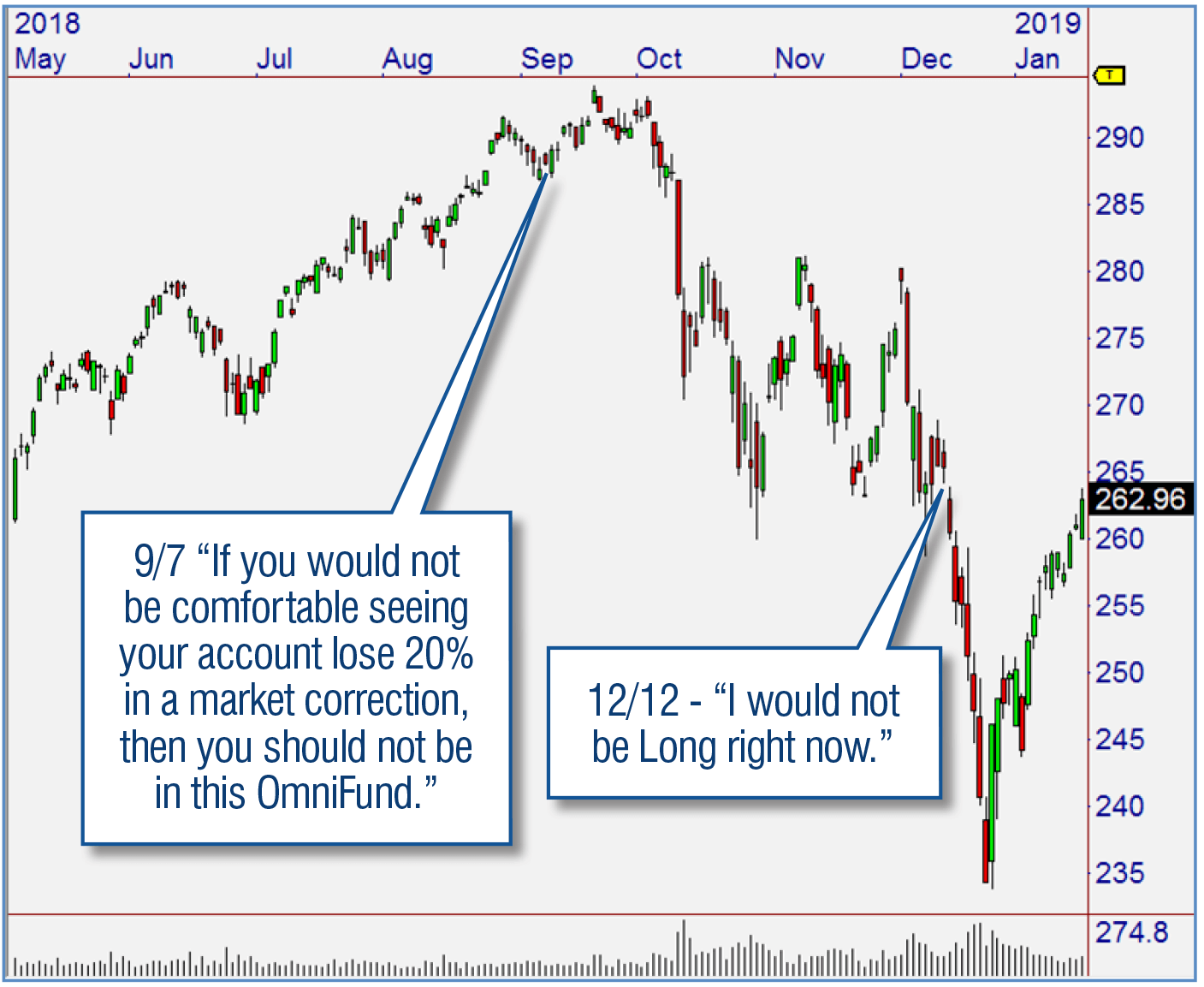

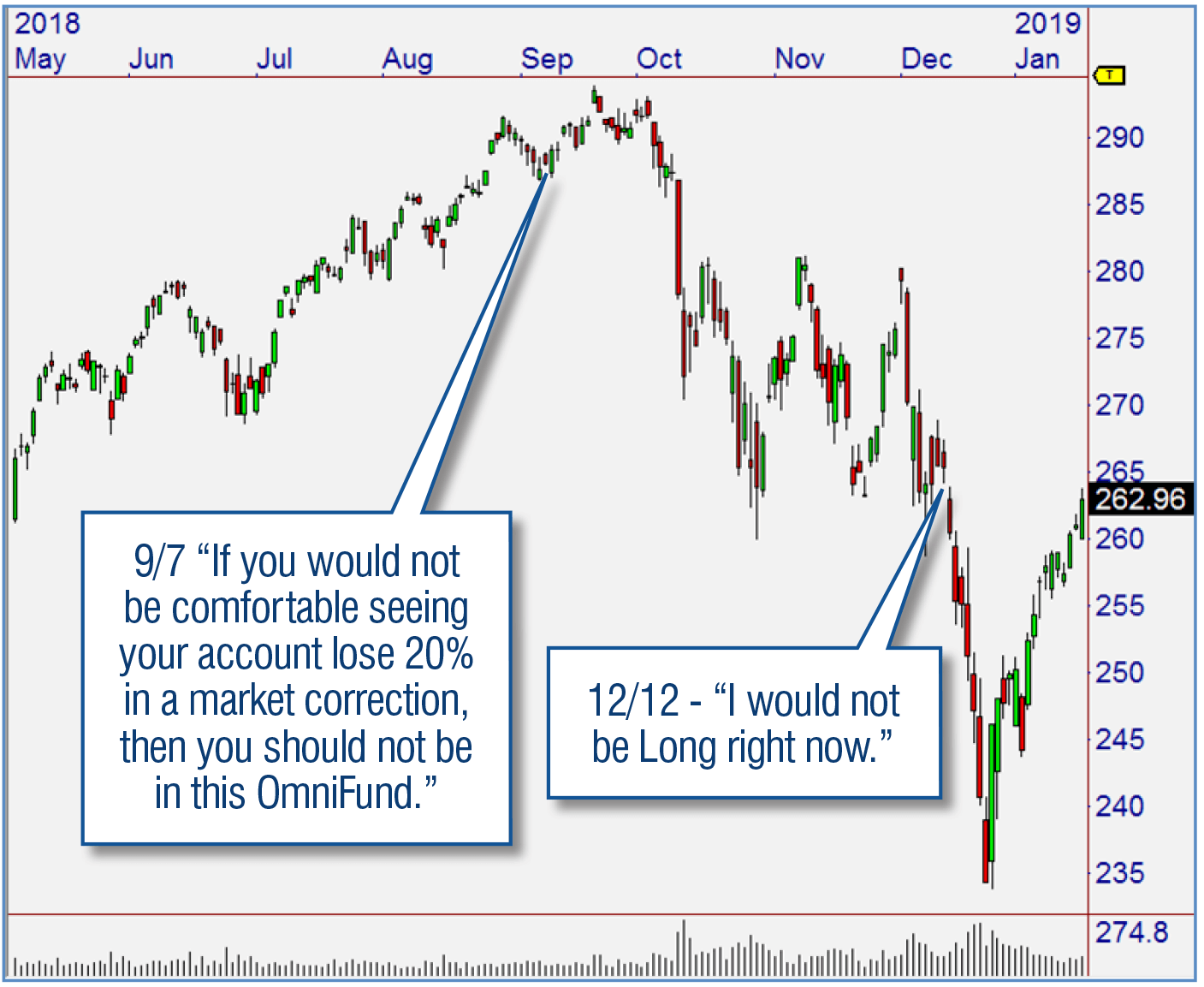

Assessing Market Risk

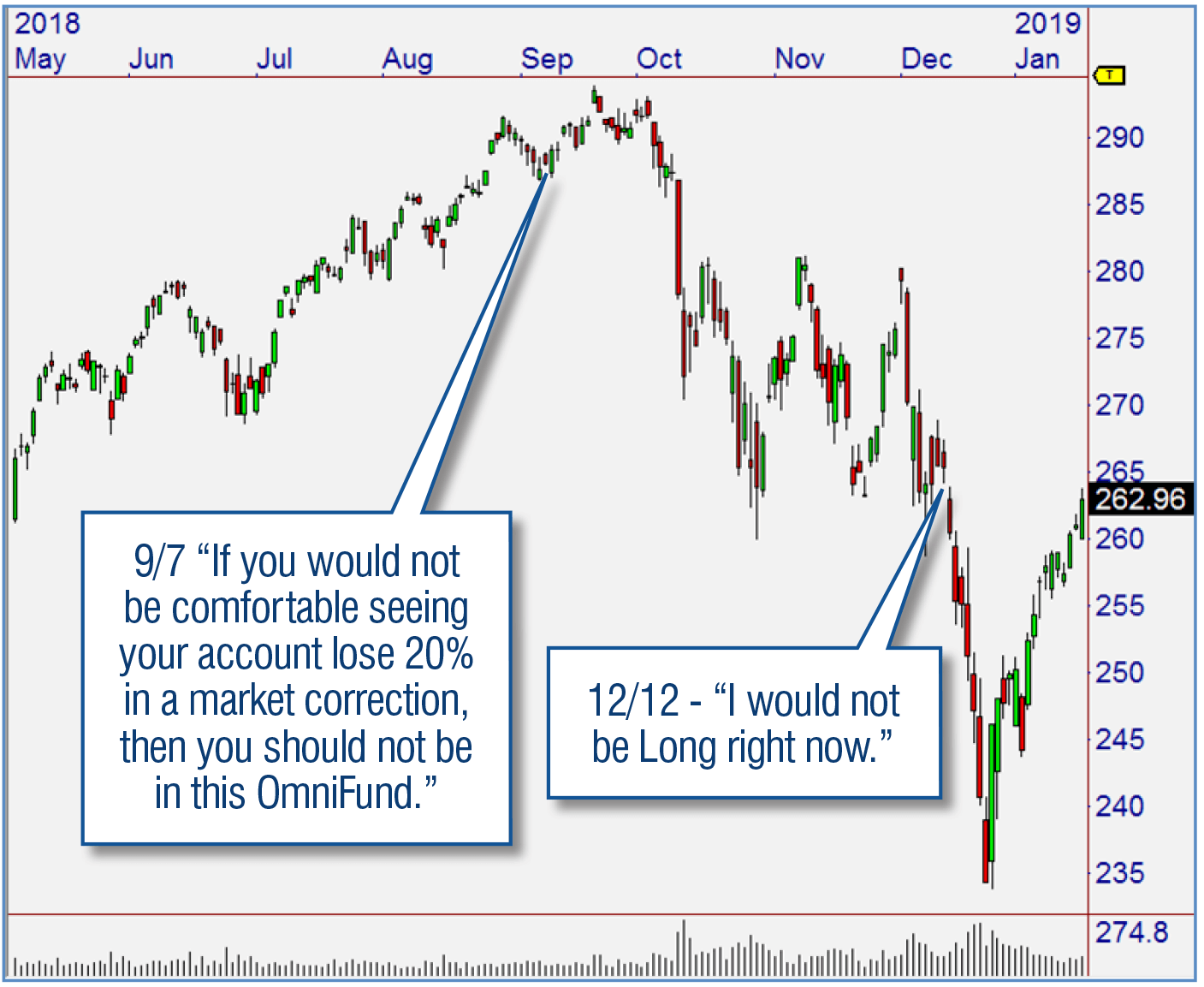

Market Clues can tell us when the Risk is too high to stay invested. Ed Downs applied these ideas in his September letter to OmniFunds subscribers, and in a December webinar. Ed’s precise market analysis techniques are revealed and used in Trade Secret 1.

Assessing

Market Risk

Market Clues can tell us when the Risk is too high to stay invested. Ed Downs applied these ideas in his September letter to OmniFunds subscribers, and in a December webinar. Ed’s precise market analysis techniques are revealed and used in Trade Secret 1.

It’s all About

Market Phase

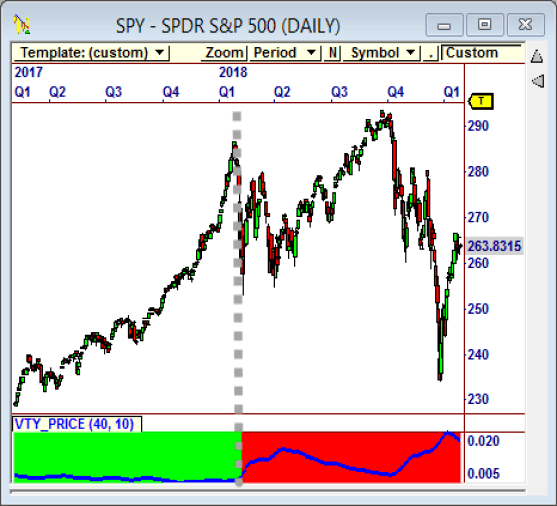

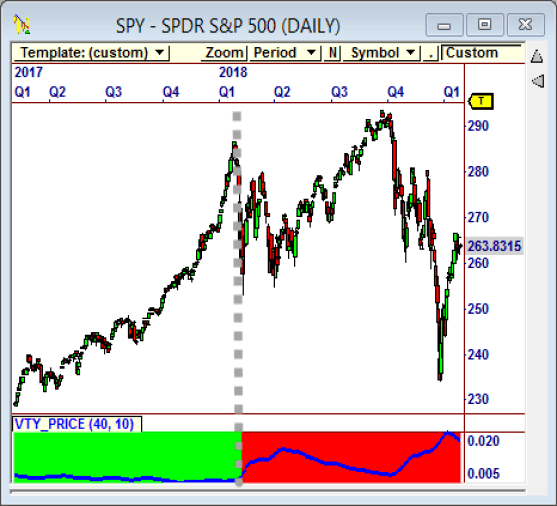

Adaptive Trading is based on defining the Market Phase. Once we know what phase the market is in, we can apply the strategies and techniques that work in that particular Market Phase.

Market Direction

CLUES

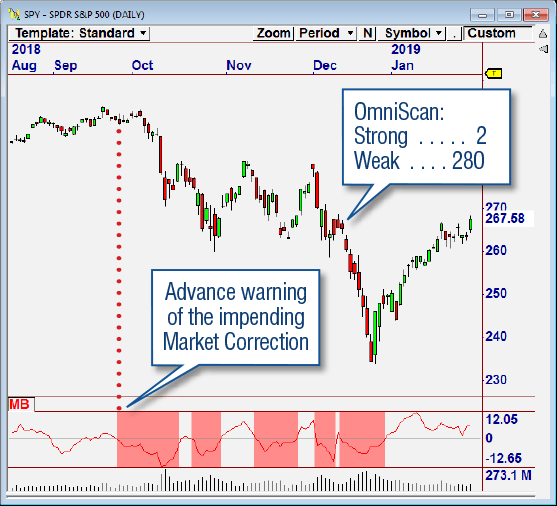

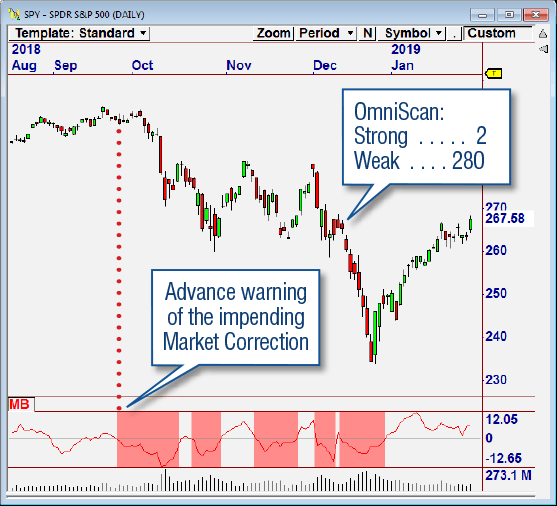

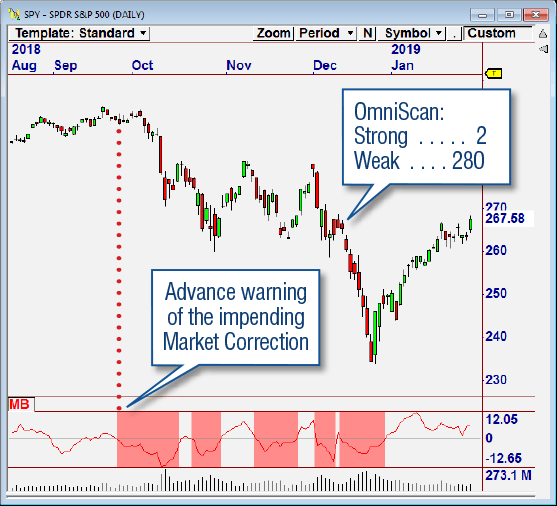

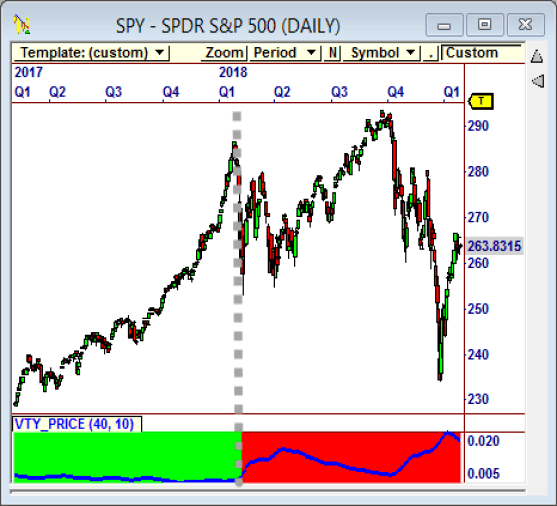

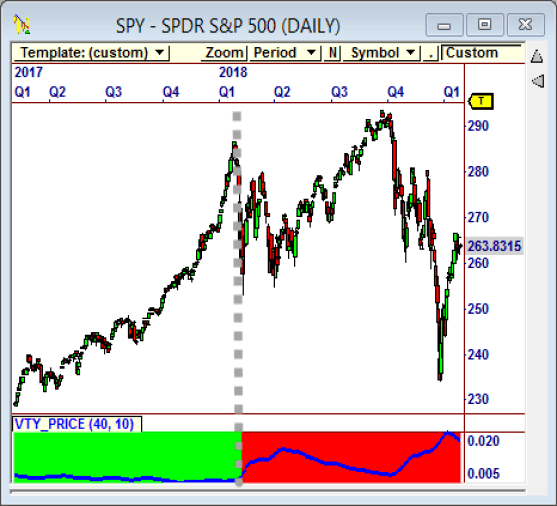

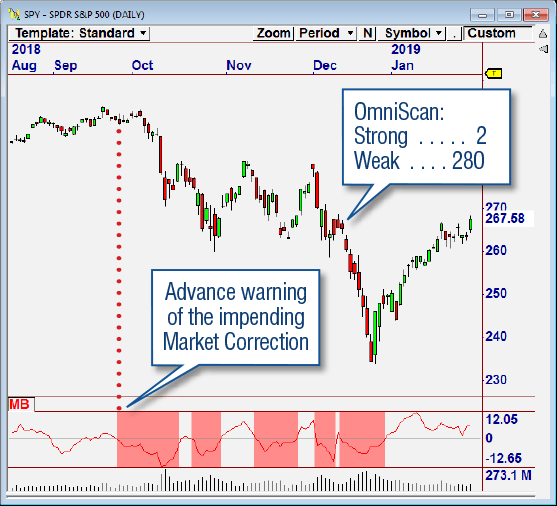

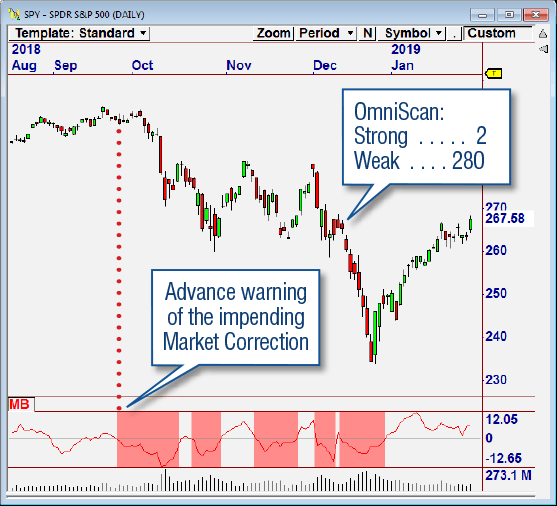

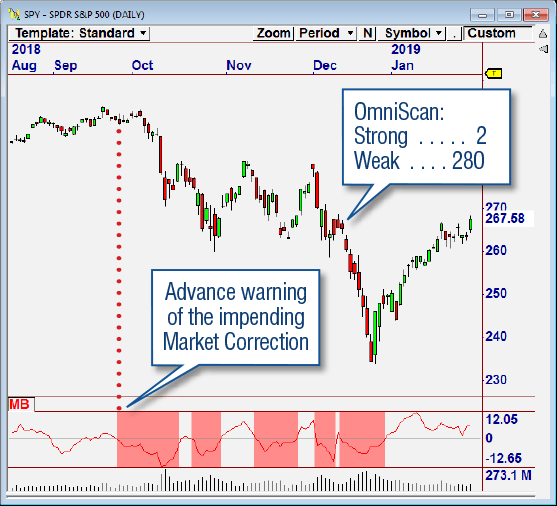

The new Composite Market Breadth indicator can signal potential market events ahead of time. You can see in the left chart that the indicator turned red a week ahead of the correction. When combined with OmniScan counts, we can get a clearer picture of market strength or weakness.

Market Direction

Events

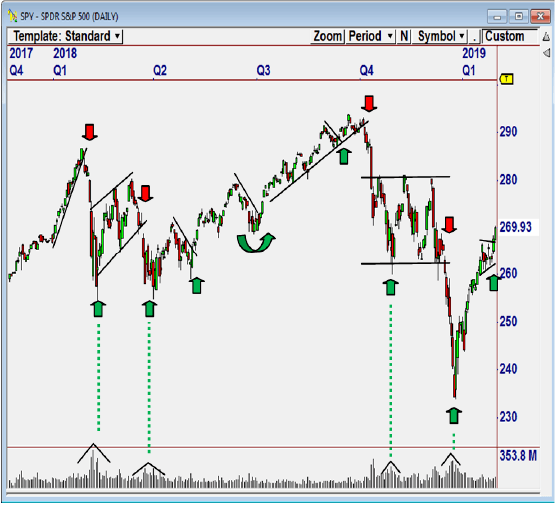

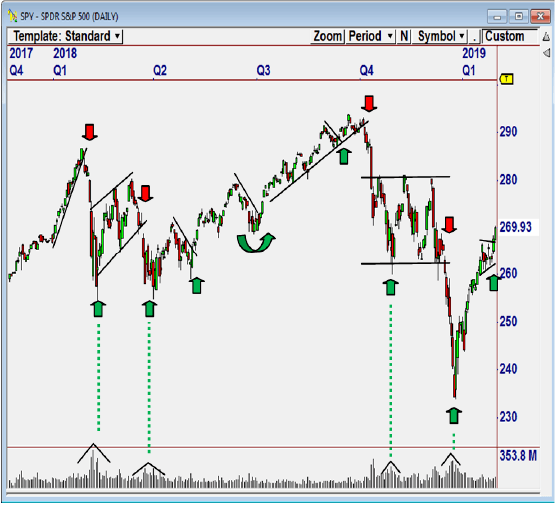

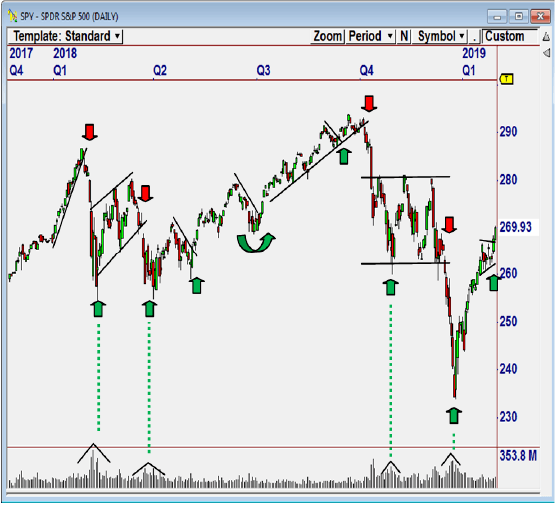

Consolidations, Support and Resistance Levels, Trend Lines and Volume Climax patterns often predict market direction and targets.

Trade Secret 1 includes specialized indicators that can detect these events on indexes and on individual stocks.

Updated and Targeted for Today's Market!

It’s all About

Market Phase

Adaptive Trading is based on defining the Market Phase. Once we know what phase the market is in, we can apply the strategies and techniques that work in that particular Market Phase.

Market Direction

CLUES

The new Composite Market Breadth indicator can signal potential market events ahead of time. You can see in the left chart that the indicator turned red a week ahead of the correction. When combined with OmniScan counts, we can get a clearer picture of market strength or weakness.

Market Direction

Events

Consolidations, Support and Resistance Levels, Trend Lines and Volume Climax patterns often predict market direction and targets.

Trade Secret 1 includes specialized indicators that can detect these events on indexes and on individual stocks.

Updated and Targeted for Today's Market!

The First Monthly Installment of the Trade Secrets Club:

One Trade Secret a Month for Four Months!

This first Trade Secret will help you engage any market for higher profits with less risk. We have collaborated to bring you great Trading Assets that support the approach, grounded in solid truths we have learned about the market over 30 years!

When you purchase Trade Secret 1: Adaptive Trading, you will receive:

• The 3 Part Seminar Series with Ed Downs and Jeff Drake .

• Strategies that have been designed to fire in specific Market Phases.

• Market Allocation Calculator tells you how much Long/Short Exposure is appropriate in any market.

• NEW 3 Live Sessions targeted to Today's market, hosted by Ed Downs and Jeff Drake.

• Indicators that show the most likely Market Phase or Direction for the current time period.

• OmniScans that deliver actionable candidate lists for each Market Phase.

Regular Price ..................................................... $1,495

OmniTrader Customer Price ..................................... $995

After Nirvana Club Discount .............................. $597

Or Get All 4 Secrets by Joining the Club!

See Details Below:

The First Monthly Installment of the Trade Secrets Club:

One Trade Secret a Month for Four Months!

This first Trade Secret will help you engage any market for higher profits with less risk. We have collaborated to bring you great Trading Assets that support the approach, grounded in solid truths we have learned about the market over 30 years!

When you purchase Trade Secret 1: Adaptive Trading, you will receive:

• The 3 Part Seminar Series with Ed Downs and Jeff Drake .

• Strategies that have been designed to fire in specific Market Phases.

• Market Allocation Calculator tells you how much Long/Short Exposure is appropriate in any market.

• NEW 3 Live Sessions targeted to Today's market, hosted by Ed Downs and Jeff Drake.

• Indicators that show the most likely Market Phase or Direction for the current time period.

• OmniScans that deliver actionable candidate lists for each Market Phase.

Regular Price: $1,495

OmniTrader Customer Price : $995

After Nirvana Club Discount: $597

Or Get All 4 Secrets by Joining the Club!

See Details Below:

Join the Club to Get One Secret

a Month for Four Months!

That's ALL 4 Secrets at an Incredible Value!

For those who want to receive actionable trading methods that will dramatically improve their trading, these Trade Secrets are being built just for you! Grab this limited time offer on all 4 Secrets!

All 4 Trade Secrets

Regular Price ..................................................... $5,995

OmniTrader Customer Price .................................... $2,995

After Nirvana Club Discount .............................. $1,797

Join the Club to Get One Secret

a Month for Four Months!

That's ALL 4 Secrets at an Incredible Value!

For those who want to receive actionable trading methods that will dramatically improve their trading, these Trade Secrets are being built just for you! Grab this limited time offer on all 4 Secrets!

All 4 Trade Secrets

Regular Price:

$5,995

OmniTrader Customer Price: $2,995

After Nirvana Club Discount: $1,797

Our software is backed by our unconditional Money Back Guarantee. If for any reason you are not fully satisfied, you may return the software, within 30 days of purchase, for a 100% refund, less shipping and handling. Texas residents add 8.25% sales tax. Educational material is non-refundable.

Important Information: Futures, options and securities trading has risk of loss and may not be suitable for all persons. No Strategy can guarantee profits or freedom from loss. Past results are not necessarily indicative of future results. These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. There are numerous market factors, including liquidity, which cannot be fully accounted for in the preparation of hypothetical performance results all of which can adversely affect actual trading results. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.