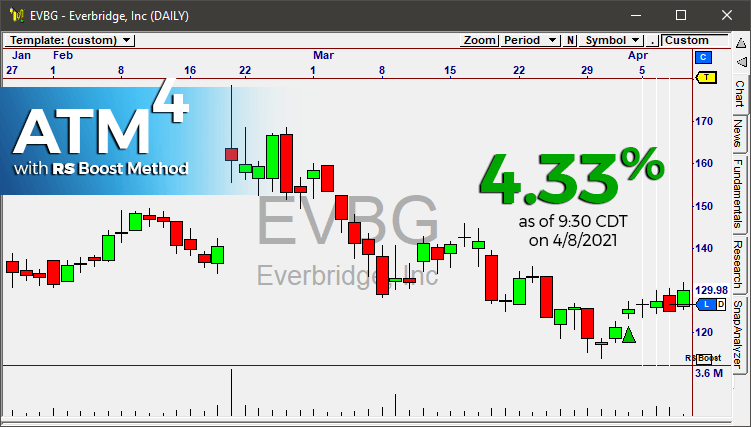

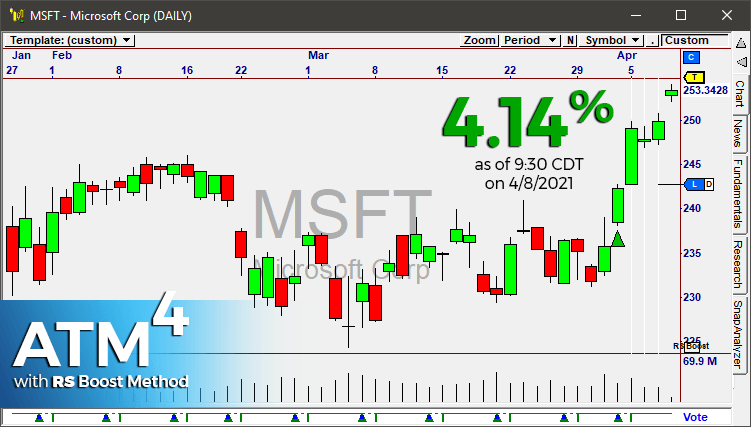

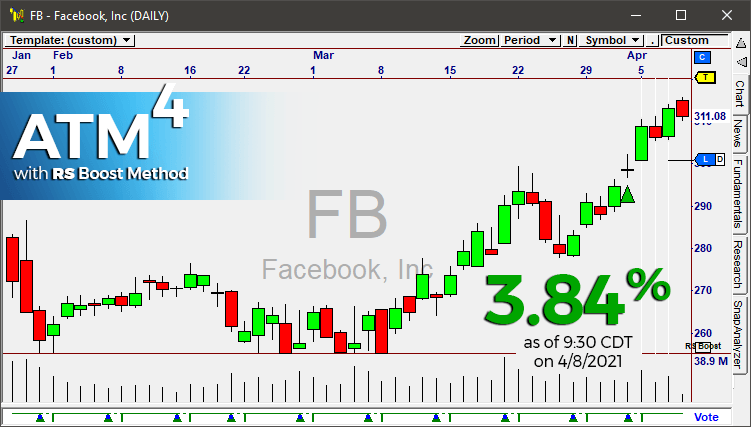

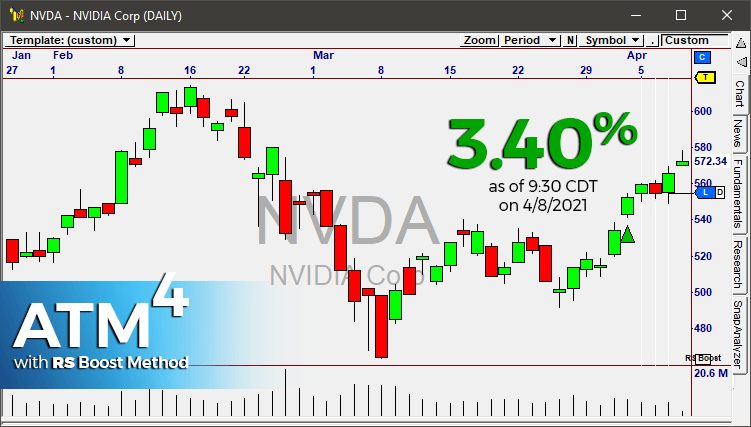

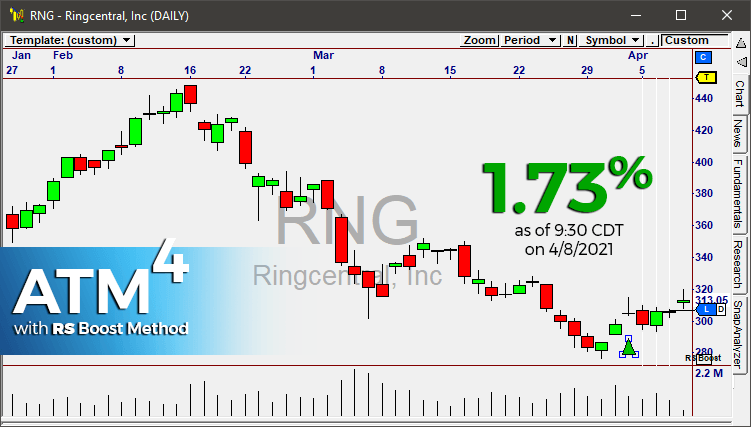

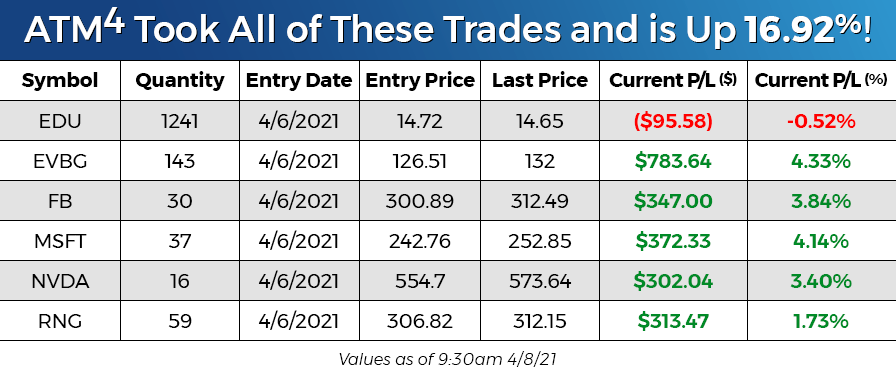

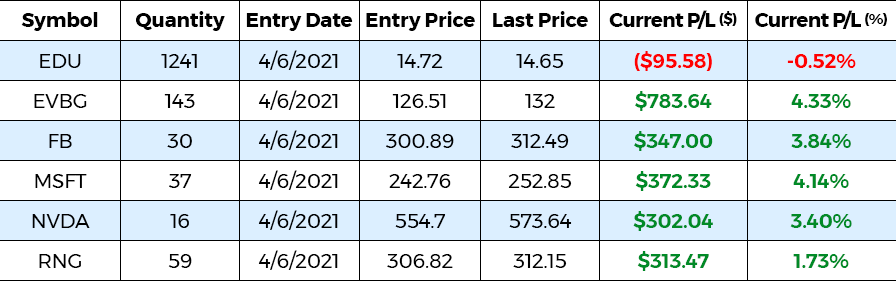

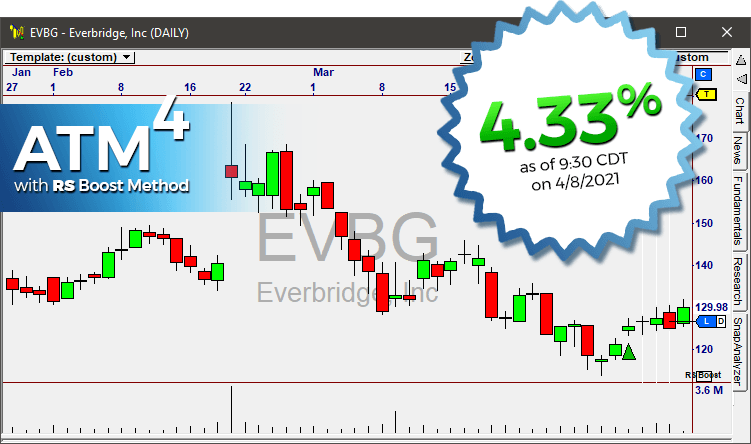

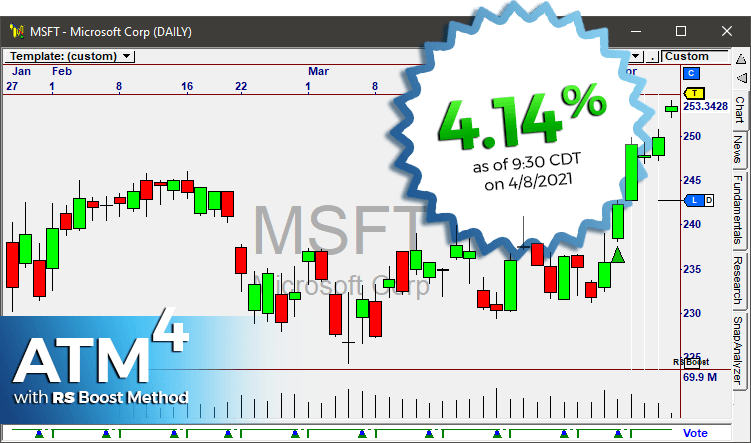

ATM4 Took ALL Of These Trades on Monday... We're Up 16.92% on Thursday!

Values as of 9:30 CDT on 4/8/2021

Click Here to See the

Other Trades in the List!

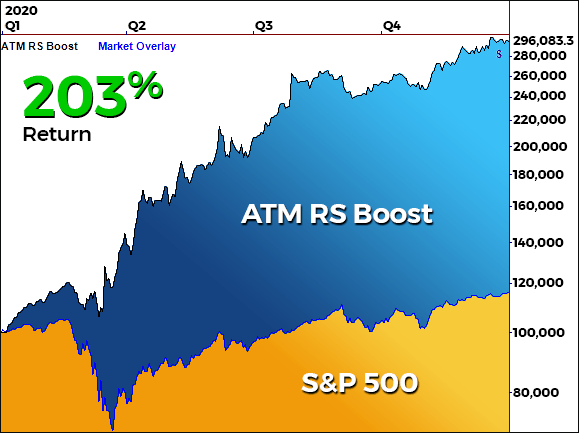

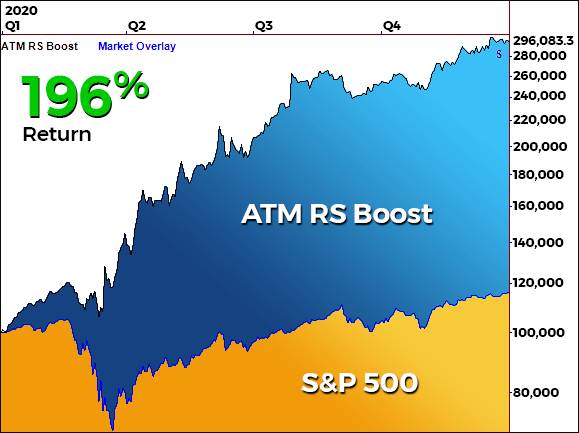

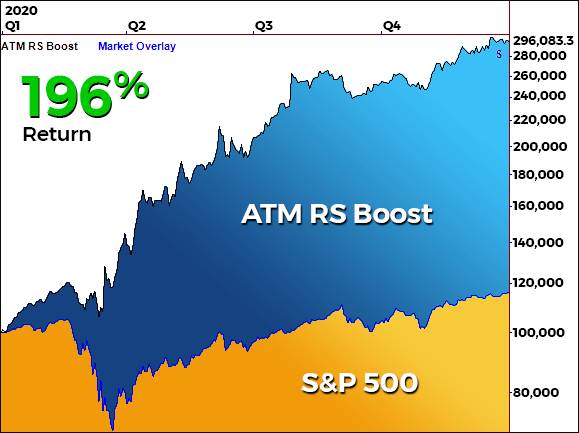

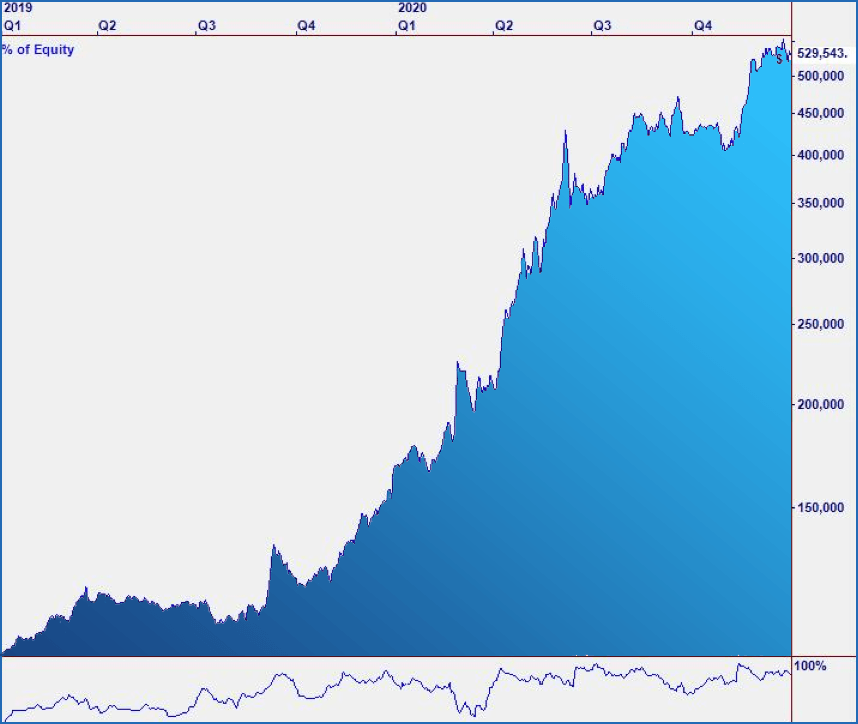

RS Boost made 203% in 2020 with only 12% drawdown!

RS Boost uses three different Market States to make a remarkable 203% in 2020 alone with only a 12% drawdown!

RS Boost Method

RS Boost uses three different Market States to provide 203% returns in 2020.

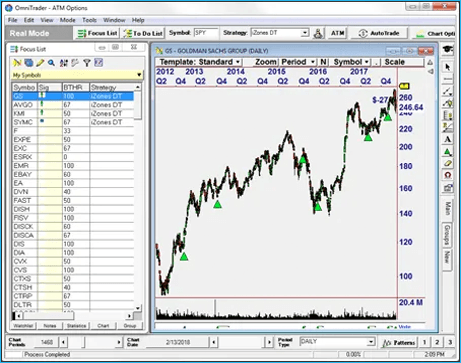

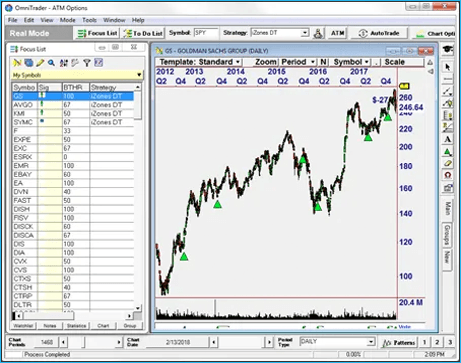

ATM4 - With Dynamic Lists

What is ATM

The ATM Difference

RS Boost uses three different Market States to make a remarkable 196% in 2020 alone with only a 12% draw-down!

RS Boost uses three different Market States to make a remarkable 196% in 2020 alone with only a 12% draw-down!

RS Boost Method

RS Boost uses three different Market States to provide 196% returns in 2020. Learn More

ATM4

ATM4 breaks the Static List Barrier with Dynamic Lists. Learn More

What is ATM

Adaptive Trade Management (ATM) is a dynamically automated approach to trading. Learn More

The ATM Difference

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Learn More

A Virtual Market Mastermind

First ATM detects the state of the market. Once we have identified what type of market we are in, we can then adapt to the current market to maximize our strategy's potential. ATM then filters the trades generated by our strategies to only take trades that are conducive to the current market state.

Watch the Demo

RS Boost Method

Several pre-configured ATM Methods are provided with ATM4, including the brand-new RS Boost Method, which uses a Dynamic List based on Relative Strength – our latest winning approach!

With any of our built-in Methods, just install, activate and trade! You can either manually select from the candidates that populate your Focus List each day, or “flip the switch” for fully automatic trading.

ATM4

What's New?

Dynamic Lists!

ATM4 Breaks the Static List Barrier with Dynamic Lists

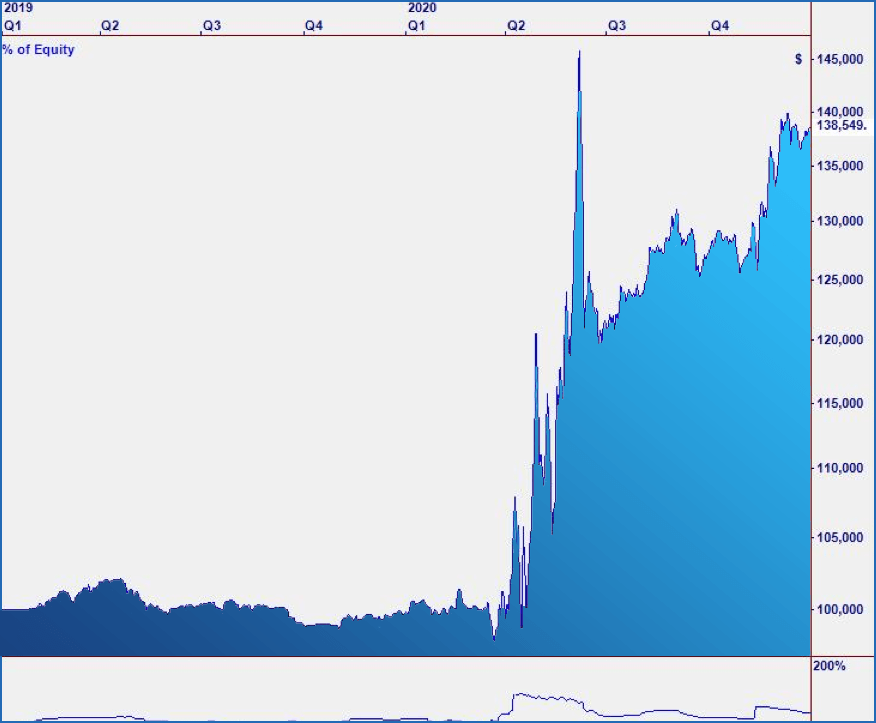

Last year, we added Strategy Analysis for ATM3, which enabled ATM to select Strategies based on how well they are performing in the immediate past. We didn’t think we could improve it much more than that – until we experimented with Dynamic Lists.

Rather than trade the same List of Symbols every day, ATM4 can trade the BEST list by filtering for those Symbols that are most likely to succeed with the given Strategy – on that day!

The improvement is stunning. The new Dynamic List feature in ATM4 boosted profitability from 20% to 148%.

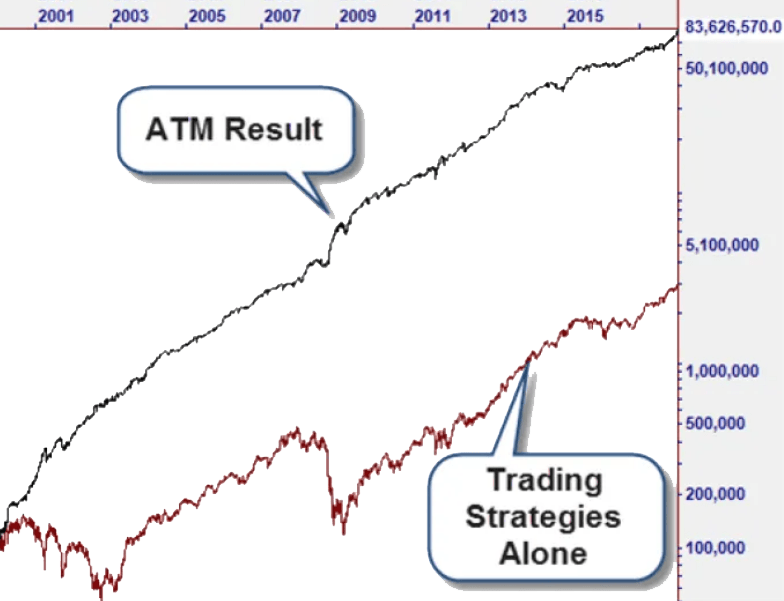

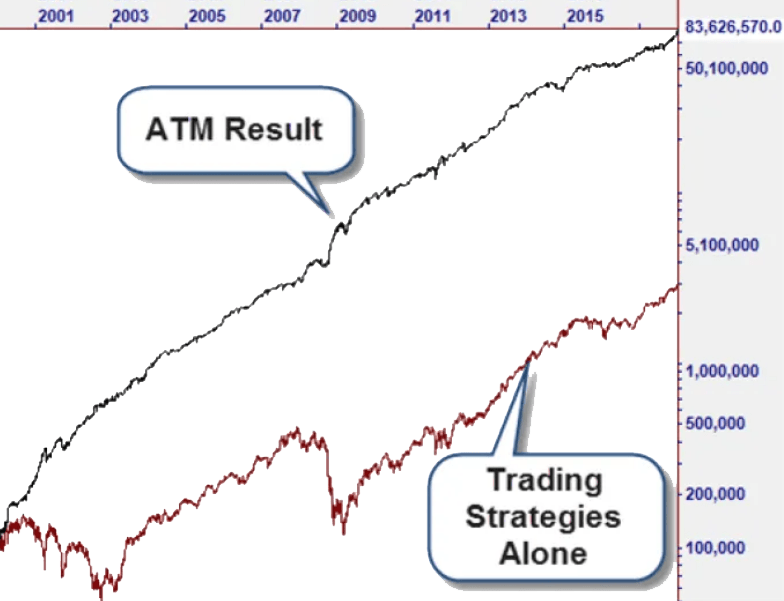

What is ATM

Adaptive Trade Management (ATM) is a dynamically automated approach to trading. ATM allows us to adapt to changing markets by determining the type of market, and then adjusting our trading approach in order to maximize results.

Click More Details to see the equity curves and the dramatic improvement that this technology can have on results. Consistent gains, low drawdowns, outstanding performance in all markets - ATM delivers! Click

The ATM Difference

Automation Makes the Difference:

ATM Benefits Your Trading 2 Ways:

-1- Manual Trading: Use it to show you the best trades to make each day...

-2- Fully Automated Trading: Let it manage your account with 100% automated trading!

RS Boost Method

Several pre-configured ATM Methods are provided with ATM4, including the brand-new RS Boost Method, which uses a Dynamic List based on Relative Strength – our latest winning approach!

With any of our built-in Methods, just install, activate and trade! You can either manually select from the candidates that populate your Focus List each day, or “flip the switch” for fully automatic trading.

ATM4

What's New?

ATM4 Breaks the Static List Barrier with Dynamic Lists

Last year, we added Strategy Analysis for ATM3, which enabled ATM to select Strategies based on how well they are performing in the immediate past. We didn’t think we could improve it much more than that – until we experimented with Dynamic Lists.

Rather than trade the same List of Symbols every day, ATM4 can trade the BEST list by filtering for those Symbols that are most likely to succeed with the given Strategy – on that day!

What is ATM

Adaptive Trade Management (ATM) is a dynamically automated approach to trading. ATM allows us to adapt to changing markets by determining the type of market, and then adjusting our trading approach in order to maximize results.

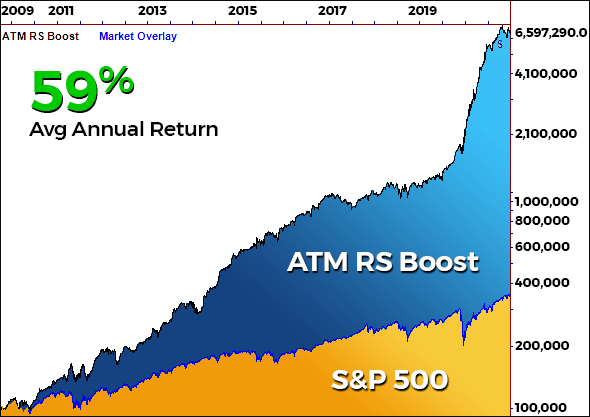

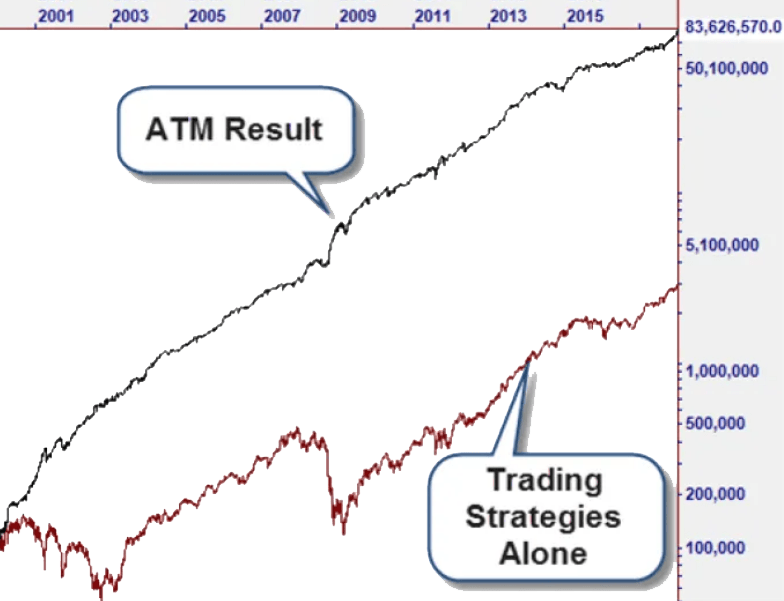

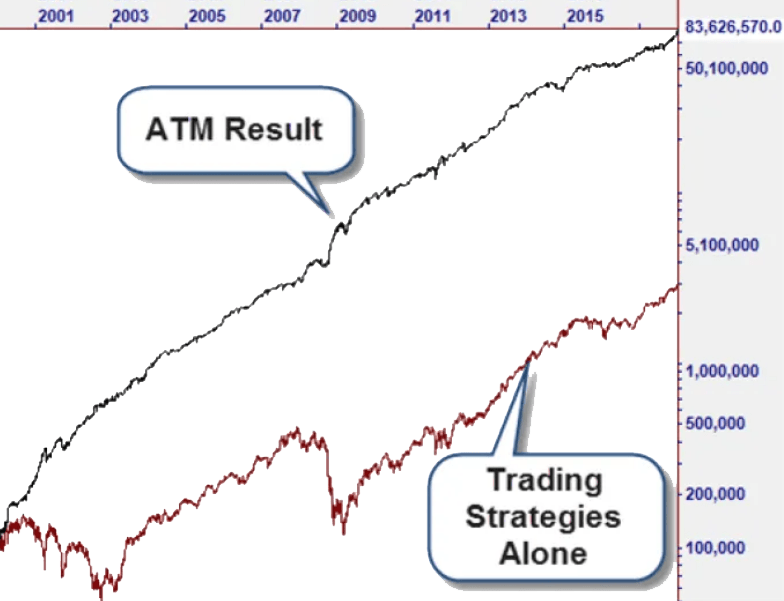

The equity curves to the right shows the dramatic improvement that this technology can have on results. Consistent gains, low draw downs, outstanding performance in all markets - ATM delivers!

The ATM Difference

Discover the Difference ATM Can Make:

ATM Benefits Your Trading 2 Ways:

-1- Manual Trading: Use it to show you the best trades to make each day...

-2- Fully Automated Trading: Let it manage your account with 100% automated trading!

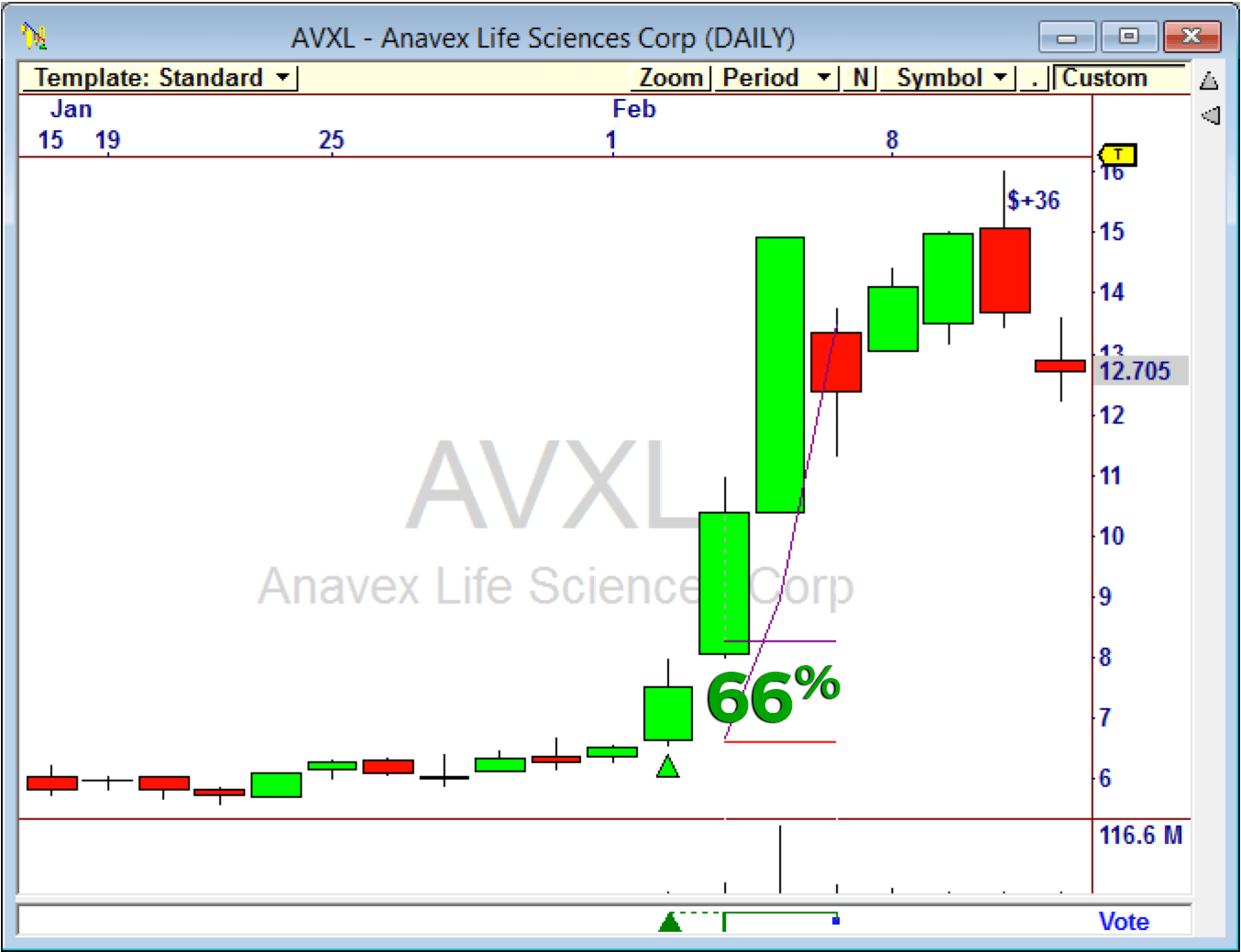

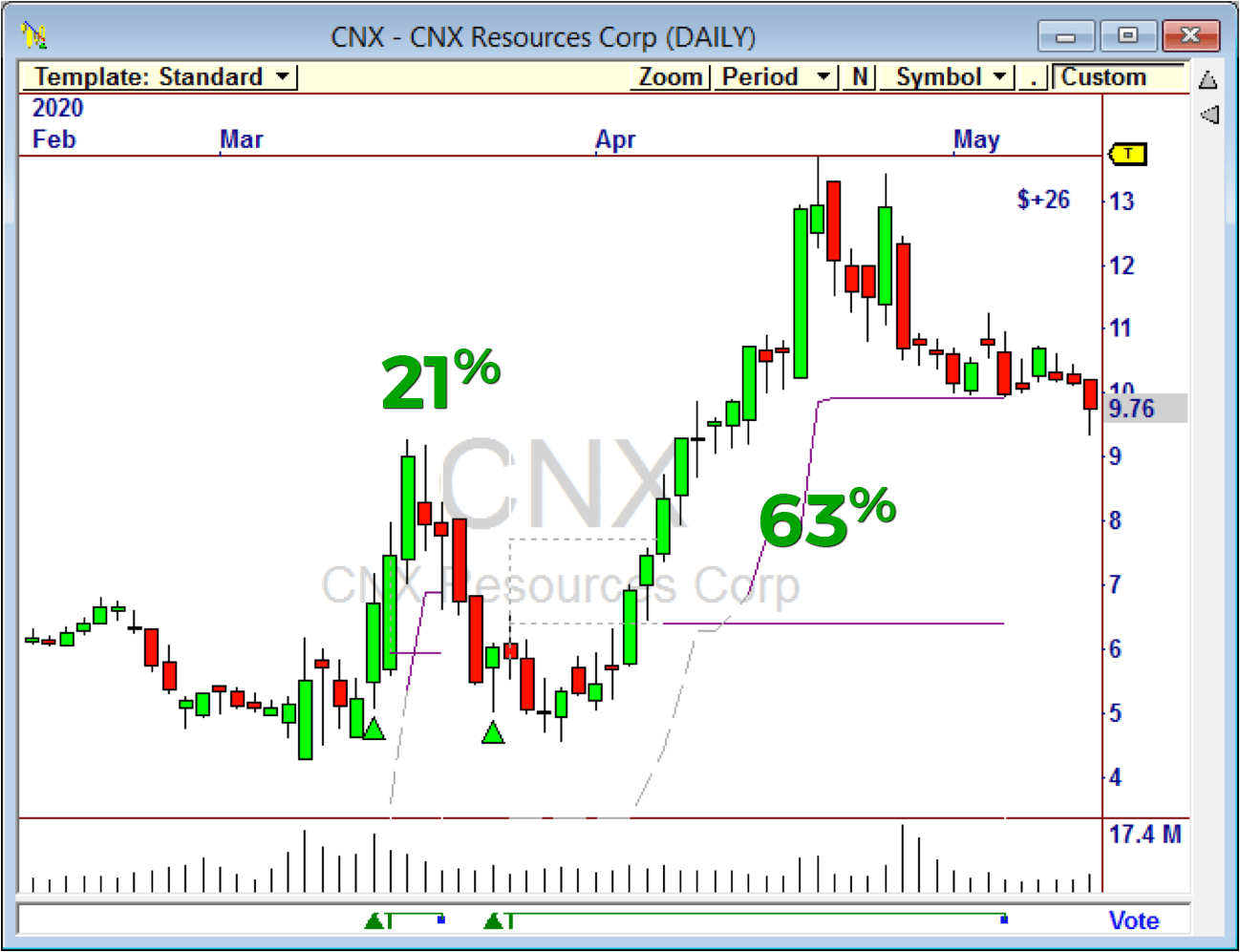

The ALL NEW RS Boost Method

Included with ATM4

As the markets change, wouldn’t it be nice to automatically switch to Trading Strategies that work best in the new market?

RS Boost uses three different Market States. One Market State continually invests in stocks that show steady gains, even when the broad market falters.

Another Market State will add Tech Stocks when the NASDAQ is bullish for added gains.

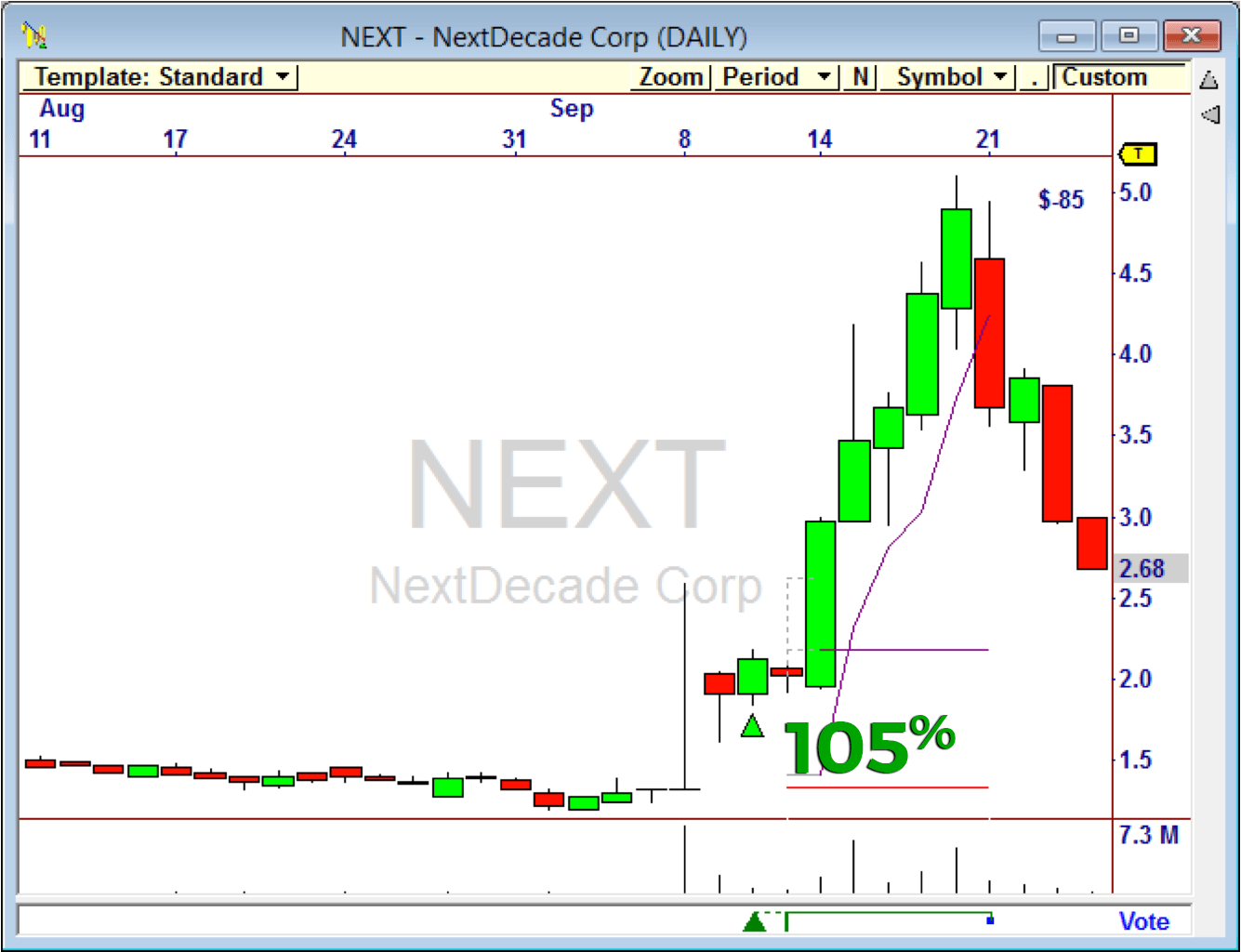

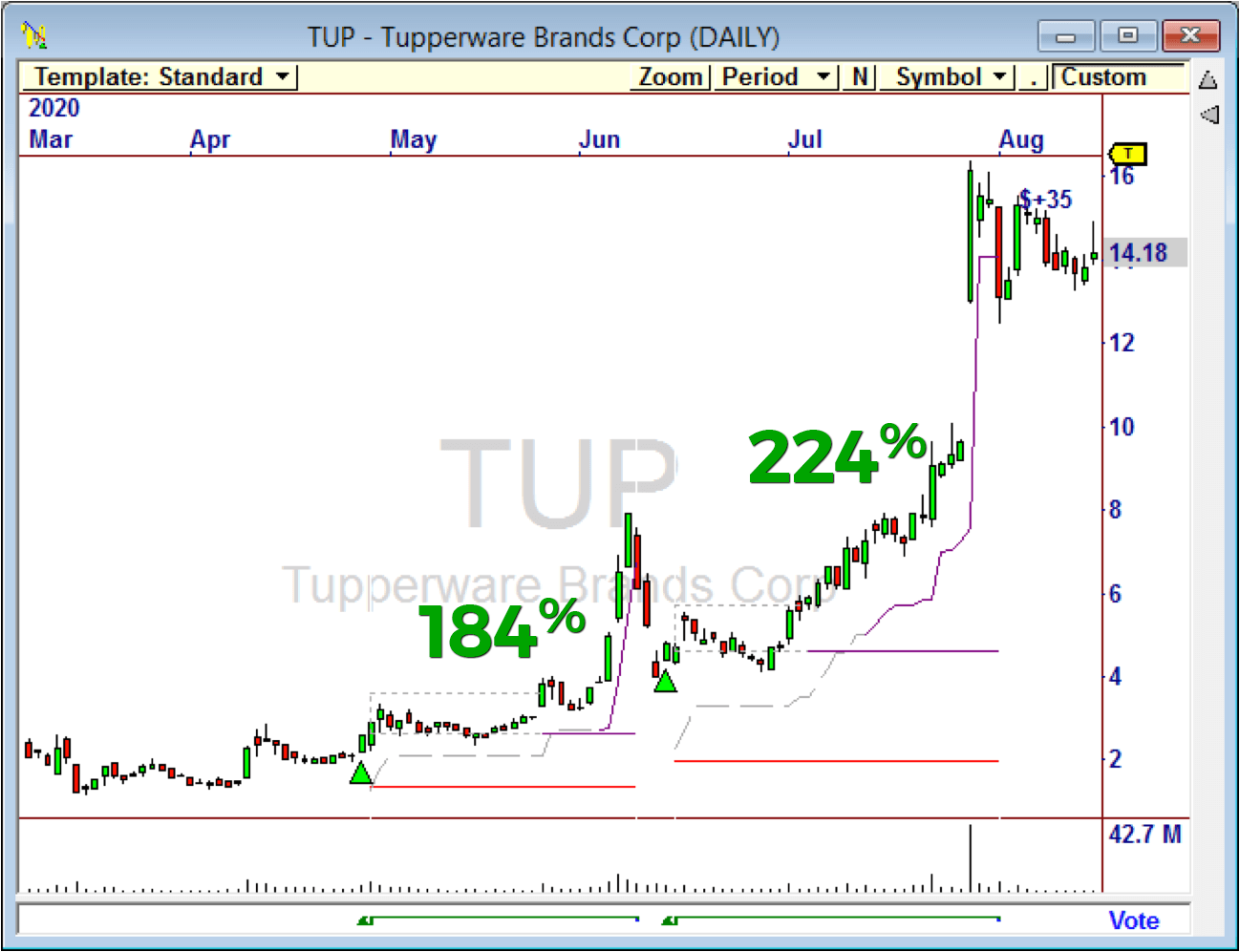

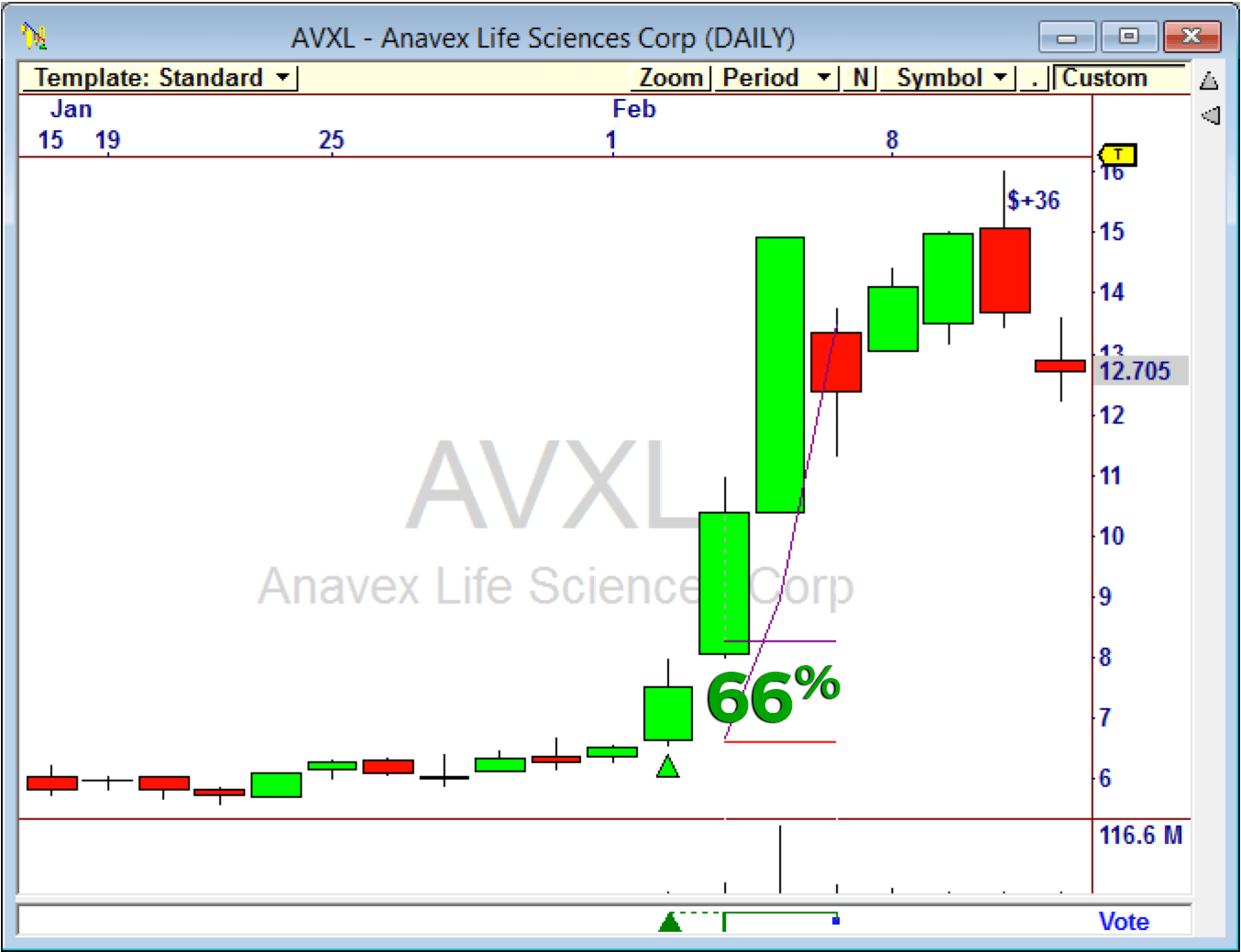

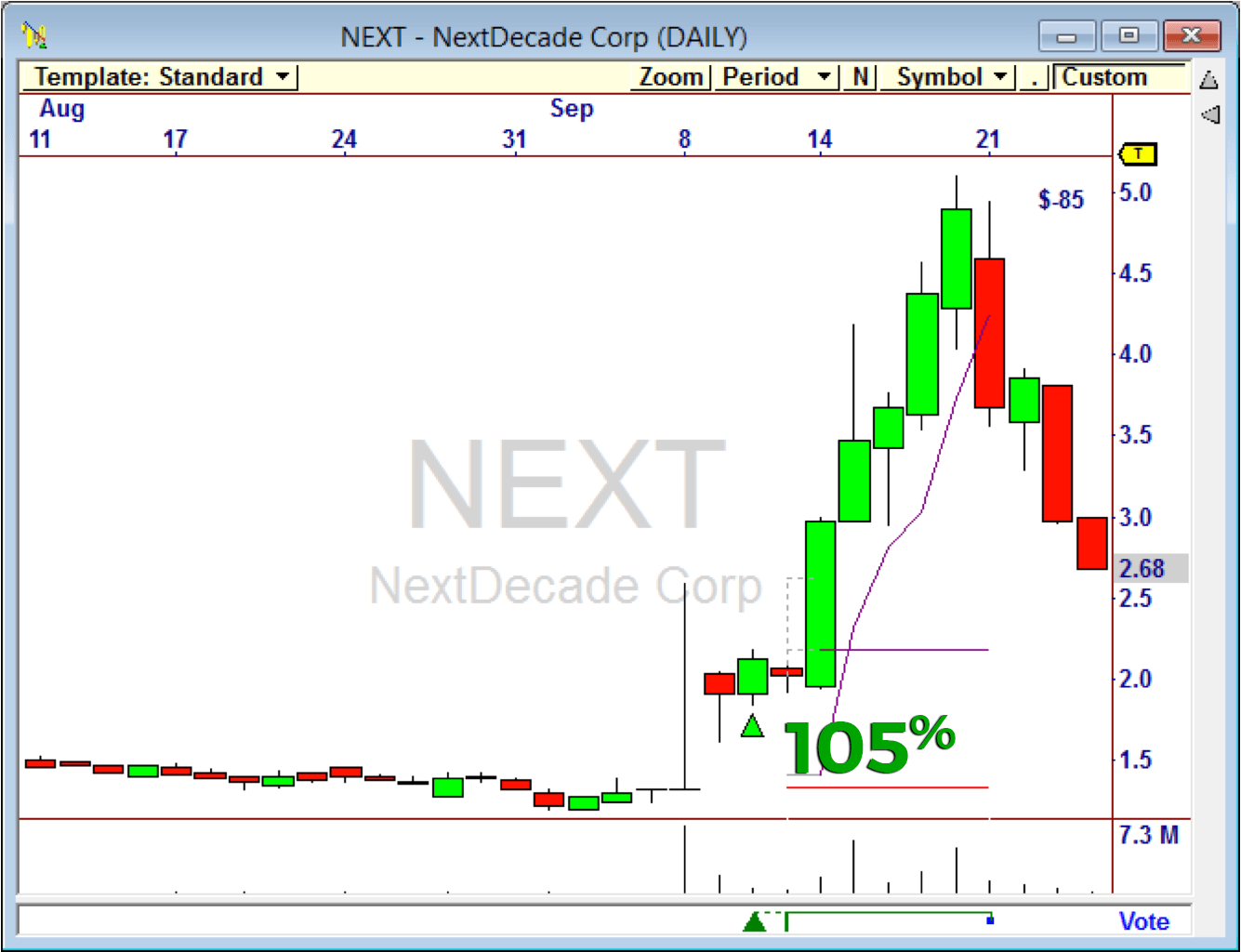

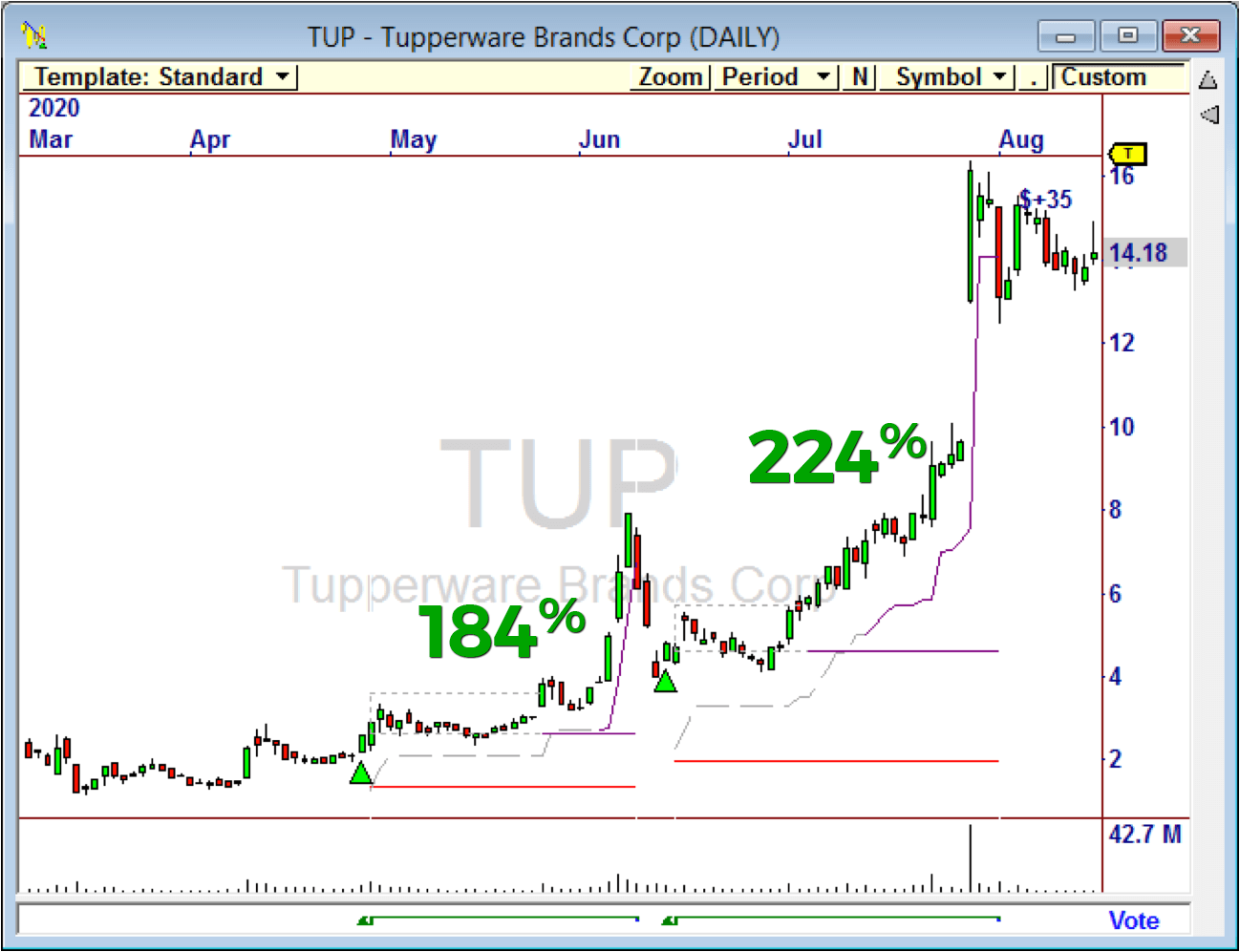

And finally, the third Market State takes advantage of the recent market phenomenon of investors piling into low priced stocks (see example stocks below). This Market State helps RS Boost make a remarkable 203% in 2020 alone with only a 12% drawdown!

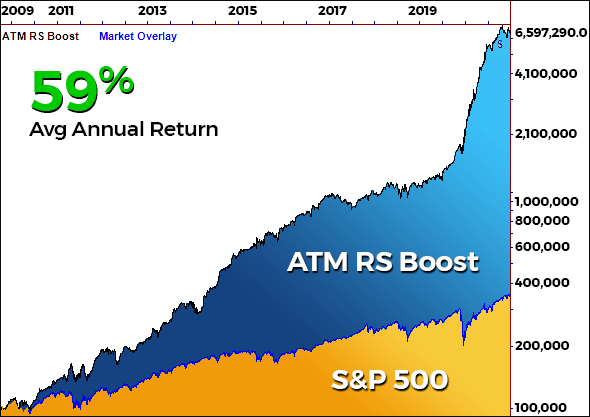

59% Avg Annual Return. 14% Avg Annual Drawdown. 18.5% Max Drawdown

The RS Boost Method

As the markets change, wouldn’t it be nice to automatically switch to Trading Strategies that work best in the new market?

RS Boost uses three different Market States. One Market State continually invests in stocks that show steady gains, even when the broad market falters.

Another Market State will add Tech Stocks when the NASDAQ is bullish for added gains.

And finally, the third Market State takes advantage of the recent market phenomenon of investors piling into low priced stocks (see example stocks below). This Market State helps RS boost make a remarkable 203% in 2020 alone with only a 12% draw-down!

59% Avg Annual Return. 14% Avg Annual Drawdown. 18.5% Max Drawdown

The ALL NEW Dynamic Lists

Breaks the Profitability Barrier

Included with ATM4

Different Markets Require Different Strategies!

As the markets change, wouldn’t it be nice to automatically switch to Trading Strategies that work best in the new market?

With ATM, it's Automatic!

For every Market State, ATM can switch to the strategies that work best in that type of market. This feature alone makes ATM the most powerful trading tool ever.

The Difference will Amaze You!

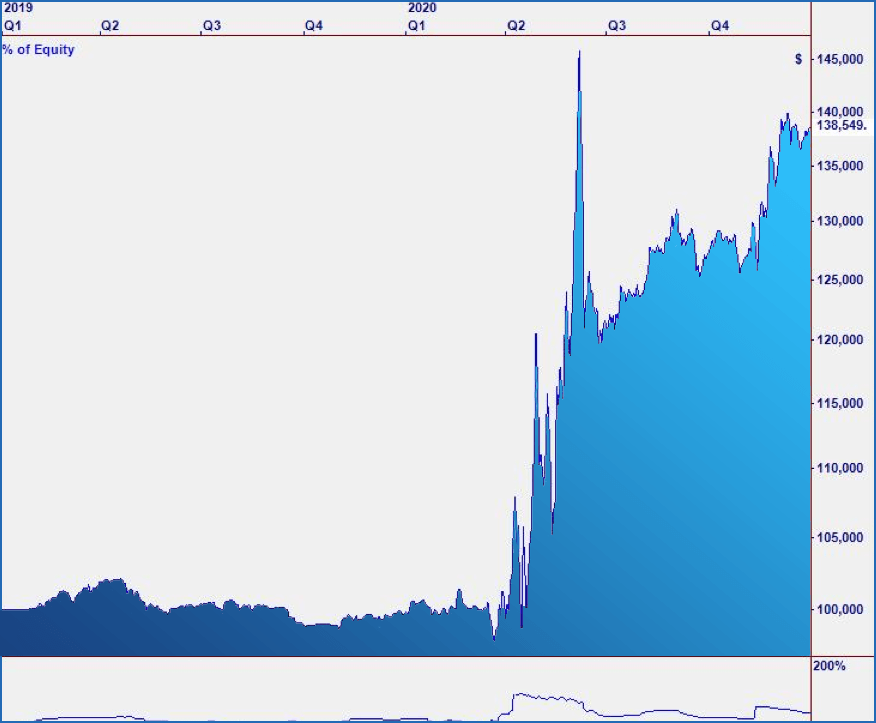

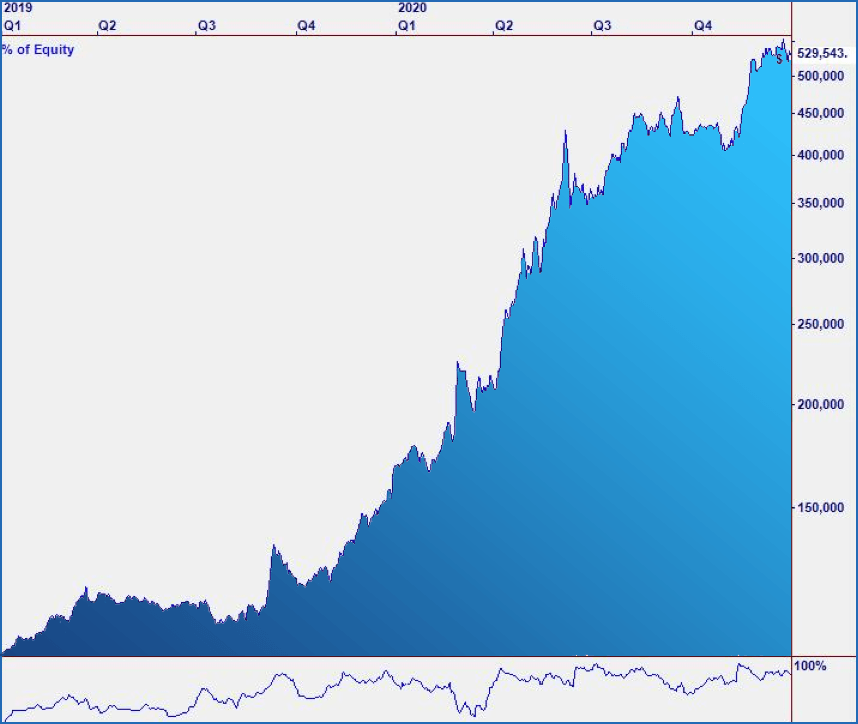

To show how powerful ATM4 is, let’s take a look at the two Equity Curves to the right. The ATM Methods use the same Strategy, but the first one uses all Symbols in the S&P 500 over the historical period. The second one uses a List that changes every day based on identifying those Symbols that are best suited to the Strategy each day.

The improvement is stunning. The new Dynamic List feature in ATM4 boosted profitability from 20% to 148%. And, did I mention how easy ATM is to use. Just select an OmniScan to build your list and feed it into ATM4, along with your favorite Strategies and optional Market Conditions.

New to ATM?

Learn more about the amazing power of ATM and how it delivers the best trade candidates every day.

Strategy with Static Lists - 20% per year!

Strategy with Dynamic Lists - 148% per year!

Different Markets Require Different Strategies!

As the markets change, wouldn’t it be nice to automatically switch to Trading Strategies that work best in the new market?

With ATM, it's Automatic!

For every Market State, ATM can switch to the strategies that work best in that type of market. This feature alone makes ATM the most powerful trading tool ever.

The Difference will Amaze You!

To show how powerful ATM4 is, let’s take a look at the two Equity Curves shown below. The ATM Methods use the same Strategy, but the first one uses all Symbols in the S&P 500 over the historical period. The second one uses a List that changes every day based on identifying those Symbols that are best suited to the Strategy each day.

The improvement is stunning. The new Dynamic List feature in ATM4 boosted profitability from 20% to 148%. And, did I mention how easy ATM is to use. Just select an OmniScan to build your list and feed it into ATM4, along with your favorite Strategies and optional Market Conditions.

Overview of the Steps ATM4 Uses

to Find the Best Trades Every Day

When you click "Run Analysis", ATM4 performs the following task:

In the Test Period, ATM4 Automatically...

In the Walk-Forward Period, ATM4 Automatically...

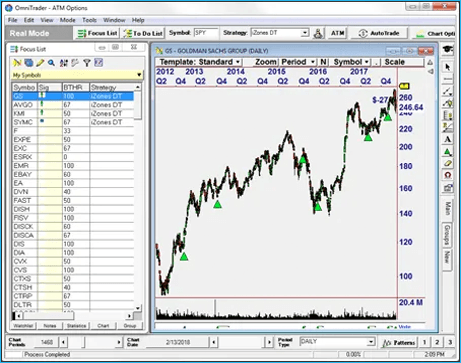

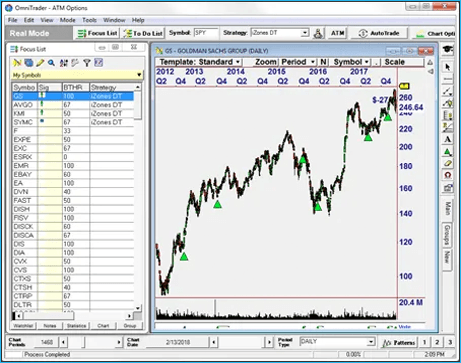

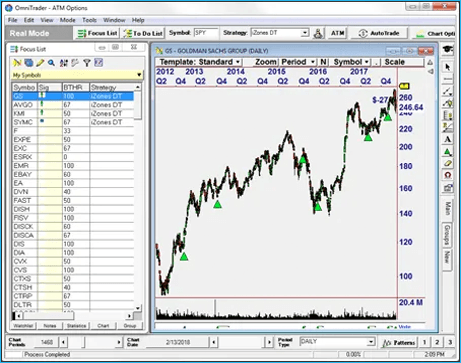

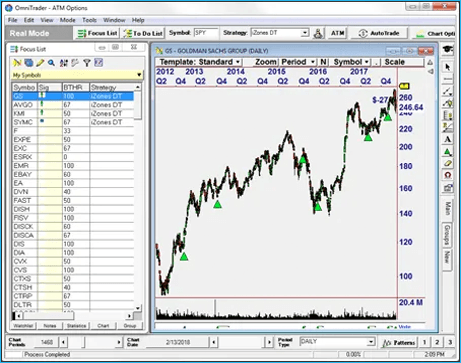

Trading with ATM4

Activate ATM4 in the To Do List in OmniTrader. Of course, you can paper trade it first. When you’re ready, hook up to your live brokerage account.

It's So easy to use!

With ATM4, you do NOT have to know...

· Which Symbols to trade.

· Which Strategies to use.

· Which Market States to use.

ATM4 comes with several great Methods, or you can create your own. Remember, ATM4 will decide which assets to trade, so it’s not that important to “get it right”. You just need a good selection of Market States and Strategies for it to work from. The included Methods have great selections, and can be used right out-of-the-box.

All you have to do is click “Run Analysis” in the Portfolio Simulator!

What is ATM?

Adaptive Trade Management (ATM) is a dynamically automated approach to trading. ATM allows us to adapt to changing markets by determining the type of market, and then adjusting our trading approach in order to maximize results.

The equity curves above show the dramatic improvement that this technology can have on results.

Consistent gains, low drawdowns, outstanding performance in all markets - ATM delivers!

It's So easy to use!

With ATM4, you do NOT have to know...

· Which Symbols to trade

· Which Strategies to use

· Which Market States to use

ATM4 comes with several great Methods, or you can create your own. Remember, ATM4 will decide which assets to trade, so it’s not that important to “get it right”. You just need a good selection of Market States and Strategies for it to work from.

The included Methods can be used right out-of-the-box.

All you have to do is click “Run Analysis” in the Portfolio Simulator!

Step By Step - How ATM Achieves These Results:

Market States

ATM will first determine the state of the market. By looking at different factors in the broad market, ATM will determine the Market State which determines which Trading Strategies to use, which trade filters to employ, which available trades to take, and how much to allocate to each trade.

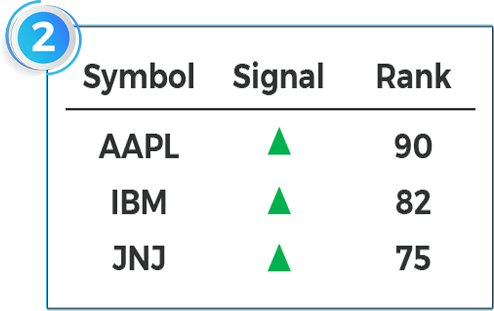

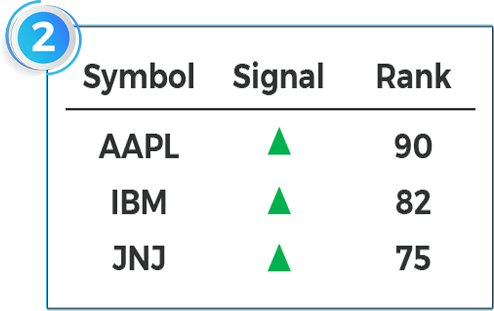

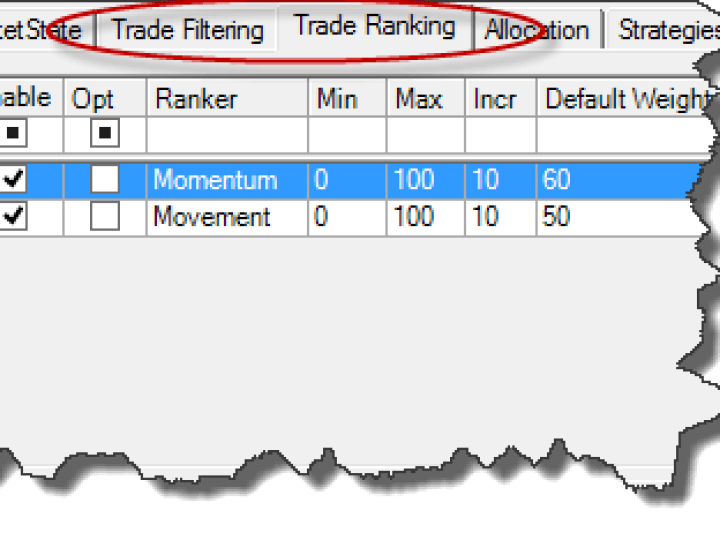

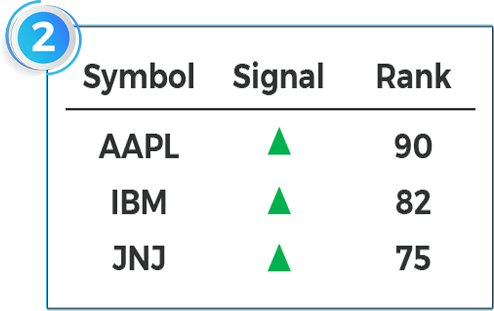

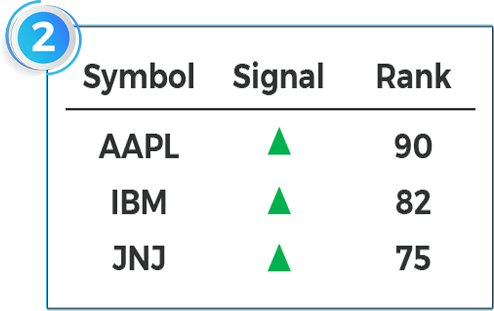

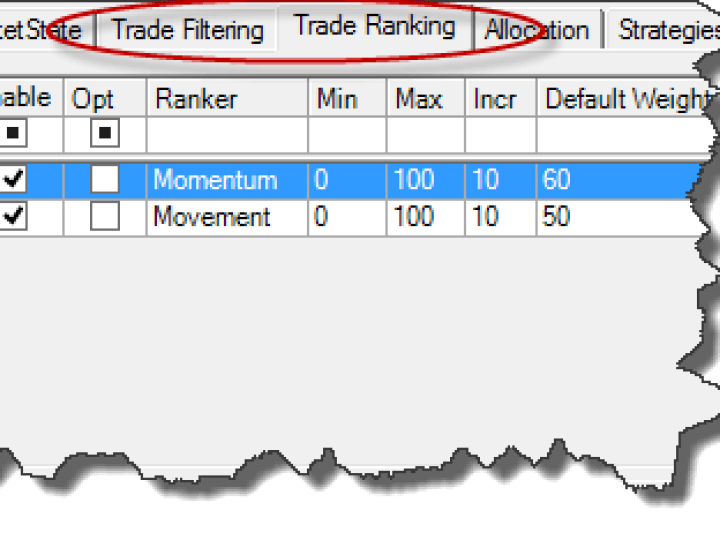

Trade Ranking

Once ATM has determined which Trading Strategies to use in the current Market State, ATM will then look at the trades generated by the strategies. It will rank them in order to determine which trades are best poised to profit in the current market.

Symbol Filters

ATM is designed to determine which trades have the best chance for success in the current market. Each Market State has Trade Filters which are used to make sure that all trades taken are conducive to the current market personality.

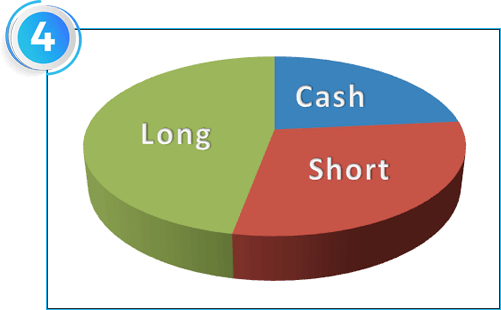

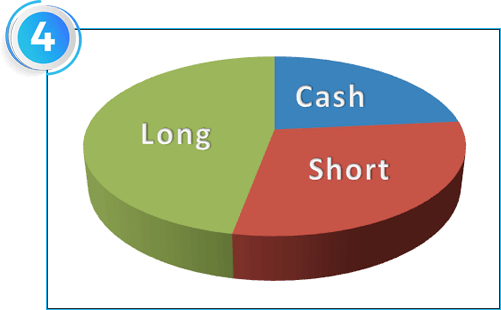

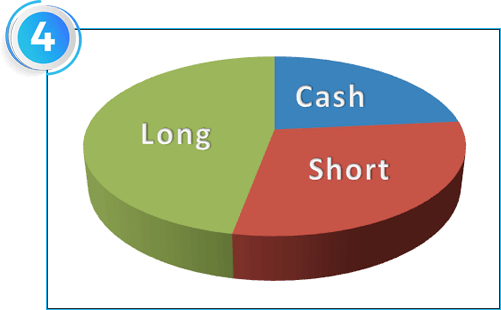

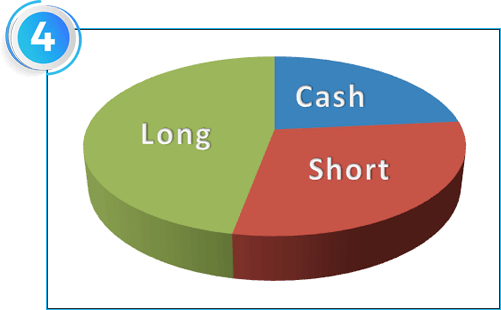

Smart Allocation

Depending on the Market State, we may want to increase or decrease our amount invested, number of trades, and trade size. ATM allows each of these factors and more in every Market State, giving you unprecedented control over your market exposure.

Believe it or not, ATM doesn’t stop there.

It also has the ability to have different long/short balance and trade size for each Market State.

Automatic Ranking for the Best Trades

Using the best Strategies for each Market State is good, but we want the absolute BEST trades.

ATM can filter out the trades that we don’t want, and then it will rank the remaining potential trades in order to insure that we are only taking the trades with the highest profit potential.

Market Specific Allocation is Key

Whether you want all longs in a Bullish Market, a mix of longs and shorts in a Sideways Market, or reduced trade size in a Volatile Market, ATM automatically adjusts to make sure you have the perfect balance.

What is ATM?

Adaptive Trade Management (ATM) is a dynamically automated approach to trading. ATM allows us to adapt to changing markets by determining the type of market, and then adjusting our trading approach in order to maximize results.

The equity curves above shows the dramatic improvement that this technology can have on results.

Consistent gains, low draw downs, outstanding performance in all markets - ATM delivers!

Step By Step - How ATM Achieves These Results:

Market States

ATM will first determine the state of the market. By looking at different factors in the broad market, ATM will determine the Market State which determines which Trading Strategies to use, which trade filters to employ, which available trades to take, and how much to allocate to each trade.

Trade Ranking

Once ATM has determined which Trading Strategies to use in the current Market State, ATM will then look at the trades generated by the strategies. It will rank them in order to determine which trades are best poised to profit in the current market.

Symbol Filters

ATM is designed to determine which trades have the best chance for success in the current market. Each Market State has Trade Filters which are used to make sure that all trades taken are conducive to the current market personality.

Smart Allocation

Depending on the Market State, we may want to increase or decrease our amount invested, number of trades, and trade size. ATM allows each of these factors and more in every Market State, giving you unprecedented control over your market exposure.

Believe it or not, ATM doesn’t stop there.

It also has the ability to have different long/short balance and trade size for each Market State.

Automatic Ranking for the Best Trades

Using the best Strategies for each Market State is good, but we want the absolute BEST trades.

ATM can filter out the trades that we don’t want, and then it will rank the remaining potential trades in order to insure that we are only taking the trades with the highest profit potential.

Market Specific Allocation is Key

Whether you want all longs in a Bullish Market, a mix of longs and shorts in a Sideways Market, or reduced trade size in a Volatile Market, ATM automatically adjusts to make sure you have the perfect balance.

ATM Benefits Your Trading 2 Ways:

Manual Trading:

Use it to show you the best trades to make each day...

Fully Automated Trading:

Let it manage your account with 100% automated trading!

It Also Works with Any Strategy!

Nirvana has created and released many great Strategies, including Reversion to Mean,

Trend Following, Swing Trading and More! Whatever you are using, ATM can improve results.

Don't have any Strategies? Call us and we'll help!

ATM Benefits Your Trading 2 Ways:

Manual Trading:

Use it to show you the best trades to make each day...

Fully Automated Trading:

Let it manage your account with 100% automated trading!

It Also Works with Any Strategy!

Nirvana has created and released many great Strategies, including Reversion to Mean,

Trend Following, Swing Trading and More! Whatever you are using, ATM can improve results.

Don't have any Strategies? Call us and we'll help!

Get Your ATM Started Today!

For ATM Owners

ATM4 Upgrade Package Includes:

• The RS Boost Method

• ATM4 Upgrade

• 30-days of OmniData and OmniScans

$995

$995

$29.95

$2,000+ value

Special · Just $995 *

For New ATM Customers

ATM4 Full Version Includes:

• The RS Boost Method

• Full ATM Install

• 30-days of OmniData and OmniScans

$995

$2,995

$29.95

$4,000+ value

Special · Just $1,995 *

* ATM is a product of OmniTraders International.

Special Loyal Customer Discounts Available at Checkout.

Get Your ATM Started Today!

For ATM Owners

ATM4 Upgrade Package Includes:

• The RS Boost Method - $995

• ATM4 Upgrade - $995

• 30-days of OmniData and OmniScans - $29.95

Special · Just $995

For New ATM Customers

ATM4 Full Version Includes:

• The RS Boost Method - $995

• Full ATM Install - $2,995

• 30-days of OmniData and OmniScans - $29.95

Special · Just $1,995

Our software is backed by our unconditional Money Back Guarantee. If for any reason you are not fully satisfied, you may return the software, within 30days of purchase, for a 100% refund, less shipping and handling. In bundle offers, the OmniTrader upgrade is valued at $199 if purchased by the deadline,$249 after the deadline. Texas residents add 8.25% sales tax. Educational material is non-refundable.

Important Information: Futures, options and securities trading has risk of loss and may not be suitable for all persons. No Strategy can guarantee profits or freedom from loss. Past results are not necessarily indicative of future results. These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. There are numerous market factors, including liquidity, which cannot be fully accounted for in the preparation of hypothetical performance results all of which can adversely affect actual trading results. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.