-

Welcome

-

Moving to omnifunds 2

welcome to OmniFunds Premier

Discover all our exclusive portfolios and investment opportunities by logging into OmniFunds Premier. Access the latest strategies and tailor your investments to meet your financial goals.

If you wish to switch your trading accounts from www.MyOmniFunds.com to the new www.Omnifunds2.com, please follow these steps:

Close Current Positions on MyOmniFunds:

- Log into www.MyOmniFunds.com and navigate to the MY OMNIFUND page.

- Click the CHANGE button next to CAPITAL UNDER MANAGEMENT and set it to 0%.

- This action will submit market orders to close all your open positions. If performed after market hours, Market on Open orders will be placed for the next market day. Please wait until all positions are closed before proceeding.

Disconnect Your Broker Account from MyOmniFunds:

- Once all positions are closed, click the DISCONNECT button next to BROKER on the MY OMNIFUND page. This will remove your trading account from www.MyOmniFunds.com.

Log into OmniFunds2:

- Visit www.OmniFunds2.com and log in.

- Navigate to the EXPLORE page to view and select the fund you want to trade.

- Click the SAVE button below the equity chart to add the selected fund to your MY OMNIFUND page.

Set Capital Under Management:

- On the MY OMNIFUND page, set the CAPITAL UNDER MANAGEMENT % to the desired percentage of your account you wish to trade. Set it to 0% if you do not want trades to be entered immediately. You can adjust this percentage after connecting your account.

Subscribe to AutoTrade:

- Subscription levels are based on your account size and can be found on the Pricing page.

- Once your subscription is activated, you can connect your broker account.

Connect Your Broker Account to OmniFunds2:

- Go to the MY OMNIFUND page and click the CONNECT button next to BROKER.

- Enter your Nirvana USER ID, GXTrader password, and Garwood Account #, then press CONNECT.

- Your Garwood account #, account balance, and AutoTrade subscription level will be displayed on the MY OMNIFUND page.

Note: If you connect your account during market hours and have set Capital Under Management to any value greater than 0%, market orders will be placed at the current market price. If connected after market hours, Market on Open orders will be placed for the next market day.

If you have any questions or encounter any issues, please feel free to contact us. 800.880.0338

-

Welcome

-

Instructions

-

News and Information

-

Active Strategies

welcome to the inner circle

To Our Very Special Guest!

On behalf of all of us here, I want to say, “Welcome to the Inner Circle!” We quickly closed out the group and are now preparing for first launch. We really appreciate your coming on board ahead of Launch. I can assure you, it’s going to be quite a ride.

This week, you can expect to receive the following:

- An overview of Collective 2 (“C2”) and How it Works.

- How to set up your C2 account.

- How to connect your broker account to our Trade Streams coming from C2.

As I have more information on the development of the Trade Throttle process, I will share it with you. Today, we ironed out the last few issues connecting to brokerage internally, so that’s looking good. As I mentioned, we have already tested C2, so we are good to go there as well.

Right now, I am specifically working on Filters that can isolate the best-trading symbols, and will be integrating “variable allocation” as soon as our programmer finishes it. With that feature, the Throttle can trade lower-priced stocks, which is important because they are more volatile.

I have also started preparations to engage a second Throttle Operator, who will be trading a different list. I firmly believe that the best way to control risk is to diversify and “watch the money” which is precisely what the Trade Throttle facilitates.

This is the most exciting project I have ever been involved with. The outcome has the potential to benefit almost every other area of what we do. Your Inner Circle membership has given us the most valuable commodity of all – the time to focus on, and execute this plan, and I just want to say “Thank you” for coming along with us on this journey.

Sincerely,

Ed Downs

Welcome

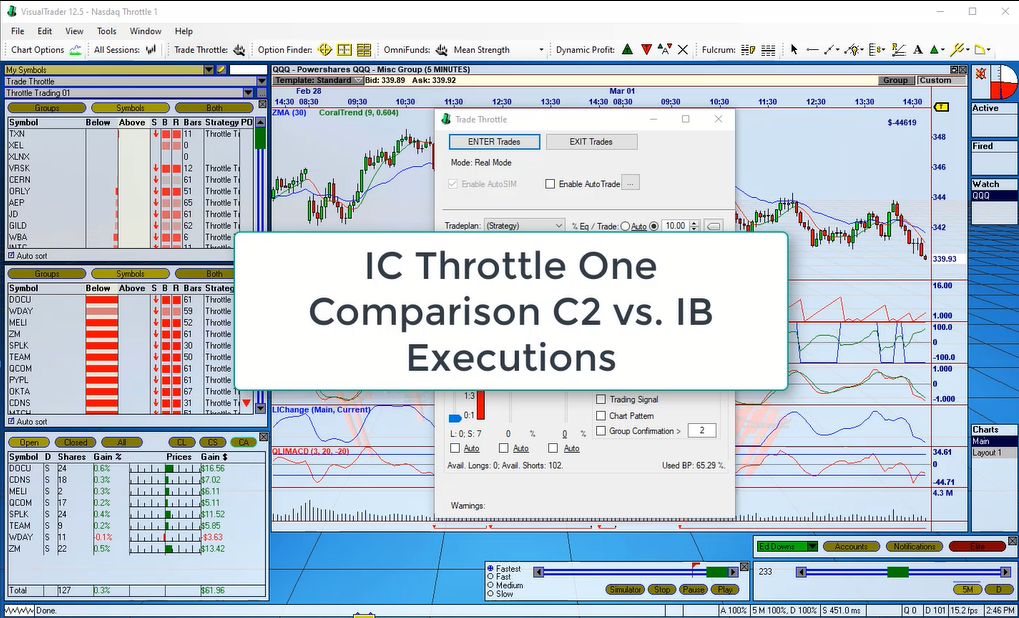

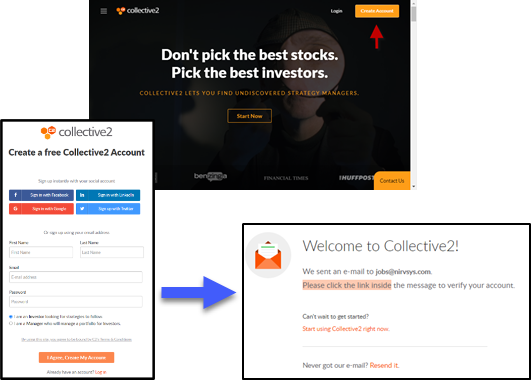

We are excited to have you as a valued member of The Inner Circle! This document will help you quickly establish your account on Collective 2 so you can monitor IC Throttle One in Real Time as it is used to trade the market. When you are ready, you can engage Collective 2’s AutoTrade function to send the trades generated by IC Throttle One to a live brokerage account. The last page lists contacts should you need additional help.

Why Collective 2?

As far as we know, Collective 2 is the only company that allows traders (which they call “Trade Leaders”) to submit trades into a server, so they can be distributed to individual client accounts. C2 has been in business over 20 years and has a very good reputation for accurate delivery of trades to investor accounts. It is the best way to serve our Inner Circle Members, so we can focus on trading, rather than the machinery that makes it happen.

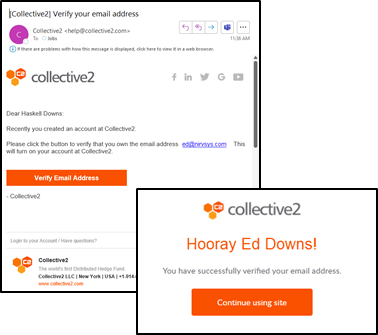

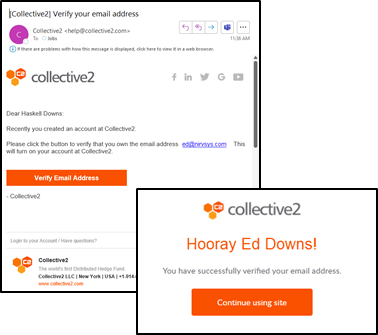

Establishing an Account at Collective 2

1. Create Account: Go to www.collective2.com and click Create Account.

2. Check Your Email: Your account is created and a verification email is sent...

What's This?

Collective 2 is a complex beast if you are a Trade Leader (like us). But it’s not that complex for subscribers. We think you will find the following instructions to be straightforward. Note that if you click “I don’t like free training” on this pop-up, it will tell you how to get help later.

Subscribing to IC Throttle One

Subscribing costs $0 and enables you to track the Strategy’s Performance via email.

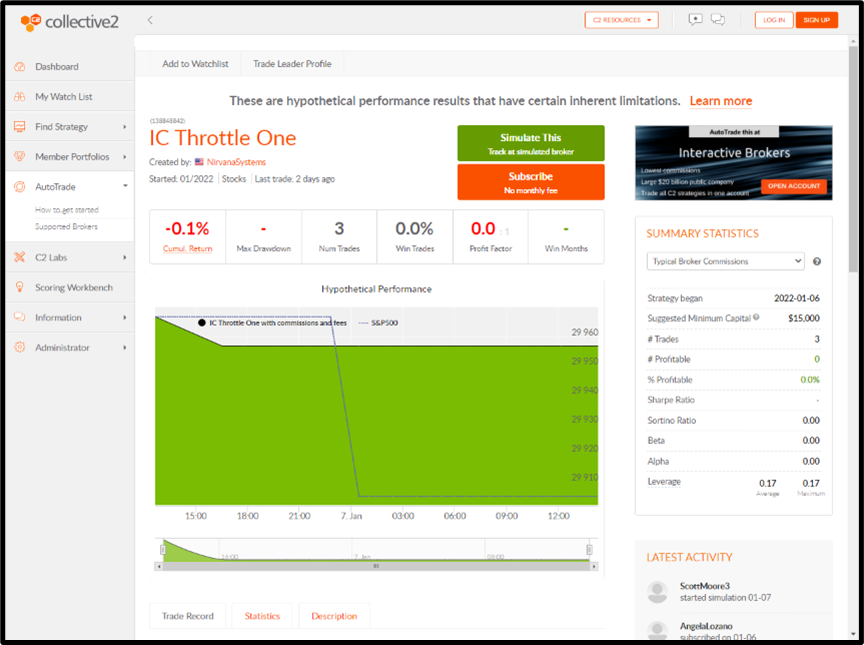

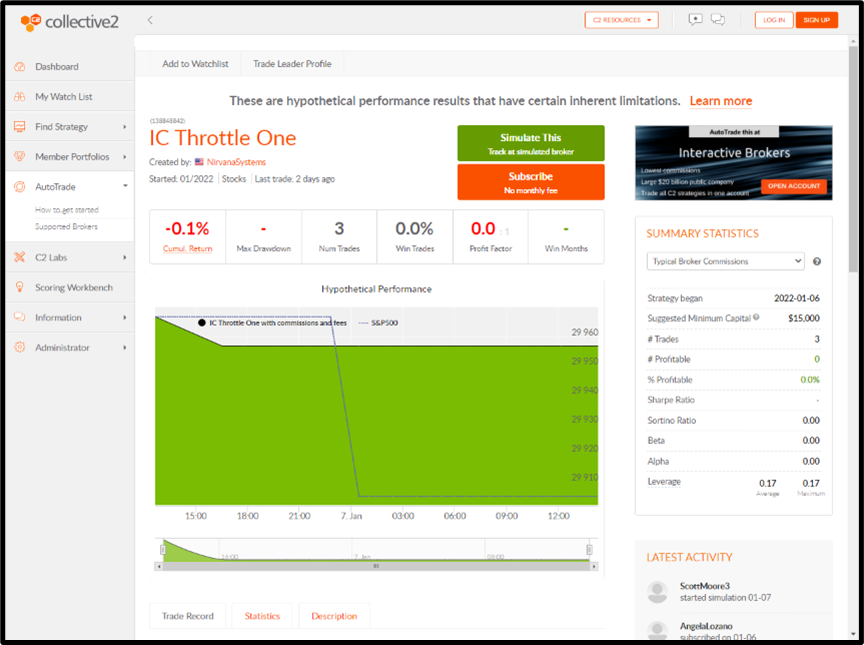

3. IC Throttle One Page

Click this link: https://collective2.com/details/138848842

You will be asked to log in, after which you will see the IC Throttle One page.

Normally, Trade Leaders charge $100-$1,000/mo to access their Strategies. Since you are an Inner Circle Member, your cost is $0.

Click Subscribe (no monthly fee).

Can’t Subscribe?

The Strategy is set to “public” from time to time so members can subscribe. If it is currently “private”, contact us and we will make it “public” so you can subscribe.

Angela Duran aduran@nirvsys.com

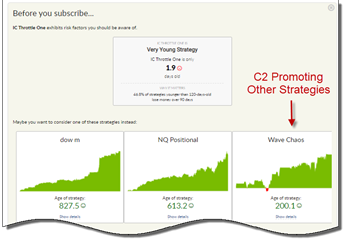

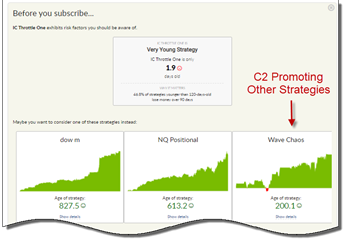

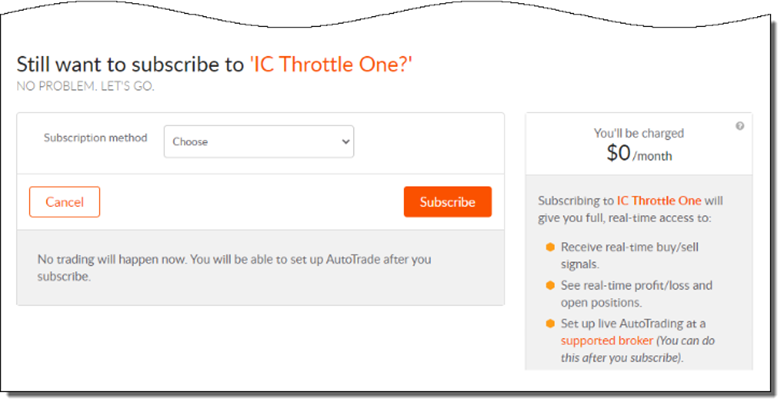

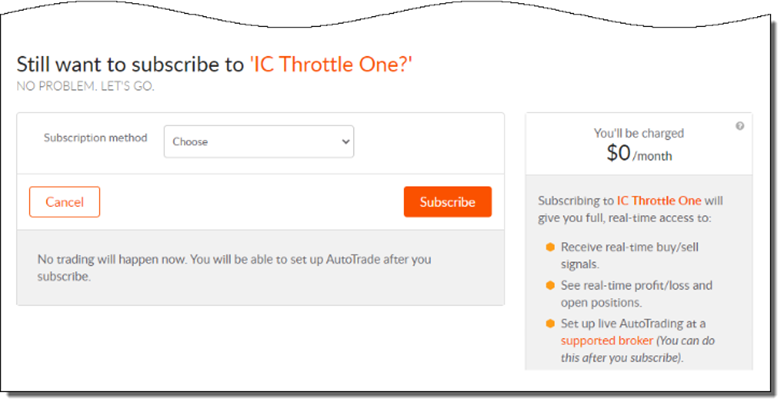

4. The "Are You Sure" Page

Collective 2 detects that IC Throttle One is a brand new Strategy that has only been on the site for a short period of time. So they promote other Strategies that have been running longer and basically ask “Are you sure you still want to subscribe? ”

The note at the right indicates that you will receive Trades in Real Time through email, as well as P&L Statements and Position Reports

-- > Click Subscribe <--

Immediately after you subscribe, you will be taken to the AutoTrade payment screen. We recommend that Inner Circle Members gain experience with the IC Throttle One Method before turning on Autotrade.

About AutoTrade

With C2 AutoTrade, any Strategy monitored by C2 can be set to target an account at Interactive Brokers and about 15 other brokers.

Important Information about C2 AutoTrade

AutoTrade Cost - After subscribing to Throttle One and will receive trades and performance information at no cost. For Collective 2 to automatically trade your broker account, they charge $49/month or $390 a year – a $200 savings.

Number of Accounts – AutoTrade can only be connected to one account per Inner Circle Member Login. Multiple Logins per user are not allowed.

Account Size – We set the recommended starting balance to $30,000 so anyone in the Inner Circle can start with a smaller amount of capital. C2 allows Investors to trade up to 10x this amount, or $300,000. Members can use leverage to take advantage of this. For example a $30,000 account can trade at least $150,000 at I.B. during the day (using margin). In this case, all trades will be amplified 5x in the user’s account (see 8. AutoTrade configuration Screen).

Dedicated Account – Because of the potential for trade collisions and resulting user frustration (which C2 does not want to deal with), any account traded by C2 must ONLY be traded by C2.

No other positions can be present in the account that you connect C2 up to.

Setting Up AutoTrade

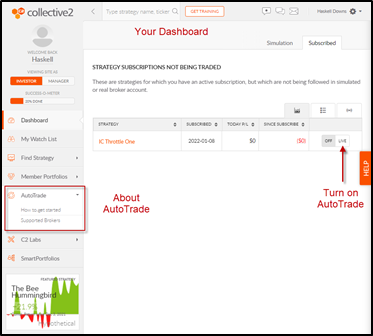

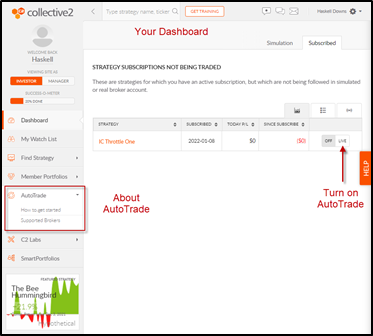

5. The Dashboard: Log into C2. You will be taken to your Dashboard. Or, If you are already logged in, you can click Dashboard on the left from anywhere in C2.

Dashboard (also called Home)

Click the LIVE button to the right of the IC Throttle One entry. You will be taken to the AutoTrade Payment Screen.

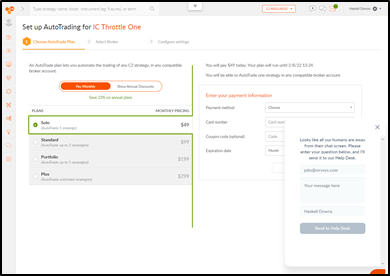

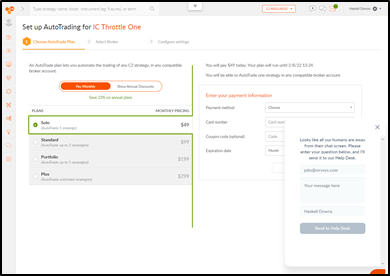

6. The AutoTrade Payment Screen

To AutoTrade a single Strategy in a brokerage account, C2 charges $49/month. There is also an Annual Subscription, which is just $390 – a $200 savings.

Select Solo Monthly or Annual payment plan and enter your payment information.

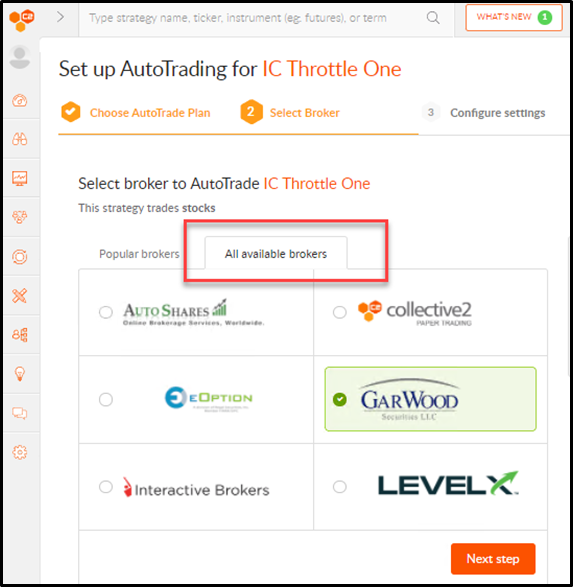

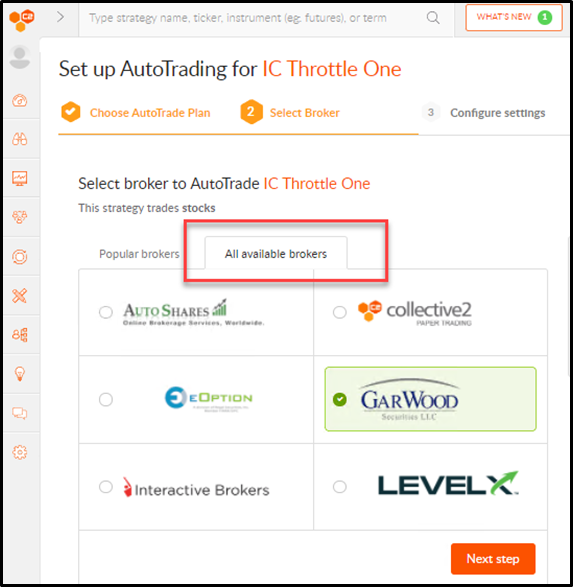

7. Select the Broker

Click the All Available Brokers tab and select your desired broker. If your I.B. account is linked to Garwood Securities, select GarWood. If you use TWS for your trading, select Interactive Brokers.

Select a broker and enter your brokerage account number. Then click Next Step

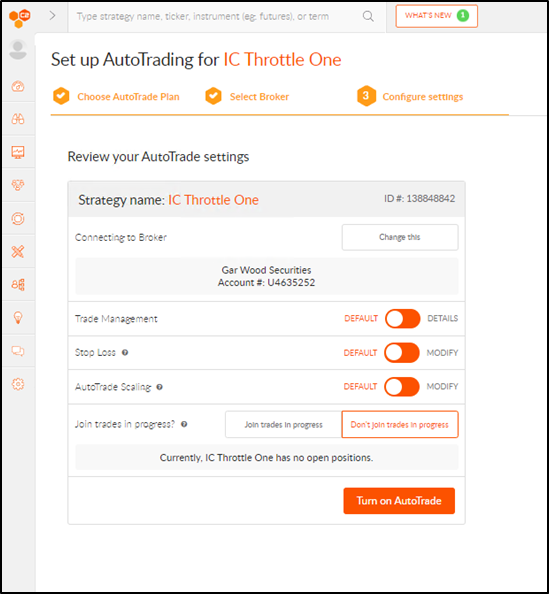

8. AutoTrade Configuration Screen

We suggest default settings to start. Trade Management enables you to intervene in the trading process. Since IC Throttle One is trading in Real Time, you want to leave this on Default. You can set Stop Losses beyond what the Strategy does and scale the account up to 10x using AutoTrade Scaling. The setting Don’t join trades in progress is right for IC Throttle One, since it is in and out quickly each day. When you are ready, click Turn on AutoTrade

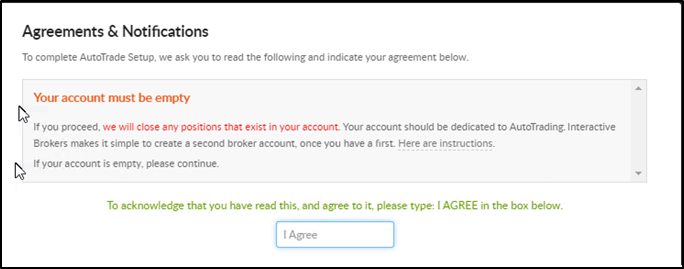

9. Agreements

There are 6 Agreements and Notifications. Read and type I Agree for each.

Once each agreement has been accepted, you will need to send the appropriate signed document to the Broker, with identification, and then wait for broker approval. Instructions on this are provided on the page.

Once approved, you may have to click the LIVE button on the Dashboard (the page that comes up when you log in). Bring LIVE means you are AutoTrading.

C2 Resource Email

When you subscribe to a Strategy, you receive a confirmation email. This email has links to the IC Throttle One Strategy page, the AutoTrade Control Panel, and other links. Save the email you received to refer to if you need it.

Getting Help

For additional assistance, contact:

Collective 2 Support (914-610-3979)

Angela Duran (aduran@nirvsys.com)

Barry Cohen (bcohen@nirvsys.com)

news and information

Inner Circle Update

August 16, 2023

Dear Inner Circle Member,

I mentioned in my video update last week that I was working towards a BETA release of Throttle One supporting SuperTrend today. I actually did trade it into C2, and was up 1% on investment (50% of the account). Below is a picture of today's two opportunities:

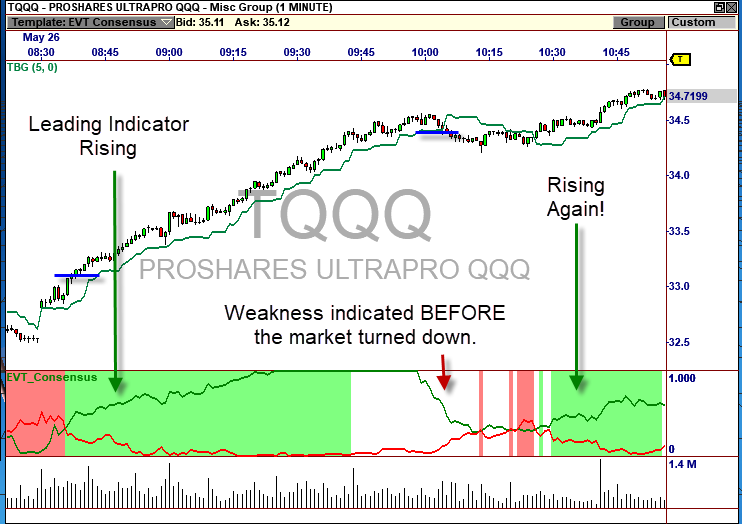

The "adder" here is the confirmation provided by SuperTrend. First we have a solid Leading Indicator gaining strength. In this case, SQQQ is being traded so RED in the L.I. is associated with UP in this Symbol. You can see that the strong upward movement is easily confirmed when the price chart rises above the SuperTrend lines. There is a second trade I did not engage, but it was set up exactly the same way.

This market looks really weak. There are a lot of articles about it. I am finding that this indicator, when used in EOD charts is really good at determining the same thing, and am employing it in both Rocket and ETF Consensus. More about these later, but here below is an End of Day chart with the same markings:

I will continue trading into Throttle One in C2 and will keep you informed as I adjust the method.

Sincerely,

Ed Downs

Inner Circle Update

June 16, 2023

Dear Inner Circle Member,

Good day! If you've been tracking progress with Throttle One in C2, you've seen me trading for several weeks now. It's been very enlightening. Sometimes the market telegraphs it is going into what I call "Herd Mode" and at other times it's downright Schizophrenic. I traded a couple of Herd Mode days and easily made 2-3%. But I tended to give it back on the Schizo days. All of this experience has helped me understand how to detect the difference. I'm gaining on it...

Recent success with the Leading Indicator

(Click Image Above to Expand)

I am holding a meeting today for those who have invested in certain projects here at Nirvana. We are embarking on an important mission centered around OmniFunds, but I wanted you to let you know that, as a result of this recent work, I believe I am very close to finally automating "Consensus Trading" with the Trade Throttle. We continue auto-trading our other Strategies, including Dynamic Equities, Option Income, and TRADEnosis under the supervision of staff members.

I remain 100% committed to our work in the Inner Circle. I have been able to run VT on a machine next to me, reacting to it only when the market starts moving (thanks to the Leading Indicator) and can keep doing that, or will assign/train the right person to monitor it for me. The Team will continue to manage our Strategies (at our direction) while my senior staff and I work to fulfill this important mission.

Sincerely,

Ed Downs

Inner Circle Update

May 29, 2023

Dear Inner Circle Member,

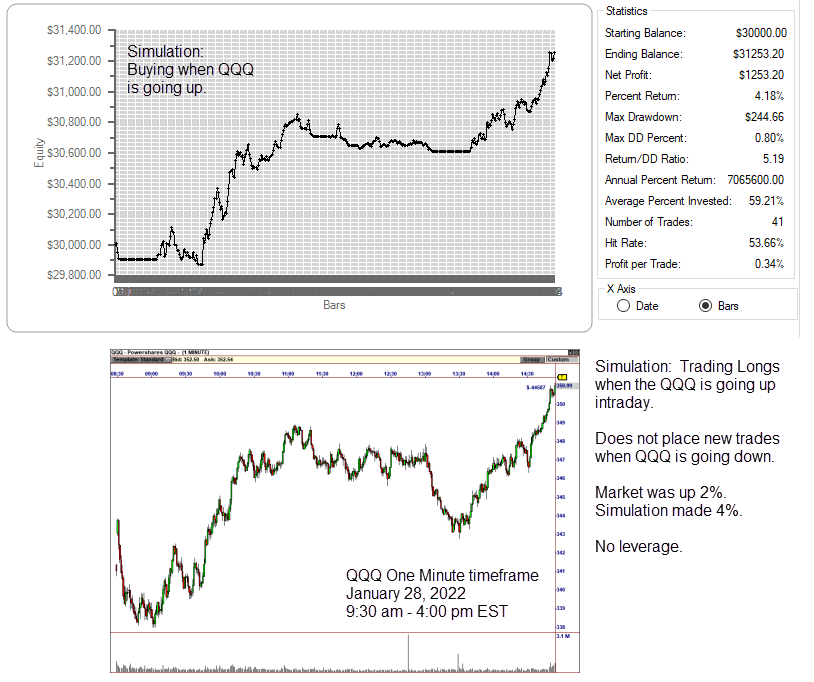

I have been monitoring the market, looking for Throttle Trade opportunities. Over the past several weeks, there have been times when a move appeared to be starting, but then did not follow through. Friday was different. I also changed how I am approaching it. Instead of trading the 5 Minute Chart, I have turned to the 1 Minute, with confirmation from the 5 Minute.

(Click Image Above to Expand)

The Leading Indicator was turning up and strong. I entered a position near the blue line in this screen shot, but my allocation was just 10%. So about 20 minutes later I closed it and entered another one at 50% strength. I ended up with 1.5% profit, as shown in the C2 record. But if I had traded it perfectly, it could have been 2.5%, or 5% at full allocation.

I will continue monitoring the market for these moves, and hopefully can get a consistent growth pattern established. I am also working to bring back some of the End of Day Methods I developed over the past few years, including "Rocket." As these are deployed I will let you know so you can evaluate them for consideration.

Sincerely,

Ed Downs

Inner Circle Update

May 16, 2023

Dear Inner Circle Member,

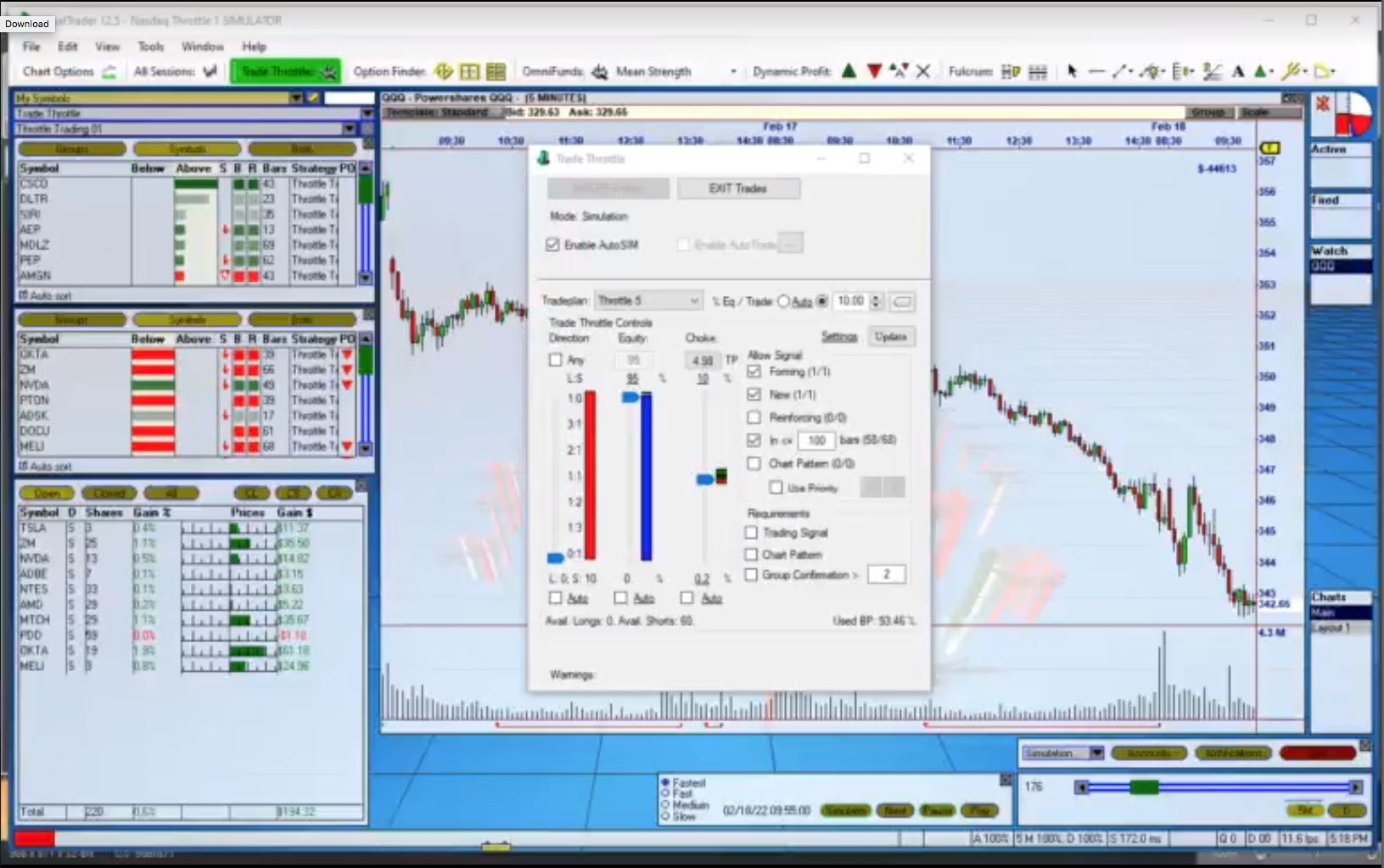

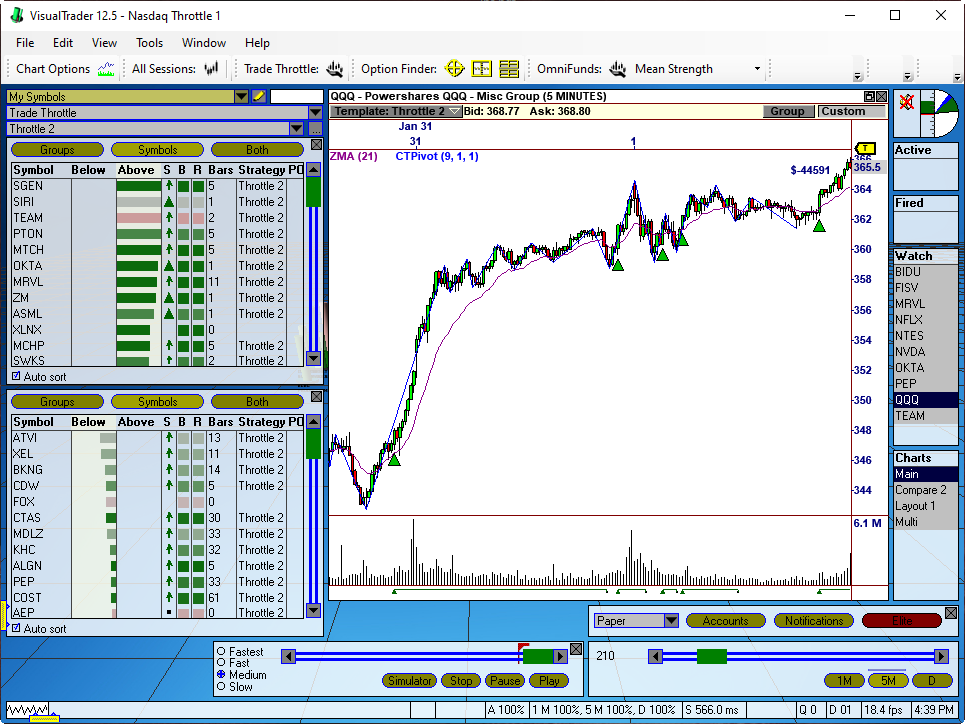

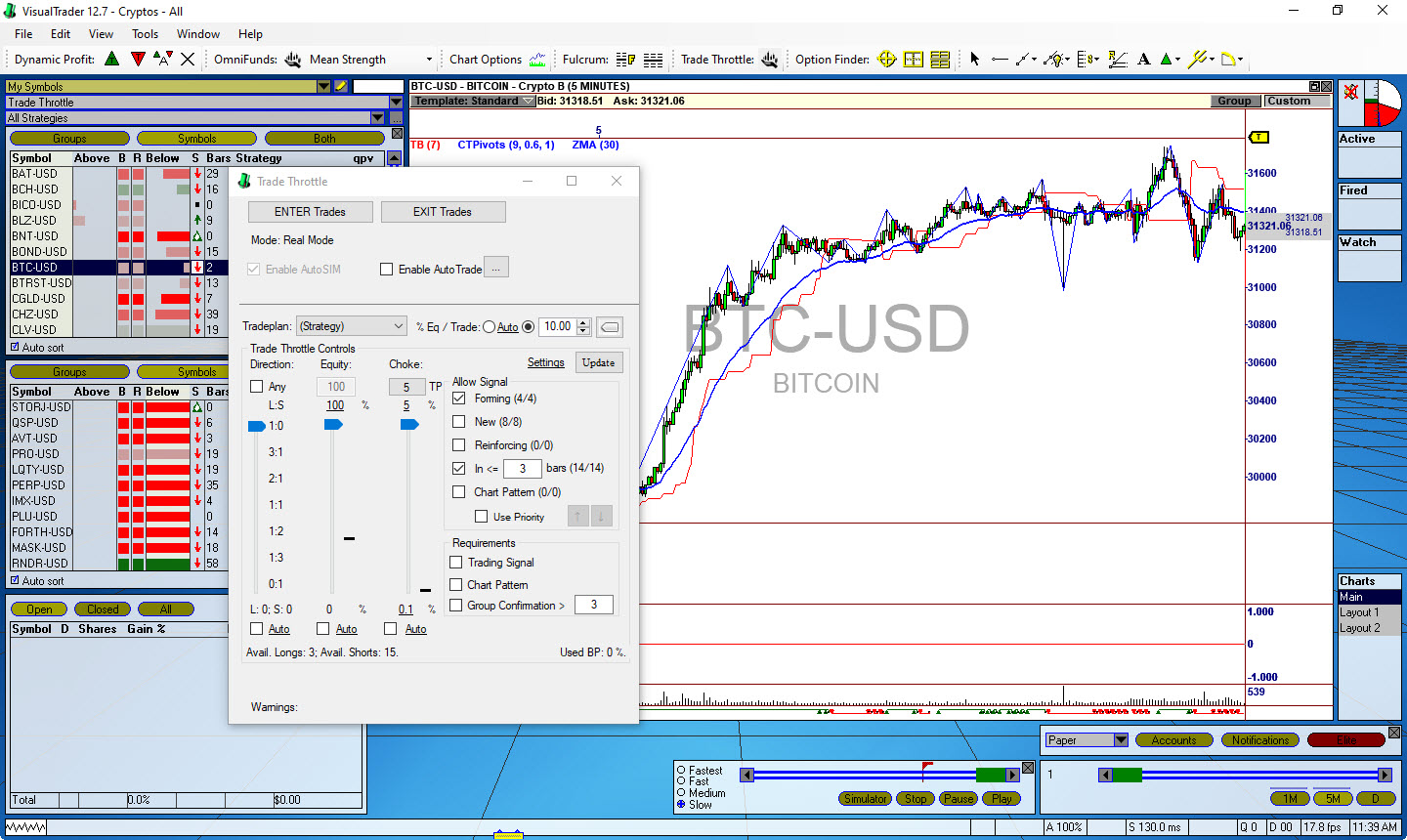

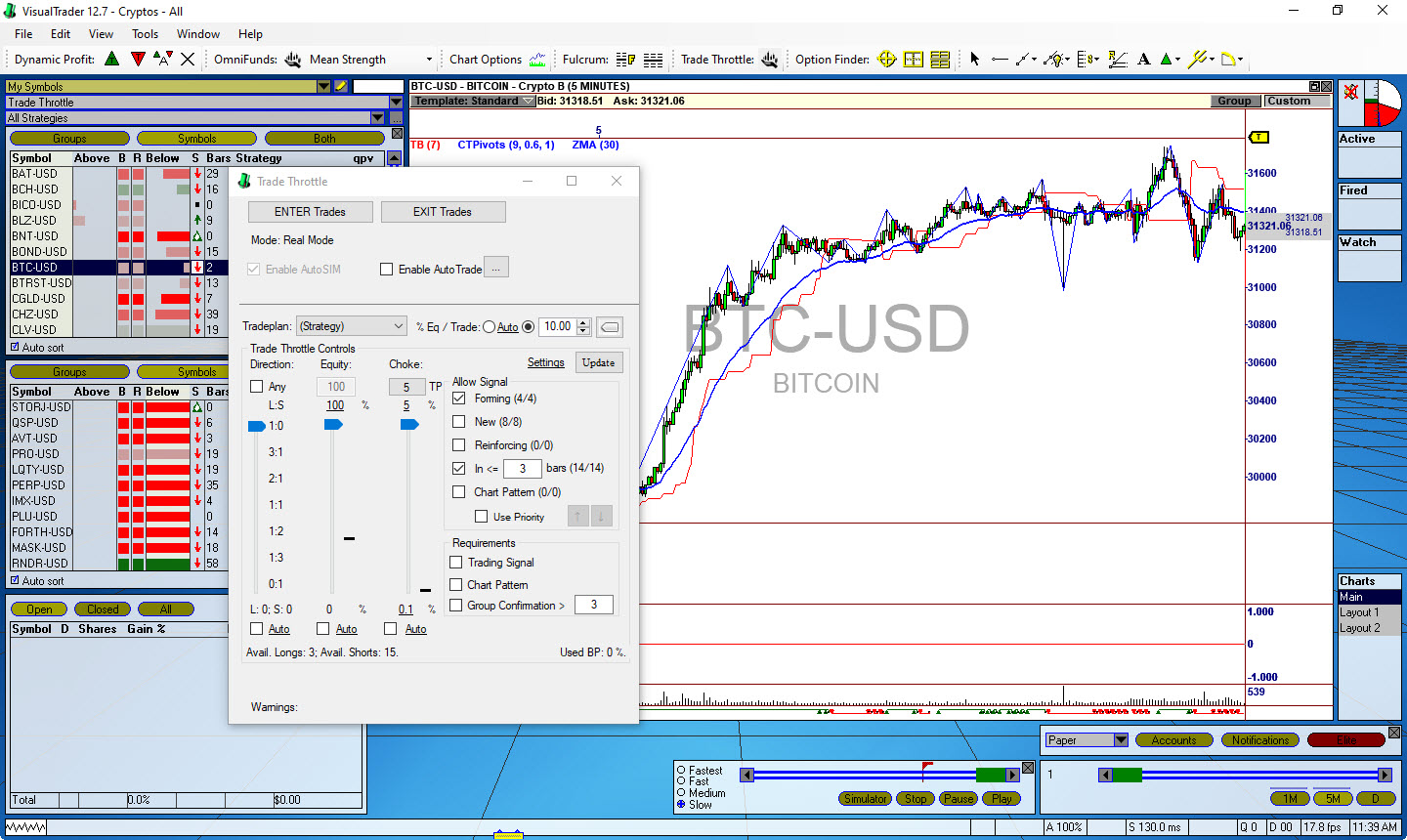

I wanted to put out a quick update today regarding my current work on the Trade Throttle. In the three weeks since my last update on our Consensus Trading Apps, I have been working with VisualTrader's new features to complete a version of The Trade Throttle I can deploy in Collective 2 and on the accounts we have access to.

Current Leading Indicator Setup in VisualTrader

The above screen shot was taken of my current setup, which uses my latest Leading Indicator to determine "Buy and Sell Zones", the result of perhaps 60 hours of testing. As I have said before, the secret to automated Throttle Trading is "holding back" for the Big Moves and avoiding the choppy markets.

If you look closely at this image, you can see the green and red areas line up well with profitable moves in the one minute chart of TQQQ. I am continuing to run tests and simulations, and will host a formal Inner Circle webinar once I conclude this research. But I wanted to keep you in the loop and let you know that progress is being made.

I told my staff this morning that the current market feels a bit like the Twilight Zone. It's been slowly advancing, but not without rather large intraday corrections. I have asked Jeff Drake and Steve Mayo to review performance of the Strategies we have published and see what can be done to improve them. I will provide an update when I host my next Inner Circle webinar.

Sincerely,

Ed Downs

Inner Circle Update

April 21, 2023

Dear Inner Circle Member,

I wanted to put out a quick update today on the Mobile App project I've been working on, and more specifically how it connects to the Trade Throttle.

As I mentioned in my prior update, we are building a Mobile App for lead generation, and that is its primary purpose. However, in the course of using it, I made what could be "The" Discovery that puts my Leading Indicator and Trade Throttle work over the goal. It has to do with what I am calling "Double Consensus".

As you know, the Leading Indicator is based on the concept of Consensus - when nearly every stock in an index is going up, the index will have momentum and usually follow through. I've documented many cases of this and manually traded some of them. What I discovered is, if I look at the next level of Consensus across multiple markets, the probability of an upward move is even higher.

I want to share this very short clip from a commercial I just made for our ETF Consensus Apps project, where I show the "Dashboard" in VisualTrader tracking eight SPDR Industry Group ETFs and their components. Each Leading Indicator display shows consensus within that industry. But when consensus among all the industries is high, that is typically the sign that a "Monster Move" is taking place!

The idea is to look for consensus across all groups (ETFs) to signal a trade on QQQ or SPY. I notice in this profile that QQQ can often signal a false breakout, but if I wait for consensus, it tends to follow through. Today, I have been porting the code over to OmniTrader so I can create and test a Strategy based on this idea. I will share the results as soon as I have them. I feel really good about this.

The Mobile App project is being promoted as a "Trio" composed of ETF Consensus Trader (ECT) for OmniTrader, ECT for VisualTrader, and the Mobile App. Naturally, all Inner Circle Members will get the Mobile App - it's an exciting application that will take advantage of this Consensus phenomenon.

Request: The Team is focused right now on getting the App out the door and we are promoting a "Crowd Funding" event at https://www.nirvanasystems.com/CTA Everyone here is pushing hard to make this happen, and of course, revenue can't start until we put it out there. I greatly appreciate any Inner Circle Members who can participate. Thank you.

Sincerely,

Ed Downs

Inner Circle Update

March 14, 2023

Dear Inner Circle Member,

I wanted to share my work from last week on the Trade Throttle and a few other new items. I ran VT every from March 3-10 and documented each day's observations in the attached PDF. I am once again working on the Rules, which is what the document is about.

As I have said before, waiting for the big moves is important, and the examples I captured clearly demonstrate this. As trader, it's too easy to get into a trade where there is good movement but not that level. It's also all too easy to exit on a small but reasonable pullback to generate a loss that would have turned into a profit. (Guilty.) I have spent a lot of time defining a System that trades these opportunities correctly. But I now have some new "secret weapons."

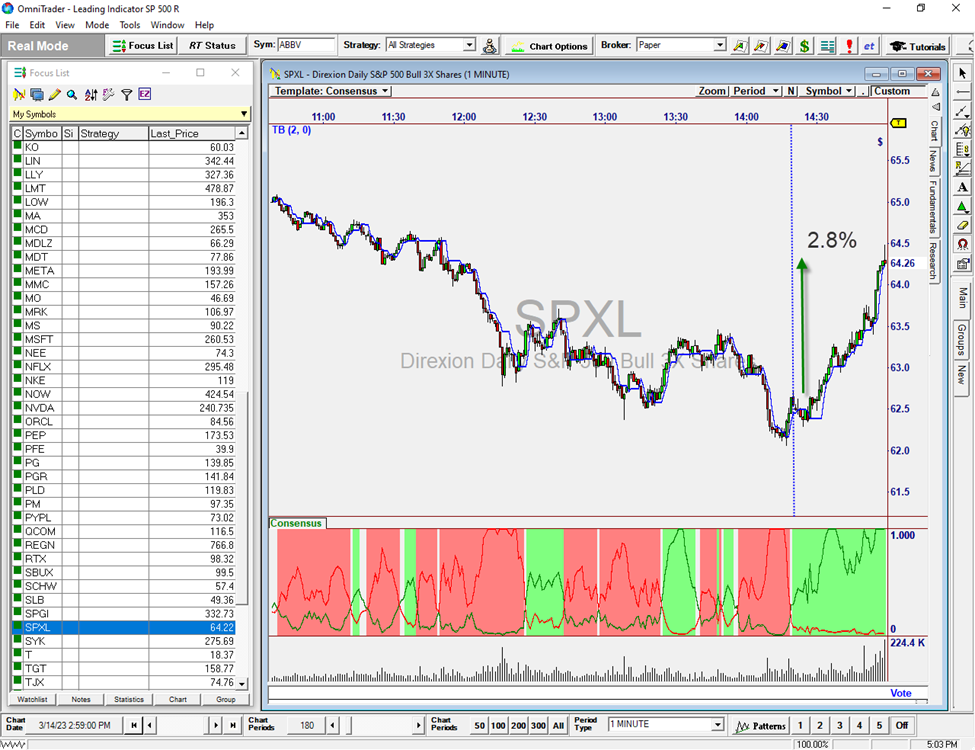

OmniTrader with the Leading

Indicator on SPXL1 Like reaction.1

(Click Image to Expand)

I have been working closely with Mark Holstius, who is using the Leading Indicator concept to trade the ES futures contract. Mark is one of the most talented system designers I know. He has said repeatedly, "Ed, this is the best thing I have ever seen for trading..." (paraphrased). He agrees with me that the ability to signal a new internal movement is incredibly powerful and is now just as dedicated to it as I am.

As I have worked with Mark, I began looking at the S&P 500 equivalents to the TQQQ and SQQQ ETFs - SPXL and SPXS - which also have 3:1 leverage. The image in this post is of SPXL and a move that happened late today that could have made 2.8%. You can see how the green and red zones predict and demonstrate the movement.

You can also see that the chart is in OmniTrader, which is Secret Weapon #2. We have been running the Leading Indicator in OT, which is now working well enough to start running tests. With OmniTrader, I can generate long back tests to see if the rules hold up over a long period of time. I'm really excited about it, and you can expect more on that in my next update. I may in fact start automatically trading it in a few days. If I do, I will let you know.

I am thrilled to see that TRADEnosis has been performing within the early test parameters over the past few weeks, as it's currently up over 2%. Today we identified a few more ways to improve performance, including changing from Market on Open to Market on Close orders. More about that in my next formal update on TRADEnosis next week. I am also pleased to see that Dynamic Equities is also starting to perform.

Clearly, there's a lot going on here. After my initial successes with the Leading Indicator a few weeks ago, I have continued to study (and trade) the market's ebbs and flows to refine this powerful concept. With Mark and OmniTrader on the Team, I think I have what I need to break through. Once the Signals have been tested on the leveraged ETFs, I can go back to the Throttle, where multiple trades are taken in the direction of the market. I will continue to keep you updated...

Sincerely,

Ed Downs

Trade Throttle Update

February 27, 2023

Dear Inner Circle Member,

I am pleased to provide this brief Inner Circle Video Update today, with news on:

• The Trade Throttle

• Dynamic Equities

• TRADEnosis

I am reworking my primary indicator in the Trade Throttle to provide a clearer "engage" Signal and Exit. In the video, I show what this new indicator does and how I think it can help us identify markets that have the highest "breakout" potential.

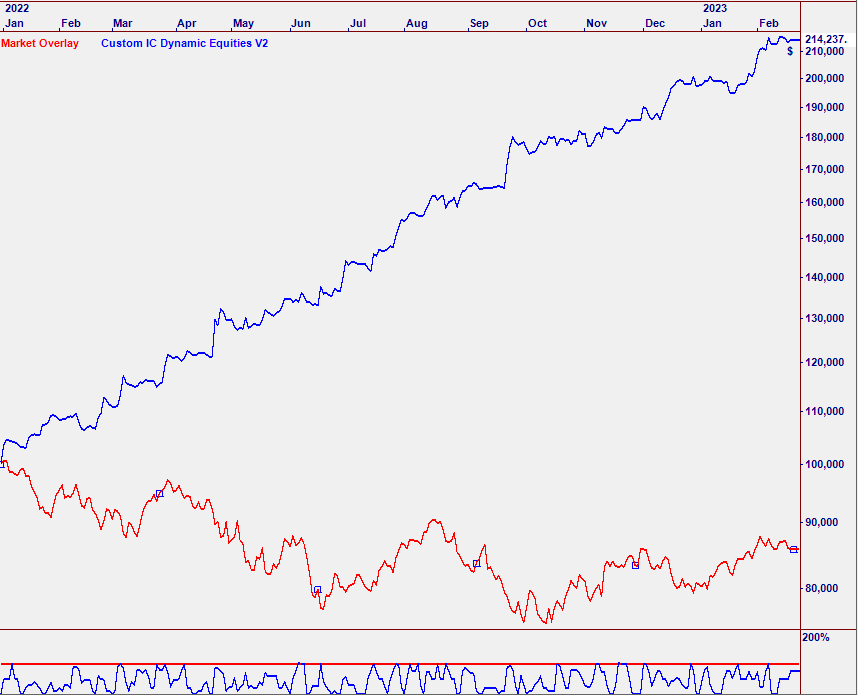

Dynamic Equities remains one of our strongest concepts. Jeff Drake has studied all aspects of the approach to create D.E. Version 3. In the Update, I included a video by Jeff in which he goes over the work he did and the resulting improvements.

Finally, today is the first day we deployed the TRADEnosis System in C2 for Inner Circle Members who have subscribed to it. I'm sharing some of the recent work, including historical simulations and what we are focusing on next.

We are continuing forward on these and other projects for our Members. We greatly appreciate your support, which has made it possible for us to focus on this important Trading Agenda.

Sincerely,

Ed Downs

Trade Throttle Update

February 27, 2023

Dear Inner Circle Member,

I have several important announcements to share today. The Team is configuring TRADEnosis in C2; I will send out the update once everything is in place. I also have news on the Trade Throttle and Dynamic Equities. Watch for my update.

Sincerely,

Ed Downs

Trade Throttle Update

February 23, 2023

Dear Inner Circle Member,

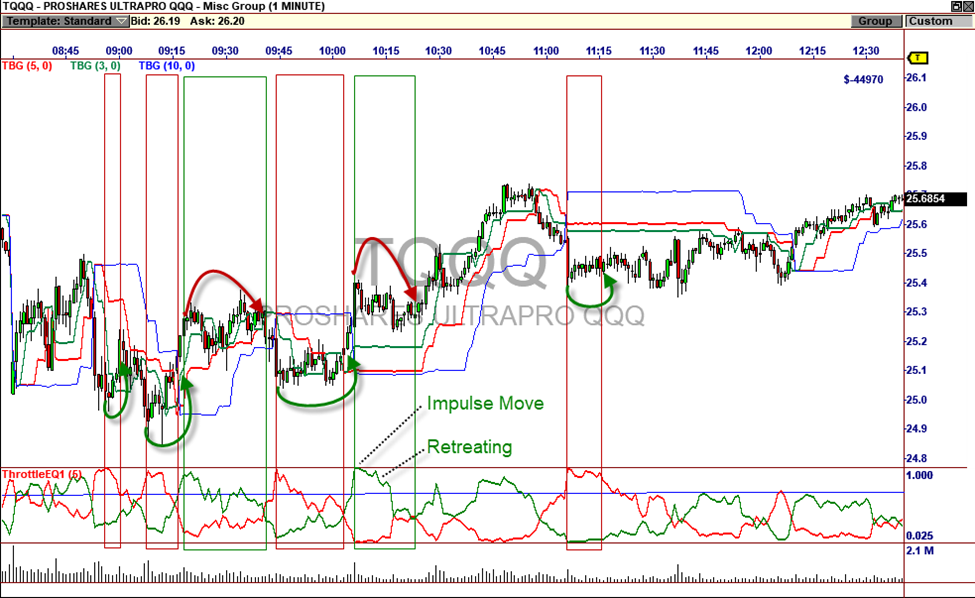

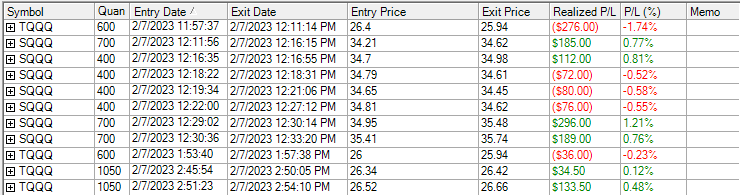

Good day! I have two specific updates today. First, I want to talk about the Trade Throttle, what happened the past few days, and what is happening now. The chart below shows yesterday's afternoon market. The red arrows mark the places where the Leading Indicator goes up to a high value, and in this case, the market is going down (so we are trading SQQQ). What happened multiple times was, the ETF would almost immediately begin retreating.

Some of the Throttle Signals and reactions from Wednesday, 2/22.

(Click Image to Expand)

Within 5 minutes, a 1/2% draw down would be experienced, which has been my max tolerance on a losing trade. It didn't take many of these to get to a 1% loss for the session.

So Today... I'm re-evaluating the best way to avoid this level of volatility. In doing so, I am looking at 100 Tick charts - a capture I just made is shown below. You can see that the Leading Indicator tends to trend nicely in the moves. But it's more about the separation. When Red and Green are gradually diverging or coming together, the market is steadily going down or up. This is especially evident in the first and last 2 moves in this chart, which would have made about 2%.

Tick chart demonstrating volatile and non-volatile zones.

(Click Image to Expand)

The nature of the market the past 3 days has been one of uncertain direction - relatively slow trends with internal volatility and, in the case of the past 2 days, strong counter-trend "whip saws" that force an exit.

If you look at the first and last red zones (9:02 and 9:29 CST) and the last green zone at 9:32, you can see the chart smoothly declining and advancing. The middle green zone is trending but volatile. So today I am working on Filters that can detect this, and will update you on my findings tomorrow.

I'm also investigating my trades from 2/7. We all know the essence of good trading is "Cut your losses short and let your profits run." And that went well on this day. The problem the last few days has been having multiple trades pull back hard against the entry. My feel right now is that analyzing those trades in addition to the internal smoothness in the tick chart may enable me to avoid this.

Investigating the trade record from Tuesday, Feb. 7.

(Click Image to Expand)

TRADEnosis is Live!

Monday, we released v 1.0 of TRADEnosis to OmniTrader users who licensed it, and have been monitoring its trades the last 2 days. TRADEnosis was such a large undertaking that we have been careful about deploying it in C2. The good news is, the servers and other technology seem to be working fine. You can see the updated performance and news at www.nirvanasystems.com/tradenosis I will have more news in Friday's Inner Circle video update.

My video update will include news on the Trade Throttle, the TRADEnosis launch, and more. I plan on recording it ahead of Monday's market and will work towards getting it out tomorrow.

Sincerely,

Ed Downs

Trade Throttle Update

February 16, 2023

Dear Inner Circle Member,

My goal in life isn't to become a professional trader - I started Nirvana to automate all this! But I can't tell you how valuable it has been to sit in front of the live market this past week to experience the emotions of trading. Today was similar to yesterday - a ton of volatility most of the day, with only 2 well-defined moves.

In the chart, you can see the strong down move that happened in the last hour of the day. The chart is inverted because it's SQQQ, the 3x inverse ETF on QQQ. Trading less and using tighter stops, I was able to keep the losses down on the early trades, so when the big move came, there was plenty of dry powder to push into the green.

Important observation: If we wait for the Leading Indicator to "peg" the upper boundary, the chart will almost always be in a strong accumulation or distribution and should be trusted. I entered and exited several trades on that last run because I was taking profits. If I had just let it go until the blue line was crossed, the SQQQ would have moved from 34.4 to 35.5 for a 3% gain. Actually, it never crossed the blue line!

Larry Luck, an intuitive member of our mastermind group, suggested I try Heikin Ashe charts. I did, and discovered there is clearly an advantage in doing this. (Thanks, Larry!) The second chart is Heiken Ashe 1-minute. You can see that, in the H.A. chart, the strong moves typically have a sequence of red or green bars that exponentially advance. It only takes 3 of these to confirm the strength of a move.

But perhaps the BEST way to avoid loss risk is to WAIT for the "maxed-out" Leading Indicator we saw at the end of the session. That may not happen on some days (like Wednesday), but there are typically 3 to 6 swing moves that have the potential to make 0.5%+ with small losses, provided stops are tight enough. So I plan to try running 2 Strategies at the same time - one that has very tight stops for the swing moves, and another with loose stops for the "maxed-out" Leading Indicator moves.

Armed with all these ideas, let's see how we do tomorrow...

Sincerely,

Ed Downs

Trade Throttle Update

February 15, 2023

Dear Inner Circle Member,

Today was definitely different. I marked a chart with the AM trades that had the strongest Entry Signals (Leading Indicator peaking), and you can see that in each case, the ETF almost immediately turned against the trade.

Yesterday, the runs were so strong that the best Exit was generally at the next Leading Indicator crossover. Today, waiting for these crossovers incurred losses (see picture).

Also, in several cases my Stops were "run", meaning I did not see the bar touch them, but one "tick" would come in low enough to trigger them. I didn't see that happen yesterday either. There were 2 good runs today (10:20 and 12:10 CST) but they trended up slowly, so the Leading Indicator did not identify them as strong moves.

Perhaps today's market behavior was due to all the news coming out on inflation, and certain important earnings reports. I am studying each situation to see if I can detect this behavior to tighten stops until an initial profit is reached, or stop trading for the day to avoid further losses.

One thing I did notice - in Yesterday's market, the Leading Indicator would max out at 1.0 and stay there for a number of bars (see yesterday's picture). Today, it would peak for just 1 or 2 bars and then retreat. If the trades were to Exit on this condition, there will still be losses, but they will be much smaller. Working on that approach this evening.

Sincerely,

Ed Downs

Trade Throttle Update

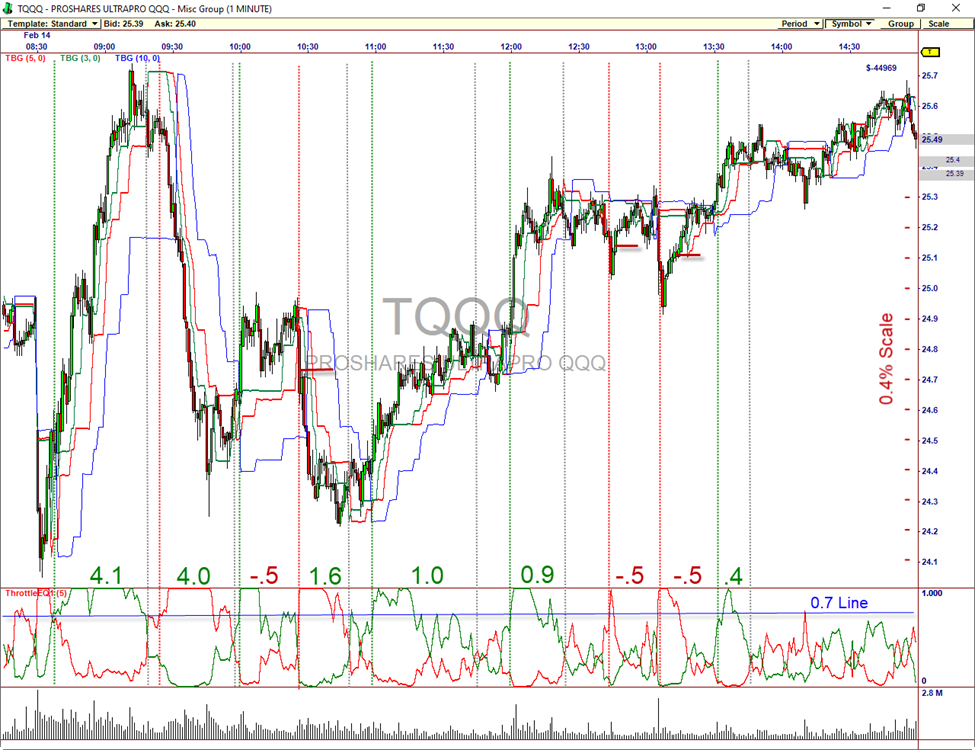

February 14, 2023

Dear Inner Circle Member,

I do hope I'm not wearing you out with all these Throttle updates. I know many of you want to see "behind the curtain" as to how I am actually doing this, and I enjoy sharing the progress.

Today was easy, thanks to market reactions to the CPI report. You can see the moves marked with approximate percentages on the ETF. I am still trading too conservatively, because I have been trying to protect against draw downs. It does appear there will be larger gains once my "conservatism" is out of the decision process.

I wanted to run in live fire with the Rules, which I have been refining. I added a Fixed Loss stop, because sometimes the market does what I call a "dipsy doodle" and just completely reverses itself. Even in One Minute, these ETFs can move a percent or more. There are two of these in this chart. What you see in the vertical lines are Entry decisions in green/red and Exits in grey, based on Leading Indicator moves through 0.7 when the red line is above the blue line in the chart (i.e., in trend) with exits on reverse crossovers of the L.I. or the Fixed Loss.

Thanks to the Leading Indicator, I've managed to beat the 1% a day goal these past 3 days. I will admit that, after working on this for so long, part of me doesn't want to let it auto trade! But I'm getting there. Will let you know where I get to tomorrow. Once this is deployed with automation, I will start working on stocks for larger gains, and options for those of us who want to see magic happen.

Sincerely,

Ed Downs

Trade Throttle Update

February 13, 2023

Dear Inner Circle Member,

I was monitoring and trading the Throttle into C2 again today. Most of the trades followed my rules but I did place some experimental trades, including three option trades to compare executions in Collective 2 to what I am getting in VisualTrader. I find that as long as I am willing to let trades pull back above the blue line but not through it, they almost always recover.

But sometimes, like the last 20 minutes of the session, they don't. That's why I am once again considering using options to avoid draw downs on adverse excursions Trading 1 contract, the initial purchases typically cost about $0.05 more but C2 precisely matched my exits on all three trades.

In the picture, the vertical Entry/Exit lines represent my Rules, using the Leading Indicator crossings for Entries with the trend (the blue indicator line), and the L.I. Crossover as a Stop. We had two strong moves today from 9:15 to 10:15 and another from 1:15 to 2:00. If I had traded them perfectly today's gain could have been higher. I am still working on the automation, but will continue trading manually until I have it.

Sincerely,

Ed Downs

Trade Throttle Update

February 10, 2023

Dear Inner Circle Member,

In my last post, I said, "I am going to adjust the Trade Plan to use the 2nd stop level and give it a go again tomorrow. Will let you know how it goes..."

So I did that Thursday to discover that I was getting out too quickly. I did have some winners but they weren't large enough to overcome the losses from early in the day. There is a rule in trading, "Cut your losses short and let your profits run." The problem is, if you don't allow trades to "breathe" sufficiently you end up cutting your profits short, too.

After reviewing all the trades I did yesterday, I jumped in again today mid-morning. There was a really good early trade on SQQQ (the leveraged short ETF) that I missed. I could have entered it within the trend but decided to wait for the next signal, which came around 11:30p in the opposite direction. In the video, I discuss the trading rules while I was in this trade. Ended up with about a 1% gain for the day, - from just that one trade. The video is only about 8 minutes long. Check it out!

Trading with the Throttle this past week has helped me understand which timeframe works the best (1 minute.), how to best use the Leading Indicator for Entries, and how to use Trend Break for trade management. I am using these insights to code a new Strategy that I will test in simulation this weekend. I now have a much clearer idea of what it's going to take to deploy a fully-automated, Throttle-based Strategy that makes steady profits.

Ed Downs

Trade Throttle Update

February 9, 2023

Dear Inner Circle Member,

I decided it might be helpful to document Wednesday's trade action, to accompany the trade history in C2. About 11am, I posted a video of the move I captured, purchasing the QQQ inverse (SQQQ) and holding for about an hour. From that point on, I continued trading to better refine the rules.

While only one of the subsequent trades was profitable, the others had small losses, leaving a net gain of about 1.5% for the day. We didn't get another large trending move, though there were about 6 "Singles" I marked on the chart as "Other Opportunities" that could have cleared 0.25% each if an early, tighter stop had been employed.

Rather than use a 4 (or 5) period Trend Break (the red line), I am shifting to using the 2 period TB until the trade has cleared a 0.5% profit, then shift to the next line. This should leave mostly winning trades, provided they are entered in the direction of the market, which is what the Leading Indicator provides.

This was the result of last Thursday's discovery coupled with today's action in the live market. It's time-consuming, but I realized it's the best way for me to overcome the issues with trade management to get the automation right. I am going to adjust the Trade Plan to use the 2nd stop level and give it a go again tomorrow. Will let you know how it goes...

Sincerely,

Ed Downs

Trade Throttle Update

February 8, 2023

Dear Inner Circle Member,

Greetings! I have been trading with the Trade Throttle in VT this morning, and thought I would make a quick video that shows the approach I am taking. If any of you are trading in real time, you may find it useful.

Basically, I am using the Throttle Indicator to find entries, and managing exits and re-entries with Trend Break Lines. The trade I show just closed out with a +2.5% gain.

My approach is to continue trading manually while I code the rules I am using (per the video). VT has great audio clues that can call my attention to the chart while I work on the automation and my staff on other important agenda items.

TRADEnosis is moving forward well - when you take something into production there are always issues to address, but I am fortunate to have the Nirvana Team working it. Thanks go out to Steve, Cose, Carolina and Gianluca for focusing on our important A.I. agenda.

I will continue to keep you informed as I get us into play on the Throttle. Looking good today!

Sincerely,

Ed Downs

Throttle One Update

February 7, 2023

Dear Inner Circle Member,

I've been watching and working with Throttle One since I announced the release last Wednesday, this short video shows what I discovered Thursday, and changes I have been testing since then.

I have also been doing some manual throttle trading Friday, Monday and today, but the automation can do a better job than I can. I will post here as soon as I re-deploy.

I am placing throttle trades as I see cases in the market that warrant it, but obviously, they won't be as consistent as what the automation can provide. Late this morning while I was working on a Trade Plan I glanced at VT and saw this monstrous bar, 100% RED on the Leading Indicator! I made money but was late to the party. I'll keep going on the automation and let you know.

Sincerely,

Ed Downs

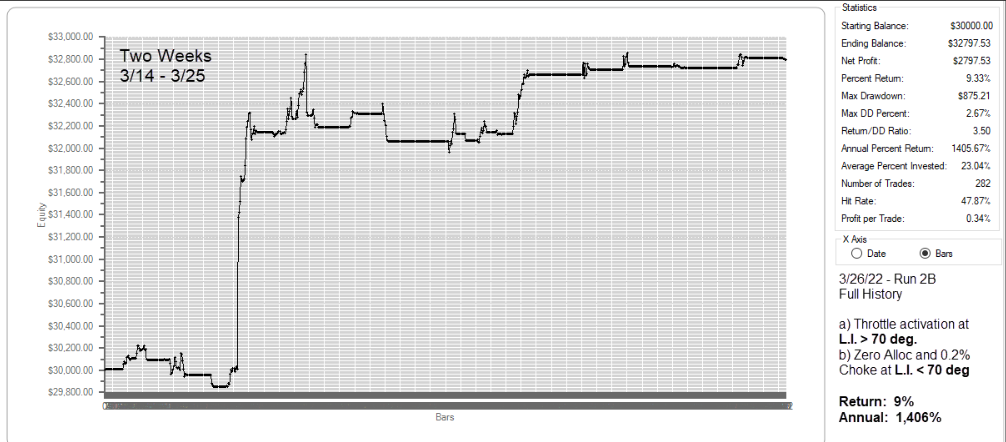

Throttle One Breakthrough!

February 1, 2023

Dear Inner Circle Member,

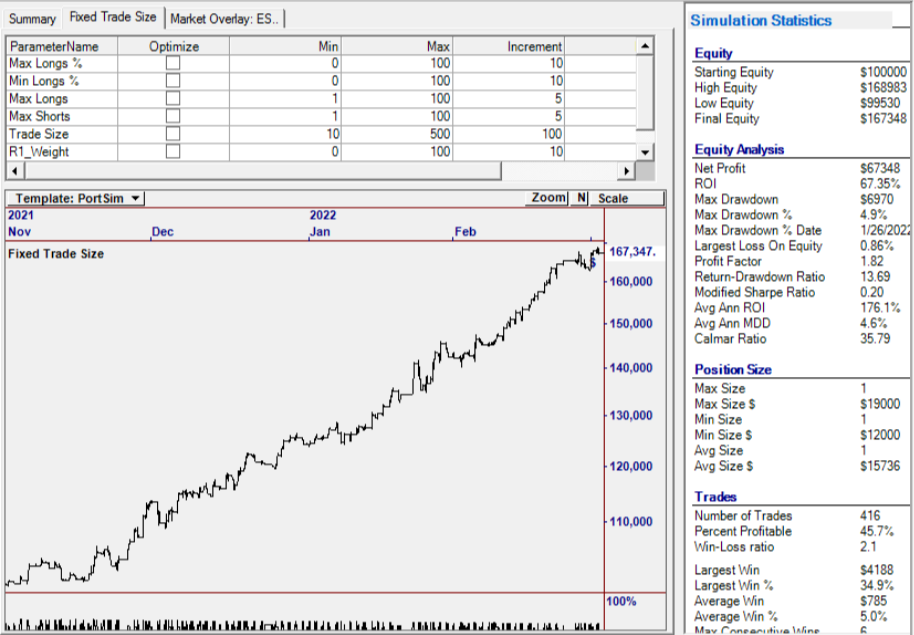

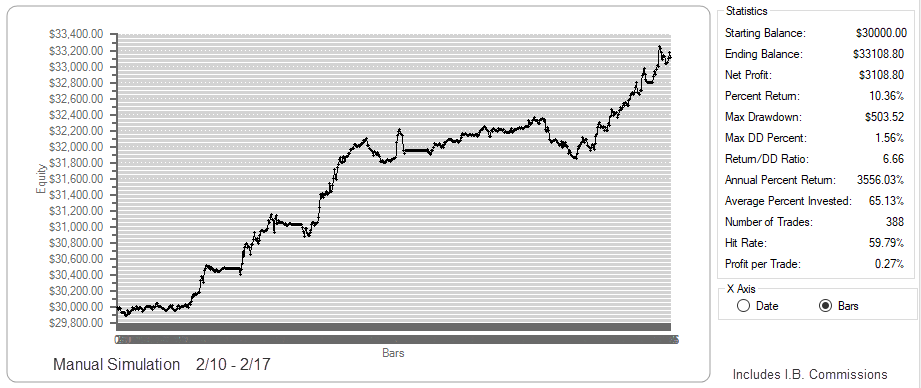

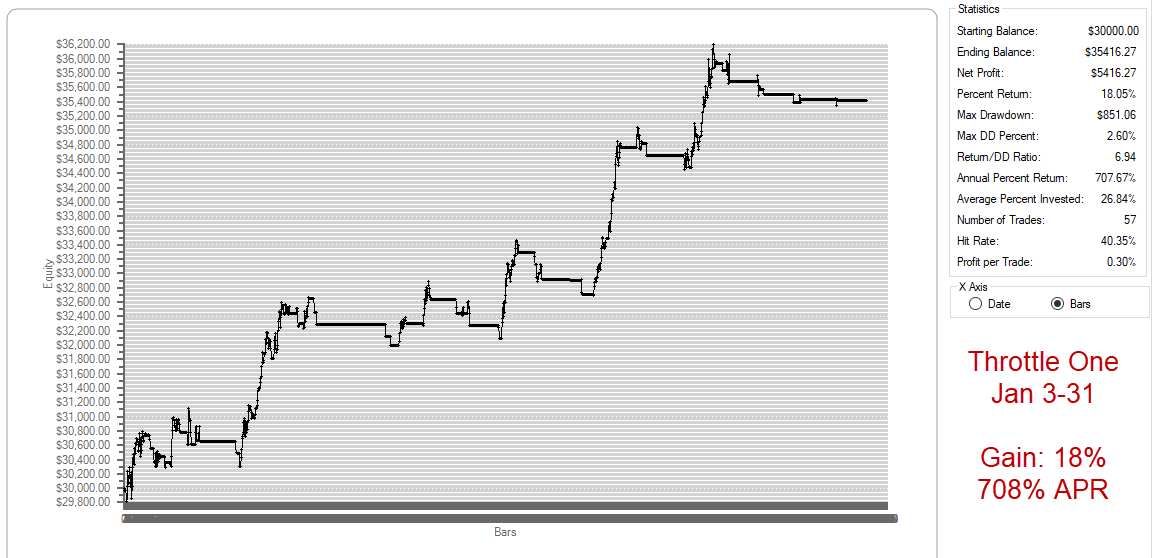

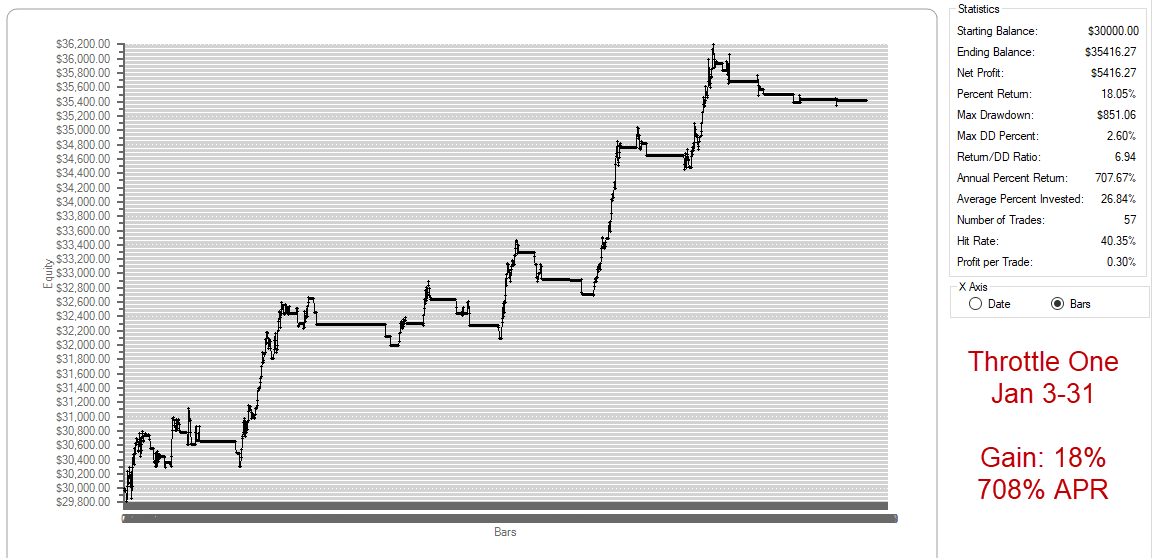

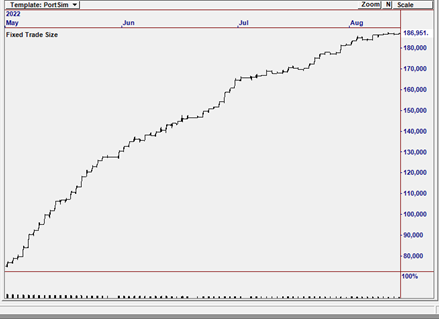

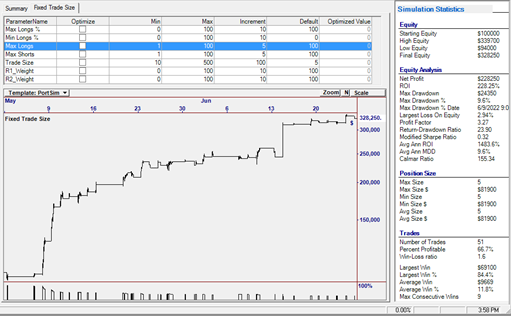

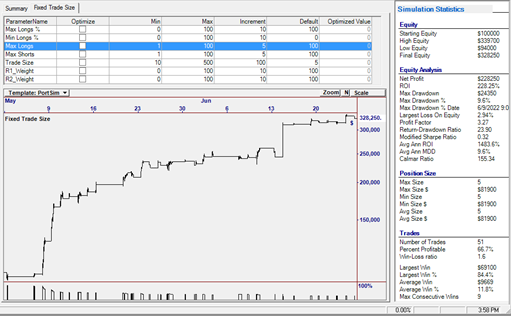

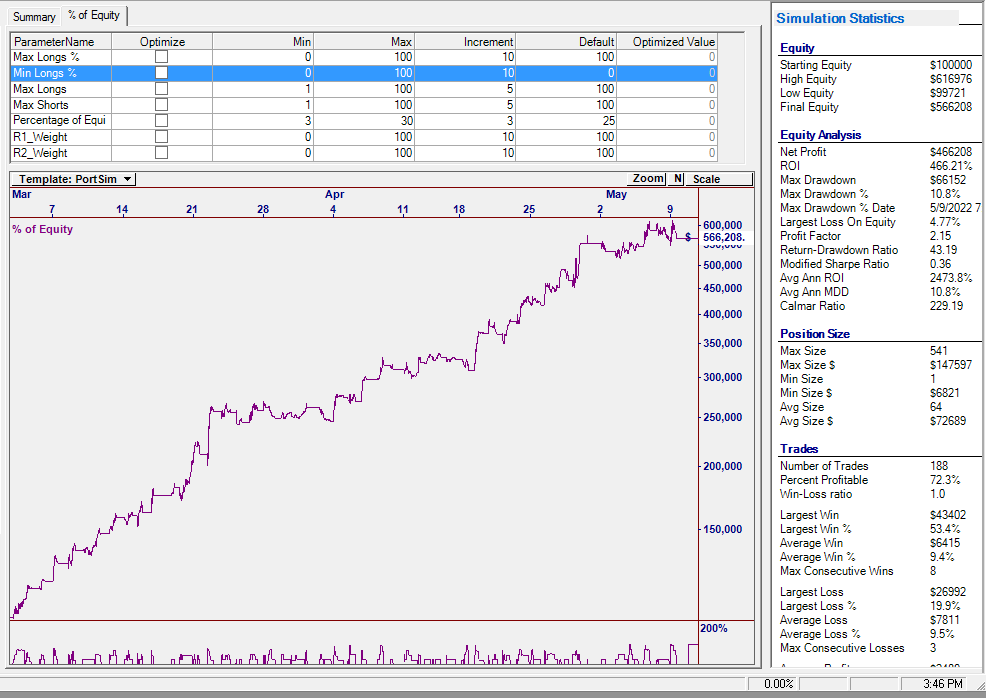

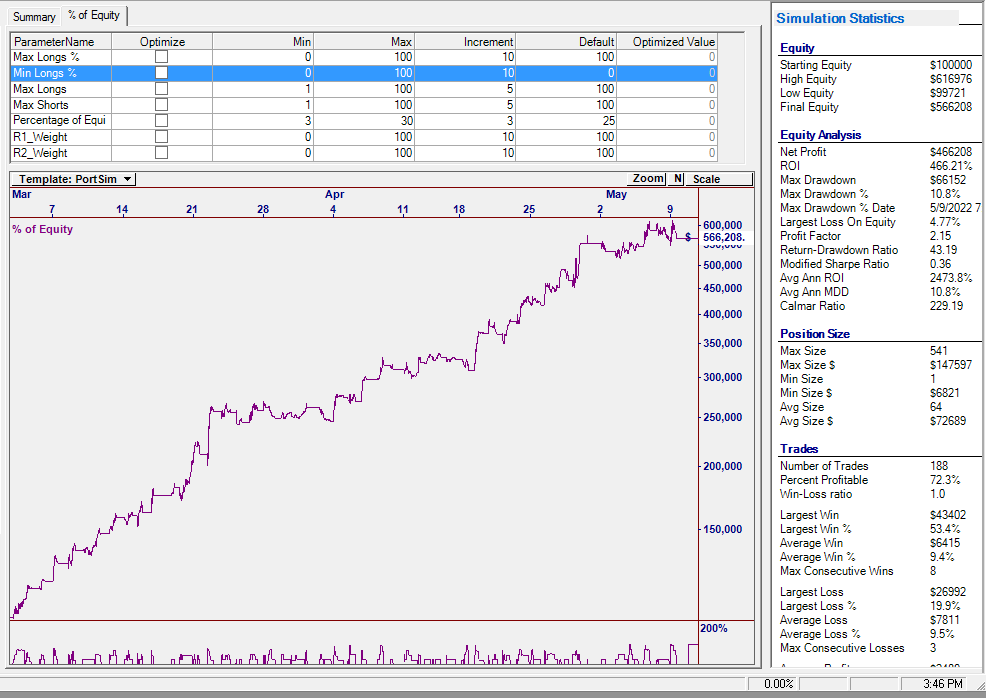

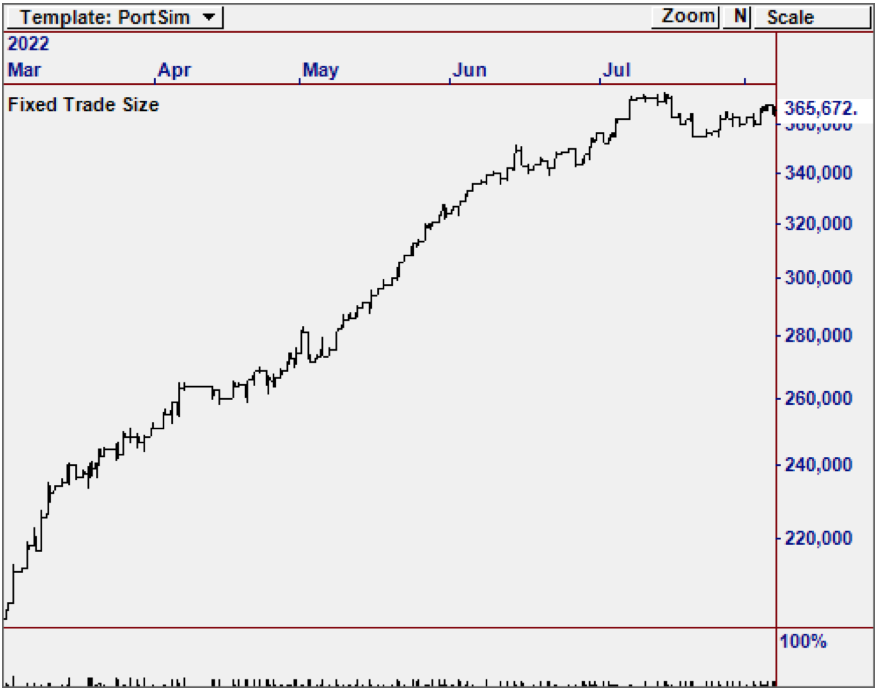

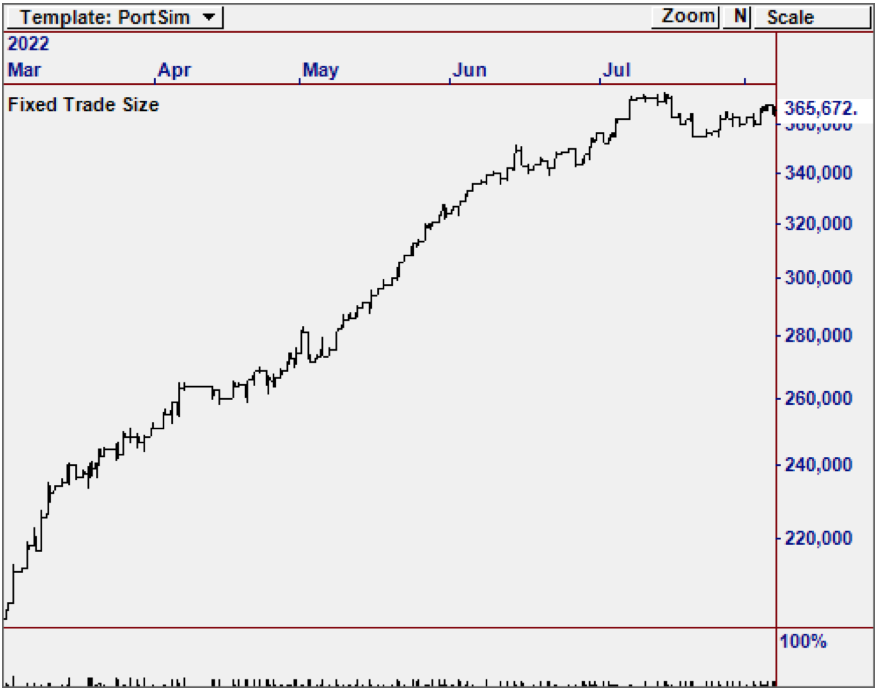

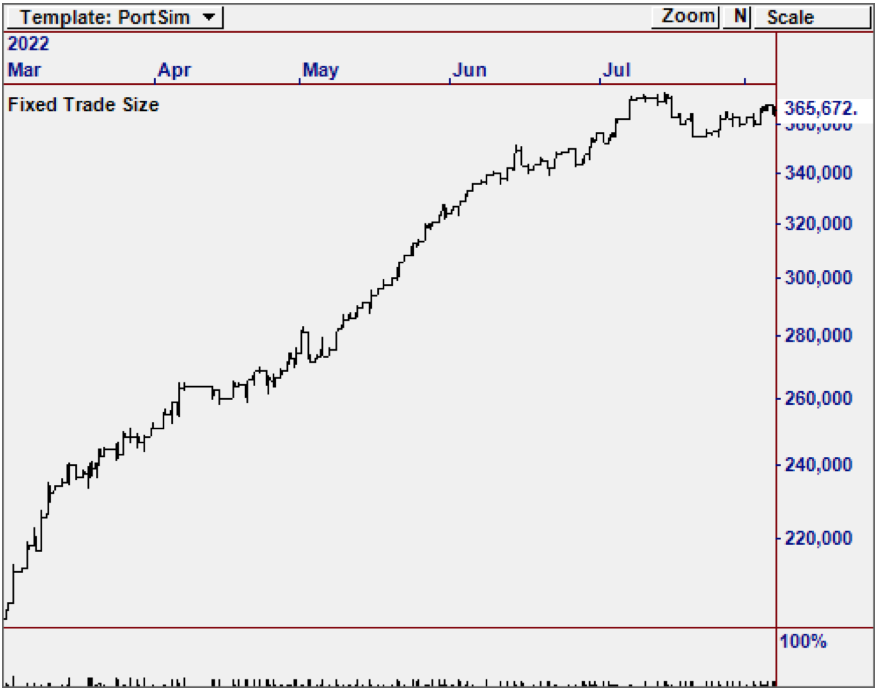

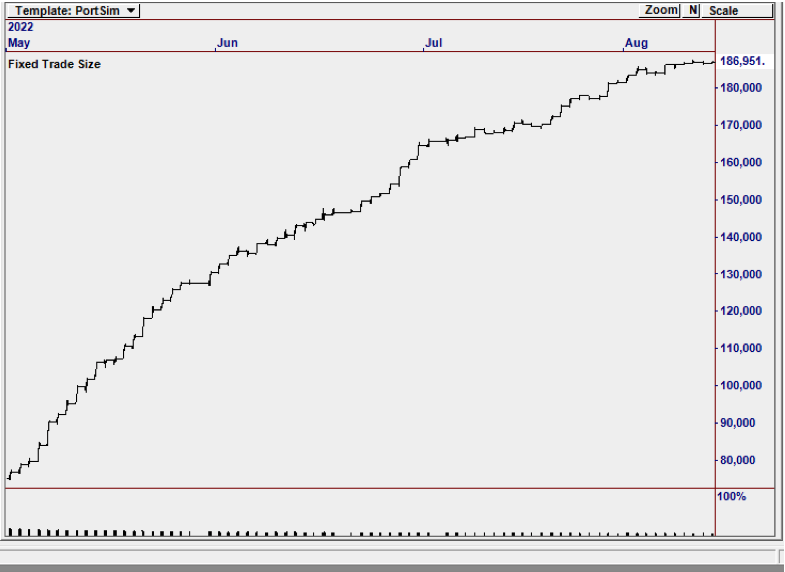

If you watched my webinar from last Thursday, you know I was able to get a very good simulation over about 4 days using the Trade Throttle. I hit a few problems with my setup when I tried to run longer simulations, but after fixing them yesterday, I got the curve you see here for all of January.

This is EXACTLY what I was hoping to see - good gains in the bullish/bearish zones but small losses or avoiding trading altogether in the sideways markets. This test from 1/3 to 1/31 shows 18% return for the month with less than a 3% draw down.

Bottom line: I think we are finally there! I have asked my Team to reset Throttle One, and plan to start trading it into C2 tomorrow. It's new, so I suggest watching it a little while before engaging it. I'm trading leveraged ETFs (SQQQ and TQQQ) so we will have to see how liquidity holds up. To address that potential issue, I will be testing it trading stocks next.

I see more room for improvement but I am satisfied enough with these results to deploy it. My sincere thanks go to all of you for your patience as I have worked on this over the past year. There may be a Winter Storm raging here in Austin, but I'm a happy man today.

I'd like to add a few notes about the TRADEnosis project... The Team is moving really fast on this prime objective here at Nirvana. I'd even say it's Warp Speed. Steve just implemented something like an Advisor Rating on the A.I. Signals, so the best ones can be allowed to trade. In just a few days, we expect to be testing it in OmniTrader. Steve and our developers are easily running at Warp 9!

We have been providing licenses for early adopters at the TRADEnosis web site to raise funds so we can keep The Team focused on this important Cloud A.I. mission. Any Inner Circle member who takes us up on it will gain access to the TRADEnosis Stream in C2 when it's released, which is currently expected to happen some time in the next 2 weeks (plus an Extra Seat to trade it).

I will keep you informed as we continue to continue to advance these and our other automated trading projects.

Sincerely,

Ed Downs

Inner Circle Webinar Video

January 27, 2023

Dear Inner Circle Member,

I am pleased to publish this recording of Thursday's webinar. This event was not so much a presentation as it was a discussion of where we are going with the Inner Circle and the new TRADEnosis initiative.

In the webinar, I share some special insights into Trade Throttle development and Steve Mayos' expertise in creating TRADEnosis.

The webinar only lasts 35 minutes, but the following Q&A session was a great exchange with members and worth the time to listen to. As I indicate in the webinar, I am ready to publish the Throttle trading live this Monday and will keep you informed as we move forward.

Sincerely,

Ed Downs

DE Market States

January 9, 2023

Dear Inner Circle Member,

Why didn't Dynamic Equities trade last week?

Dynamic Equities now uses a market state based on the Trend Intensity Index. Last week, it was Bearish and inverse ETF trades were in play. We need new Signals in order to engage. It looks like today, the Market State could be changing to the upside, so if it follows through we would expect to see new Equity trades in the Strategy.

Sincerely,

Ed Downs

Special End of Year Webinar

December 30, 2022

Dear Inner Circle Member,

Good Greetings! Today’s Inner Circle Update webinar has two really important pieces of news to cover as we enter the New Year…

First, I show how I simplified Throttle One, configuring it to engage the market on the larger moves. Then, I review the other Strategies we have had deployed in C2, including notes about improvements that are being made to each.

Then, I include a very special presentation on Dynamic Equities by Jeff Drake. The really good news is that Jeff has discovered several ways to make it more robust and risk-tolerant, which is important in current market conditions. I know you will enjoy learning about it.

Finally, I talk about what we are focused on going into 2023, starting with the deployment and monitoring of Dynamic Equities 2, Throttle One, and other important Strategy work. I want to wish all of you the best New Year’s and look forward to working with you in 2023.

Sincerely,

Ed Downs

Trading with Throttle One

December 6, 2022

Dear Inner Circle Member,

I have been focused on Throttle Trading since last Tuesday, and feel like I'm getting "in the groove" as they say. In the brief video I made for this post (starting yesterday), I show what I am looking for and how

I am engaging the market with Throttle One. The good news (aside from the Fed Meeting trade last week) is my Gains have generally been larger than my losses. However, I learned a valuable lesson this morning about trading into Collective 2...

Last night, just after the close, I attempted to execute a Long Throttle Trade on TQQQ. I hadn't done that before, but these ETFs trade after the Close and the movement was there. VisualTrader entered the trade just fine, but when I brought up C2, it wasn't there. I figured it was a "glitch" so I closed the trade in VT and called it a day.

What I didn't know was that C2 had entered a market order to Buy TQQQ that would be executed at the Open. So, when I fired up VT this morning, I saw that I was Long TQQQ in C2, which was down over $700 in the weak market. Of course, I closed it immediately (in C2). I've already recovered some of the loss. But lesson learned. I am now making sure I verify not only the trades, but also whether any orders are live in C2.

As you can tell from the video, I am excited about the results I am seeing using the new indicators. I will keep you updated as progress continues!

Sincerely,

Ed Downs

December 1, 2022

Dear Inner Circle Member,

Yesterday, I used the indicators I mentioned last Thursday to engage the market during the Fed Announcement and wanted to share what I was looking at, and what happened in this brief update.

Since my last post, I have been monitoring the Throttle for a strong move, which of course came Wednesday. In the video I discuss some other observations that I am incorporating. We are getting there! Have a great rest of the week.

Sincerely,

Ed Downs

November 22, 2022

Dear Inner Circle Member,

Good News - the recording from today's live webinar is now ready! Three topics were covered in the webinar - A quick review of what we are doing in the Inner Circle Strategy assets, Ed's breakthrough discovery on identifying solid Throttle trades, and a Special Announcement for Inner Circle Members ahead of Black Friday.

The webinar itself is only 30 minutes long, and the Q&A afterwards was really great, as many Members were present in the meeting. Additional news will be made available to IC Members as the Throttle is deployed in live trading. Thanks for watching, and have a great and restful Thanksgiving!

Sincerely,

Ed Downs

November 16, 2022

Dear Inner Circle Member,

I wanted to send you this brief set of instructions for activating futures trading in Collective 2. If you've already been trading futures, you know about this.

I was unaware it was required, until I discovered that my account missed the NQ trade that was made in the big rally last Thursday. I mentioned this in my video, but I now know it was a C2 setting I had to change, not an IB issue. Hopefully helpful...

Sincerely,

Ed Downs

November 15, 2022

Dear Inner Circle Member,

I just made a video update for the Inner Circle blog that includes a review of our current Strategies, plus some notes on work we are currently doing to improve them.

Most of the update is about Dynamic Equities - our newest Strategy and the one we are most focused on right now. I've been trading it in my IRA, which I show in the update. I also provide some insights into my Trade Throttle work. In the course of developing this proprietary approach to day trading, I created a new Indicator that does a superb job of signaling that a breakout move on an individual stock has begun. I am testing it now with the goal of providing a Report/Update by Monday, and ideally, deploying it in C2.

Sincerely,

Ed Downs

October 14, 2022

Dear Inner Circle Member,

I have some special news to share today, related to my last blog post. As you may recall, we had run experiments on a hedge approach that we were calling The Dynamic Hedge.

With the market pushed even further down the past few weeks, we were in need of a product to promote to our customer base. So we took this concept and improved it to create "Dynamic Equities" - a Trade Stream that incorporates all the best ideas we have for investing in equities, and especially in retirement accounts. This is the next Strategy we are deploying for our The Inner Circle members, with Monday as the target release date.

I embedded my "commercial" for Dynamic Equities in the blog video so you can see what it does and what sets it apart. In case you want to share it with friends and acquaintances, I am including a link to the YouTube commercial video below. But just to be clear - Dynamic Equities is going into the Inner Circle (like all such products we create) so you will have access to it as part of your Inner Circle Membership. As you can tell from the video, I'm really excited about it!

In the update video, I also discuss what we are doing with Futures, and my recent work on the Trade Throttle. Yes, it's very much in play! I am targeting the end of this next week for an update on it; watch the video for details. I just want to end today's post by saying Thanks again for all your support. Have a great weekend!

Sincerely,

Ed Downs

September 30, 2022

Inner Circle Members...

For this week's update I have some very exciting news! As you know, virtually all of our work so far has been in Real Time. The primary reason for this has been to avoid overnight risk. Jeff and I recently talked about

implementing an investing Strategy, which would have the benefits of fewer transaction costs and larger moves on each symbol. But that overnight risk held us back.

Then, Jeff began testing the concept of a Dynamic Hedge, which uses NQ Futures to hedge risk - any time - day or night. This concept is simply beautiful, folks. In tonight's video, I explore how Jeff built it, and what the initial performance looks like. Prepare for an upside surprise!

I also talk about how this work is positively impacting the Throttle One project. So enjoy, and have a great weekend - we will let you know when the NEW Dynamic Stocks Strategy has been deployed, early next week!

Sincerely,

Ed Downs

Important Inner Circle Update

September 15, 2022

Inner Circle Members...

I have two great pieces of news to share today. There is a 15-Minute video attached to the post in which I visually cover both.

Here is a summary:

Trade Throttle Breakthrough

My first news is about the Throttle work I have been doing since my last update. The “breakthrough” has to do with finding an indicator combination that appears to accurately identify the big moves, which is what we want to trade. You will see a simulation I ran over Tuesday’s market, where I share how I am translating this to create and test the Trade Throttle Automation.

New Strategy: IC RT Nasdaq

After recruiting Jeff about a month ago to help with Throttle Development, he decided to apply some of the principles to develop a Real Time Equities Strategy in OmniTrader. The result is IC RT Nasdaq, a new Strategy we have now deployed in The Inner Circle. The first day was up! I will make sure Angela sends out the link to it early tomorrow.

My next update will be on my progress deploying the Trade Throttle in The Inner Circle. The Strategy is ready to go on the page; my next task is to apply the indicators I developed to create the Throttle Automation. Expect me to cover that in my next update. Clearly, my goal is to deploy Throttle One!

Ed Downs

Recent Trade Throttle Advances

August 30, 2022

Inner Circle Members...

I mentioned in my last update that I have some important Throttle News to share. A lot has been happening on the Trade Throttle project.

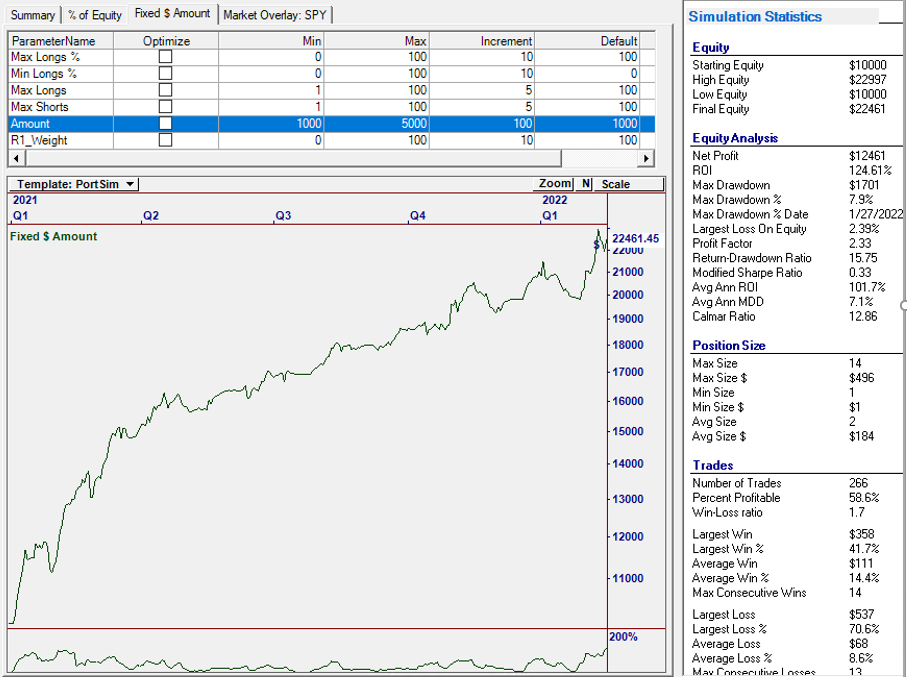

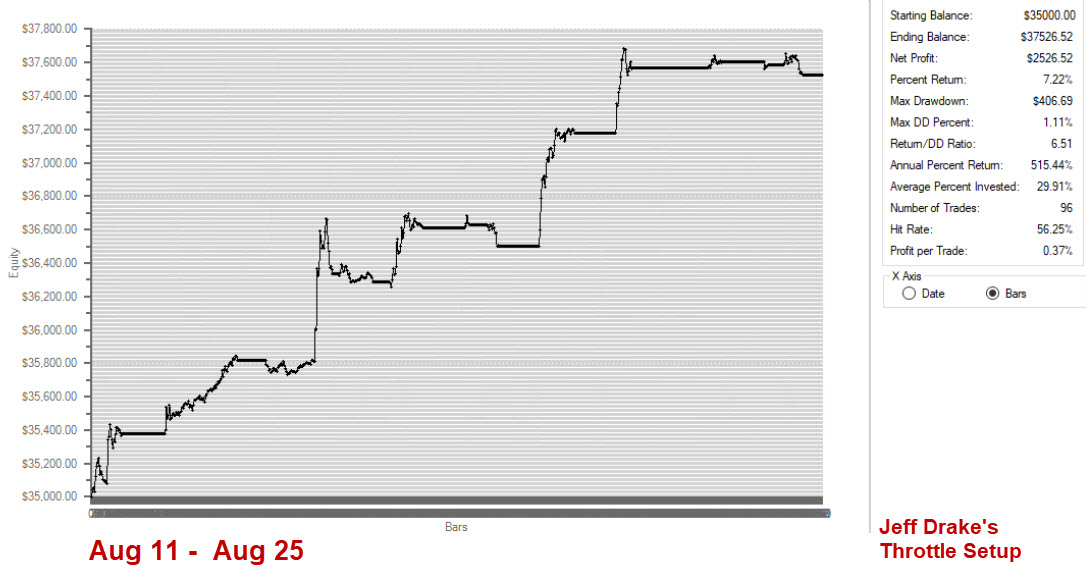

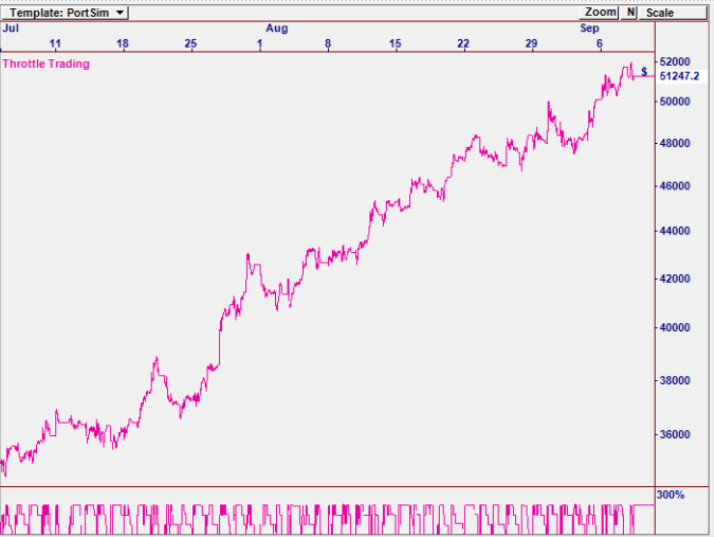

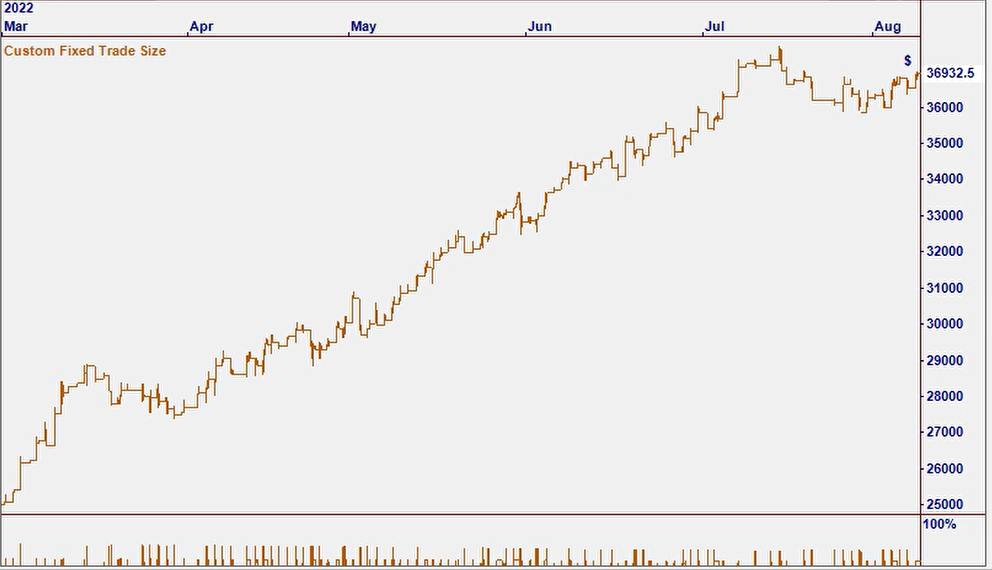

Recent Simulation on Throttle One by Jeff Drake

One of the big challenges in trading "market consensus" is the potential for a losing Throttle trade to give back a good portion of equity if the market turns sharply against us. To counter this, I asked our developer to create an "Equity Curve Indicator", so I could close all trades from the Throttle under program control when this occurs. Other changes made at the same time invoked a fairly involved Q.A. cycle, but the good news is it's all working properly now, and I am seeing improved results.

Perhaps the biggest issue I have encountered developing Throttle One is that automated runs are very time consuming, with each Simulation taking about 30 minutes. In order to accelerate our progress, I recruited Jeff Drake to apply his knowledge of Strategies and Trade Plans to the Throttle application. That was a good move - in about a week, he was able to get the Simulation shown here.

Another feature that was just added is the ability to run Simulations in the past, which is important because the market is always changing. Up to now, we have only been able to run on the most recent 2,000 bars (about a month in 5 minutes). With this improvement, we can Simulate any month in the past, and aggregate the performance.

I appreciate the great work Jeff has done to create the Futures, Equities, and Options Strategies that have been deployed in the Inner Circle. At this point, completing and deploying Throttle One is the highest priority project in the Company. When I announce its release, I will host a webinar to review the many discoveries that have gone into this one-of-kind technology. While the project has taken much longer than I expected, I know it's going to be worth the effort.

Sincerely,

Ed Downs

August 22, 2022

Inner Circle Members...

IC RTY Breakouts is now live for Inner Circle Members. Last week, Collective 2 restricted the number of Crude Oil Micro contracts that can be traded. We are working with them to determine how to configure it, and may have to switch to a Strategy that trades a single contract. We will have more news on this tomorrow. I will also have an update on Throttle One.

Sincerely,

Ed Downs

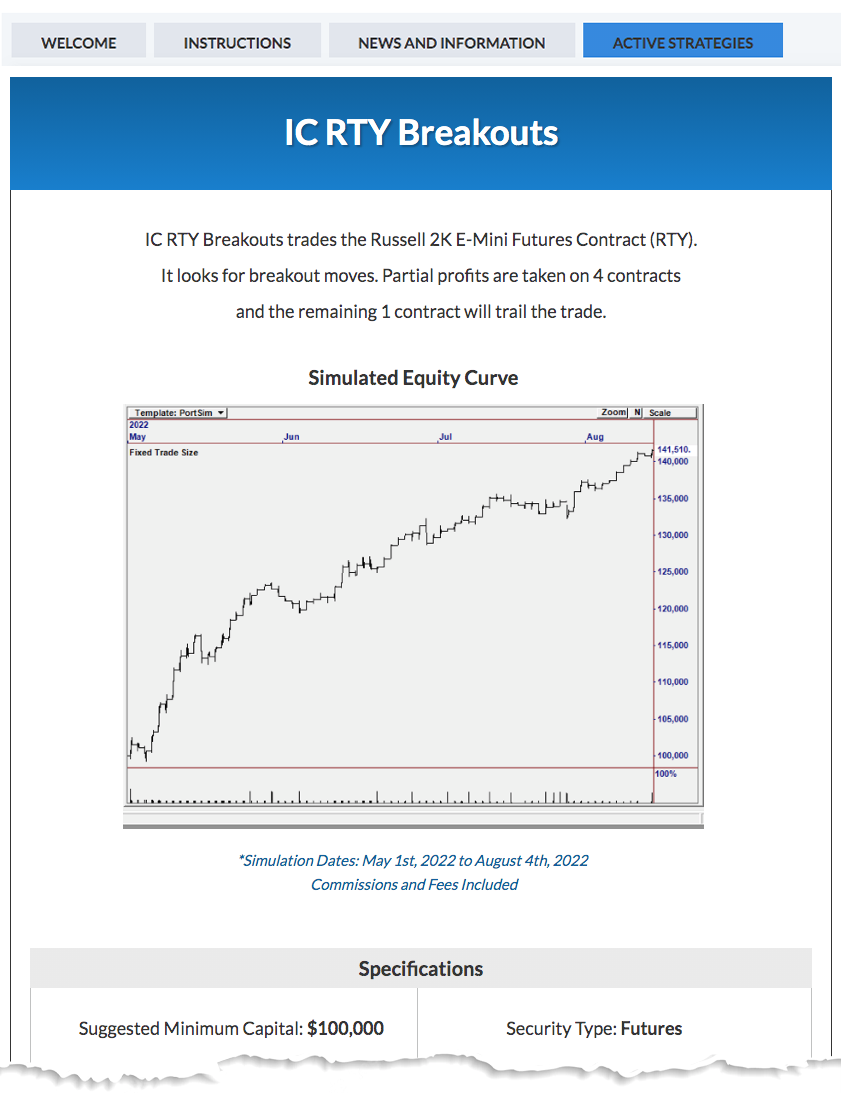

IC RTY Breakouts is now Live on C2.

August 15, 2022

Inner Circle Members...

In my last update, I mentioned that we had added detailed Strategy descriptions to the Active Strategies tab. I also mentioned there were two Strategies under development for the Russell 2000 and S&P 500 futures contracts (RTY and ES). These Strategies are now documented in the Pending Strategies section, at the bottom of the Active Strategies tab.

ES Trend Trades is a new Index Futures Strategy that trades

5 contracts. It is expected to go live over the next few days.

Both IC RTY Breakouts and IC ES Trend Trades have been trading live since last week, and some important adjustments have been made resulting in less capital required to trade them. Requirements had to be increased on other futures Strategies (like CL) because we are now "scaling out" which requires the use of multiple contracts. But Jeff worked out a way to trade these new Index Futures Strategies with fewer contracts.

I also did considerable work last week and over the weekend on Throttle One. I am testing a new Trade Plan concept that uses the new Equity Curve Indicator that our developer, Cose, added for me. Looking good. I hope to have more definitive news in my next update this week.

The new ES and RTY Strategies are expected to be deployed tomorrow or Wednesday.

Sincerely,

Ed Downs

August 5, 2022

Inner Circle Members...

As I indicated in my post last week, the Nirvana Team added several new Strategies and updated our existing ones to take advantage of the Trade Plan discoveries Jeff Drake had made in prior weeks - reducing draw downs and improving profitability.

With so many Strategies and all the changes, we have received requests for notes or information explaining what the Strategies do and how they should be traded, including recommended capital, number of contracts, and so on.

We have now updated the Active Strategies tab to contain this information. In addition to Throttle One, we have a few pending Strategies based on the Russell (RTY), S&P 500 eMini (ES) and Equity Breakouts (formerly "FAANG"). We will keep you updated here but that tab will now have more detailed information on all our currently Active Strategies.

Sincerely,

Ed Downs

July 26, 2022 -

IC Update #2

Inner Circle Members...

I hope you had the chance to watch my short video this morning in which I traded options on the QQQ to capture the downside movement. I have additional news on the Throttle that I am including in today’s second update that I think you will be interested to hear about.

In addition, I have some breaking news on the new Strategies that Jeff has been working on using his new Trade Plan approach. It’s truly ingenious and in the update I explain exactly how it is able to improve profits and reduce draw downs. I also include some curves based on the new index Futures Strategies that Jeff developed using this approach. And that is actually the most exciting part of the update because the return to draw down ratios are so high. As I indicated in the update, I will let you know when they have been deployed to Collective 2. Thanks again and my next update will come out soon!

Sincerely,

Ed Downs

July 26, 2022 -

IC Update #1

Inner Circle Members...

I am preparing a BIG update for later today on the work Jeff has been doing on futures - very exciting stuff. This morning I was working with the Throttle and testing an approach for retirement accounts that I have discussed before -

using Puts on QQQ to trade the Short Side of the market. The news is: I have a new Leading Indicator that is very good at predicting continuous directional movement, which is enabling me to catch longer moves. The video shows a live QQQ Put trade from start to finish. This will become a Strategy that trades down markets this way, based on the Leading Indicator and other chart clues I talk about. My 2nd video on Jeff's work will be out later today.

Sincerely,

Ed Downs

July 15, 2022 -

IC Update #2

Inner Circle Members...

At the end of yesterday's video, I showed MarketScans running on the VisualTrader Throttle and said I would run them in the live market today.

I just made a 4-Minute video that I am attaching to this post on the web site. I was excited to see the MS+VT combination generate over 1/2% in fully-automatic trading on a flat market. This first test was Long Only. I need to run additional tests that incorporate market direction into the trading decisions and then potentially add options.

I think this has HUGE potential. I will continue working on Throttle One, but this approach has a larger universe to trade, and thus may be more productive. It looks like MarketScans feeding the Throttle has the potential to make steady, daily gains. I will continue running these tests a few more days, with the goal of then adding this new trade stream to C2 for our Inner Circle Members. I'll also continue to keep you updated on all our trading initiatives.

Sincerely,

Ed Downs

July 15, 2022 -

IC Update #1

Dear Inner Circle Member,

Before I provide my update for this past week, I want to again say "Thank you" for being a part of The Inner Circle. This exciting endeavor continues to move forward with better Strategies and concepts that, without your help, we

would not be able to develop and deploy. It's a vigorous process for us because it has to be. In addition to fulfilling our promise to Members, we are ourselves dependent on the trading profits we can generate. These updates are designed to share what is happening and how we are advancing the ball in Futures, Equities and Option trading.

Again, welcome aboard.

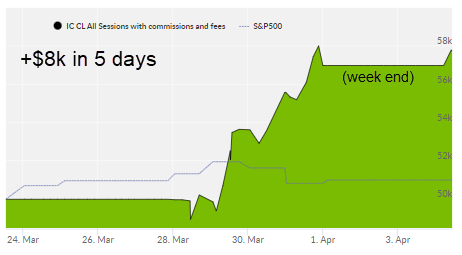

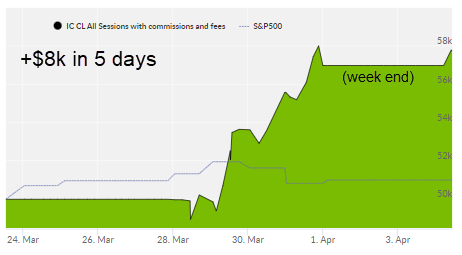

I would say our most intense focus, aside from the Trade Throttle, has been on futures and CL in particular. Crude oil quickly made 30% after launch but over the last month has not advanced. Rather than just continue to watch it trade, we decided to look at what's happening in order to move to the next level. In this update, I share recent CL Strategy advances Jeff has made that are truly exciting. The new version, showing an incredibly smooth equity curve, is expected to be deployed next week.

Our Option Income 2 Strategy has been surprisingly effective. Its only drawback is it can't be traded in a retirement account. But a Margin account would be up 10% since it was released less than a month ago. And in terms of retirement account support, that is a primary focus I have in my Trade Throttle work.

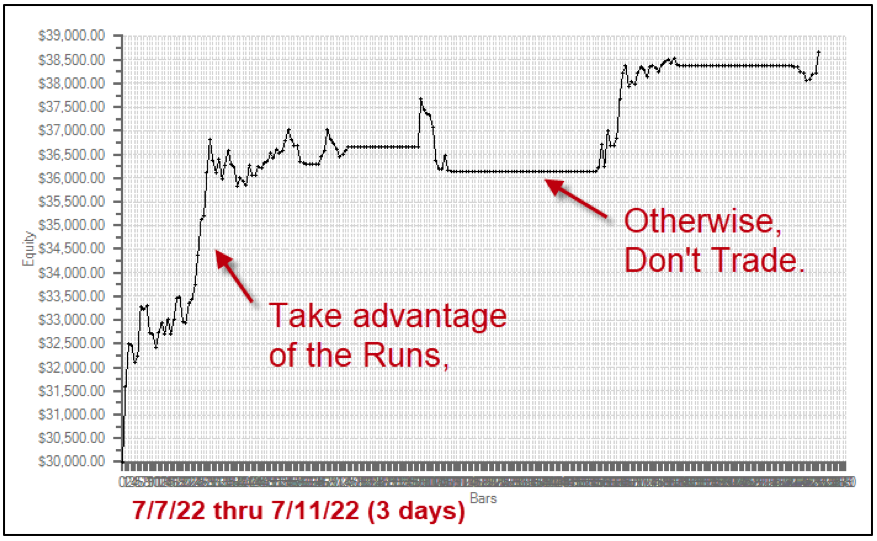

I continue to work on the Trade Throttle problem and have made great progress trading the moves, while avoiding the sideways markets. In the update, I show a recent equity curve that shows this kind of trading. It's been a difficult problem to solve, but every new experiment gets us closer.

At the end of the video, I show a related project we just embarked on that has the ability to trade breakouts across the entire market using the power of MarketScans. It just makes sense to find and trade the stocks that are moving - when they move in Real Time. I think you'll be excited about it.

I will continue to keep you informed. Thanks again for being a valuable part of the journey.

Sincerely,

Ed Downs

July 8, 2022

Greetings! I am working on a video update, but wanted to make sure I got some news out to you at the end of this week. Since my last post, we have been very busy here working on several projects for the Inner Circle. Let's start with the Trade Throttle.

In this post, you can see my current "test bed" for Trade Throttle runs. It has plots for the Leading Indicator (red, green), a Separation indicator, and DMI. I am finding this combination is very reliable for directional Throttle Trades. By looking at longer term Separation, it is able to maintain trend direction in small whipsaws, which means less trading. I will share the results after running a few more tests.

You may recall that several weeks ago we changed the Crude Oil Strategy per the video I made with Jeff - taking quicker profits and holding stops tighter. This was done to reduce draw downs. And, it did that, but it also reduced profits. During this time, we noticed a phenomenon that we call "whale trades".

For example, near Tuesday's stock market open, Crude Oil dropped below $100 - which made headlines. Our Strategy shorted it and took quick profits, only to watch CL go much, much lower. So we are working on multiple Strategies that run in parallel, each designed to trade a specific setup. There is so much to be made in this market that this is taking a large part of our focus right now.

We also have another test running on Anchored VWAP in a private channel. It's done well in its first week, but it is 100% discretionary. We plan to release it to the Inner Circle if it continues to perform. More about that later. As I say, over the next several days, I plan to publish a video update on my Throttle work and any additional advancements we make during this time. Thank you.

Sincerely,

Ed Downs

June 29, 2022

Today's Inner Circle video covers the Strategies that have been deployed as well as an important addition to the Trade Throttle that is making it easier to capture gains from a Market Move. As you know, we have had a very strong focus on Futures in the Inner Circle due to the leverage and movement potential of these contracts. This week, Jeff deployed two new Strategies - one on Cotton and the other on Natural Gas. One of them shows a 200% gain in just two months. We are using this week to "burn them in" but if all goes well they should be available to members next week.

I also explain the new feature that was just implemented for the Trade Throttle, though it's actually a VisualTrader improvement. With the new Account Equity Indicator, I am able to "see" (in code) when a throttle move is starting to wane, so profits can be preserved at that point. As explained in the video, this is enabling me to have looser stops on the Strategies for the individual stock trades, but be able to react when the account as a whole is giving back gains. I have just started working with this but I think it could be the last "missing link."

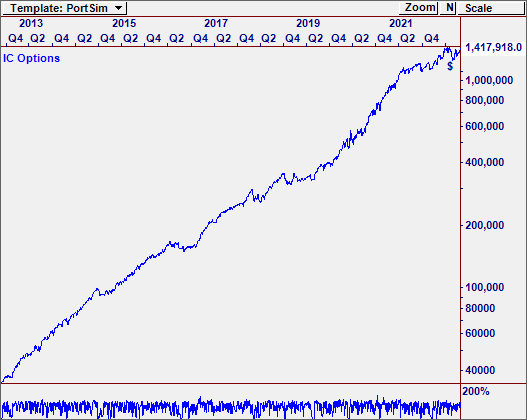

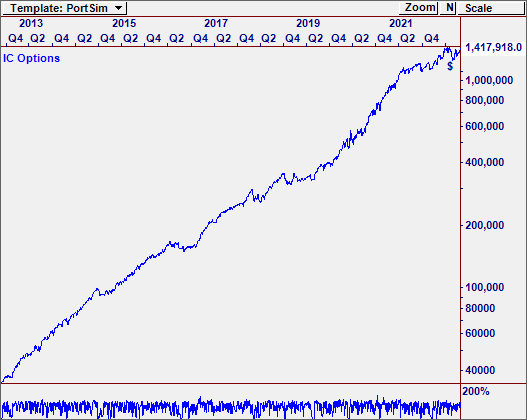

Finally, I also discuss Option Income 2 - the new option selling Strategy that is currently showing a 53% annual rate of return. It's only been trading since June 1, but the behavior and shape of the curve are very encouraging. I talk about the history of this project, and why this new Strategy is ideal for capturing income from selling options on reversals in the direction of the market. I think it's a huge advancement. As always, I will continue to keep you updated on the development of these important trading assets.

Sincerely,

Ed Downs

June 24, 2022

Greetings, Inner Circle Members..

Last week I explained the work my Development Team was doing on Throttle One to get the Simulation and Live Trading to match more closely. They will never be precisely the same because of the processing delay after a new bar forms, but they are much closer.

New NG Strategy tripled the simulation

account in less than two months.

I have some additional, exciting news on the Throttle. Since it places many trades at once, it needs to maximize and retain the gains it makes on each "wave." A special new feature I just got from the Dev Team is enabling me to do precisely that. I am running tests now and expect to publish a video demonstrating it in the next few days. The goal, of course, is to re-deploy Throttle One on the live C2 account.

Jeff and the Team have been working every day to test and deploy additional Strategies to C2. The curve to the right is from Jeff's latest work on Natural Gas or NG. The energy markets are enormously volatile right now, and this Strategy clearly takes advantage of that. The Calmar Ratio above 150 is quite impressive. Today, they are hooking it up to C2 for testing early next week, after which it will be made available to Members. Jeff is also testing a new Strategy on Cotton. I will share more details in my video update.

Sincerely,

Ed Downs

June 13, 2022

This week we made some important gains in our quest for the best possible automated Strategies for our Inner Circle Members. The most significant is Jeff Drake's advances on the Crude Oil Strategy. In today's video, I asked Jeff to come on and explain his research and the changes that have gone into Strategy.

Click the Video Above to Play

Impressive. I also discuss our work on Throttle One, which at this point mostly has to do with synchronizing Live Trading with our Simulations.

My Team made good progress there. Finally, we have deployed both the FAANG Strategy trading equities and the Option Income 2 Strategy, which sells both Puts and Calls under Market State Control. I will continue to update you this week as we have new information on the Strategies we are deploying to Collective 2.

Sincerely,

Ed Downs

June 6, 2022

Dear Member,

Over the weekend, I traded the Crypto market (Open 7-days, 24 Hours) using Crypto Trader to run tests and work with our developers on the differences I experienced Thursday. We think we found the issue - VisualTrader can change the sort order of the list as new "ticks" come in, which means different trades will be taken.

Crypto Currency Test on the Throttle in

VisualTrader over the weekend.

They are addressing this today so hopefully we can resume tomorrow (Tuesday), The screen shot in this post, is of VisualTrader running on Bitcoin using data from CoinBase. BTW, there is a lot of potential in Crypto Currencies! For another day. I'll continue to keep you informed.

Sincerely,

Ed Downs

June 2, 2022

I hope you had the chance to watch the 5 Minute video I made just before the Open today. I now have a throttle algorithm that seems robust - it's time to test it in live fire and make sure it behaves in the real market as well as, or better than, the Simulation. The Trade Throttle ran on the NASDAQ stocks all day, and ended with some impressive results.

The C2 record was up 1.3%, which is great. But the discovery I made is even more significant. In this short video, I explain what happened and also talk about next steps. We are getting there!

Sincerely,

Ed Downs

June 2, 2022

Members...

I made this quick 5-minute video this morning to explain my current live tests with Throttle One for the Inner Circle. Pretty exciting stuff.

As explained in the video, I'm running a live experiment today, after which I will make another video comparing live vs. simulation. See you later today!

"Results! Why, man, I have gotten a lot of results. I know several

thousand things that won't work." - Thomas A. Edison

Sincerely,

Ed Downs

May 27, 2022

Inner Circle Update for May 27, 2022: Trade Throttle Review

Greetings! In my video Wednesday, I showed my recent success with Throttle Simulations and said I planned to activate Throttle One in C2 this week.

I actually did that today,

but a problem in VisualTrader prevented the trades from reaching C2. I recorded the outcome of the Throttle Trade (in paper broker) and also took the opportunity to explain how I have been testing Throttle entry points. I hope you find it interesting. The bug I encountered was fixed this afternoon so we should be all set for Tuesday's market. Have a great Memorial Day Weekend and we'll pick it up next week!

Sincerely,

Ed Downs

May 25, 2022

IC Update for May 25, 2022:

Throttle One plus 2 exciting new Strategies!

Greetings Inner Circle Members...

I have a lot of great news to share this evening, as presented in today's video. Here's a summary:

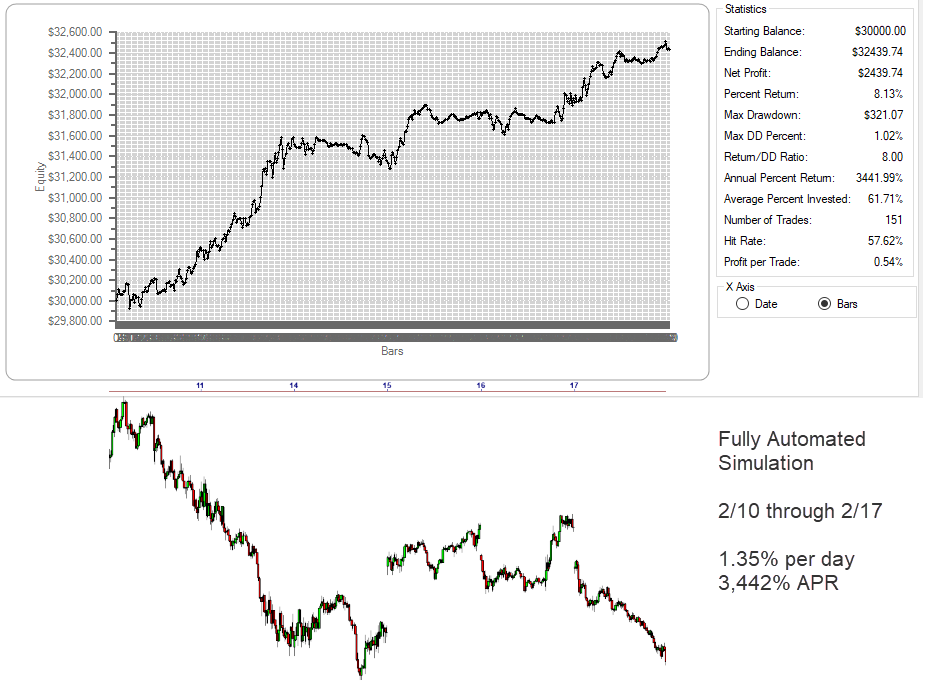

I am ready to start trading Throttle One live on the site. On the video I talk about the challenges of Throttle One, but also how important this approach is to making steady profits. I also show a simulation I ran over the past 2 weeks, hitting that 1% a day goal.

We are deploying two new Strategies - one that trades both Puts and Calls to generate income in Up and Down Markets using ATM Market States, and another that trades the most liquid stocks on the NASDAQ to replace NQ Overnight. I want to applaud Jeff Drake for his hard work on these Strategies. They are really good.

Finally, I talk about what Don Frazeur is doing to test his unique Strategy, called HVKCH (you'll have to watch the video to find out what that means!) This is very exciting work and I want to applaud Don for taking the time to engage this. It could be huge.

So, that's a rough summary. I hope you enjoy the video, which is under 20 minutes long. Thanks for being part of The Inner Circle...

Sincerely,

Ed Downs

May 23, 2022

I.C. Update for 5-23-22:

Update on recent events in the Inner Circle

It's been a little over a week since my last update. I had planned to make a video today but I hit a bug in VisualTrader that's taken all day to isolate. Hopefully they will get a new build over to me tomorrow. I have some great throttle news but want to test over more data to verify it. Expect to get a video update from me tomorrow or Wednesday.

I had mentioned in the last update that I embarked on a new "Mach" series with my member friend Don Frazeur. Don is trading his Strategy into a private area of C2 in order to validate it; As you know, we had some really wild swings in the market last week! Since his Strategy trades 100% options, the swings penalized it. We need more time in live trading before opening it to the group. I have stopped trading Mach One pending the outcome of these tests.

The CL Strategy continues to do well. We are revising Option Income and NQ Overnight. For the Option Income Strategy, we added liquidity filters (like max bid-ask spread). As a result, in live trading (not back testing) a very large number of trades are being filtered out. We are looking at switch to a liquid list like the S&P 100 and will reset. NQ Overnight is on hold for the moment.

I showed a very exciting Options Strategy in my prior post, which Buys/Sells Put & Call options on the FAANG stocks, primarily at the Open to catch breakouts. When we started testing it live last Wednesday, it made 10% in just one day due to the large drop in the NASDAQ. Since this is the first time we have traded options in real time, we need to compare executions to Simulation for at least as week before opening it on the site.

I will provide more details in my coming video update.

Sincerely,

Ed Downs

May 13, 2022

IC Update for May 13, 2022:

Great Throttle Progress & More

Greetings, IC Members! It's Friday the 13th! Actually, we had a great week. I made really good progress on the Throttle, having it wait to trade the stronger moves. Today's 5-day simulation ended up almost 5%,

(1% a day) even though

most of the week was slowly down. When we have weeks

New Real Time Options Strategy Simulation.

with a lot of volatility, that should increase. I think I can improve its performance, but you will start seeing Throttle Trades coming through Monday. Thanks for your patience. Automating the Throttle has been one of the most challenging things I have ever done!

I also started trading the new Mach One Strategy that I talked about last Friday. I must admit my performance wasn't that hot (and C2 didn't close 2 of my trades due to an error on my part). But there is hope! I have been working with member Don Frazeur on this for a few weeks, and HIS trades have been spectacular. My Good News today is that Don has agreed to help me get Mach One into shape - you'll be hearing more about that in coming weeks. If you ever meet Don, and I hope you do, you are going to find the nicest, most easy going person in the world. I am really enjoying working with him. Just want to say, "Thanks, Don for all your help!"

Futures trading continues to move ahead. One member wrote that the IC CL Strategy has already paid for his Inner Circle membership, which I was happy to hear. But more is in play. We now have the Micro CL Strategy running AND there is a new Options Strategy that is shown in this post. The back test results are so good, we decided to test it internally for a few days before activating it on the site. The Strategy made 2% today in our test. So, you can look forward to hearing more about that!

Next update soon. Thanks again for being part of the Inner Circle.

Sincerely,

Ed Downs

May 9, 2022

Inner Circle Webinar Recording

for 5-6-22: Ed and Jeff talk about recent news, including the addition of new Trade Streams into I.C.

We had a great Inner Circle session Friday. Jeff and I both disclosed new Inner Circle assets during the webinar, as well as our plans for adding additional value to the group. We also fielded some great questions from attendees.

Click video above to play.

In the webinar, Jeff talked about the new CL Micro Strategy and additional Trade Streams he is working on, including the new FAANG Strategy that trades the most active stocks in Real Time. I did a Throttle Demo and unveiled a new Swing Trading Strategy called IC Mach One. Click here for the C2 page for this new Strategy. There is also the new Crude Oil Micro Strategy. Click here for the link to IC CL Micro.

Our Strategies be going "Private" today, so please subscribe to any you want to follow by clicking the Subscribe button on the page (free for Inner Circle Members.) Our web department will be adding links to the I.C. site for easy access, but you need to subscribe before they are marked Private. As we add new Strategies in the future, we will open them in a "window" and notify Members so they can subscribe.

My Team and I remain dedicated to getting the best possible Trade Streams into C2 for our Inner Circle Members. I will continue to update you on Inner Circle News, and as additional trading assets come online...

Sincerely,

Ed Downs

May 2, 2022

I.C. Update for May 2, 2022

Live Webinar for Inner Circle Members This Friday

Greetings! Since my last update, I have continued to work in the faster timeframes with the Trade Throttle, including the use of Momentum as shown on the chart in this post. I am continuing to run these experiments and expect to have news by Friday.

Our CL Strategy continues to perform well. Jeff has been evaluating additional futures contracts and Strategies to deploy in the Inner Circle, which is very exciting work. I have been working on a new

Trade Stream for equities, which I will deploy this week. Due to the recent changes in behavior of the NASDAQ, we have decided to stop trading the NQ contract. A replacement will be available soon. Jeff and I have decided to host a live webinar to discuss what we are doing to further enhance the Inner Circle deliverables and results. The webinar will be held Friday, May 6, at 4p CDT. In the webinar we will explain our current work and plans, as well as answer any questions you may have.

Click here to register for the webinar.

Sincerely,

Ed Downs

IC Update

April 27, 2022

Today, I used 1 Minute bars with the Trade Throttle to get a faster Signal. I also tried 100 Ticks but didn't see much advantage over 1 Minute, so I stayed with that. At the Open, the market was screaming up, so I immediately bought the first 5 stocks on the top of the list "Above" List. They

were moving incredibly fast, and Market momentum carried them up. I had gained $200 at one point, where I started taking profits. After a pull-back I entered a new Throttle trade which did not follow through.

The advantage of the short timeframe is that the picture of strength and weakness across all symbols changes very rapidly. In fact, you can see it change twice in today's 8-minute video from Solid Green to Solid Red and back. I wanted to see if I could enter these trades more quickly (and I could) and also get a quicker indication of a turn to signal an Exit. I discovered that the Exit Signals tended to come too quickly.

The other thing I wanted to test is option trading in lieu of a basket of stocks. I did about six QQQ option trades, using the bullishness (or bearishness) of the List to tell me when to enter and exit. While these trades stopped out for small losses, the exercise enabled me to test the concept. My conclusions at the end were that short timeframes are great for the earliest possible entry, but I need to use indicators for exits, so the trades can run. I plan to continue live testing tomorrow.

Sincerely,

Ed Downs

IC Update - 4-26-22

Breakout Throttle Trades

I made another short video today (10 minutes) where I used the breakaway method. Only two throttle trades were done - both profitable. However, you can see in the video that the market can move up a substantial amount - even when 90% of the stocks are in the "red zone". This

provided some great additional insight that I will incorporate. Running Throttle in the live market has provided information about how to get through 'sideways' market behavior and hold the trade long enough to lock in a profit. I will continue to work towards Throttle Automation and share my findings as I go.

Sincerely,

Ed Downs

IC Update for April 25, 2022

Throttle Work: Live Market

Over the weekend I ran tests on a new Measurement that uses Momentum, and decided to trade live with it today. This morning, I recorded the first hour and a half, and picked it up again near the Close. I would say the video, which is 22 minutes long, provides good insights into what can happen on a day when the market is non-directional.

As I mentioned in my last post, this work is experimental, and I suggest Inner Circle members wait on following these trades until I can get the automation worked out. But I think it is better for me to engage the market live in addition to the Simulation work because of the insight it provides. Hopefully tomorrow will be a true "Break Out" day. Stay tuned...