Research Breakthrough

By Ed Downs (with research by Mark Holstius)

Mark recently created an ATM method called "Micro States" which is available on the Downloads page for ATM users. He just revealed a new way to further improve ATM results that he posted about in the OmniTrader Forum. With Mark's permission, I am sharing this idea today because of its significance.

Let's start with some definitions...

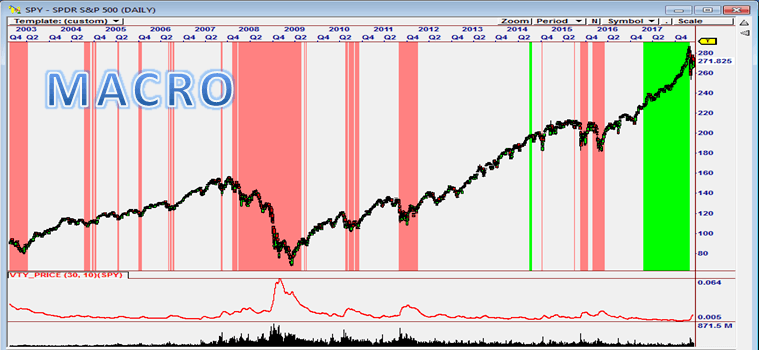

In the picture to the right, we see the Market States used in the Universal Method, which are indications of directional bias for an index symbol (like SPY). We now will call these longer term measurements Macro States.

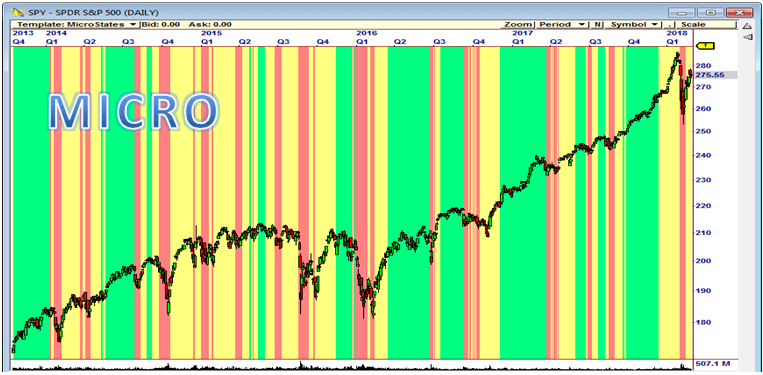

Micro States are very short term technical measurements applied to an index symbol (like SPY) to determine when it is optimal to take new Long or Short trades based on the probability of short term movement direction.

Mark began experimenting using Macro and Micro States together, resulting in a tremendous boost in performance.

Market States used in the Universal Method

Market States used in the Micro States method.

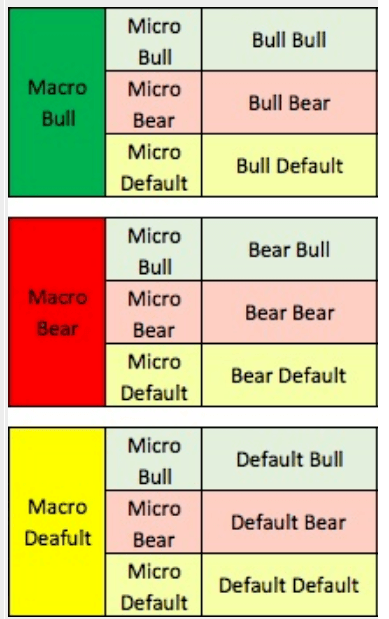

We typically define 3 Market States - a bullish, bearish, and default (neutral or slightly bullish) state. If there are 3 short term (Micro) States and 3 long term (Macro) States then there are 9 combinations.

We can use these combinations to increase allocation to take advantage of the high probability of movement that can exist with certain combinations, like "Bull-Bull" or "Bear-Bear". This is very similar to multiple time frame confirmation, since one state is longer term than the other. Mark just posted the image shown to the right which illustrates the 9 combinations.

For each combination we create a new Market State composed of the Micro and Macro States by "ANDing" the conditions together. For example, if our Long Term Bullish condition is "C > EMA(C,200)" and our Short Term Bullish condition is "C > EMA(C,21) then we would write the combination as:

Bull-Bull Market State condition:

C > EMA(C,200) AND C > EMA(C,21)

These are not necessarily the formulas Mark is using, but it illustrates the idea. By creating 9 Macro-Micro States, Mark has been able to achieve some fairly impressive results...

9 Combinations of Macro + Micro Market States.

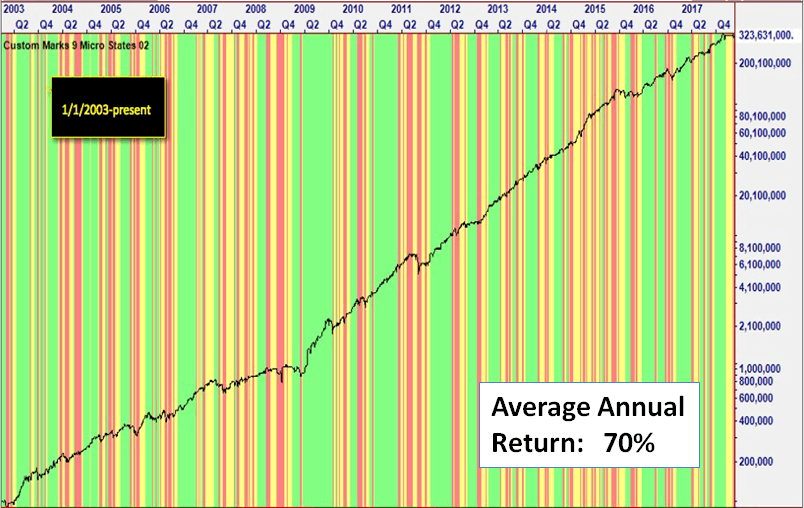

The screen shot at the top of this shows a Portfolio Simulation using this concept. From 2003 through 2017, equity grew from $100k to $323m, fueled by compounding an average annual return of 70%. This is the highest result I have seen generated by any ATM method. I want to thank Mark for continuing to push ATM to higher levels of performance and look forward to posting more of his work in this blog.