It’s easy to get excited about Relative Strength! However, creating a profitable Trading Method takes some careful thought. Of course, I’ve done that for you! But I’d like to share a few details about this superb approach to trading.

First, I want to clarify what we are talking about. If you Google “Relative Strength”, nearly all the articles are going to be about the Relative Strength Index – an indicator that measures strength WITHIN a security. This is all about measuring strength versus the market – that’s where the Power lies.

Calculating the “Sweet Spot”

We start by measuring Relative Strength patterns on all stocks in the market by analyzing Relative Strength trend. Those with the highest ratings are the ones that are being accumulated by market participants. We then determine which ones have the right timing for the start of a move – I call it the Sweet Spot.

Once we have a target list we measure other factors that tell us the Risk Profile of each candidate, we sort the list on an empirical formula based on these measurements.

Bringing Home the Bacon!

After sorting the candidates, we can balance Longs and Shorts based on market direction. Being Long in accumulation stocks and short in distribution stocks dramatically reduces market risk.

Now, we are ready to trade. On those candidates where our odds of success are over 70%, we can purchase options to gain leverage – but they need to be the right options. We will show how to determine that. No additional knowledge needed.

Finally, our RS Trade Plan can manage and exit the trade by determining when weakness enters the stock or a profit target has been reached.

In Harness the Power, you will learn everything about this powerful Method so you understand precisely what it is doing. Then you will get practice doing it.

Trading the Method is Easy

Since most of the method can be automated, your primary task will be to learn about final trade selection and balancing. This will be explained in the course materials and then practiced in live trading.

learn how to harness the power in your trading!

and for real time:

VisualTrader is a great platform for trading Relative Strength

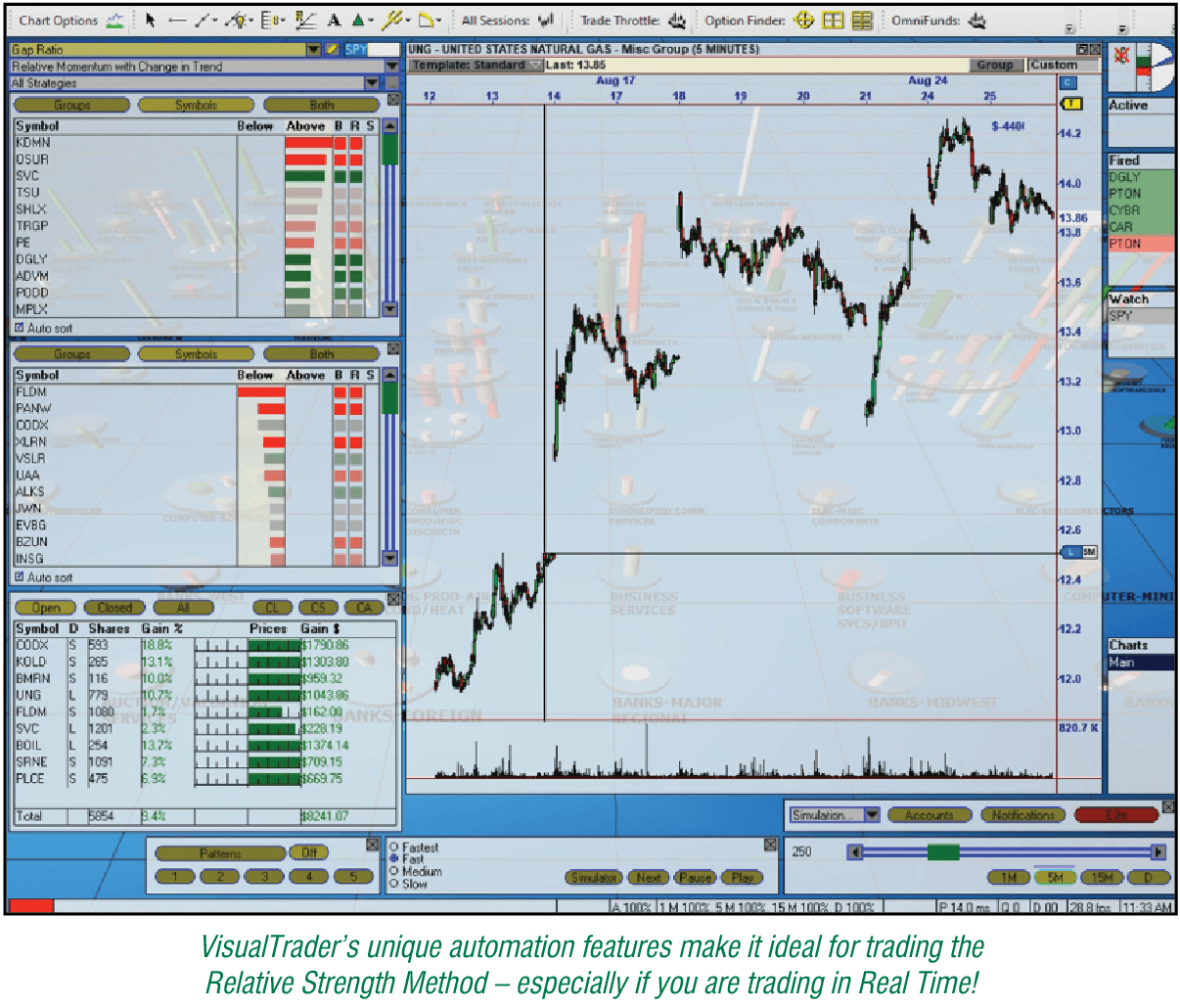

Harness the Power is taught using OmniTrader, which does a great job. But I also include VisualTrader in the course because it has some unique features that help us engage the Method.For example, you can identify Long and Short opportunities at the same time using the Upper and Lower lists. The Trade Throttle can automate trade selection. And, we can use the VisualTrader Simulator to watch the Method trade on historical data – an instructive and exciting exercise!

Learning the Method

Using the new Quick Course format, I am producing concise instructional videos on all aspects of the Method, which will be delivered daily starting September 22. The videos will be short on theory and long on education, focused on the specific “How to’s” of the Relative Strength Method. Watch and learn on your own and (optionally) attend the Q&A session on Saturday to review the material with us.

Then, in Week 2, I will host a webinar each day before Market Open to review the End of Day selections from the day before using OmniTrader. We will also use MarketScans to identify those stocks that have been under intense accumulation or distribution in overnight trading, and import them into the VisualTrader Map.

As the Market opens, we will engage the Relative Strength Method to trade our carefully-prepared Candidate list as market direction is established.

An Incredible Value

This is the first time I have offered a course like Harness the Power of Relative Strength. It’s also the first time Jeff and I have adopted this new Quick Course format. You get concise instructional videos, a special Q&A Session, live trading sessions plus all the assets I created for OmniTrader and VisualTrader to trade the Method.

The Method is designed to be “turnkey” and ready to trade. All you need is a little coaching on how to get everything set up, and how to find the highest Reward:Risk trades. It’s going to be efficient, interactive and fun!

I’ve seen trading education that costs $5,000 without any trading assets or live practice sessions. And you have to watch hours and hours of instruction. I know you will agree that the Nirvana Trading Summit is the best education we have ever offered our Nirvana customers.

OR CALL: 1-800-880-0338

30-Day Money Back Guarantee: Our software is backed by our unconditional Money Back Guarantee. If for any reason you are not fully satisfied, you may return the module, within 30 days of purchase, for a 100% refund, less shipping and handling. Texas residents add 8.25% sales tax.

Important Information: Futures, options and securities trading has risk of loss and may not be suitable for all persons. No Strategy can guarantee profits or freedom from loss. Past results are not necessarily indicative of future results. All statistics and results shown in this mailer are simulated. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading.