As you may know, ATM Elite membership includes a

Personal Concierge Service. Russell, an Elite Member,

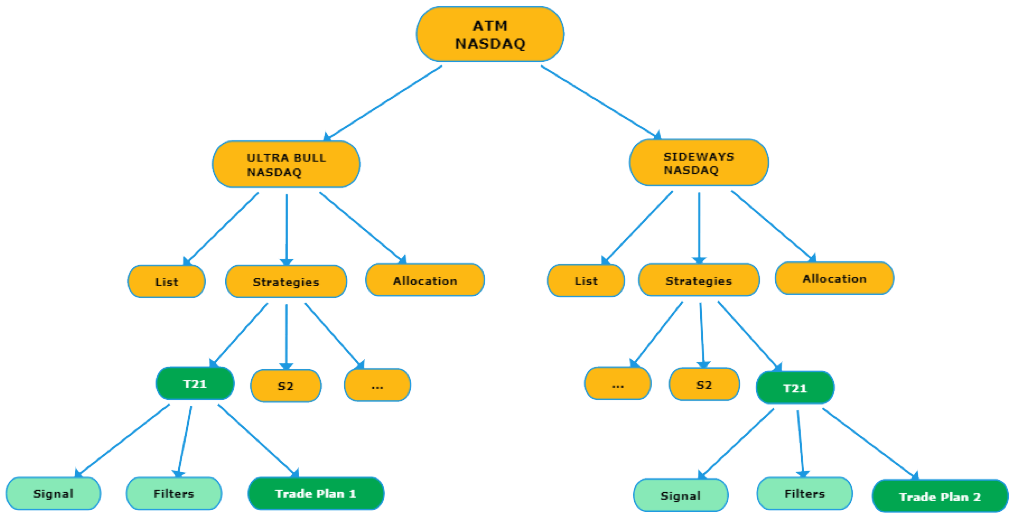

used the concierge service to request a custom ATM Method

that reflected his investing goals.

The Concierge Team fulfilled the request and

created RS BOOST Intermediate!

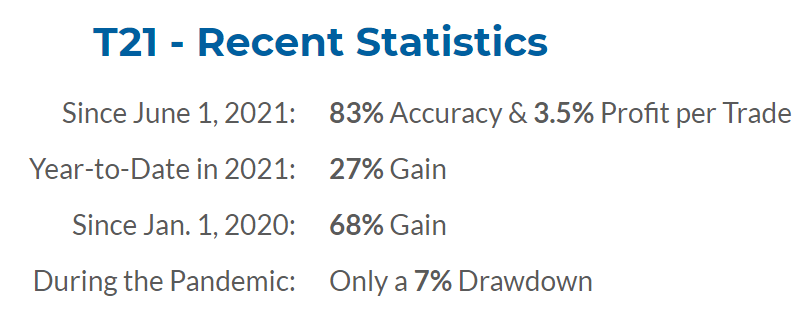

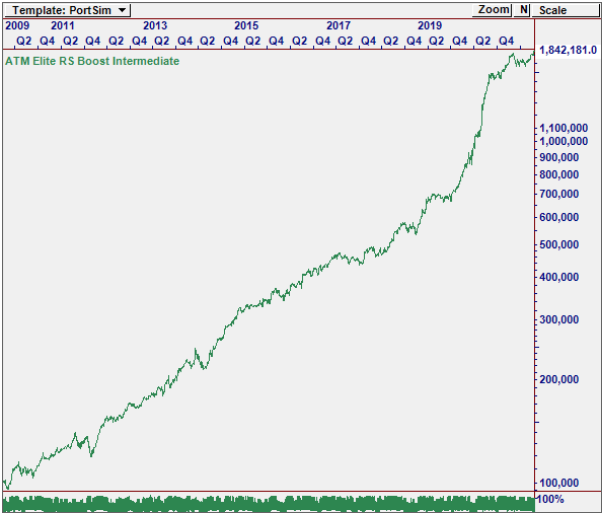

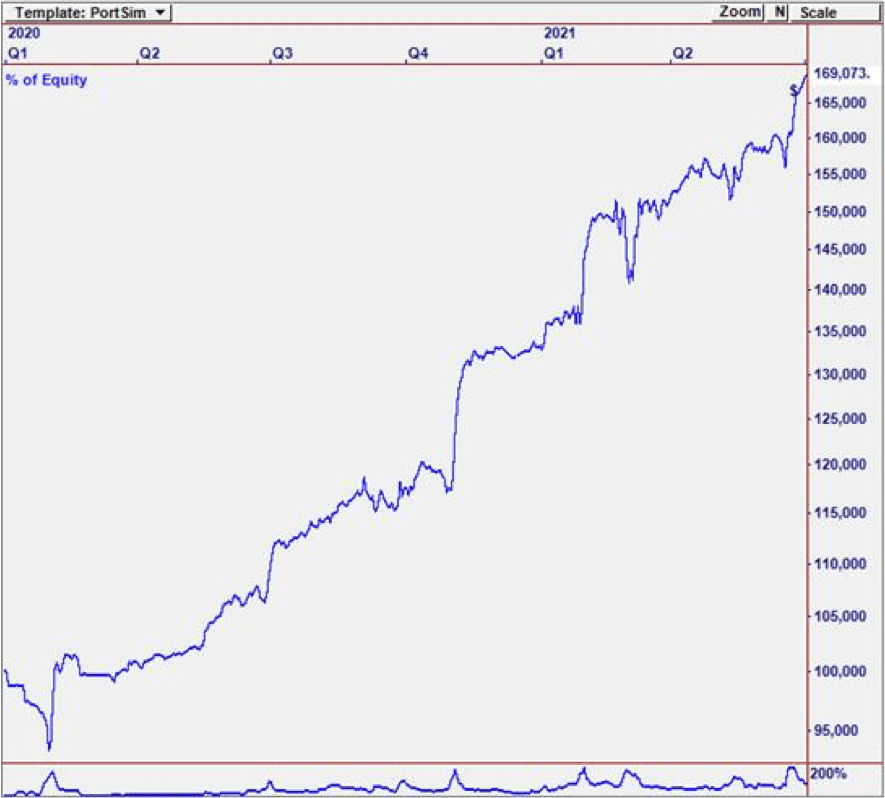

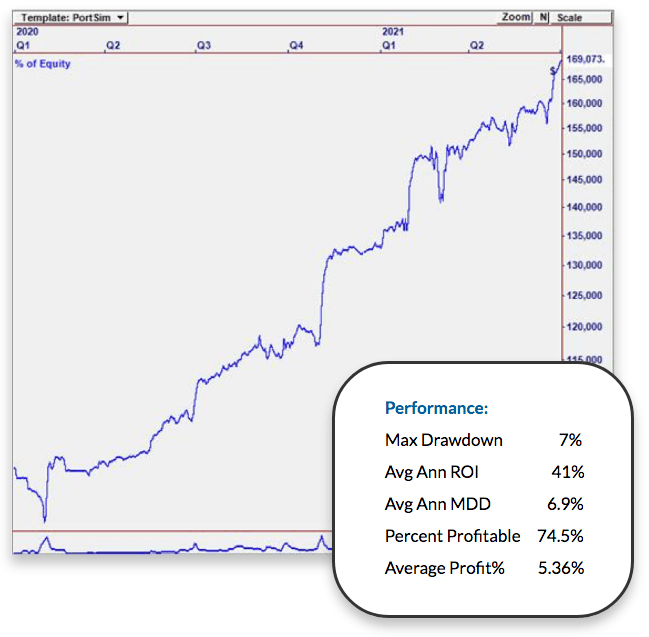

The equity curve below, for RS BOOST Intermediate,

reflects the investing goals of Russell: 30% Average Annual Return with less than 10% Drawdown.

32% Avg Annual Return with only 9% Avg. Annual DD

Great News: ATM Elite Members get

access to ALL custom ATM Methods!

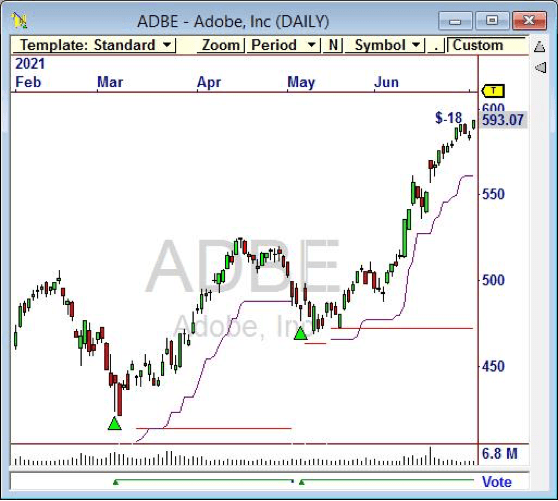

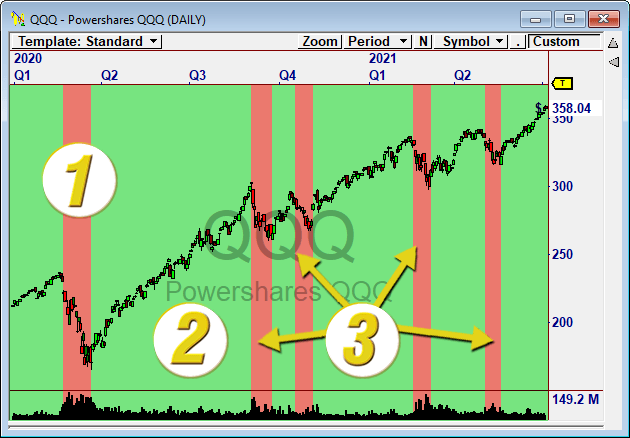

Per Trade Allocation

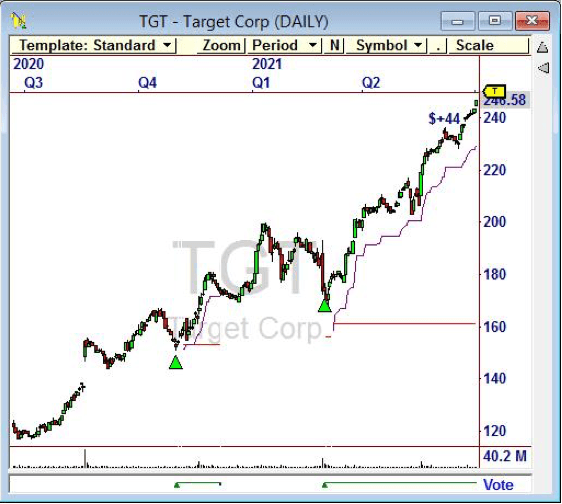

Per Trade Allocation