What are

Elliott Waves?

According to Investopedia… “The Elliott Wave theory was developed by Ralph Nelson Elliott in the 1930s. After being forced into retirement due to an illness,… Elliott began studying 75 years worth of yearly, monthly, weekly, daily, and self-made hourly and 30-minute charts across various indexes.

The theory gained notoriety in 1935 when Elliott made an uncanny prediction of a stock market bottom. It has since become a staple for thousands of portfolio managers, traders, and private investors.”

Classic Elliott Wave Structure

The Elliott Wave Structure

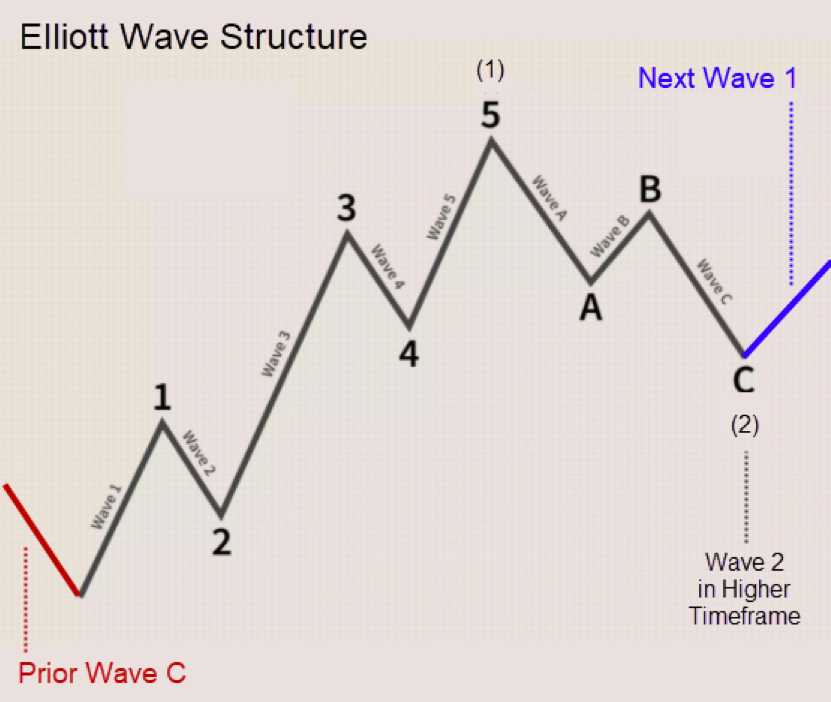

Elliott Waves form as 5 Impulse Waves in the direction of Trend, followed by 3 Corrective Waves. The pattern sequence repeats (as in 5-3-5-3-…)

The 3 Unbreakable Rules for a correct Elliott Wave Structure are:

1

Wave 2 cannot retrace more than

100% of Wave 1

2

Wave 3 is longer than Waves 1 & 5

3

Wave 4 cannot retrace more than

100% of Wave 3

Other Observations

The Corrective sub-waves (2, 4, and B) often form Fibonacci Retracements of 38% or 62%, and the Impulse sub-waves (3, 5, C) often form at Fibonacci Extensions of 162%. When observed, this adds to the validity of the overall structure.

Elliott Waves are “Fractal” in nature, meaning they can nest within each other. In the image above, Waves (1) and (2) formed in the next higher timeframe. There can be multiple nested Elliott Wave Structures.

Trading the Waves

Ralph Elliott said, “These patterns do not provide any kind of certainty about future price movement, but rather, serve in helping to order the probabilities for future market action.” In essence, trading Elliott Waves is all about probability.

The probability is enhanced as the Structure is verified. For example, assume we see what looks like a Wave 1-2 formation with a measurable Pivot at the end of Wave 2. The question is, “Will there be a Wave 3?” And “Will it be strong?”

If Wave 1 begins after a Corrective Wave, the probability for a strong Wave 3 is higher. If Wave 2 hits a 38% or 62% retracement of Wave 1, it’s higher still. If the chart appears to have well-formed waves on most moves the probability is again increased. And finally, if Wave 1 is in the direction of trend, it’s even higher!

There are many cases of well-formed Impulse Waves 1 & 2 leading to enormously profitable Wave 3 moves as well as profitable trades from the other Waves.

That’s What Elliott-Fibonacci Trader is Designed to Find.